2025 IRS Retirement Plan Contribution Limits Released

The IRS has announced the updated retirement plan contribution limits for the 2025 tax year. These annual adjustments reflect cost-of-living changes and help individuals and employers plan more effectively for retirement savings and benefits strategy.

If you contribute to a 401(k), 403(b), 457(b), Traditional IRA, Roth IRA, or manage a workplace retirement plan, now is a great time to review the new thresholds and adjust your contributions accordingly. The new limits may present opportunities to increase tax-deferred savings or fine-tune retirement strategies in alignment with your long-term goals.

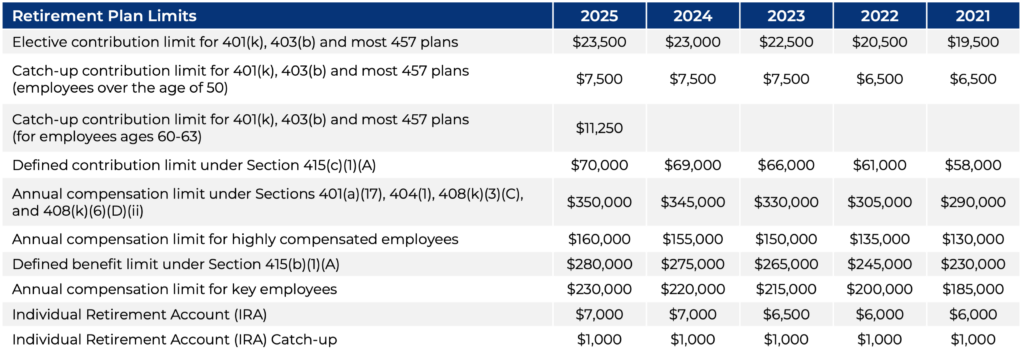

Below is a snapshot of the 2025 contribution limits:

Whether you’re optimizing your personal retirement contributions or reviewing employer-sponsored plan limits, our advisors are here to guide you through what these changes could mean for your financial future.

Align Your Strategy with the New 2025 Limits

To learn more about how these changes may impact your plan or portfolio, contact your CAPTRUST financial advisor at 800.216.0645, or visit our locations page to connect with an advisor near you.