Offering HSAs Pays

Since health savings accounts (HSAs) first became available in 2003, they have been helping individuals covered under a compatible health plan, known as a high-deductible health plan (HDHP), become more engaged healthcare consumers who are better prepared for their healthcare expenses both now and in retirement.

HSAs can be used in a variety of ways to help manage current qualified medical expenses and also future qualified medical expenses even after employees retire. Unlike flexible spending accounts (FSAs), HSAs are not subject to the use-it-or-lose-it rule. And employees can actually sock away quite a bit of money annually in an HSA.

For 2022, the annual cap on HSAs is $3,650 for self-only and $7,300 for family coverage. Also, employees who don’t use the money can keep saving it in their HSA accounts. Once employees establish a cash cushion within their HSA to pay for short-term, unanticipated, qualified medical expenses and out-of-pocket maximum deductible limits, many have a large enough balance to begin investing in mutual funds, stocks, or bonds.

Ultimately, these programs empower employees as healthcare consumers. Because they are contributing more of their own money when they’re using an HDHP and an HSA, they are more involved in the cost of healthcare services, says CAPTRUST defined contribution practice leader Jennifer Doss. “Employees may be more inclined to consider the necessity of high-cost health care in certain circumstances; for example, an urgent care visit versus a visit to the emergency room.”

By enabling employees to choose when and how their healthcare dollars are spent, HSAs allow participants to decide what’s best for their unique situations. What’s more: HSAs offer savings and tax advantages that traditional health plans can’t duplicate.

HSAs are the only type of retirement account that is triple tax free. The money employees put in is tax free; the money employees take out for qualified medical expenses is tax free; and earnings on account balances are tax free. Further, because an HSA stays with the employee, not the employer, it’s very attractive to employees who are worried about paying for healthcare costs if they are furloughed, laid off, or simply want to move to a different organization.

Also, HSAs are growing. In recent years, enrollment has increased significantly with over 30 percent of workers covered under these plans, according to the Kaiser Family Foundation. And, by some estimates, HSA-eligible health plan enrollment is projected to continue to grow by nearly 25 percent annually and is on pace to exceed 36 million enrolled in HSAs by 2023. In 2022, 63 percent of large employers offered an HSAs: a rise of 20 percent since 2018.

While the rapidly evolving HSA market undoubtedly points to improved spending and saving experiences for the employee, it also shows meaningful value for employers.

HSA Advantages for Employers

Since 2008, there has been a significant increase in employers offering HDHPs and HSAs. In 2020 alone, the percentage of employers that offer HSAs grew at a rate of more than 50 percent. According to the experts, the reasons are clear.

From reduced taxes and lower insurance premium rates to employee retention and increased flexibility for plan sponsors, the HSA is as much a savings gem for employers as it is for employees.

HSAs reduce taxes. When employers contribute money to their employees’ HSAs, 100 percent of those contributions are tax-deductible, Doss says. “A lot of employers contribute between $500 and $1,000 to the HSA for a participant to start out with.” Some employers choose to contribute a lump-sum payment, while others opt for periodic deposits.

When employees contribute to HSAs through payroll deductions, the contribution is made pre-tax, which saves both employees and employers on Federal Insurance Contributions Act (FICA) taxes (7.65 percent each).

In other words, while employees are able to leverage the triple tax advantage HSAs offer, employers are also able to benefit from HSA tax advantages. Experts say the FICA tax savings for employers alone can be so substantial that many employers choose to increase their employer HSA contributions in order to maximize those tax savings.

HSAs reduce insurance premium rates. Used in conjunction with HDHPs, HSAs help employers save on health insurance premiums, says Doss. “As employees take ownership over their health and become more involved healthcare consumers, that often spills over to lower increases on annual premiums.”

Even with an employer contribution to employees’ HSAs, the overall cost for healthcare coverage is usually less because the premium rates on HDHPs are considerably lower than traditional health plans. In fact, the National Bureau of Economic Research indicates that employers who switched from non-HDHPs to an HDHP paired with an HSA saw a 10 to 12 percent decrease in firm-wide health spending in just two years.

HSAs improve employee retention. An employer contribution to = an HSA is a visible, valuable, and welcome addition to an employee’s total compensation package. “Because HDHPs and HSAs can help your employees save money and invest for the future in a way they can see, they’re a great addition to any benefits package,” Doss says.

In a survey of 1,200 employers, 50 percent said employee recruitment was a big part of their decision to offer an HSA, and 57 percent indicated employee retention as a driver. What’s more, those numbers increased by 100 percent from the year prior.

Garry Simmons, practice leader of health and group benefits consulting at Milliman says that uptick makes sense. “There’s such a war for talent right now. It’s so hard to find anybody who’s willing to work, for one thing. And then beyond that, it’s how do you keep them?” Simmons says offering an HSA helps employers “maintain a market competitive position and can aid in attracting and retaining top talent.”

Although not all employees will embrace HSAs, savvy employees who understand the benefits will value a program that includes an HSA. And employees appear to be getting more comfortable with the combination of an HDHP and HSA–especially younger employees.

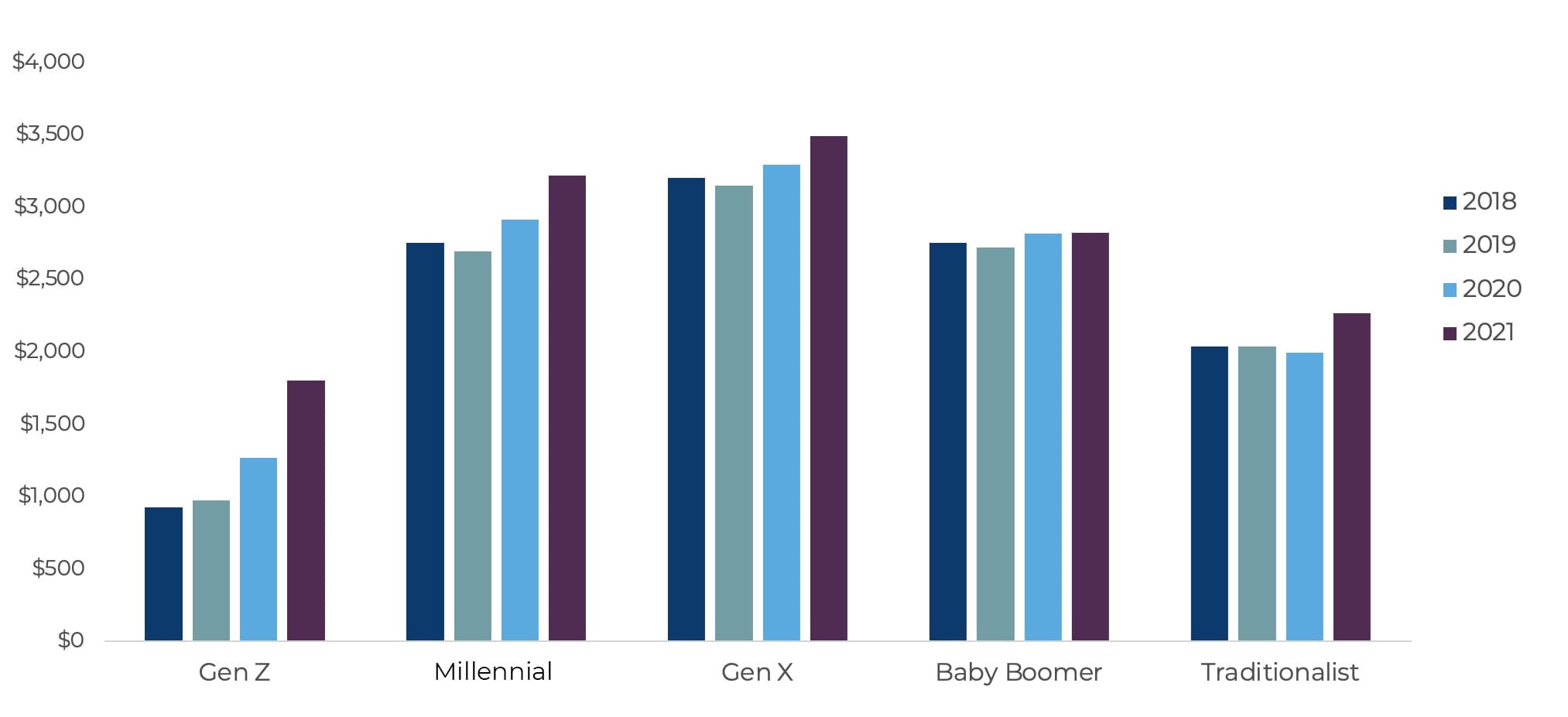

It’s these younger generations—Generation z, the millennials, and Generation x, which make up a combined 68 percent of the current labor force—who are responsible for the highest growth in HSA contributions since 2018, as shown in Figure One. Additionally, gen z employees nearly doubled their family HSA contributions since 2018, increasing contributions by 42 percent in 2021 alone.

Figure One: HSA Contribution Trends by Generation

Age groups used in this report: Generation z (born 1997 and after), millennials (born 1981-1996), Generation x (born 1965-1980), baby boomers (born 1946-1964), and traditionalists (born 1945 or before).

Source: “2” benefitfocus.com, 2022

HSAs support overall employee wellness. Fifteen months after the start of the COVID-19 pandemic, a study by MetLife discovered even more reason for employers and plan sponsors to offer HSAs: They make a positive impact on workers who are shaken by the pandemic’s resulting financial uncertainties.

Simmons agrees. “An HSA certainly can help employees manage their medical finances and avoid what could be a catastrophic financial situation,” he says. If employees are stressing or they’re distracted by finances, they’re not as productive to the employer, he says. “As part of an overall financial well-being package, HSAs ultimately improve the productivity of a workforce, and [the employer] benefits from that.”

The study indicates that employees who owned an HSA felt significantly better about their financial wellness and were better able to manage stress related to their personal finances compared with employees without an HSA. Based on MetLife’s research, employees who owned an HSA were 22 percent more likely to say they felt better in general—physically, financially, mentally, and socially.

Additionally, companies offering HSAs find that employee healthcare choices and behaviors change dramatically, Doss says. “HSAs create a powerful reason for employees to want to stay healthy.” It’s the concept of consumer-driven healthcare, Doss says. “That means, with HSAs, employees tend to be more careful and inquisitive into their healthcare purchases because this is their money.”

HSAs improve employee retirement readiness. According to a recent report, healthcare costs have risen by 40 percent since 2015 and 5 percent in 2022 alone. In fact, according to HVS Financial, for a healthy, 65-year-old couple retiring in 2022, total costs for premiums and out-of-pocket expenses will average $683,306. Moreover, if this couple starts receiving Social Security payments at 65, healthcare expenses will consume 71 percent of their benefits, leaving far less than many might expect for other living expenses such as housing.

Sound stressful? It is. John Hancock’s 6th annual financial stress survey reports that saving for retirement is the most prominent cause of financial anxiety for employees. Specifically, respondents’ top retirement-related financial concern was putting enough funds away to cover the healthcare costs they’ll incur.

This stress doesn’t take a toll only on individuals, Doss says. “Employees struggling to effectively prepare for retirement can have a real impact on the health of a business through reduced productivity and increased employee absences.” Moreover, when workers are extending their employment into their senior years out of necessity, they can slow the promotion pipeline and consume a disproportionate share of the organization’s resources, Doss says.

Luckily, employers have a powerful tool at their disposal to help address these issues and give their employees peace of mind.

With its triple tax advantage, the HSA is a great way for employees of all ages to supplement their retirement savings while covering out-of-pocket health expenses, Doss says. “HSAs’ unique ability to avoid paying taxes on both contributions and earnings if used for qualifying medical expenses sets them apart from 401(k)s and IRAs and puts them at the top of the list for tax-efficient investment options for retirement.”

Better yet, at the age of 65, employees can use their HSAs to pay for any nonqualified medical expenses. As Simmons says, there’s always the long-term HSA advantage. “You’ve got money to pay for the expenses that Medicare doesn’t cover, or even premiums for Medicare supplement plans.”

Plan flexibility. A major strength of offering an HSA is program flexibility. “Like any other benefit, employers have the ability to go out and shop to decide what kind of HSA platform they want to offer,” Doss says.

HSA platforms differ in the types of investments offered, minimums required for investment, account accessibility, and overall fees, Doss says. Some platforms also offer education for employees and assistance with creating model portfolios. “Education here is key. Employers should consider offering resources to help employees look at ways to invest their money and reduce the difference between what they should have in short-term savings for everyday medical expenses versus that long-term retirement medical expense,” Doss says.

Another flexibility: The two cost components of HDHPs and HSAs—the HDHP premium and the employer contribution to employees’ HSA accounts—are independent and can be changed as needed. Flexible plan design means employers can adapt the plan options according to their changing business needs. For example, employers can partially fund their employees’ HSAs or pay for a percentage of HDHP coverage. They can also fully fund an HSA and pay for the HDHP coverage. Employers are using the flexibility of the HSA to reduce their involvement in benefits and share more responsibility with the employee.

Low administrative burden. Speaking of sharing more responsibility with the employee, given the individual account nature of HSAs, much of the administrative burden is switched from the employer (or paid third-party administrator) to the employee and the HSA provider.

From the employer standpoint, you’re engaging with an HSA provider to do the administration for you, Doss says. “Once the money goes into these individual HSAs, it belongs to the individual. The employer is not administering anything from the HSA perspective at that point.”

Experts agree: Employees are not the only ones who benefit from having an HSA. Employers can also realize savings through lower medical premiums, tax-deductible contributions to employees’ HSAs, plan flexibility, and more.

Employers not yet offering these accounts may want to explore their health plan offerings and consider incorporating an HDHP paired with an HSA. As offerings continue to expand, employers that are already offering HSAs may think about comparing terms of their current accounts with other industry offerings to ensure they are taking advantage of plans with minimal fees and the best investment performance.