Creative Disruption

The mood of an era is perhaps best captured by its futurists’ visions of tomorrow. An article by John Elfreth Watkins Jr., published in the December 1900 issue of The Ladies’ Home Journal (LHJ) titled “What May Happen in the Next Hundred Years,” envisioned a future of pneumatic tubes, airships, two-day Atlantic crossings, fantastically large fruits and vegetables, and other strangely specific predictions, such as the elimination of the letters C, X, and Q from our alphabet.

However, a few of the author’s predictions are strikingly relevant today, in the wake of the jarring disruption caused by the COVID-19 pandemic. Although many of the changes predicted in the article have been underway for years or decades, the pandemic has served as a growth catalyst for some.

Food

Watkins writes, “Ready-cooked meals will be bought from establishments similar to our bakeries of today. They will purchase materials in tremendous wholesale quantities and sell the cooked foods at a price much lower than the cost of individuals cooking. Food will be served hot or cold to private houses in pneumatic tubes or automobile wagons.”

Today’s pandemic has rapidly accelerated online ordering and delivery of food, whether restaurant meals (Uber Eats, GrubHub), groceries and other staples (InstaCart, Postmates), or meal kits (Blue Apron, HelloFresh). Of course, these meals are delivered not by pneumatic tube but by a decentralized workforce of smartphone-wielding gig-economy contractors. The widespread availability of food-delivery services during lockdowns helped both consumers and restaurants struggling to keep their doors open, although there are concerns about the long-term impact on restaurant profitability with such services often charging restaurants a 15 to 30 percent commission on every order.

Entertainment

With entertainment and sports venues shuttered by social distancing requirements, we turned in record numbers to at-home digital streaming entertainment. The digital availability of the Broadway megahit Hamilton helped drive more than 60 million paying subscribers to the Disney+ streaming service in the first nine months the service was available.

Watkins hits the mark again, writing in the December 1900 LHJ article, “Grand Opera will be telephoned to private homes and will sound as harmonious as though enjoyed from a theatre box. Automatic instruments reproducing original airs exactly will bring the best music to the families of the untalented.”

Consumer Staples

Watkins even forecasted a sophisticated system of package delivery in his LHJ piece. “Pneumatic tubes, instead of store wagons, will deliver packages and bundles. These tubes will collect, deliver, and transport mail over certain distances, perhaps for hundreds of miles.”

Again, the fascination with pneumatic tubes! E-commerce has grown at a breakneck pace since 2000 when Amazon extended its platform beyond books to a wide range of product categories. The pandemic has rapidly increased the range of products bought online, especially supplies difficult to find on store shelves, such as paper goods, personal protective equipment, home office equipment, and other essentials.

In this article, we will explore how technology has impacted our response to the COVID-19 pandemic and how the crisis rapidly accelerated trends already underway. As with any disruption, winners and losers have emerged, with potential impacts to investment strategy. Pneumatic tube investors of the 1900s were likely disappointed, while fortunes were made in the auto industry—and we seek to understand which firms will prosper, strengthen, and gain market share in our post-pandemic future.

The Quick Shift

As the COVID-19 pandemic forced the global economy into suspended animation earlier this year, markets reacted with the fastest-ever bear market. The S&P 500 Index fell 30 percent in just 22 trading days. Yet amid this uncertainty, businesses, organizations, and communities quickly adapted and found creative ways to do business in a bubble.

Clearly, many have suffered and continue to suffer from illness and the loss of loved ones, employment, and income, and we do not minimize the remaining challenges. But a potent combination of technology platforms—including widespread connectivity, e-commerce, cloud computing, and collaboration technologies—allowed many businesses to adapt to a fully remote, work-from-home world far more quickly than feared in mid-March. Technology is the only way to remain connected while physically distant.

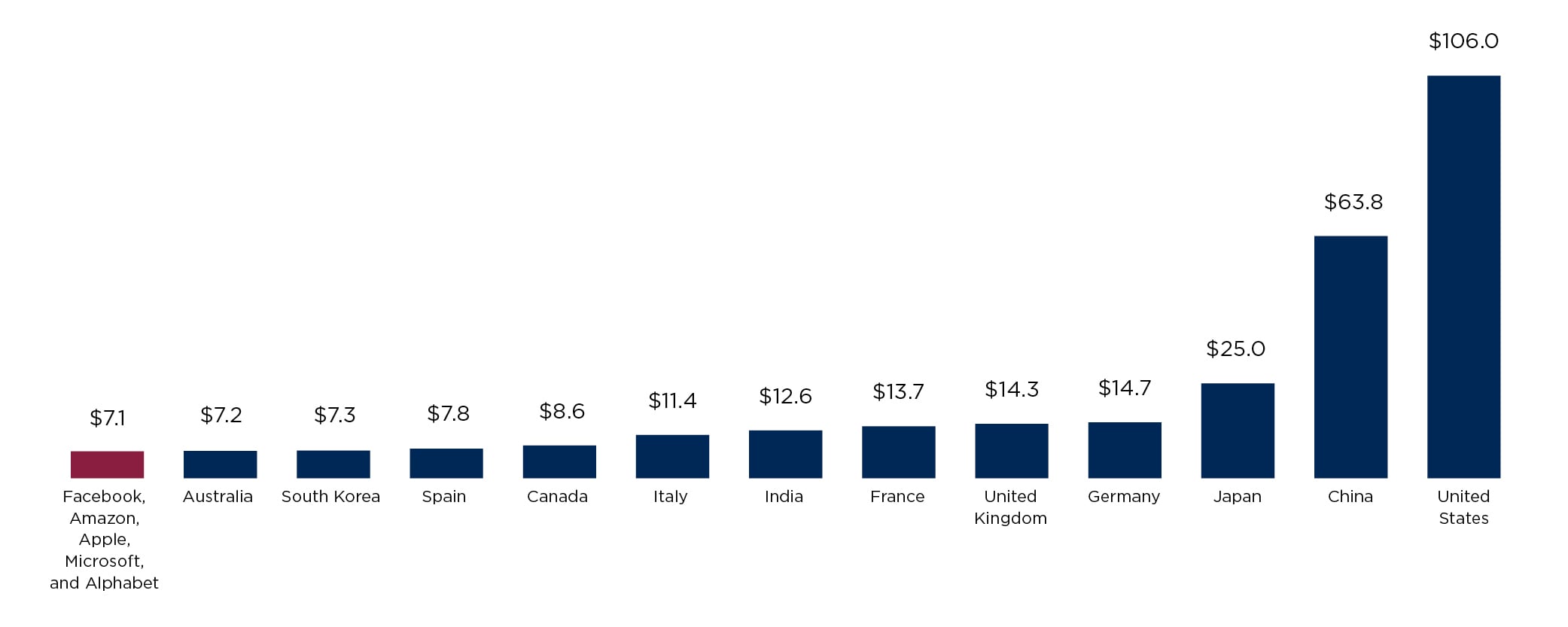

The digital platforms underpinning this transition were richly rewarded in the ensuing stock market recovery. Today, Apple alone has a larger weight in the S&P 500 Index than the entire energy and utilities sectors combined. And, as shown in Figure One, at $7.1 trillion, the combined market cap of the five largest U.S. firms— Facebook, Apple, Amazon, Microsoft, and Alphabet (Google), otherwise known as the FAAMG stocks—is greater than the national wealth of all but the 12 wealthiest nations on earth.

Figure One: Wealth of FAAMG versus 12 Wealthiest Nations (Amounts in Trillions)

Sources: visualcapitalist, Bloomberg

In addition to these technology providers, businesses and organizations that were leaders and early adopters of digital transformation also benefited relative to their competitors. Firms that were well on their way to moving infrastructure to the cloud and collaboration platforms; retailers with online and mobile ordering, curbside pickup, and contactless payment systems; and educational institutions with mature virtual learning platforms found themselves in a strong competitive position. Meanwhile, laggards that had resisted change faced a stark decision: invest in digital transformation or close their doors.

A 2019 study by Accenture sought to measure the performance gap between technology leaders and laggards. The authors surveyed more than 8,000 companies across the globe and assigned scores in three categories, including implementation of a wide range of key technologies, degree of adoption of these technologies once implemented, and their organization and culture of innovation. The performance gap was significant, with companies scoring in the top 10 percent (the leaders) showing double the revenue growth of the laggards in the bottom 25 percent.

This performance gap has likely grown significantly in 2020, creating a winner-take-all environment where larger, better-capitalized, and more innovative firms stand to gain significant market share from those less willing or able to innovate.

Tubes in the Walls

As painful as the pandemic has been, it is interesting to think about how much better prepared we were to withstand such a shock in 2020 than we would have been just two decades ago, when phones were used mainly for talking, medical records existed in manila folders, and business data and applications were locked in company-owned data centers. But when COVID-19 emerged early this year, critical pieces of infrastructure were already in place to support sheltering-in-place and the shift to work-from-home. The pneumatic tubes were already installed, ready to be turned on.

Three technology trends in particular have supported our ability to adapt to the crisis: the three Cs of connectivity, cloud computing, and commerce.

Connectivity

The single biggest contributor to our pandemic response is likely the pervasiveness of high-speed Internet connectivity. Imagine how different the work-from-home transition would have been if nearly everyone didn’t have a powerful, fully networked computer on their desk and in their pocket at all times. And consider how much less effective (and more frustrating) working and learning from home would have been over slow, dial-up connections.

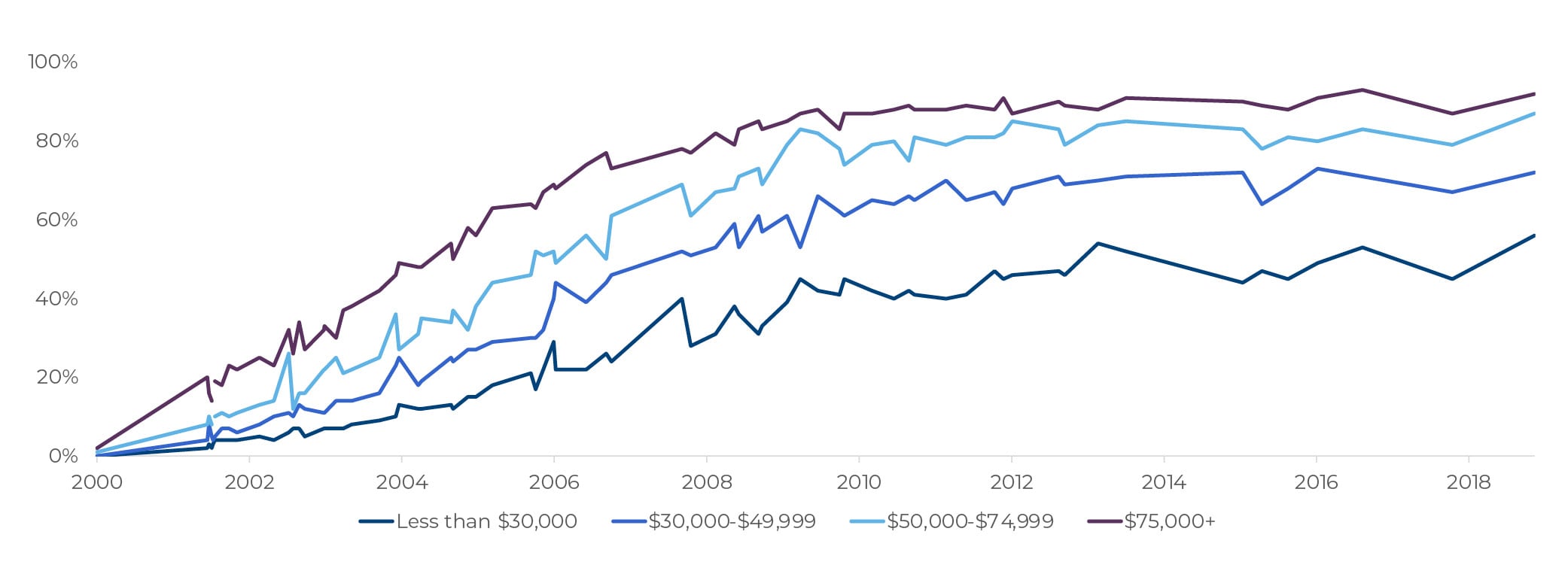

As of last year, almost 80 percent of U.S. adults had broadband Internet access at home, a number likely to grow with the expansion of high-speed 5G wireless networks. However, there are significant gaps in broadband access, with racial minorities, older adults, rural communities, and those with lower incomes showing a significantly lower degree of broadband adoption. As shown in Figure Two, only 56 percent of those with incomes less than $30,000 have broadband access at home, versus 92 percent for those with incomes greater than $75,000. The longer the pandemic crisis continues, the more damaging these gaps will become.

Figure Two: U.S. Adult Broadband Users, by Income

Source: Pew Research Center

An enduring shared experience of the pandemic will be the informal Zoom social gatherings, not to mention weddings and, tragically, funerals. In July, Microsoft reported that the use of its Teams online meeting software reached 5 billion meeting minutes in a single day.1 Social media platforms served as a vital way to connect and share information with friends and family while stuck at home, and as platforms for social movements.

Cloud Computing

Futurists in 1900 may have envisioned doing business in the clouds from the comfort of an airship. But today, cloud computing refers to the movement of computer hardware, data, and applications away from on-premises servers to Internet data centers, often providing advantages in reliability, security, the ability to scale up (or down) based upon demand, and greater speed to integrate future capabilities, such as machine learning.

The migration of computing applications to the Internet has been underway for more than two decades. But the modern era of cloud computing began in 2006 with the launch of Amazon’s Elastic Compute Cloud, a breakthrough service that allowed any business to rent Amazon’s world-leading Internet infrastructure.

New consumer applications of the technology are also emerging, such as cloud gaming, offering anyone with a high-speed Internet connection access to the latest cutting-edge gaming hardware. And regardless of their physical location, students studying artificial intelligence or even quantum computing can affordably access and experiment with highly specialized, extremely expensive hardware in the cloud.

An industry survey completed before the pandemic indicated that almost 60 percent of technology buyers expected to be mostly or completely in the cloud within 18 months.2 Polls taken after the pandemic show that the trend is only accelerating, with 40 percent reporting an acceleration of cloud efforts and 76 percent reporting an increase on cloud spending.3

Commerce

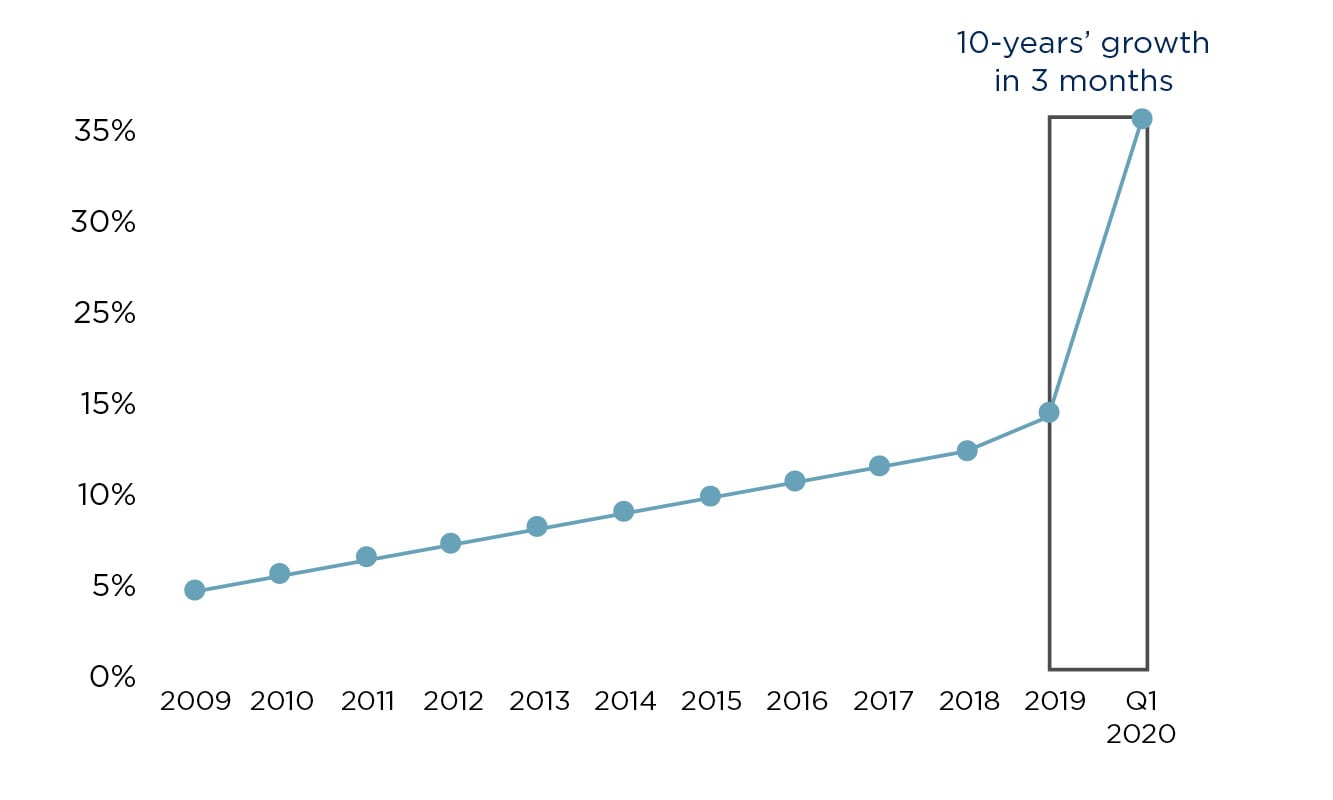

There was a time at the height of stay-at-home orders when it seemed that vehicles on the road came in just three colors: gray (Amazon), brown (UPS), and white (FedEx, USPS). While e-commerce has been a steadily growing influence on the retail world over the past 25 years, the pandemic has both accelerated and broadened it to include more product categories, businesses, and customers, representing both challenges and opportunities for traditional retailers. During the early days of the pandemic, as shown in Figure Three, it is estimated that e-commerce witnessed 10-years of growth in a span of just three months.

Figure Three: U.S. E-Commerce Penetration

Source: McKinsey

Historically, the growth of e-commerce has been driven by three factors: convenience, product selection, and price. However, as physical stores moved to restrict occupancy and with store shelves laid bare by demand spikes and supply chain disruptions, consumers turned to e-commerce out of necessity in new categories of goods. In March, the largest year-over-year e-commerce sales increases occurred in the categories of disposable gloves, bread machines, cough and cold medicine, staple food items, and exercise gear. The largest declines were seen in luggage and briefcases, swimwear, and bridal clothing/formalwear.4

It was not just the digital-native platforms such as Amazon that benefited from the surge in online shopping. The largest percentage change in online purchases was seen by traditional chain stores, signaling that the long-heralded transition to the hybrid clicks and mortar or omnichannel model has arrived. Firms such as Target that already offered this service saw usage soar by more than 700 percent, as others scrambled to launch their own. One survey of large retailers found that the number offering curbside pickup increased from 7 percent at the end of 2019 to nearly 44 percent in August.5

Implications for Investment Strategy

The CAPTRUST Investment Committee has been following these changes closely to consider potential impacts to investment strategy. Key themes include:

Dominant business models. The pandemic has pulled forward years of expected change into a matter of months. In an expected low-growth environment, we favor companies and sectors with strong balance sheets, higher return on equity, and higher earnings growth rates.

Uneven landscape. An uneven economic recovery creates winners and losers. Some businesses will continue to struggle and ultimately fail, while others will prosper. We continue to examine these dynamics for more resilient business models with tailwinds, search for shorter-term opportunities when price action overshoots, and consider the long-term impact of changes to corporate budgets and priorities.

Lean into disruption. We have begun developing disruptive innovation portfolios that seek to capture the potential long-term investment opportunities created by foundational technologies that will drive change and growth over the next 100 years, such as genomics, automation, autonomous vehicles, and artificial intelligence.

Amid the fear, uncertainty, and loss triggered by the pandemic, it is heartening to consider the resiliency and adaptability of businesses and communities in the face of a significant threat. While we may not yet enjoy the peas as large as beets delivered by pneumatic tubes (as predicted in 1900), we have witnessed rapid shifts in behavior, technology, and productivity, many of which will remain long after the virus threat has passed.

1 Microsoft Q4 2020 Earnings Call Transcript, June 2020

2 Knorr, Eric, “The 2020 IDG Cloud Computing Survey,” infoworld.com, 2020

3 Donnelly, Caroline, “Coronavirus: Enterprise Cloud Adoption Accelerates in Face of COVID-19, Says Research,” computerweekly.com, 2020

4 “Top 100 Fastest Growing & Declining Categories in E-commerce,”

Stackline, 2020

5 Ali, Fareeha “Charts: How the Coronavirus Is Changing Ecommerce,” digitalcommerce360.com, 2020