Trust Basics

What is a Trust?

A trust is a legal entity that holds assets for the benefit of another. Think of a trust as a safe that can be loaded with anything you choose. You get to decide who can open that safe, and when.

There are generally three parties in a trust arrangement:

- The grantor (also called a settlor): This is the person who creates and funds the trust.

- The beneficiary: This is the person or people who receive benefits from the trust, such as income or the right to use a home. These individuals have what is called an equitable title to trust property.

- The trustee: This is the person or people who hold legal title to trust property, administer the trust, and have a duty to act in the best interest of the beneficiary.

You create a trust by executing a legal document called a trust agreement. The trust agreement names the beneficiary and the trustee. It also contains instructions about what benefits the beneficiary will receive, what the trustee’s duties are, and when the trust will end, among other things.

Potential Advantages

A trust can:

- Help reduce estate taxes;

- Shield assets from potential creditors;

- Avoid the expense and delay of probate*;

- Preserve assets for your children until they are grown, in case you die while they are still minors;

- Create a pool of investments that can be managed by professional money managers;

- Set up a fund for your own support in the event of incapacity;

- Shift part of your income tax burden to beneficiaries in lower tax brackets; and

- Provide benefits for charity.

*Note: Probate is the court-supervised process of settling a deceased person’s estate. Probate can be a complicated process and often takes six to 18 months to complete.

Potential Considerations

Trusts also have potential disadvantages. First, there are costs associated with setting up and maintaining one. These may include trustee fees, professional fees, and filing fees. It’s also important to know that, depending on the type of trust you choose, you may give up some control over the assets in the trust. Also, maintaining the trust and complying with recording and notice requirements can take considerable time. Lastly, income generated by trust assets and not distributed to trust beneficiaries may be taxed at a higher income tax rate than your individual rate.

Types of Trusts

There are many types of trusts, the most basic being revocable and irrevocable. The type of trust you should use will depend on what you’re trying to accomplish.

Revocable Trusts

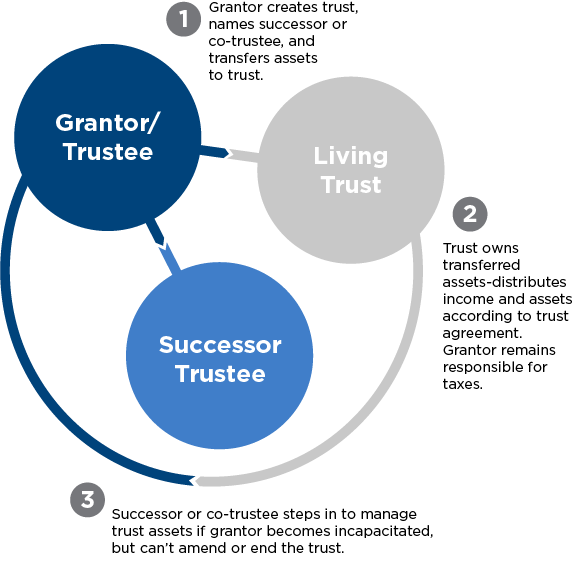

A revocable trust, also called a living trust, is a trust that you create while you’re alive. This type of trust:

- Avoids probate. Unlike property that passes to heirs by your will, property that passes by a living trust is not subject to probate, avoiding the delay of property transfers to your heirs and keeping matters private.

- Maintains control. You can change the beneficiary, the trustee, and any of the trust terms as you wish. You can also move property in or out of the trust, or even end the trust and get your property back at any time.

- Protects against incapacity. If, because of an illness or injury, you can no longer handle your financial affairs, a successor trustee can step in and manage the trust property for you while you recover. In the absence of a living trust or other arrangement, your family may have to ask the court to appoint a guardian to manage your property.

A revocable trust can also continue after your death. You can direct the trustee to hold trust property until the beneficiary reaches a certain age or gets married, for instance.

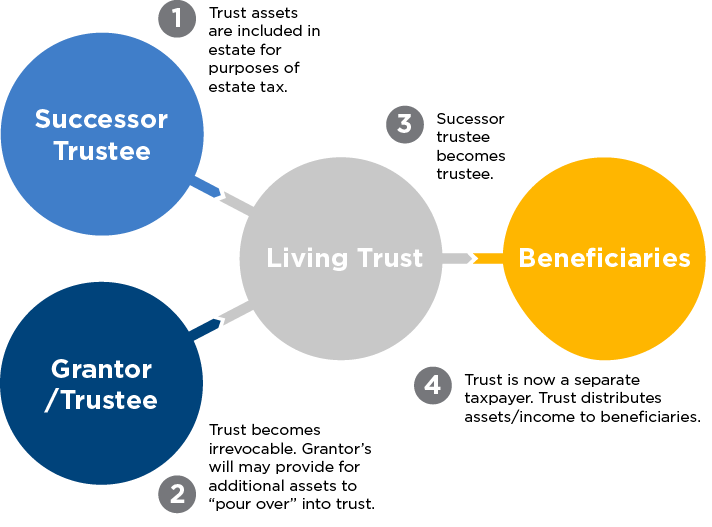

Despite these benefits, revocable trusts have some drawbacks. A revocable trust does not:

- Remove assets from your estate for tax purposes. Although these assets would avoid probate, they are still owned by the grantor and would be included in the gross estate.

- Provide creditor protection.

- Provide tax advantages.

Irrevocable Trusts

An irrevocable trust is a type of trust where, once established, the grantor generally can’t change, revoke, alter, or modify the trust. These trusts are considered separate entities, can remove assets from an individual’s estate, and may be subject to their own tax filing. There are many types of irrevocable trusts depending on what you want to fund it with, your intended beneficiary, and the access required. Irrevocable trusts can be established and funded during life or at death, depending on your goals for the trust.

An irrevocable trust:

- Avoids probate. Assets owned by an irrevocable trust are distributed subject to the terms of the trust outside of the probate process.

- Exists outside of your gross estate. For those with a taxable estate, funding an irrevocable trust during life can remove those assets and their growth from your taxable estate.

- Provides creditor protection. Assets are generally considered no longer in the control of the grantor and would generally not be subject to creditors. Provisions can be added to protect assets from the beneficiaries’ creditors as well.

- Provides control over distributions. Trust provisions determine when and how trust beneficiaries receive assets from the trust.

As the name implies, an irrevocable trust cannot be revoked. Although some changes can be made depending on trust rules, the funding of these trusts is generally permanent and irreversible.

Funding a Trust

You can put almost any kind of asset into a trust, including cash, stocks, bonds, insurance policies, real estate, and artwork. The assets you choose to put in a trust will depend largely on your goals. For example, if you want the trust to generate income, you could put income-producing assets, such as bonds, in your trust. If you want your trust to create a fund that can be used to pay estate taxes after your death or to provide for your family when you die, you might fund the trust with a life insurance policy.

Since an irrevocable trust is a separate entity, gifting rules would apply, and the transfer may be subject to gift tax at the time it is funded.

For help deciding which type of trust might fit your needs and goals, call CAPTRUST.