High Earners Face Retirement Challenges

High earners relying solely on qualified plans and Social Security to generate retirement income will face savings shortfalls. And the higher an individual’s compensation, the more severe the potential retirement income gap can be.

Generally speaking, a highly compensated employee needs to save above and beyond the maximum 401(k) or 403(b) contribution limits—along with other options, including health savings accounts (HSAs) and individual retirement accounts (IRAs)—to maintain their current lifestyle when retired.

“Part of being highly compensated is the inherent challenge of saving enough to replace 70 to 80 percent of your working income in retirement,” says Scott Matheson, Managing Director of the Institutional Group at CAPTRUST. “High earners need to look for other ways of saving outside of traditional retirement plans. For these people, it’s much more complex than just maxing out your 401(k).”

According to a MarketWatch study, 51 percent of investors who have investable assets of $500,000 or more report feeling concerned about their financial security in retirement, and 46 percent are worried their portfolios are not properly tax optimized. Research from Urban Institute also reveals that one in 10 high-income families have no retirement savings at all. In fact, Neilsen reports, 25 percent of families making $150,000 a year or more are living paycheck to paycheck.

It’s counterintuitive, but what seems to be true is that a hefty income doesn’t necessarily lead to a successful retirement. The question is, what can high-earners do now, while they’re still working, to help make sure they have enough money to maintain their current lifestyle after retirement?

Don’t Go Belly-Up Keeping Up

First and foremost, live within your means. The trend of keeping up with the Joneses can affect high-income people just like anyone else. And living outside your means is a bad habit, no matter what yearly income you’re working with.

“People tend to have comparable margins for spending as a percentage of their compensation, but they don’t seem to have an expanding relative margin of saving,” says Matheson. “Which means when they make more money, they’re going to buy a bigger house. Make more money, maybe join the country club. Make more money, maybe buy a more expensive car and put the kids in private school, and so on.”

This trend can condition high-ranking employees to believe that a consumption-based lifestyle is expected or even necessary to take full advantage of their wealth. But showing the world that you’re making more money can come with a big cost.

“I’ve worked with families who are trying to keep up with other families who make double, triple, or more each year, and it’s a recipe for disaster, no matter how much you earn,” says CAPTRUST Financial Advisor Mike Molewski. “A high income can leave you more wiggle room, but it shouldn’t be used as an excuse to go out and buy yourself whatever you want.”

According to Molewski, people at every income level can have money problems, especially if they are trying to keep up with others who are in a higher earnings bracket. “It’s the same for high earners; they just have more at stake,” he says. “Failure to set a realistic budget and stick to it will hurt you regardless of your income.” This is one reason why it is so important for high earners to accurately assess all potential streams of income and maximize their savings opportunities.

Retirement Plan Jenga®—Stack ’Em Up!

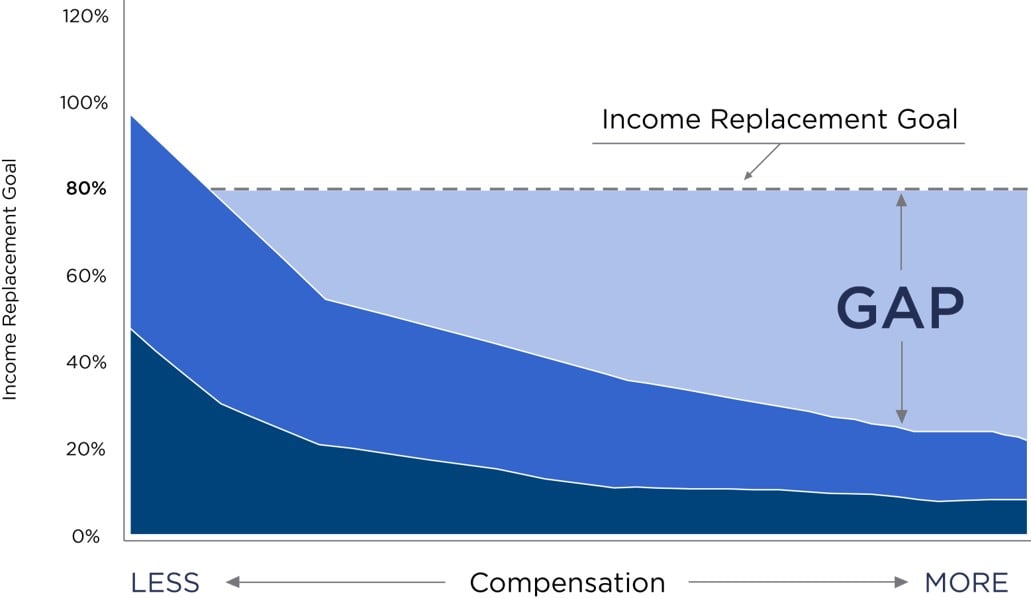

The combination of qualified retirement plan benefits and Social Security retirement benefits fall quickly as income rises. In fact, according to CAPTRUST research, an individual earning more than $200,000 a year cannot maintain their standard of living in retirement by relying on Social Security benefits and qualified retirement plan savings opportunities alone. Unless high earners find a way to save the additional money necessary to approach a 70 to 80 percent income replacement rate, they are at risk of serious retirement savings shortfalls, as shown in Figure One.

Figure One: Retirement Income Gap

Source: CAPTRUST Research

To attain the recommended retirement income replacement rate, high earners can utilize a combination of other savings programs, such as HSAs, nonqualified deferred compensation plans, stock purchase or stock option plans, and personal after-tax savings.

Layering benefit plans is a great way to maximize retirement savings and put away more money on a tax-favored basis. For example, high-income employees looking for further tax-favored saving should consider using an HSA. Participants can contribute up to $4,150 to an HSA if they have individual health insurance coverage or up to $8,300 for family coverage in 2024. People ages 55 and older anytime can contribute an extra $1,000. And, if you still have an HSA balance after the age of 65, you can take withdrawals from the account for non-medical expenses, penalty free.

“I can’t stress it enough to my clients, how important healthcare costs are for a couple retiring today,” says Molewski. “Maxing out an HSA and having those funds earmarked for healthcare expenses is a big deal. It’s not something you want to pass up.”

Additionally, those who have maxed out their employer-sponsored retirement plan savings limits and HSA contributions but still want to save more for retirement could benefit from using their company’s nonqualified plan. This type of plan offers high earners pre-tax savings proportionate with their income.

“Nonqualified deferred compensation plans are often used by employers as an added executive benefit, because 401(k) plans are inadequate, by themselves, for high earners,” says Matheson. “A nonqualified plan is like an agreement between employee and employer to defer a portion of the employee’s annual income until a specific date in the future. Depending on the plan, that date could be in five years, 10 years, or in retirement.”

Stock awards and stock options provide an added layer of long-term savings for high earners that can complement a stack of retirement plans. Executives, successful sales professionals, and business owners often receive stock purchase or stock option plans that can be used to supplement existing retirement accounts.

“While many recipients of equity compensation intend to use it to boost their savings and lifestyles, they often do not see this compensation as part of the bigger picture of retirement savings and post-retirement withdrawal plans,” says Matheson. “People often need a reminder to view these assets as a way to build up their long-term retirement nest egg.”

Possibility of Disability

Of course, long-term financial planning is not only about saving. It’s also about managing risk.

One big risk to your ability to save is the possibility of experiencing disability. And the reality is that more than 25 percent of Americans will acquire a disability before reaching retirement age, with numbers shooting upwards exponentially after age 65. Once a person becomes disabled, the Council for Disability Awareness reports that the average long-term disability absence lasts 34.6 months—nearly three years.

“Key employees acknowledge that their income is important, but they frequently misjudge the value of insuring it as an important asset,” says Matheson. “Adequate income protection, like disability insurance and life insurance, can help ensure financial obligations are met in the event of a disability or death.”

Many employers offer short- and long-term disability insurance options as employee benefits. Most commonly, these plans provide 60 to 70 percent of gross income in the event of disability. Nevertheless, Molewski says, the coverage that employer-sponsored disability policies provide is generally not enough for high-income earners because their base salary and incentive payments often end up exceeding the maximum policy coverage.

“In many cases, we have seen companies identify a shortfall and develop supplemental disability and life insurance plans that can help solve for these problems. Often at a minimal cost to the employer,” says Molewski.

Between lost income and increased healthcare expenses, the financial strain a disability can cause can create serious retirement savings shortfalls. A supplemental disability insurance plan and life insurance plan can help mitigate the risk of income shortfalls due to disability or death.

Tools and Advice Unique to the C-Suite

Integrating corporate benefits, equity compensation, and retirement risk management requires time and expertise that many busy professionals do not have. In fact, a nationwide survey of 1,000 equity compensation plan participants by the National Association of Plan Advisors found that half of respondents felt confident in their ability to make the right decisions about their equity compensation plan on their own.

Setting objectives, developing a clear picture of financial assets, understanding risks and time horizon, and measuring progress toward goals are four key pieces of the wealth planning process. But employers are increasingly finding ways to initiate financial advice and education that cater to the complex planning needs of high earners.

For any company expecting executives or partners to retire at a certain time, it makes sense to consult with these key employees at least five or 10 years before that date to gauge how their retirement plans are going. Executives may learn that they’ve fallen behind on their goals and may benefit from help with financial planning. Some high earners don’t even realize how much they may have amassed.

“Often, even those who are earning significant salaries don’t know they can retire because they have limited knowledge of their consolidated wealth, and this isn’t surprisingly, since it might be in four or five different places,” says Molewski. “The tools and resources available to high earners are lacking when it comes to being comprehensive and properly accounting for all of their assets.”

“A comprehensive program that looks at all the different layers of compensation is critical for high earners because it consolidates an employee’s full financial profile,” says Nick DeCenso, CAPTRUST director of wealth management. “As a core of the offering, the services need to overlay advice on top of the employee’s entire existing pool of assets, regardless of where they are held or who may have recommended the specific investment.”

“What we see is that the vast majority of retirement plan services fall short of providing adequate advice for executive-level needs,” says DeCenso. “It’s important that the tools and advice address more complicated payment packages that can include benefits like bonuses, partnership distributions, retirement contributions, and restricted stock units. This type of customized financial advice for executives is fairly unique in the industry.”

One way to position executives favorably against the possibility of a retirement income gap is to have these individuals complete a retirement needs calculation that truly encompasses their full financial picture. This exercise will help high earners determine how much they have amassed in different accounts and what they need to save to meet their goals. Armed with this crucial information, they may be motivated to save more, take advantage of other company-sponsored savings programs, and more accurately calibrate their retirement expectations.

The bottom line for high earners is that big paychecks don’t necessarily translate into high savings rates. While a high income gives people a distinct advantage when it comes to building wealth, that advantage can only take them so far. Customized advice and planning, enhanced risk protection strategies, and optimization of benefit and savings opportunities can make a big difference when trying to bridge a potential retirement income gap.