Who Is Your Financial Ally?

This is a problem that Marti DeLiema, a University of Minnesota researcher, has spent years trying to solve. In her research, DeLiema surveyed and interviewed thousands of older adults and heard stories about losses ranging from $50 to millions of dollars in scams perpetrated over the phone, through email and social media, and on the internet. Some of the worst ones involved investment-romance scams, in which schemers acted romantically interested in their victims.

In one scenario, the con artist talked about how he “just made half a million dollars in a crazy new coin offering on a crypto exchange.” He was charming and flirtatious, offering to share the opportunity with the other person, DeLiema says. They had multiple long conversations. But it seems he had the same conversations with numerous people.

Victims sent money, and “when the scam finally unraveled, the older adults had lost thousands of dollars, as well as a person they had a deep romantic connection with. It’s a double whammy of pain,” says DeLiema, an interdisciplinary gerontologist and an assistant professor in the School of Social Work at the University of Minnesota, Twin Cities.

Enlisting a financial ally, often a family member or close friend, could be the best defense against these attacks and other fiscal missteps, DeLiema says.

A financial ally, sometimes called a financial advocate, is someone who assists you in managing your financial responsibilities, like paying bills and taxes, filing insurance claims, monitoring retirement accounts, and applying for government benefits. Financial allies can run interference on other potential problems as well.

“There are many examples of financial exploitation or abuse by people who misuse an older person’s debit and credit cards, forge signatures, improperly transfer property, or change beneficiary designations,” says DeLiema.

Almost everyone knows at least one friend or family member who has experienced identity theft or financial fraud. In the investment-romance scam, a financial ally “might not have stopped the first $1,000 from leaving the account, but they could have prevented the deep-pocket losses,” DeLiema says.

An ally could be a spouse or partner, an adult child, a grandchild, a niece or nephew, a close friend, a fellow church member, or a paid professional, such as a trust officer, attorney, or accountant. Generally, this should be someone you have known for a long time and are sure you can rely on to make good decisions.

“Your ally is someone you can depend on to have your best interest at heart,” says John Keeton, a CAPTRUST financial advisor in San Antonio, Texas. “You can lean on them to help you make well-informed decisions. This sets the groundwork for your ally to take on more responsibilities if you start to lose interest in decision-making or experience some cognitive decline.”

Cathy Seeber, a CAPTRUST financial advisor in Lewes, Delaware, agrees. She says many advisors will ask clients to name a trusted contact in case questions arise and the client is unreachable or seems to need financial intervention.

Similar to a financial ally, a trusted contact is someone your financial institution is authorized to communicate with if you’re unavailable. “Ideally, this contact will have a close relationship with your financial advisor, who is often the first one to notice unusual transactions or behaviors,” Seeber says.

Selecting the Right Person

Although some people remain financially sharp as they age, many will experience some cognitive decline, dementia, or an illness that impacts their ability to make critical choices. And those who don’t are still at risk of financial mistreatment, as new methods of money transfer; new markets, such as cryptocurrency; and new types of communication technology allow scammers to target thousands of people simultaneously.

To help people navigate these issues, DeLiema and her colleagues created the Thinking Ahead Roadmap, a website and booklet, which provides a step-by-step guide to keeping money safe as you age. One of its strongest recommendations: Identify a financial ally by the time you retire, or sooner.

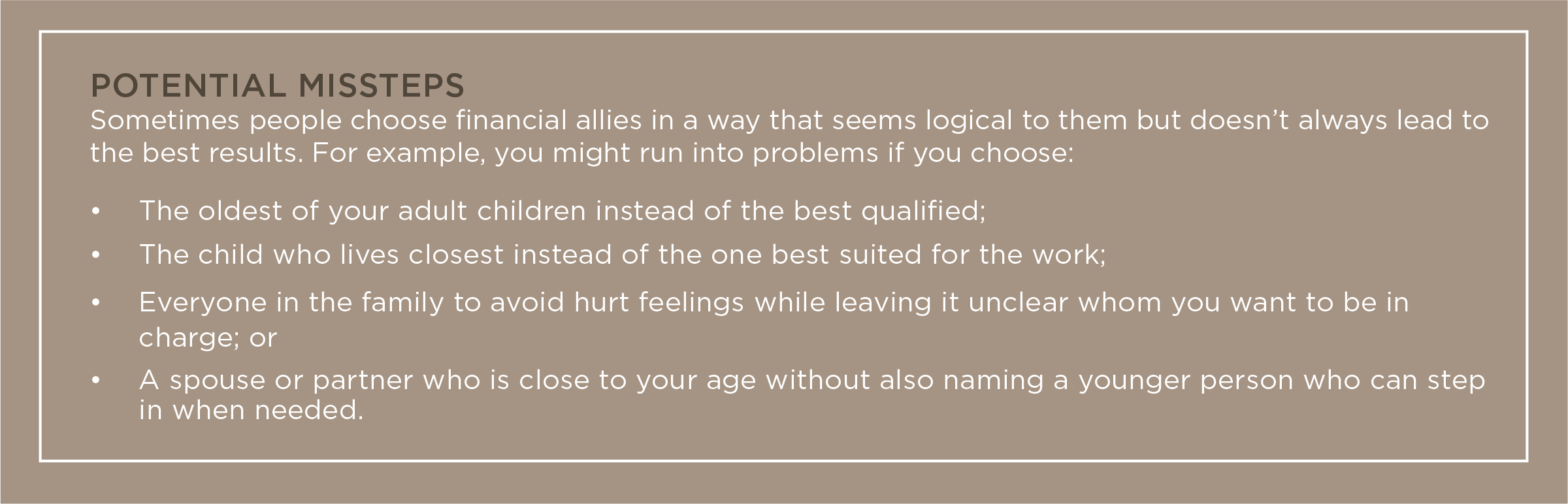

When it comes to selecting the best candidate, people often automatically select their spouse or partner as a first choice because they believe that person understands their finances and will put their needs first. But because of the likelihood of serious health issues or the loss of a partner, DeLiema recommends that everyone choose a backup ally as well—someone who is organized and reliable. This should be someone you’re comfortable being honest with and who will listen to you.

At first, the person might play a consulting role and offer guidance only when asked. In these early stages, they can act as a sounding board and provide assistance if you think you’ve been the victim of fraud or exploitation. Your ally can then assume additional responsibilities over time as their competence grows and as they become more familiar with your financial situation.

However, unless you give them legal authority via a financial power of attorney (POA), they will not have the power to act on your behalf. A financial POA is a legal document that gives someone the right to make decisions about your money and property. DeLiema suggests preparing a POA document early on but signing it only when you think you need regular assistance with daily tasks, such as paying bills and taxes and monitoring investments.

It’s a lot of responsibility, so you want to select the right person to take the driver’s seat at the right time, instead of leaving things to chance. “If you don’t make a decision, you may be manipulated into giving power of attorney to a child who should never be trusted with money,” DeLiema says.

Most parents know which of their children they can rely on to make good financial decisions and which ones they think might try to cash in early on their inheritance, she says. In one interview, DeLiema says a woman told her that she clearly understood her adult son’s limited financial decision-making capabilities and her own responsibility to protect herself in light of them. The woman asked, “If he can’t take care of his money, how is he going to take care of our money?”

Navigating Family Dynamics

Instead of choosing just one contact, some people choose to enlist two or more people as their financial allies, Seeber says. “It’s almost like having a personal financial board of directors.” A small group of people working together can also reassure other family members and friends that decisions are being made in the individual’s best interest, she says.

For example, Seeber knows one elderly woman who was experiencing short-term memory loss and turned over control of her finances to a son who lived nearby. But a second son, who lived farther away, was also given access to all her accounts so that he could keep an eye on transactions. “This way, they share accountability,” Seeber says.

When one adult child is given the authority to supervise a parent’s finances, it can cause hard feelings between siblings. But there are ways to navigate these dynamics by giving everyone separate responsibilities, says Keeton.

For example, you might ask the most monetarily savvy adult child to take over your finances while calling on another to be responsible for healthcare issues and asking a third to plan family events, he says. “You can build a role for each child, based on their interests.”

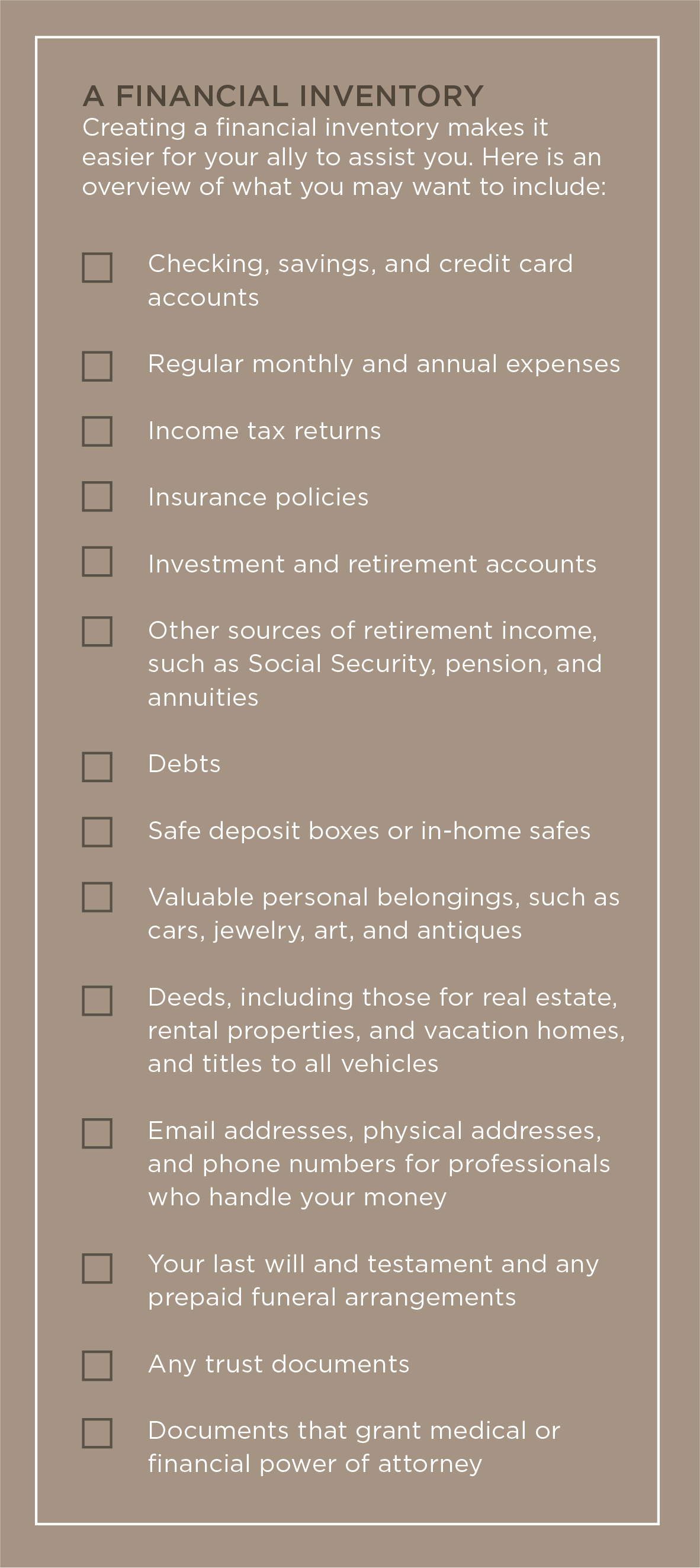

DeLiema recommends bringing your family together to tell them about their potential roles in a single group discussion. This way, everyone will know the plan comes straight from you, reducing the risk of future disagreements about how you want your money managed and by whom. She also advises walking your allies through your current accounts, assets, income, expenses, liabilities, and long-term goals.

Building the Foundation for Success

Throughout the process, communication is key. Your ally will need guidance to understand and accomplish what you’re trying to achieve, says Keeton. “Think of the ally as the family’s chief financial officer. You may want to consider coaching your children to manage the family finances. And ideally, you would phase them into that role, not just give them the keys overnight.”

You can lay the groundwork when your children are young by teaching them about earning, spending, gifting, and saving, he says. Consider letting them use kids’ financial apps, like Greenlight, PiggyBot, or iAllowance, to organize their budgets and track their spending. “It’s a great way to develop financial awareness and acumen,” says Keeton.

Keeton recommends people introduce their financial ally to their financial advisor. Adult children can be included in financial planning sessions and tax meetings to show them what you’re trying to accomplish and how you think through big decisions, he says.

Some people are uncomfortable sharing financial information with others, including their children. “One fear I’ve heard is that people don’t want to disclose the scope of their wealth to their adult children out of fear that their children will choose to live a more lavish lifestyle or won’t pursue their own career goals knowing how much they are going to inherit,” DeLiema says.

Utilizing the services of a corporate trustee is an alternative option if you feel that your family members aren’t well-equipped to manage your estate. “This trustee will have a fiduciary responsibility to ensure that decision-making is aligned with your overall estate plan,” says Keeton. Eventually, your ally could become well-positioned to be the executor of your will, he says.

To make things easier for your ally, DeLiema recommends simplifying your finances as much as possible and creating an inventory of your income, debt, and other money needs. Keep this information in one place to make it easier for this person to assist you in the future.

Most people who have a designated financial ally say the arrangement gives them confidence and peace of mind. “For many people, it’s a huge relief not to have to manage their day-to-day financial matters when things become challenging,” says DeLiema.