Returning to Normal (After a Year of Anything But)

If 2021 could be summarized in one word, it would be dichotomy—the sharp contrast between our financial lives and our daily living. The fourth quarter capped off a year that witnessed robust growth of all kinds, including both positive examples, such as rising home and financial asset prices, levels of household wealth, corporate earnings and profits, and wages, along with a troublesome rise in areas such as virus case counts, order backlogs and delays, and price inflation.

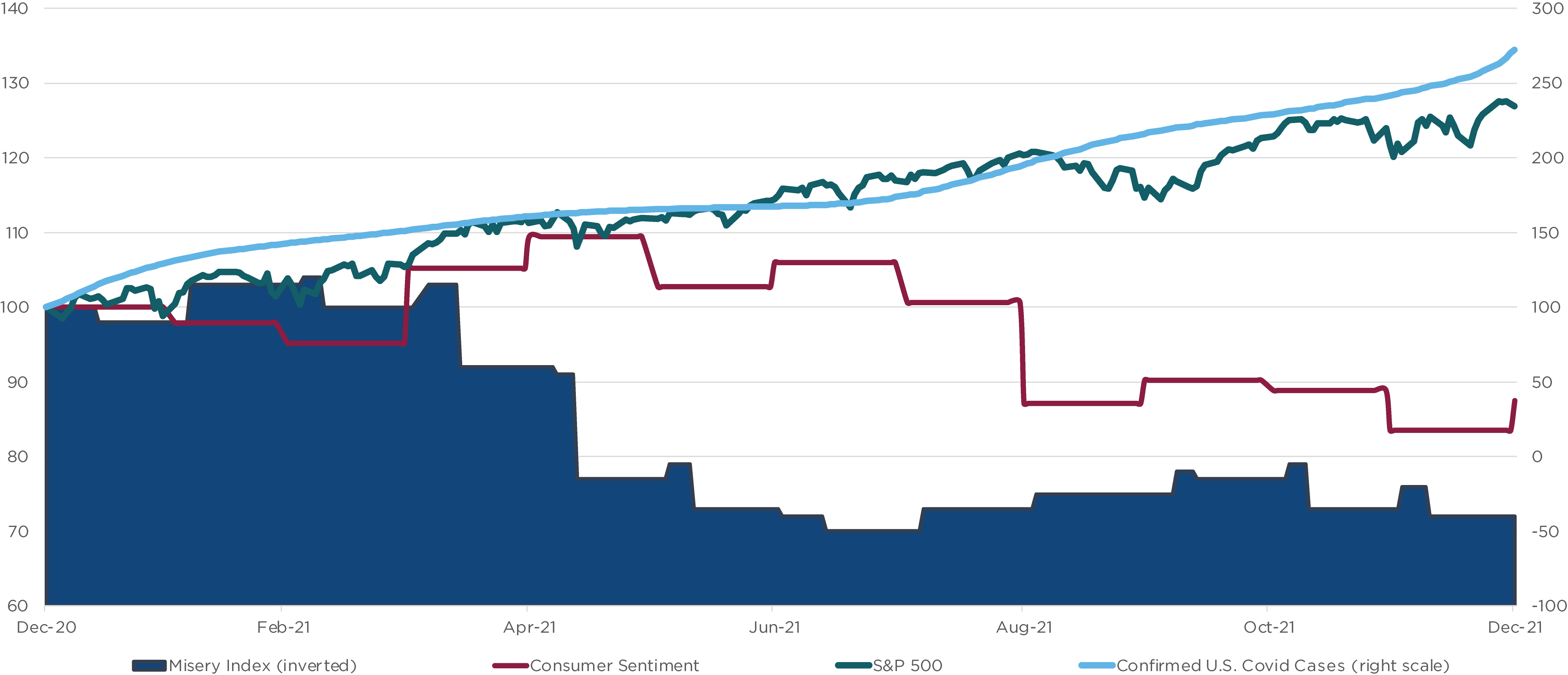

Figure One illustrates this split between financial success (with the S&P 500 Index up 29 percent) and our daily lives, as illustrated by declines in consumer sentiment, the rise in COVID-19 cases, and the increase in the so-called Misery Index.

Figure One: Financial Euphoria vs. Real-Life Challenges (2021)

Sources: Bloomberg, CAPTRUST Research

When you combine 2021 returns for the S&P 500 with similar results in 2020 and 2019, we have just concluded a three-year run in U.S. equities that ranks in the top 10 since 1928. The index showed a price return of more than 90 percent during this period. More impressively, U.S. stocks rose by more than 800 percent (or more than 18 percent annualized) since the Financial Crisis market bottom in 2009. It has truly been an exceptional run.

Given all the turmoil of the past few years, investors should celebrate these results. But they should also remember that returns of this size are abnormal, having been shaped by equally abnormal economic and policy conditions. And while we all hope for and crave a return to normalcy in our daily lives, a return to normal for investors may require adjusting our expectations.

Fourth Quarter Recap

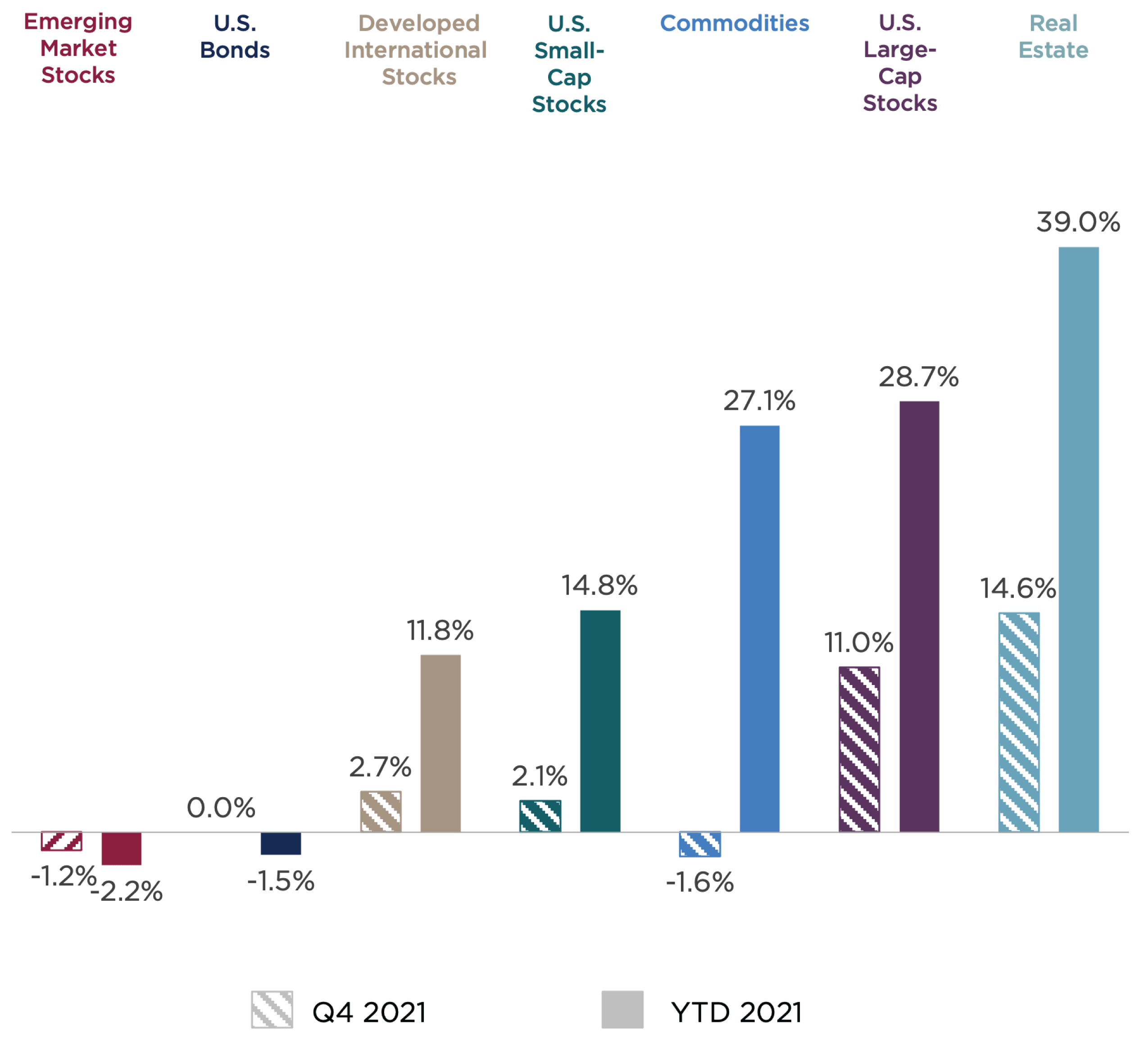

Despite bouts of volatility fueled by virus and policy uncertainty, supply chain woes, and inflation worries, most asset classes posted solid returns in 2021, led by economically sensitive sectors that benefited from reopening trends. Figure Two summarizes asset class returns for the fourth quarter and calendar year 2021.

U.S. large-cap stocks delivered solid returns for the quarter and the year. Notably, the S&P 500 Index failed to show a drawdown of much more than 5 percent during the year and reached new record highs on 70 different days, stats that underscore the steady march higher seen within domestic large-cap stocks during 2021.

Small-cap stocks lagged their large-cap peers but still posted solid, double-digit returns. Along with value stocks, small-cap stocks performed well during the year, as these more cyclical firms benefited from continued progress toward full economic reopening.

International developed market stocks also posted healthy returns for the year, even as China cast a dark cloud over emerging markets. Fueled by a rebound in oil prices, commodities advanced by more than 27 percent for the year despite a fourth-quarter pullback amid rapid spread of the omicron variant. Public real estate added to gains in the fourth quarter despite virus concerns, following steady advances over the course of the year.

Figure Two: Major Asset Class Returns for the Fourth Quarter and 2021

Sources: Bloomberg; CAPTRUST Research. Asset class returns are represented by the following indexes: Bloomberg Barclays U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

Fixed income investors shrugged off rising inflation concerns during the quarter as Treasury yields barely budged, leading the Bloomberg U.S. Aggregate Bond Index to tread water in the fourth quarter. Core bonds suffered a rare (albeit, very modest) loss just over 1.5 percent for the year, representing only the fourth decline for this index in the last 45 years.

Diversification showed benefits within fixed income during the year. Continued strong appetite for risk led to positive returns within credit sectors. Outside the U.S., international bonds faced steeper losses as the dollar strengthened, with the Bloomberg Global Aggregate Bond Index showing a loss of 7.1 percent.

Returning to Normal

In contrast to the steady rise in stock prices witnessed over much of last year, 2022 has gotten off to a rockier start with broad weakness across global equity indexes. Investors are processing several significant challenges and risks facing markets in the year ahead as some of the powerful tailwinds that have propelled markets over the past two years begin to reverse.

The first major change that markets must navigate is the slowing, stopping, and then reversing of the flow of extraordinary stimulus supplied by governments to stave off recession and permanent economic damage over the past two years. Given the rapid snapback in asset prices and economic activity, these policies seem to have been successful, even as they stoked inflation pressures and the potential for market excesses that investors must now grapple with.

Stimulus Fading

On the fiscal side, direct financial support to households will slow dramatically in 2022. Many households face the prospect of no direct government support for the first time since 2019. These programs provided a lifeline to those facing unemployment and financial hardship during the crisis. They also fueled the boom in consumer demand that exacerbated global supply chains already stressed by pandemic-related production interruptions.

The end of government transfer payments represents the first of several important handoffs that must occur smoothly in 2022. Government stimulus has meaningfully and artificially boosted disposable personal income over the last two years. But with stimulus checks in the rearview mirror and child tax credits, student loan forbearance, enhanced unemployment, and eviction moratoriums ending, consumers will need to make up the shortfall through higher wages. This will likely represent a headwind to consumer spending in the year ahead.

Inflation Forces Fed’s Hand

The second major policy shift is the abrupt reversal of course by the Federal Reserve and other global central banks as inflation pressures originally viewed as the temporary effects of economic reopening have advanced into uncomfortable territory for policymakers and consumers.

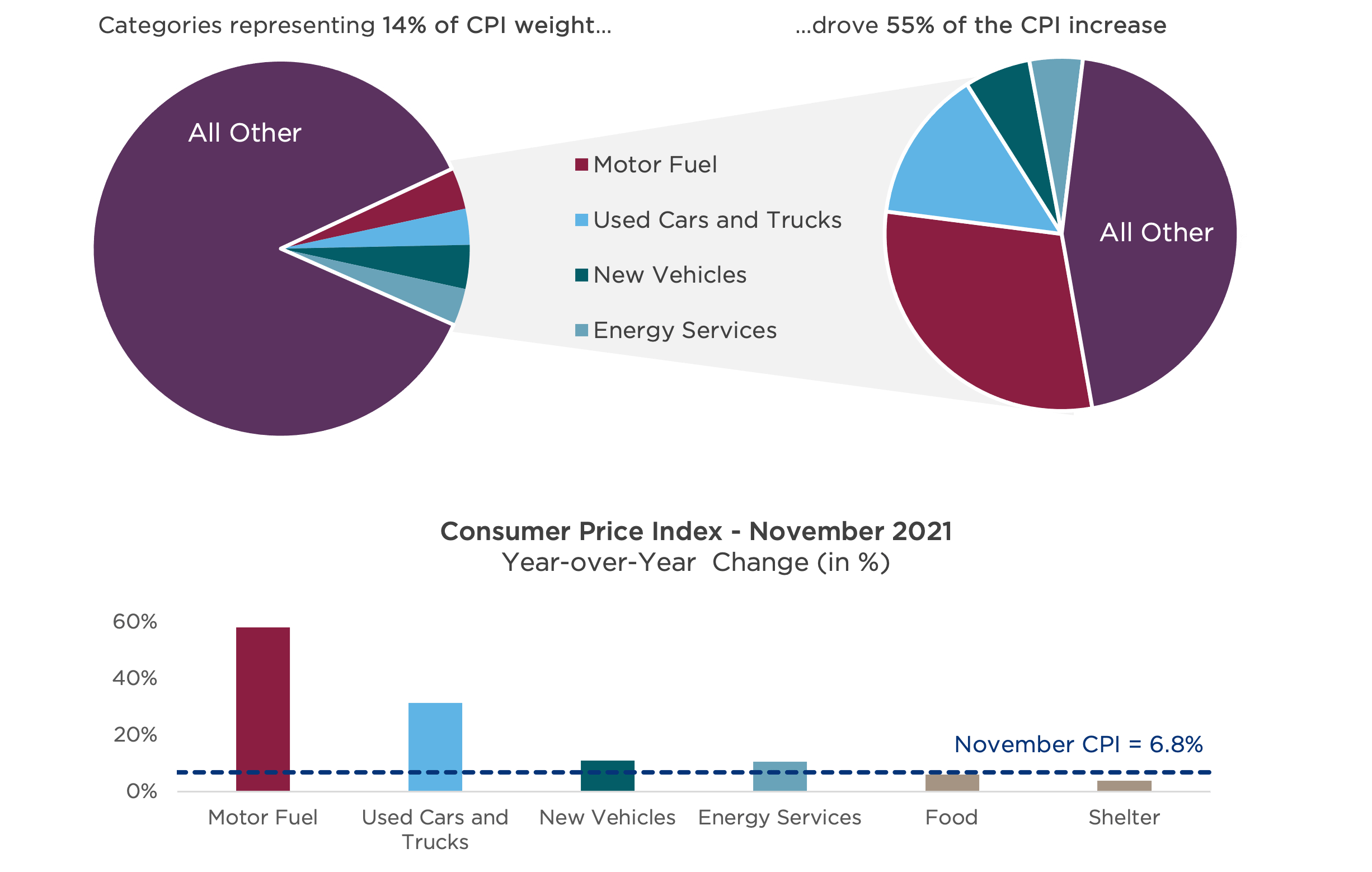

During the pandemic, we saw a spike in demand for products that were in short supply—everything from work-from-home equipment and exercise gear to cars and trucks—as chip shortages constrained production. In November, the Consumer Price Index (CPI) posted a shocking 6.8 percent year-over-year increase, representing its highest uptick since 1982.

The Misery Index referenced above combines the level of inflation with the unemployment rate, and even while significant progress was made on employment, high levels of inflation worsened the misery of many consumers.

So far, much of this inflation has stemmed from a subset of categories tightly linked to the reopening, such as fuel and energy, along with categories most affected by supply-chain problems, such as autos. As shown in Figure Three, categories representing less than 15 percent of the CPI drove the majority of the increase.

Figure Three: November CPI by Category

Sources: U.S. Bureau of Labor Statistics, Bloomberg, CAPTRUST Research

Although the blockbuster November CPI reading was largely isolated within a few categories, it prompted a swift and significant reaction by the Federal Reserve. In mid-December, just days after the November inflation results were released, Federal Reserve Chairman Jerome Powell surprised markets with an abrupt pivot toward a more inflation-fighting stance, starting with the accelerated wind-down of monthly bond purchases that paves the way for interest rate hikes by early 2022.

Despite this timing, the Fed’s policy pivot was likely fueled by changes in other economic data less widely cited within the financial media, such as increases in employment cost indexes that could translate into broader and more extended inflation risks, as well as continued improvement in jobs data indicating that the labor market was rapidly healing. The risk is that employers facing higher labor costs must raise prices across a wide range of goods and services, creating a self-reinforcing inflation spiral.

Policy Error Risk

This backdrop raises what may be the most significant risk to markets in 2022: a policy error on the part of the Fed and other global central banks. This risk always exists during periods of economic transition, as the growth baton is passed from the public sector during times of economic stress back into the hands of the private sector. But the risk now is exacerbated by the unique nature of the pandemic and the unpredictable path of the virus—factors that fall well outside the margins of the Fed’s typical business-cycle playbook.

If the Fed waits (or has waited) too long to begin tightening, the risks rise that inflation pressures have passed the point where typical containment measures will be effective. If they act too soon or aggressively, policymakers risk stalling a fragile economic recovery amid lingering pandemic uncertainty.

Stretched Valuations

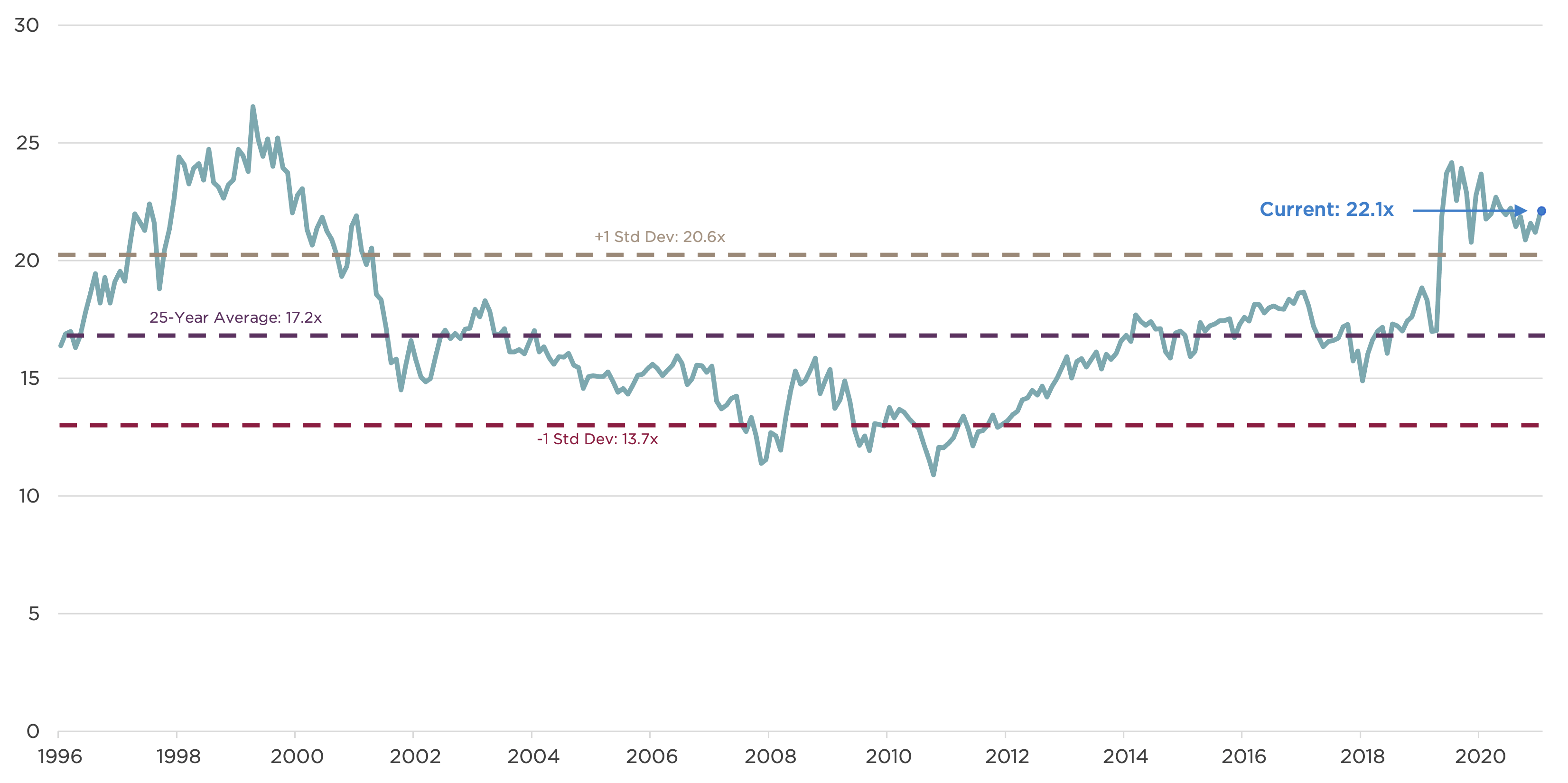

Finally, the level of prices across major asset classes are elevated today compared to historic levels. Prices for U.S. stocks relative to earnings far exceed pre-pandemic levels, while low levels of Treasury yields and historically narrow credit spreads imply lower future returns for core bonds if interest rates rise or if economic conditions soften. As shown in Figure Four, at the end of 2021, the forward price-to-earnings (P/E) multiple for the S&P 500 Index stood just above 22, well in excess of its 25-year average of 17.

Figure Four: S&P 500 Index Forward P/E Ratio

Sources: Bloomberg, Robert Shiller, NASDAQ, CAPTRUST Research.

It’s important to note that P/E multiples have declined steadily over the past year even as stock prices moved higher, as growth in company earnings far outpaced price gains. Looking ahead, we believe that stock prices will continue to be driven by operating results more than multiple expansion. With rates at historic lows and a tightening policy environment, there is less reason to expect significant gains in price-to-earnings multiples.

Not surprisingly, the types of stocks facing the most pressure in the rocky early weeks of 2022 are in the most speculative corners of the market, such as young and unprofitable technology firms that soared in 2020 and the first half of 2021. High-growth, smaller-company stocks tend to be highly interest rate sensitive, because they are valued today on the growth expected to occur far into the future, and rising rates translate into higher opportunity costs while that uncertain growth materializes.

Outlook: Strong, but Slowing Growth

Amid the risks and headwinds described above, we believe that the outlook for both the economy and long-term investors is bright. The U.S. continues to lead a global economy that remains strong. Even if growth fades from the current elevated levels, there remains optimism for positive, although more muted, returns likely with bouts of volatility.

In the decade prior to the 2020 pandemic, the growth of real gross domestic product (GDP) within the U.S. remained rangebound between 1.6 and 3.1 percent. Estimates for 2021 real GDP growth are significantly higher, between 5 and 6 percent, even after accounting for the effects of inflation. Even as rates of GDP growth return to Earth, the U.S. economy is likely to continue to enjoy above-trend growth in 2022. One important driver of continued growth is the strength of household balance sheets. Consumers have amassed trillions of dollars in excess savings over the past two years that will continue to support consumer spending.

We also expect corporate profit growth to slow and return to more normal levels as businesses face higher costs of doing business. The ability of companies to navigate labor shortages and price pressures will be company- and industry-specific, opening the door for material differences in performance within markets based on differences in cost structure and degree of pricing power.

As always, there is a host of unknowns. Although the highly transmissible, yet milder, omicron variant may pave the way for the shift to more normalcy, the path of COVID-19 has proven to be anything but predictable. Meanwhile, a combination of more aggressive government regulation and intervention, a slowing economy, and a real estate crisis have elevated risks within China, adding to geopolitical risks of Russian aggression in Ukraine and policy uncertainty from U.S. midterm elections.

Back to Normal

Our best educated guess for 2022 is that the year will bring a return to normalcy for both our financial lives and our real, everyday lives. We hope that pandemic-related disruptions will be significantly reduced, which should lead schools, businesses, entertainment, travel, and the host of other aspects of our lives to return to normal—or at least not as disrupted as the last two years have seen.

Likewise, it wouldn’t surprise us to see capital markets and financial assets return to more normal behavior. Stocks will likely see more muted returns with increased bouts of volatility. Bonds and other assets like real estate should also see calmer waters. We would be happy with this outcome for 2022: trading the sky-high returns of stocks over the last three years for a return to a more normal—and healthier—regular life.