-

Solutions

- Solutions

-

Individuals & Families

- Individuals & Families

- Individual Investors

- Executives & Business Owners

- Families with Complex Needs

- Professional Athletes

-

Retirement Plan Sponsors

- Retirement Plan Sponsors

- Corporations

- Educational Institutions

- Healthcare Organizations

- Nonprofits

- Government Entities

- Endowment & Foundation Leaders

- See All Solutions

Comprehensive wealth planning and investment advice, tailored to your unique needs and goals.Investment advisory and co-fiduciary services that help you deliver more effective total retirement solutions.CAPTRUST provides investment, fiduciary, and risk management services for nonprofit organizations. -

About Us

- About Us

- Our People

- Our Story

- Learn About CAPTRUST

-

Locations

-

Resources

- Resources

- Articles

- Podcasts

- Videos

- Webinars

- See All Resources

Nonqualified deferred compensation (NQDC) plans allow employers to offer tax-deferred savings opportunities to key employees, typically executives. Unlike qualified plans—like 401(k)s, defined benefit pensions, or profit-sharing plans—NQDCs operate mostly outside of the Employee Retirement Income Security Act (ERISA). This makes it possible for employers to offer them only to a subset of employees and to create a level of flexibility not permissible within qualified plans.

The benefits to employees are clear: Participants can make pre-tax contributions of their base salaries, bonuses, or other compensation in one tax year, then withdraw the assets—and therefore pay income tax on them—in a later year. In the meantime, the deferred funds can be self-directed in a portfolio that is typically similar to the employer’s qualified plan menu and allows the possibility of growth.

The biggest advantage to employers is the ability to leverage NQDC savings as an executive benefit when hiring, retaining, or rewarding employees. In today’s tight talent market, NQDC plans feel especially attractive, and the industry is seeing a steady uptick.

Industry Uptick

In recent years, the NQDC industry has seen a shift to larger plans, and total assets have increased 130 percent, from $80 billion in 2015 to $183 billion in 2021, according to the 2021 “PLANSPONSOR NQDC Market Survey.” As the Government Accountability Office shared in a January 2020 report on private pensions, the vast majority (83 percent) of S&P 500 companies now offer nonqualified plans.

There is also an increase in employee participation. In fact, according to the same PLANSPONSOR survey, 66 percent of employees who were eligible to enroll in their employer’s nonqualified plan chose to participate, up from 53 percent in 2018.

“These trends can be attributed to historically low unemployment and the greater need for employee retention,” says Katie Securcher, a manager on CAPTRUST’s nonqualified executive benefits team. “For employers looking to expand their holistic benefits offerings, nonqualified plans offer a way to further entice key executives to join and stay at their organizations.”

Discretionary Eligibility

Part of the uptick may also be the result of several key plan design elements that have increased in popularity in recent years. These features allow nonqualified plans to have a greater degree of flexibility that benefits both the employer and employee. The first is flexibility in who is eligible to participate.

“While nonqualified plans can, in theory, be open to employees at many different levels, they are typically focused on those employees who are limited in other retirement savings vehicles that plan sponsors offer,” says Jason Stephens, senior director of nonqualified benefits at CAPTRUST. For many organizations, this means taking a strategic approach that focuses on a few employees at the top of the organization.

As an example, in 2022, under ERISA law, 401(k) participants could save a maximum of only $20,500 and plan sponsors could provide a match on savings up to only $305,000 of compensation. An executive who earns $500,000 a year is therefore only able to save a combined total of $41,000, or 8.2 percent of their salary, with dollar-for-dollar employee matching. But retirement best practice is for employees to save 10 to 15 percent to maintain their current lifestyle.

These limitations mean highly compensated executives who are contributing the maximum amount and receiving generous employer matches still would not be able to maintain a retirement lifestyle that aligns with their expectations. NQDC plans can provide an additional savings opportunity that will help them bridge the gap.

Typically, these plans are designed for no more than 10 percent of a total employee population, although in practice, they have been more limited. Eligibility is most commonly based on job title or base salary. In recent years, Stephens says, organizations are expanding eligibility to attract new hires and retain valuable employees who may have been previously ineligible for the company’s NQDC plan.

In its “2021 NQDC Market Survey,” Plan Sponsor Council of America (PSCA) found that 6.1 percent of total employees were eligible to take part in nonqualified plans in 2020, up from 5.2 percent in 2018.

“Determining who is eligible for nonqualified plans means finding the right balance for your organization,” added Stephens. “It’s the balance of identifying employees who will truly benefit the most from this type of plan but also not overextending the benefit. Having a bit more discretion in who can participate can be impactful in the recruiting process, especially if those employees are leaving behind a nonqualified plan at their previous organizations.”

Cost and Operational Efficiency

Another aspect contributing to the increased popularity of NQDC plans is the low initial and recurring costs of offering these plans. “Obviously, there will be fixed costs relative to some of the operational aspects of the plan, but when you look at those fees in totality, the per-person expense to have this offering on the table is usually small,” says Stephens.

For efficiency, most plan sponsors (61.2 percent) bundle their NQDC plans with the same administrator that is managing their qualified retirement plan, according to PSCA. “Administration is simply more efficient when you’re sharing information with just one party,” Stephens says, “and bundling helps create a cohesive experience for participants too, so it’s mutually beneficial.”

It’s worth noting that, in recent years, a few of the large qualified recordkeepers have acquired some smaller nonqualified recordkeepers, allowing for better bundled solutions and improved operational efficiency.

Contribution Flexibility

Perhaps the most attractive feature of NQDC plans is their flexibility to include both sponsor and participant contributions. According to PSCA, while nearly all plans (93.5 percent) allow participants to defer their base salary and bonus pay (90 percent), until recently, many plan sponsors didn’t allow for employer contributions. Now, both matching and discretionary employer contributions are becoming more common.

“There’s huge flexibility in the amount that employers can contribute,” says Securcher. “If they build the right provisions into the plan, employers can basically give a contribution to all participants within the NQDC plan or a subset of NQDC participants, can assign different vesting schedules to different individuals, or can simply let the employer discretionary contribution option lie dormant until they need or want to leverage this provision.”

Securcher explains, “Some organizations smartly incorporated employer discretionary contribution allowances when they created their plans, but they’ve never used them. Now, faced with a competitive labor market, they might say ‘OK, let’s give people bonuses via NQDC plans because we need to keep our folks here.’ They’re a good option to have available, even if you’re not going to utilize them all the time.”

Another popular employer contribution formula allows discretionary non-matching contributions plus a restoration match designed to fill the gap between 401(k) contribution limits and Internal Revenue Service (IRS) limits.

Distributions and Withdrawals

There are two key points to understand about NQDC plans and distributions. First, these plans are not useful solely for retirement. Second, unlike a qualified retirement plan, when taking withdrawals from an NQDC, participants must schedule distributions in advance.

For participants who want to take a withdrawal, there are six lawful types of triggering events: a fixed date, a separation from service, disability, death, a change in ownership of the company, or an unexpected emergency that could not have been planned for, like a sudden medical expense. A large tax bill, volatility in the stock market, or a change in the company’s financial health are not considered triggering events.

Usually, NQDC plans incorporate what’s called a fixed date election, in-service election, or specified payment date election. “They all mean the same thing,” says Securcher. “Basically, the employer is giving each employee the option to pick a date in the future when the employee is still working with this company, and that’s when the account will start paying out.”

Fixed date elections are helpful to participants because they allow people to plan for big expenses that aren’t tied to retirement goals, like sending a child to college or buying a second house. “Of course, the money is taxable when it’s distributed,” says Securcher, “but unlike a 401(k) plan, if you take money out of an NQDC before you are 59 1/2, you won’t be penalized.” Some plans only offer lump-sum payment options, while others offer the option for installments.

Participants can elect the time and form of fixed-payment accounts during enrollment. Typically, the date or form of payment associated with a fixed-payment account can be changed, but those changes are subject to 409A restrictions. According to PSCA, more than 60 percent of plan sponsors allow for emergency withdrawals, but 83.3 percent of those organizations report that none of their participants took one in 2020.

Enhanced Investment Menus

By default, and for administrative simplicity, most plan sponsors simply mirror the investment options available in their qualified plans. Securcher and Stephens say roughly half of CAPTRUST clients choose that option.

But because NQDC plans are not subject to laws regarding fiduciary responsibilities, they sometimes have broader investment menus than qualified plans. This is another attractive benefit to employees, especially if your key executives represent a different investor profile than your employee base. They may be saving for specific life goals, may have a more advanced understanding of investments, or may have better access to outside advice.

For instance, one participant may want to defer their entire compensation for five years in preparing to pay for a parent’s long-term care. Another participant may want to use their NQDC plan as a retirement savings vehicle over the course of the next 20 years. These choices will drive different investment behaviors that may require an expanded investment menu.

Retention Features

NQDC plans work as an employee retention tool not only because they are attractive savings vehicles but also because employers are allowed to apply discretionary retention features. For example, an employer may choose to give the employee a large bonus that vests over the course of five to ten years, thereby incentivizing retention.

Unless a plan has specialized provisions, typically a separation from service will trigger a distribution. This can cause a large tax bill for employees who leave the company unexpectedly. In some cases, leaving before retirement can also result in the forfeiture of unvested employer contributions.

“The level of choice that a plan sponsor has in how it designs its NQDC plan will vary by recordkeeper,” says Stephens, “but overall, these plans are highly flexible and highly attractive to executives, especially in today’s talent market.”

An NQDC offering can help you attract new executive talent but also retain and reward your current team. After all, turnover is costly, and executive turnover costs even more.

For employers who are just getting started, Securcher says, “Build the provisions in now as a safeguard. Then, you can bring them out later with the big guns if you need them; for instance, when you’re building out your executive team. And for existing plan sponsors, if you don’t have an NQDC plan in place, talk to your financial advisor about possibly adding one in the future.” Your financial advisor can help you determine the best plan design for your organization and your future needs.

The economy, like the growing season, is cyclical. Farmers know when to plant seeds so that crops peak at just the right time. Along the way, they rely on weather forecasts and real-time measurements of soil conditions to fine-tune their use of water and fertilizers. They do this because the stakes are high; the upfront cost to put a crop in the ground is enormous, and a failed harvest would be disastrous.

The Federal Reserve and other global central banks are, likewise, tenders of the global economy. They can adjust monetary policy to provide stimulus when conditions slow down and tighten when growth and inflation overheat, just as farmers can adjust nutrient applications to speed up or slow down crop maturation.

But unlike farmers, the Fed lacks real-time feedback. When it pulls a lever to tighten conditions, the extent of that change will likely not be fully known for six to 18 months. It’s always operating in the dark.

Today, it is widely believed that the Fed acted too late to effectively curb inflation. They didn’t get the seeds in the ground fast enough. Now, they’re making up for lost time through the fastest tightening cycle in the modern era, effectively driving a massive tractor at full speed at midnight. If they move too fast or understeer, they could plow right through a fence and push the economy into a recession.

Third-Quarter Recap

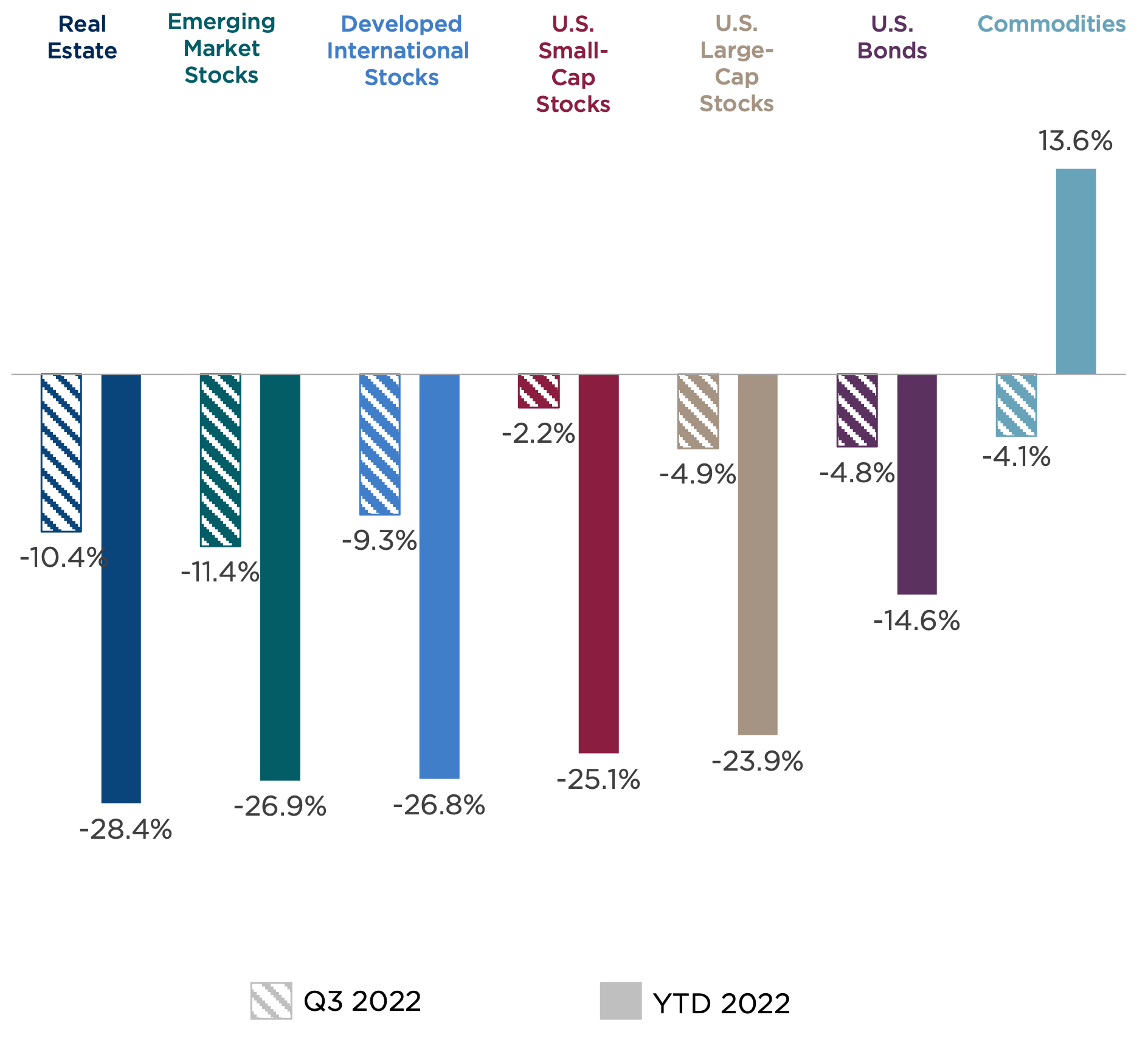

All major asset classes ended the third quarter with losses, ranging from 4.1 percent for commodities to 11.4 percent for emerging markets. It was a mirror image of second-quarter results that showed the same pattern of diversifrustration, leaving even well-diversified investors frustrated.

Figure One: Asset Class Returns (Third Quarter and Year to Date 2022)

Sources: Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

U.S. equities delivered a wild ride during the quarter, with large-cap stocks rising by more than 10 percent by mid-quarter before plunging into negative territory, resulting in a 4.9 percent loss for the quarter. Small-cap stocks fared modestly better than their large-cap counterparts, and growth stocks outperformed value stocks for the quarter.

Outside the U.S., European stocks faced further declines amid the ongoing war in Ukraine and resulting energy shortages, which grew worse after simultaneous leaks were discovered on two major gas pipelines. Led by rising energy costs, Eurozone price inflation reached double-digit levels in September. Within emerging markets, the growing prospects for slowing global trade, continuing struggles in China, and an exceptionally strong U.S. dollar created significant headwinds.

For bond investors, this no-good, very-bad year grew worse in the third quarter as core U.S. bonds declined by another 4.8 percent, bring their year-to-date return to negative 14.6 percent. This represents the worst-ever return at this time of the year, eclipsing the prior largest drawdown by a wide margin, as seen in Figure Two. One reason for this outsized reaction is that starting rates were so low; if you start a rate-hike cycle with a 5 to 7 percent yield, the income stream helps offset the price declines caused by rising rates. This year, we began with a 10-year Treasury yield of just 1.5 percent, leaving little yield cushion to offset price declines. Rising interest rates and concerns about potential recession also added to 2022 difficulties for public real estate.

Although commodities also declined 4.1 percent for the quarter, it remains the only major asset class with positive returns (13.6 percent) on a year-to-date basis.

Figure Two: Core Bond Prices on Pace for Historic Losses (1976-2022)

Sources: Bloomberg, CAPTRUST Research; Data as of 9.23.2022

While these returns will leave any investor feeling glum, there is a silver lining. Existing bond prices fell as their yields rose. This means that long-term investors can now pick up bonds with the potential to provide meaningful income. Even 10-year Treasurys are now paying yields approaching 4 percent: their highest level in more than a dozen years.

The Pest in the Field: Inflation

When markets are volatile, it’s important to attempt to cut through the noise and focus on the main event. Currently, all eyes are fixed on inflation and the Fed’s attempt to control it.

Consumer Price Index (CPI) data for the month of September all but cemented the Fed’s course toward another outsized 0.75 percent rate hike next month. CPI increased by 8.2 percent from a year earlier, which was a slight decline from the August reading. However, core CPI, which excludes some of the more volatile categories such as food and energy, which are less affected by monetary policy, rose to 6.6 percent from a year ago, the highest level in four decades.

Another issue with the inflation we’re experiencing today is its source. Some inflation can be classified as demand-pull inflation, which happens when strong consumer demand outpaces supply, causing prices to rise. This type of inflation was felt during and after the pandemic, as consumers raced to buy goods during lockdown, then rushed to consume services as the economy reopened. Demand-pull inflation tends to be reactive to Fed policy moves.

In contrast, cost-push inflation occurs when supplier costs increase, whether through rising input and energy prices, production bottlenecks, supply-chain disruptions, or higher wages. These issues are less affected by the Fed’s toolkit and may require other forms of policy change to move the needle.

Laser-Focused Fed

The goal of any central bank is to establish economic confidence by keeping inflation low and stable while supporting an environment for a healthy labor market and growth conditions.

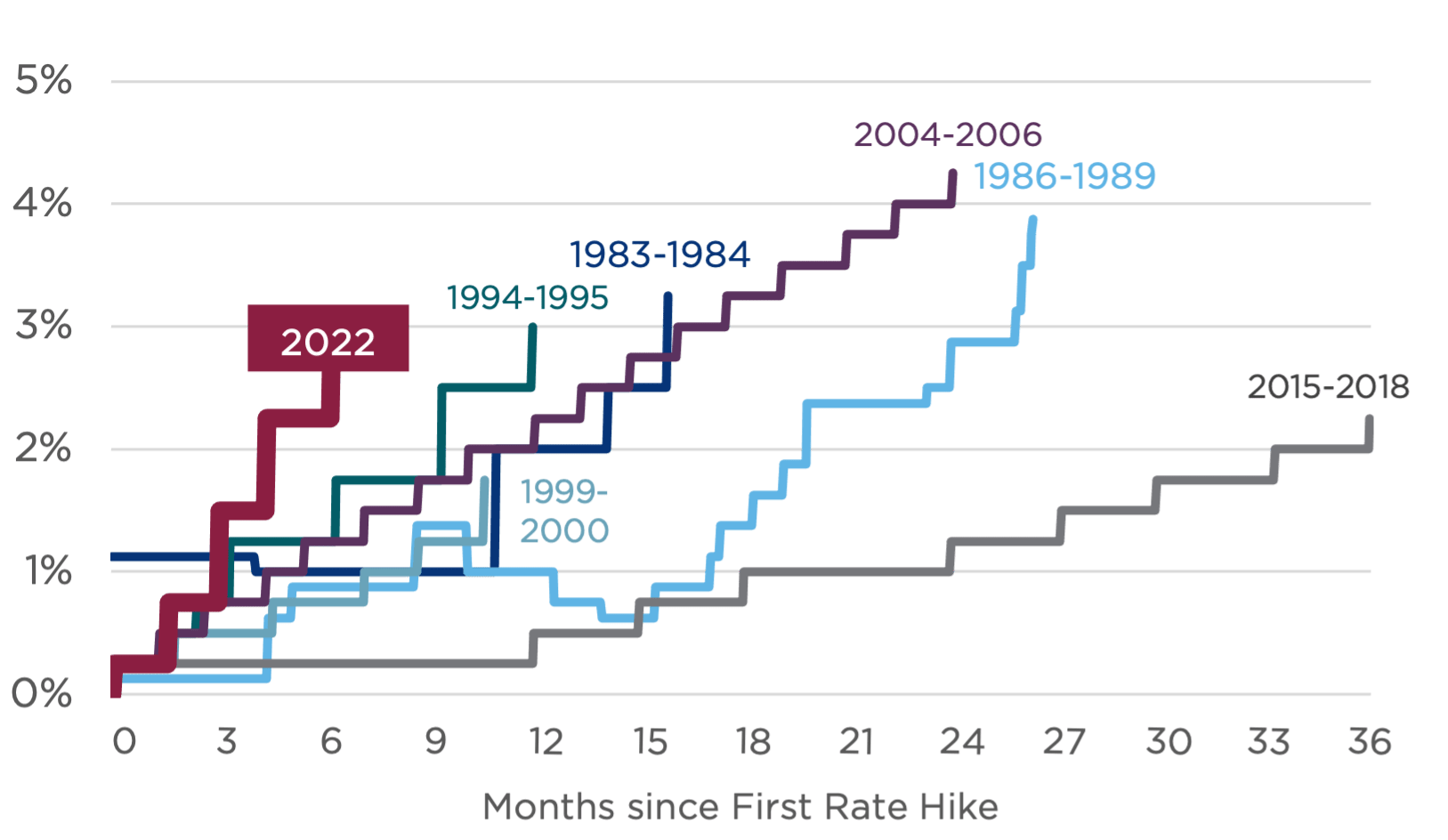

However, the high and rising level of inflation has sharply narrowed the Fed’s focus. High inflation that risks becoming entrenched has prompted the Fed to act far more swiftly than ever before, as the steep incline in Figure Three shows. Continued strength in the labor market provides room for this hawkish stance. The Fed seems resolved to tighten until inflation comes under control, even if it causes pain elsewhere in the economy.

Figure Three: The Fed’s Historical Tightening Pace

Source: Board of Governors of the Federal Reserve System, CAPTRUST Research

How did the Fed get itself into this position? As stated, Fed policy acts with a lag. It’s like trying to park a truck with the steering wheel and brakes on a 60-second delay. It seems the Fed temporarily forgot this fact in early 2021 as inflation began to accelerate but was explained away as temporary or transitory. Yet, even as it became clear late last year that inflation was a growing problem, the Fed did not raise rates until March.

The Fed’s objective is to engineer a soft landing—containing inflation without triggering a recession. But historically, this has been difficult to achieve, notwithstanding the added complexity facing the economy today. Over the past 60 years, throughout the course of eight recessions, we have seen only one true soft landing, suggesting that the odds of a Goldilocks outcome are poor.1

The last nine months are a stark reminder of what life is like when we have elevated inflation and an aggressive Federal Reserve. Markets especially dislike such policy uncertainty because it is not driven by fundamental or technical factors that can be analyzed but, rather, by the decisions of a small group of people and their various spreadsheet models, both of which are opaque.

Recession Complexion

Assuming that a soft landing isn’t achieved—a hope that’s growing dimmer by the day if you trust the continued and worsening inversion of the yield curve—then the next question on investors’ and business leaders’ minds is what the subsequent recession would look like.

Despite the significant market reaction so far this year, there are several positive signs that provide hope that even if the economy slips into recession, it could be a shallow and less painful one. Such factors include:

1. The Labor Market

One fact that has bolstered the Fed’s aggressive policy this year is the continued tightness within the labor market. There are still approximately two job openings for each unemployed worker today. And like any scarce resource, we could see hoarding behavior for talent within companies, which could prevent the mass layoffs that often accompany a recession.

2. Housing

With declining home sales and mortgage rates that have more than doubled from 3.2 to 6.9 percent this year, we expect to see weakness in the housing market. However, mortgage balances have increased only modestly over the past 20 years, while home equity has soared. This equity cushion should help keep a housing correction from becoming a crisis.

3. Strong Balance Sheets

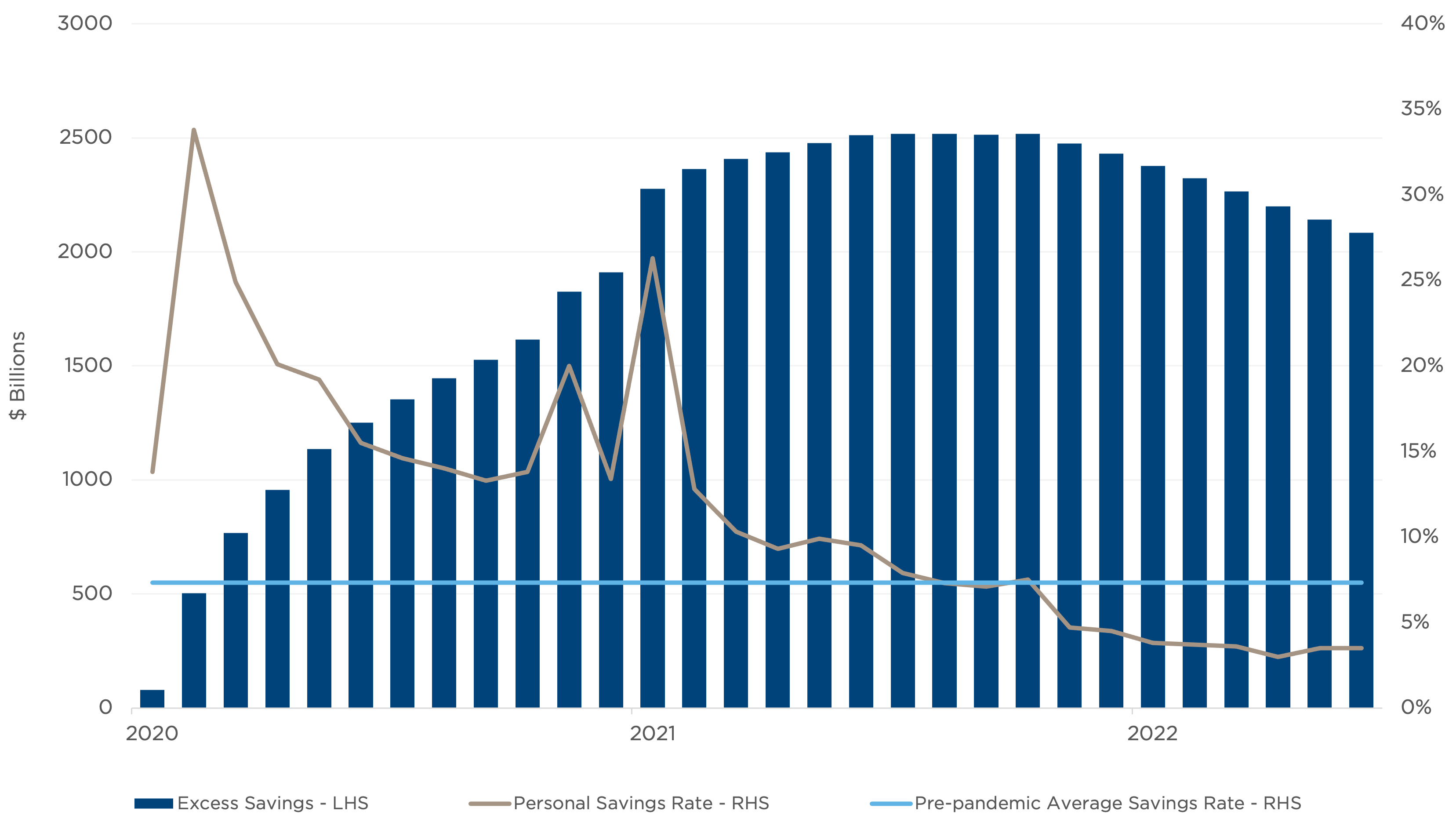

Despite low levels of consumer confidence, consumer spending has remained robust. This is due in part to strong household balance sheets that maintain a $2 trillion surplus of excess savings. However, spending began to slow in August, and the personal savings rate and levels of revolving credit have both deteriorated, suggesting that households are dipping into savings and tapping into home equity and credit cards to maintain spending or compensate for rising prices. Figure Four shows the volume of excess savings and the personal savings rate since the pandemic began in March 2020.

Figure Four: U.S. Excess Savings

On the flip side, while these sources of strength suggest a mild recession, it very well could be a longer recession as well. Typically, the Fed can turn on a dime at the first sign of recession to help soften the blow with lower borrowing costs. But this time, in an inflation-driven recession, it likely won’t have this luxury.

While the Fed could take other actions to ease financial conditions—such as suspending its quantitative tightening program—the prospect for rapid rate cuts is slim. In short, the length and severity of the recession will be driven by how high and sticky inflation proves to be relative to the Fed’s pain tolerance as the economy slows and unemployment rises.

What Might Happen

We believe the chances of a recession next year have increased to greater than 50 percent. However, stocks typically reach their bottom before the onset of a recession (or in hindsight, when it is declared). Much of the pain has already been priced in.

As we’ve said many times, the economy isn’t the market, and the market isn’t the economy.

The outlook for stocks remains clouded by uncertainty, which usually translates into volatility. Stock prices have declined significantly this year, while profit margins have remained elevated. As a result, measures of valuation, such as the price-to-earnings ratio, have fallen from well above their long-term average to below average.

On one hand, lower valuations improve the outlook for long-term stock investors, particularly when combined with depressed investor sentiment. But so far, we have witnessed a bear market in valuations but not earnings. As the risk of recession grows, stocks could come under further pressure through declining fundamentals while an exceptionally strong U.S. dollar dilutes the overseas earnings of U.S. companies.

Amid this global uncertainty, the competitiveness of the U.S. economy has never been more visible. While we may not be able to escape a recession, our economy is more resilient than those of much of the rest of the world, benefitting from abundant natural resources, a well-developed infrastructure, a stable financial system, and high levels of productivity.

Cautious Optimism

There is a Chinese proverb that explains, “The corn is not choked by the weeds but by the negligence of the farmer.” As large, dynamic, and resilient as the U.S. economy may be, it cannot escape trouble caused by the policy decisions—or mistakes—of a small group of people. We are witnessing this reality today within the UK, where policymakers appear to be fighting themselves with fiscal stimulus and tax cuts amid high inflation that the Bank of England is trying to control.

Given the high degree of uncertainty facing the markets today, we are maintaining our cautious outlook. At the same time, we are watching for signs that the worst is behind us. Until then, in a world with an expanding range of potential outcomes, the best defense is, as always, a well-diversified portfolio aligned with your personal risk tolerance, time horizon, and financial goals. The signs are pointing toward a bountiful crop, even though we can’t predict the weather for the rest of the year.

1Source: PSC Research, March 2022

Twenty years ago, the role of the defined contribution plan sponsor was to help participants accumulate as much money as possible in their retirement plan. The participant’s role was to invest appropriately and be patient. Plan sponsors kept participants focused on maximum accumulation, while working behind the scenes to build a sound retirement plan that the average participant could rely on. Today, that’s no longer the case.

“It’s not just about accumulation or the typical participant anymore,” says Jennifer Doss, senior director of the defined contribution practice at CAPTRUST. “It’s about helping each individual plan participant with a decumulation strategy that meets their unique needs, so people are ready and able to draw a steady stream of income from their accumulated savings. It’s about personalization.”

Accordingly, Doss says her team has seen a swell in questions about how to leverage tools and resources related to the personalization of retirement income planning, including questions about retirement income services and products offered at many recordkeepers and asset managers.

Why is this subject top of mind for plan sponsors? “Participant trends are a big factor,” says Michael Sasso, principal and financial advisor on CAPTRUST’s institutional retirement plan team. “But also, recent technological advancements and innovative product development are starting to drive interest.”

Retirement Industry Trends

With most of the baby-boomer generation having already met the traditional retirement age of 65, the defined contribution industry continues to see net outflows in participant numbers and assets. Yet a higher percentage of plan participants are staying in plans after retirement.

In fact, the percentage of retiree participants has more than doubled in recent years. According to J.P. Morgan’s 2021 “Retirement by the Numbers,” the number of participants remaining in their DC plans three years after retirement was more than two times the same data set from only 10 years earlier—42 percent in 2021 versus 20 percent in 2009. These numbers show that more plan participants are using their retirement plans as investment vehicles after leaving the workforce.

“From the participants’ point of view, fiduciary oversight from the plan sponsor is a benefit to staying in plan after retirement,” says Sasso. “Plus, you’ll likely see lower investment management costs than what you are likely to acquire on your own, thanks to the buying power of the aggregate plan assets.”

At the same time participants are realizing the benefits of staying in plan post-retirement, employers are realizing how retiree participants can benefit the plan itself. “Plan sponsors are seeing better scale and better pricing power with vendors and investment managers when retirees keep their assets in the plan,” says Doss. “Retiree participants tend to have larger balances so preserving those amounts for longer benefits everyone.”

Why Personalize

Until recently, plan sponsors needed to focus on providing the best possible plan for the highest number of their participants. “They were putting the foundational pieces in place for the future of the industry,” says Doss, “but those building blocks were generic by necessity. Mass personalization just wasn’t possible.”

Now, technological advancements have improved the industry’s ability to customize each participant’s retirement experience. Those advancements have opened the door for plan sponsors to create holistic retirement income programs. “A few examples,” says Sasso, “are managed accounts that can now consider nine or more data points for defaulted participants—versus the prior one to three—plus advanced account aggregation abilities and withdrawal programs for people in the decumulation phase.” He also points to better retirement planning and projection tools that are now commonplace across the industry.

Another important trend: More employees now look to their employers for financial wellness and education. They want help both saving and investing well. “Plan sponsors are increasingly interested in learning what they can do to help participants customize their plans and turn accumulated savings into a somewhat predictable stream of retirement income,” says Sasso.

“As an industry, our mantra has historically been ‘get employees in the plan, get them saving enough, and get them invested well,’” says Doss. “Autoenrollment and qualified default investment alternatives (QDIAs) helped us make huge strides in those areas, but we’re still not doing enough for retirement income,” she says.

As behavioral economist Dr. Shlomo Benartzi explains on CAPTRUST’s “Revamping Retirement” podcast, “Right now, a lot of the tools and the guidance are really geared toward the two percent in [retirement plans] that have million plus.” A vocal advocate for automatic features like auto-enrollment, auto-escalation, and auto-invest QDIAs, still, Benartzi says, “I don’t think auto features [are] the right solution for decumulation. What’s the difference? I think the difference is that, over our lifespan, we do accumulate assets, but we also accumulate differences, which requires more personalization.”

Solutions and Tools

The best thing plan sponsors can do to support a personalized retirement income planning experience is pay attention to participants’ evolving needs. Ask questions, do research, and respond with plan features that meet those needs as they align with your overall employee benefits strategy. “Decumulation planning has to be personalized in order to be effective,” says Sasso, “because retirement income is too individualized to solve through product alone.”

His advice to plan sponsors: “Start by defining the goals and objectives for your plans, then work backwards into solutions.” In other words, start with the end in mind. Here are four solutions and tools plan sponsors should consider.

1. Education and Advice

Participants want consistent access to independent third-party advice, and financial wellness support. To meet that need, plan sponsors should tap the expertise of financial advisors, and take advantage of digital features. “Participants need help planning and investing to meet their unique goals for retirement,” says Sasso. “They need education, they need access to planning tools, and they need advice from independent experts who are genuinely invested in their success.”

Some topics plan sponsors might explore are budgeting in retirement, charitable giving, when and how to take Social Security, the benefits of staying in the plan after retirement, and how much to withdraw to meet specific goals. Plan sponsors should consider offering access to one-on-one guidance, small group sessions, or organization-wide education, depending on the needs of their business.

2. Withdrawal Options

It is increasingly rare for plan sponsors to offer only one lump-sum withdrawal option to participants. Instead, systematic withdrawals have become a standard offering from most recordkeepers. Digital tools from these recordkeepers allow participants to explore different withdrawal timelines and payment options, then implement and change their selections over time. Having options around how and when they can withdraw their assets encourages plan participants to stay in plan after retirement.

3. Guaranteed Options

Traditionally, conversations about retirement income have focused on annuities, and of course, annuities can be an important resource for participants who are in or nearing retirement. Especially for retirees, they provide valuable protection against market volatility. However, they can be costly and complex to implement and understand.

Some of the newer guaranteed investment products include the use of traditional in-plan annuities but offer more alternatives for customization around their use. They can now integrate with existing asset allocation programs or be offered as standalone options in a plan.

“If you learn that your participants are looking for pension-like income guarantees, you might want to consider these newer annuity options,” says Sasso. “They are currently the only retirement income solution that can meet that goal.”

Another option is out-of-plan annuity placement services, which allow individuals to withdraw and convert a portion of their retirement account balance into an annuity, while still providing access to institutional pricing. These out-of-plan annuity placement services can be a good option for plan sponsors that don’t want to offer annuities in-plan but want to give guaranteed access to participants.

4. Non-Guaranteed Options

Non-guaranteed investment options also have emerged to help plan participants create a steady stream of retirement income or achieve their income-focused objectives. This list includes target-date funds, income- or yield-focused strategies, and managed payout funds. Several fund companies also offer income-mandated strategies that focus on producing a specific annual yield.

One important piece to note is that these investment options can be used in combination with systematic withdrawals to further customize the participant investment experience while also establishing a reliable monthly income. “If it’s done well, it should feel like getting a monthly paycheck,” says Sasso.

5. Managed Accounts

Managed accounts are another useful tool for plan sponsors that want to provide a personalized decumulation experience, especially managed accounts that include individualized withdrawal advice and Social Security guidance. Although managed accounts were historically used only by high-net-worth individuals, technological advancements have democratized their use.

Today, the typical managed account will evaluate around a dozen data points for an individual participant and create a personalized portfolio designed to meet each person’s unique needs and desires regarding retirement income. These accounts can incorporate many of the tools described above, like systematic withdrawal services and in-plan guaranteed investment options. Although they should not be considered a silver bullet for personalization, when implemented as part of a retirement income program that includes one-on-one advice and financial wellness services, managed accounts can be an effective tool for plan sponsors.

Getting Started

Retirement income planning should be a holistic service, not a single product offering. To stay responsive to participant trends and take advantage of technological advancements, plan sponsors should consider changes to their DC plans to improve the after-retirement experience for participants and help ensure a smooth transition from accumulation to decumulation, as employees become retiree participants.

“Tools alone won’t solve the retirement income problem,” says Doss. “The key is understanding that tools must be accompanied by solutions and advice about how to use the tools. Also, not every participant will need or want to use the same tools, which is why a holistic approach to retirement income makes sense for plan sponsors.”

“To get started,” Doss says, “consult with your plan advisor and recordkeeper; these key partners can help you figure out which options are available and right for your participants and your unique organization.”

Thoughtful Dismissal of Fees Case by U.S. Court of Appeals: Process Prevails

In a thoughtful and thorough decision, the U.S. Court of Appeals for the Sixth Circuit has affirmed dismissal of a suit alleging overpayment of fees and improper use of actively managed funds. Smith v. CommonSpirit Health (6th Cir. 2022). CommonSpirit was sued alleging that:

- actively managed mutual funds should have been replaced with less expensive, better-performing, passively managed mutual funds,

- underperforming investments were imprudently retained,

- plan recordkeeping fees were too high, and

- investment expenses were too high.

We recently reported on Hughes v. Northwestern University, the Supreme Court decision that seemed to make it more difficult for plan fiduciaries to have fees cases dismissed. CommonSpirit is the first circuit court of appeals decision to analyze these issues since the Hughes decision was handed down.

The court in CommonSpirit grounded its decision in investment basics, noting the relatively recent advent of index funds, the range of investment options available, and the variety of investors who may prefer distinctly different types of investments. The judge provided a thorough review of bedrock principles that apply to plan fiduciaries as they carry out their duties and how their actions will be evaluated if called into question. He initially noted the context in which fiduciaries’ decisions are made, saying:

[W]hether the [fiduciary] is prudent in the doing of an act depends upon the circumstances as they reasonably appear to him at the time when he does the act and not at some subsequent time when his conduct is called in question.

In the last analysis, the circumstances facing an ERISA fiduciary will implicate difficult tradeoffs, and courts must give due regard to the range of reasonable judgments a fiduciary may make based on her experience and expertise.

In response to the argument that investors should be skeptical of an actively managed fund’s ability to outperform its index benchmark, the court noted that:

[Actively managed funds are] a common fixture of retirement plans, and there is nothing wrong with permitting employees to choose them in hopes of realizing above-average returns over the long life span of a retirement account…. It is possible indeed that denying employees the option of actively managed funds, especially for those eager to undertake more or less risk, would itself be imprudent.

The judge noted that, for a claim to survive a motion to dismiss, the allegations in the complaint must show that it is plausible that a breach occurred, not that it was merely possible or conceivable, saying:

[A] showing of imprudence [does not] come down to simply pointing to a fund with better performance.… In addition, these claims require evidence that an investment was imprudent from the moment the administrator selected it, that the investment became imprudent over time, or that the investment was otherwise clearly unsuitable for the goals of the fund based on ongoing performance…. [It is] largely a process-based inquiry.

This reinforces the importance of ongoing monitoring of investments and taking appropriate action. The plaintiffs alleged that comparative underperformance of 0.63 percent demonstrated imprudent retention of a fund. The judge challenged the plaintiffs’ use of five-year results as a primary basis for replacing a fund, saying:

Precipitously selling a well-constructed portfolio in response to disappointing short-term losses, as it happens, is one of the surest ways to frustrate the long-term growth of a retirement plan. Any other rule would mean that every actively managed fund with below-average results over the most recent five-year period would create a plausible ERISA violation.

Sustaining dismissal of the recordkeeping fees claim, the judge noted that the plaintiff failed to provide sufficient facts that could move the allegation from possibility to plausibility. There were no allegations that the fees paid were excessive relative to the services received.

The investment management fee was also dismissed because sufficient facts were not alleged. The judge observed that the plan offered investments with fees ranging from 0.02 percent to 0.82 percent, with an average fee of 0.55 percent. This range and the average were evidence that the plan included a variety of actively and passively managed funds. He concluded with the familiar statement that “Nothing in ERISA requires every fiduciary to scour the market to find and offer the cheapest possible fund (which might, of course, be plagued by other problems).”

This case is good news for plan fiduciaries. It is sure to be relied on as they defend the numerous suits filed in this area.

Have a Thoughtful Reason for Not Using the Least Expensive Share Class

About a month after its decision in CommonSpirit, the Sixth Circuit Court of Appeals addressed a claim not made in CommonSpirit and partially reinstated a fees case that had been dismissed by the district court. One allegation in the newer case was that the plan’s fiduciaries imprudently offered more expensive share classes when less expensive share classes of the same investment were available. The judge noted that different investments of the same strategy or type that are more or less expensive or perform better or worse are not reasonable comparators that allow a court to conclude that a claim is plausible. However, when the funds being compared are different share classes of the same fund, there is a fair comparison that can support a plausible claim.

The court was quick to point out that a variety of not-yet-known factors could “exonerate” the plan fiduciaries. This could include such things as revenue sharing that benefits the plan or limited eligibility for the less expensive share class. The case was sent back to the district court for further proceedings. Forman v. TriHealth, Inc. (6th Cir. 2022).

New Cybertheft Lawsuit Filed: $750,000 Missing … and Not Restored

Through a series of well-orchestrated steps, cyberthieves managed another theft of plan assets from a plan administered by Alight. A participant’s entire account balance of $751,431 was stolen, and Alight has not restored her account.

Paula Disberry worked as an executive for Colgate-Palmolive from 1993 to 2004 at various locations around the world and participated in Colgate-Palmolive’s 401(k) plan. From time to time she checked her account online and intended to leave it in place until she reached age 65. When she tried to check her account online in August 2020, she was unable to access her account because she had the incorrect username and password. She contacted the Colgate-Palmolive benefits department. In September 2020, when she was 52, she was informed that her entire account balance had been distributed to an individual with an address and bank account in Las Vegas, Nevada. Investigation of the theft revealed that:

- The thieves first contacted Alight by phone in late January 2020, posing as Ms. Disberry and asking to update login information. In response Alight sent a temporary PIN by mail to her address in South Africa. The PIN was intercepted by the thieves. Ms. Disberry was not sent an email or contacted by telephone to let her know the PIN was being sent.

- In February, the thieves used the temporary PIN to set a permanent one, accessed the account, and changed the email and phone number on the account. They also changed the user ID and password on the account. Again, the plan participant was not alerted that these changes were being made.

- In early March, the thieves went online and added direct deposit information for a bank branch in Las Vegas.

- In mid-March, the thieves went online and requested a distribution of the entire account by direct deposit to the bank account added the prior week. They also changed the mailing address from the South Africa address to a Las Vegas address.

- Three days later, the thieves called Alight indicating that a complete distribution had been requested online by direct deposit and were told that distributions were required to be made by check. The payment was processed on March 20.

- After Ms. Disberry submitted a claim for benefits, the plan administrator denied her claim saying that it had reasonable procedures in place for plan distribution, which had been followed and the plan distribution was made “in accordance with all Plan terms and requirements.”

A lawsuit seeking recovery of the stolen funds followed. Disberry v. Employee Relations Committee of the Colgate-Palmolive Company (SD New York filed 7-7-22). The above is drawn from the complaint that initiated the case.

This case is a good reminder to plan fiduciaries to have qualified personnel review the Department of Labor’s cybersecurity best practices and their recordkeeper’s cybersecurity program to be sure the recordkeeper’s program at least meets the DOL’s recommendations. Not conducting that review could subject plan fiduciaries to allegations that they have not prudently evaluated their recordkeeper.

Poor Supplemental Life Insurance Administration: Employer May Have to Pay

Two recent appeals court decisions address situations in which supplemental life insurance was enrolled in and premiums were paid; however, required evidence of insurability was not submitted.

In Skelton v. Radisson Hotel Bloomington (8th Cir. 2022), an employee was automatically enrolled in $100,000 of life insurance. A few months later, her husband regained custody of his son, the employee’s stepson. The insurance program included a provision that coverages could be changed without evidence of insurability if the employee experienced a life event change. The employee called the benefits department and was told that regaining custody of a child was a life event. She applied for the maximum supplemental life insurance coverage available—$238,000—and began paying for that coverage through payroll deductions.

The insurance company sent her a notice on letterhead with both the insurance company’s and the employer’s logos that proof of insurability was required. It said the evidence of insurability should be returned to the insurance company. There is a dispute whether evidence of insurability was received, but the employee did not receive notification that the form had or had not been submitted. Upon the employee’s death, the insurance company paid $100,000 in life insurance benefits to the surviving husband and refused to pay the supplemental life insurance benefit.

A suit was filed against both the employer and the insurance company. The employer settled for $175,000, and the district court found the insurance company liable for the balance of $63,000. The insurance company appealed, alleging that it was not a fiduciary. The court of appeals disagreed, finding that the insurance company had sufficient involvement in the plan to be a fiduciary. The insurer breached its duties of both prudence and loyalty by failing to maintain an effective enrollment system.

In Gimeno v. NCHMD, Inc. (8th Cir. 2022), an employee elected supplemental life insurance coverage of $350,000 in addition to $150,000 in employer-paid coverage. To receive the supplemental coverage, the employee was required to submit evidence of insurability. However, he was not provided the form, and human resources staff at the employer did not follow up with him, so it was not submitted. Even so, premiums were collected for the supplemental coverage for three years until the employee’s death.

The insurance company refused to pay the supplemental insurance amount because it had not received evidence of insurability. A lawsuit was then filed against the employer for the $350,000 the designated beneficiary would have received if the supplemental insurance program had been properly administered. The district court denied the claim, believing that ERISA would not permit the employee to recover this amount from the employer.

The court of appeals disagreed, noting that the Supreme Court decision in CIGNA Corp. v. Amra (2011) expanded the relief that courts can award. In this situation the relief would be to assess an equitable surcharge against the employer to provide the benefit that would have been awarded if the employer had not breached its fiduciary responsibilities. The case was sent back to the district court for further proceedings.

These cases are a good reminder to employers (and insurers) to monitor the administration of supplemental life insurance programs.

Volatility in the global financial markets accelerated in the second quarter as investors, consumers, and policy makers alike faced opposing economic challenges: the rampant run of inflation and the looming threat of recession.

After three remarkable years of outsized returns in the stock market, the first half of 2022 was anything but. While prices of household goods and services climbed, prices of financial assets fell. The result has been a hit to both consumers’ wallets and balance sheets. With equities down 20 percent, and bonds—that typically act as a safe, diversifying asset—not faring much better, investors and consumers are navigating rough waters.

However, as we examine the factors that have brought us to this point, we must also consider a handful of financial and economic indicators that suggest the tide is beginning to turn.

Second Quarter Recap

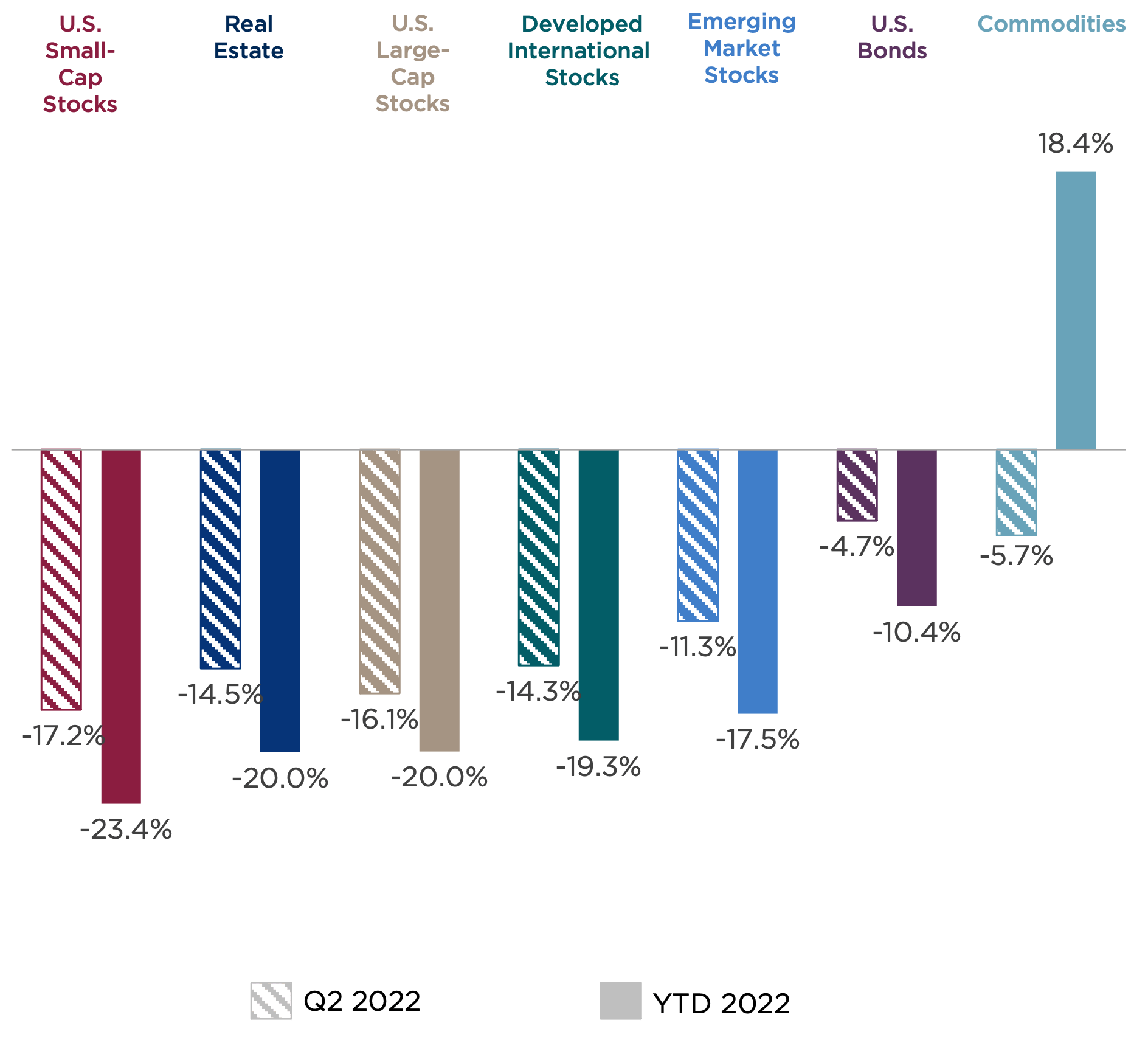

U.S. financial markets suffered their worst mid-year outcome in more than 50 years. While the first quarter was certainly volatile—with single-digit declines across the investment landscape—losses accelerated during the second quarter, resulting in double-digit declines for nearly all major asset classes over the first half of 2022. Figure One summarizes asset class returns for the second quarter and first half 2022.

Figure One: Major Asset Class Returns

Sources: Bloomberg. Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (large-cap stocks), Russell 2000® (small-cap stocks), MSCI EAFE Index (international stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

- Despite a late-quarter bounce, U.S. large-cap stocks ended the second quarter down 16 percent, bringing year-to-date losses to 20 percent. Defensive sectors such as consumer staples and utilities fared best in the declining market, while growth-driven sectors, such as consumer discretionary and technology, were hardest hit.

- International stocks performed modestly better than their domestic counterparts. However, the dollar’s continued strength offset their relative advantage. Developed international stocks ended the quarter down 14 percent, while emerging market stocks closed down 11 percent.

- Bond prices remained under pressure as interest rates continued their ascent. For the quarter, the Bloomberg U.S. Aggregate Bond Index lost another 5 percent, bringing its midyear decline to 10 percent.

- Commodities have been the outlier in the first half, as higher demand and constrained supply boosted food, energy, and basic materials prices. However, even commodities pulled back 6 percent in the second quarter as increasing growth concerns offset these positive inflation pressures.

Shifting Inflation Narrative

After the first quarter of 2022, investors were facing a great deal of uncertainty. The timing and scale of the Federal Reserve’s response to inflation was unknown; the capabilities and ambitions of Russian’s military operations in Eastern Europe were undefined; and the transition of COVID-19 from pandemic to manageable endemic was still up in the air.

Amid these unknowns, the supply-demand imbalance was worsening as factory shutdowns in China and sanctions against Russian exports continued to disrupt global trade.

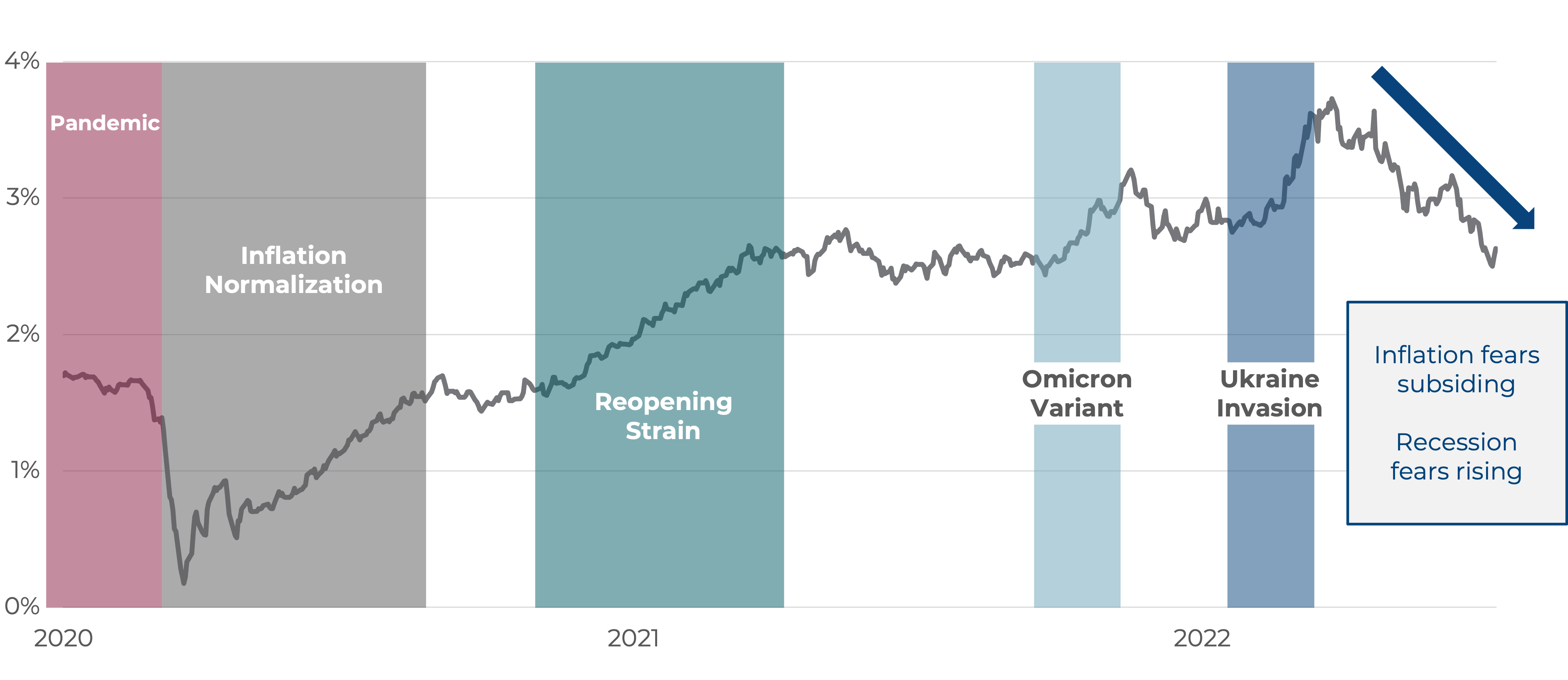

As the second quarter went on, many of these risks narrowed in scope. However, inflation expectations continued to climb with each new hurdle presented to the markets—that is, until recently, when an aggressive Fed policy stance reversed market sentiment, as suggested in Figure Two below.

Figure Two: Five-Year Inflation Expectations

Sources: Bloomberg, CAPTRUST Research. Data through July 8, 2022. Inflation expectations are represented by the five-year Treasury inflation-protected securities breakeven inflation rate.

The inflation narrative has broadened from one of COVID-19-related goods shortages to price increases taking direct aim at household budgets. Rising costs of necessities, such as food and gasoline, have consumed a greater share of consumers’ disposable incomes and eaten into stimulus-related savings. With the June Consumer Price Index (CPI) reaching a four-decade high of 9.1 percent, inflation remains top of mind. However, just as significant as the inflation reading is the Federal Reserve’s reaction.

A Little Background

Since the beginning of the year, anticipation of a higher federal funds rate had been trickling through the financial system, impacting business and consumer borrowing costs, before the Fed implemented its recent rate hikes.

Consumers felt an immediate impact, as the cost of auto loans and mortgages soared. Mortgage rates reached a 13-year high in June, driving a 55 percent increase in the average monthly mortgage payment since the beginning of the year. This, in addition to home price appreciation, has impacted housing affordability and pushed buyers out of the market.

Rising interest rates have also been the catalyst for lower equity and fixed income returns. Bond prices move inversely to interest rates or yields; as interest rates rise, bond prices fall.

The 2-year U.S. Treasury’s yield jumped from 0.7 percent in January to 2.9 percent at the end of the quarter. The benchmark 10-year U.S. Treasury saw a similar increase, reaching 3.47 percent in mid-June, its highest level since 2011, before ending the quarter at 2.98 percent, nearly double the rate from the beginning of the year.

The spread between the 2-year and 10-Year Treasury yield is a closely monitored signal. Historically, an inverted yield curve, where short-term rates exceed long-term rates, has reliably signaled a looming economic slowdown. Financial markets saw the U.S. Treasury yield curve invert in early April and twice to date in July.

Overshooting the Soft Landing

Meanwhile, the Fed increased the pace and magnitude of its inflation-fighting response with a 0.25 percent increase to the federal funds rate in March followed by a 0.50 percent increase in May and a 0.75 percent increase in June. Still, inflation continues to climb higher through the beginning of the third quarter.

Even worse, we estimate supply constraints have directly contributed to approximately 65 percent of the CPI’s recent increases. To complicate matters, the Fed’s monetary policy tools have limited efficacy against such constraints, which leaves it in a precarious position. With the CPI reaching 9.1 percent in June, the Fed may take a prolonged and aggressive stance to reduce demand to these constrained supply levels to rein in inflation, even at the cost of a policy-induced recession.

This dynamic reduces the likelihood of a Fed-orchestrated economic soft landing. In this ideal scenario, the Fed must reduce market excesses and bring inflation down to its long-term 2 percent target level without pushing the economy into recession.

Signs of a Fed-Induced Recession

While inflation grabs the headlines, investor concerns have been subtly shifting away from higher prices and toward the increasing possibility of a recession. The following indicators point to the beginnings of an economic slowdown.

- The five-year forward inflation expectation rate (as measured by the Treasury inflation-protected securities breakeven yield) has been on a steady decline since mid-June (again, as shown in Figure Two). This recent decline marks the largest drop in inflation expectations since the start of the pandemic in 2020.

- In May, housing affordability reached its lowest level since 2006. Mortgage rates climbing in tandem with the federal funds rate is creating the Fed’s desired effect. The overheated housing market is showing signs of cooling as sellers are beginning to negotiate and buyers—particularly entry-level buyers—are exiting the market.

- Consumer spending is on a downward trajectory, gaining just 0.2 percent in May. As prices rise, consumers are financing their purchases through excess savings accumulated during the peak of government stimulus. As these savings wane, consumers will likely delay large purchases, reduce travel, and spend fewer days in the office to reduce gas consumption.

While rising grocery and gas prices have directly affected consumer spending, a secondary effect is also likely to influence spending. This effect, known as the negative wealth effect, focuses on consumer balance sheets. Double-digit declines in stock and bond prices, 12-year lows in the personal savings rate, and potential housing price pressure all contribute to a level of wealth destruction that could be equally impactful to economic activity. Given these economic headwinds, corporate earnings are now increasingly in the spotlight for investors.

Corporate Valuations and Profitability

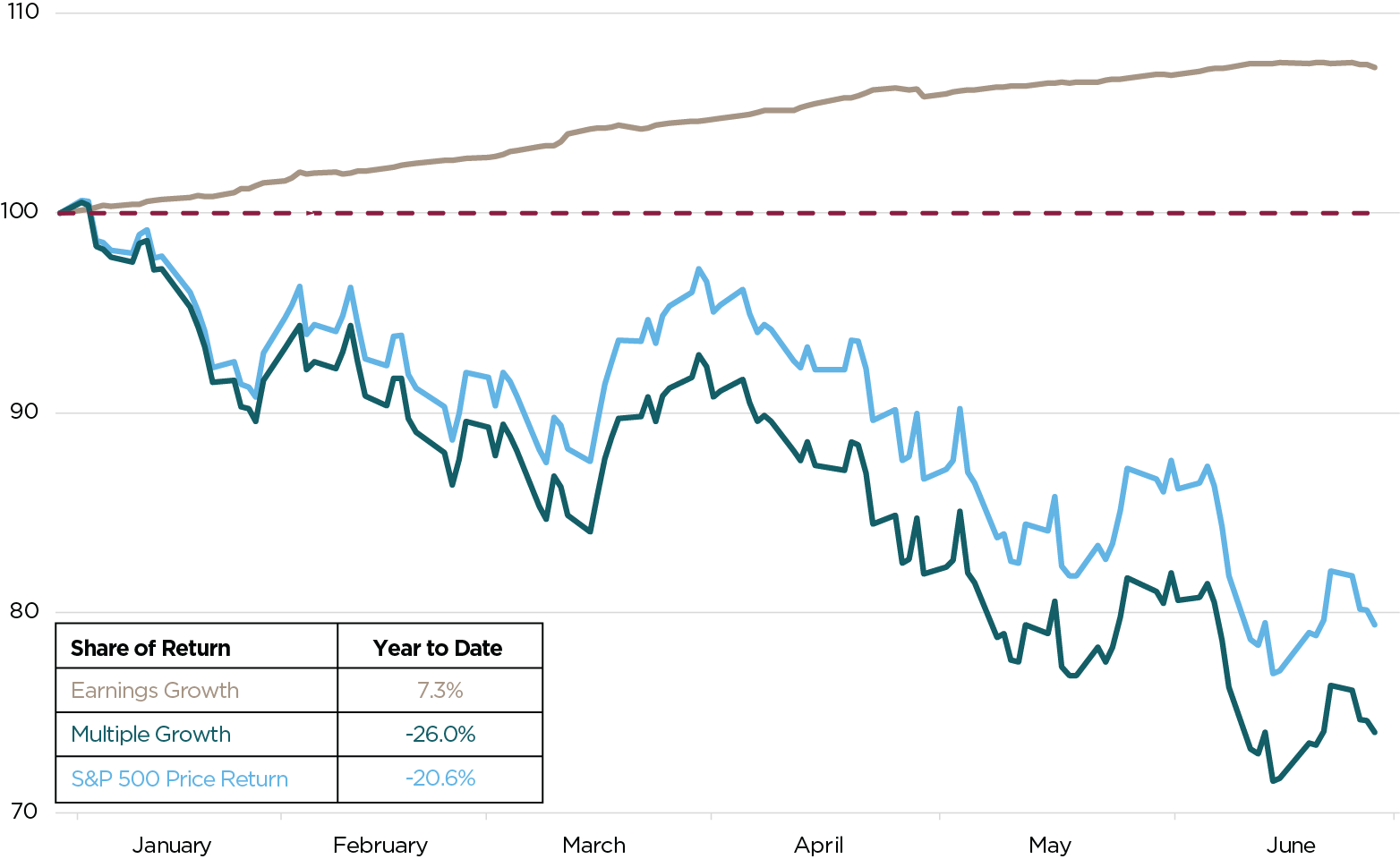

To date, 2022’s stock market declines have primarily been a correction in corporate valuations. The forward price-to-earnings (P/E) multiple of the S&P 500 Index began the year above 25x. Multiples have since fallen to 16x, a level in line with long-term averages. This drop has been driven by two factors shown in Figure Three. The first is the 20 percent decline in stock prices; the second is industry analysts’ expectations for continued earnings growth.

Figure Three: Percent Change in S&P 500, Earnings, and Valuations (Year to Date 2022)

Sources: J.P. Morgan Asset Management, CAPTRUST Research.

Is it possible that companies have navigated their supply-chain challenges and effectively passed price increases on to consumers? Have they been able to maintain profitability growth, albeit at lower levels? These are important questions as we look ahead to corporate earnings reports and guidance that will inform analysts’ revised estimates.

While the veracity of these estimates will be fleshed out in the coming weeks as second quarter earnings results are reported, one thing remains certain: Valuation dispersion is increasing. As of May 2022, more than 500 companies in the Russell 3000 Index traded with forward price-to-earnings ratios below 10x.

Although 500 is not a magic threshold, a CAPTRUST study going back 20 years shows that only seven quarter-end periods met this criterion. In all but one occurrence, equity investors experienced double-digit annualized gains over the two years that followed.

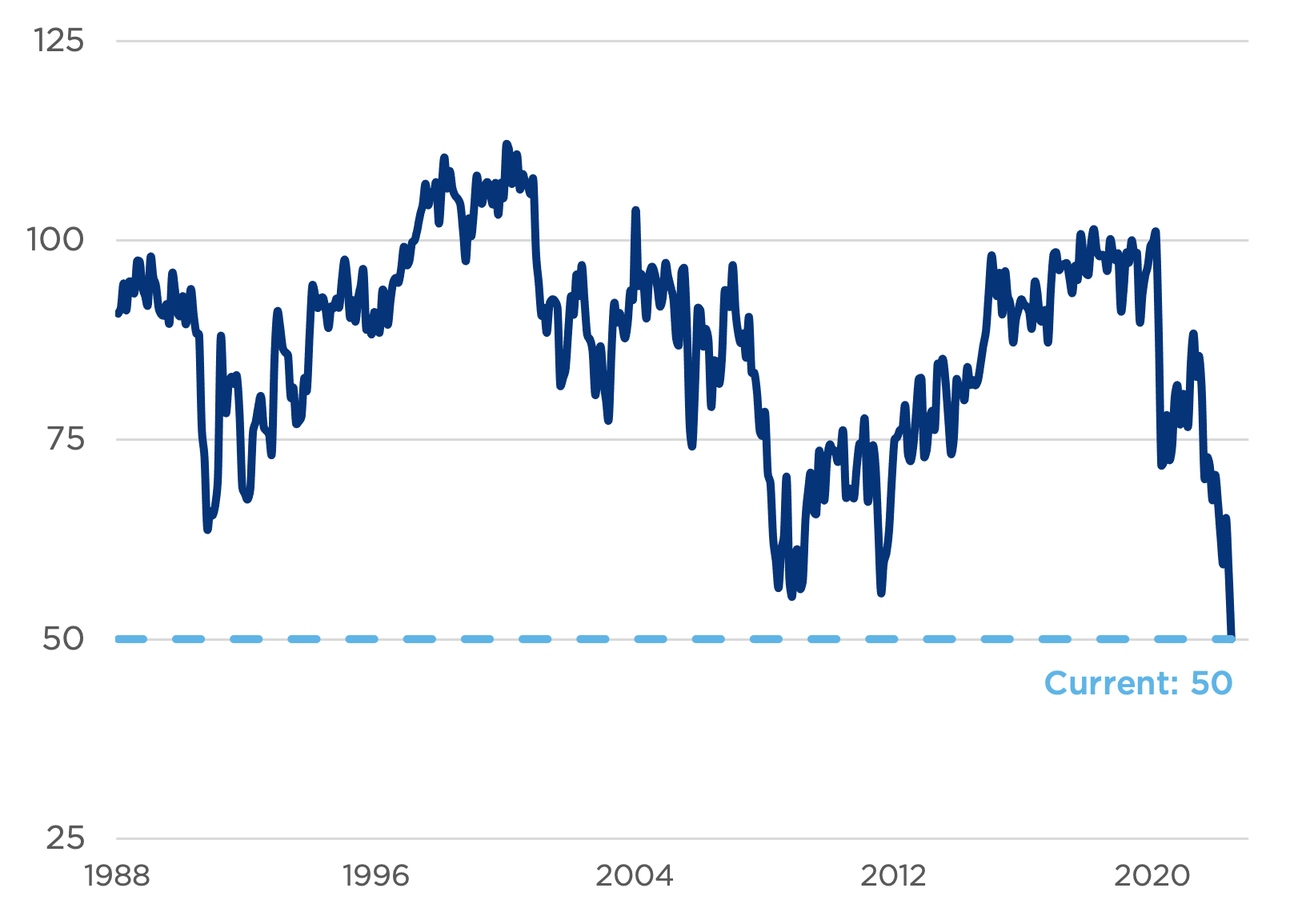

Bull Market for Pessimism

Rising expenses and falling asset prices have both consumers and investors in a foul mood. However, history shows us that troughs in sentiment are often followed by market rallies. Reviewing the University of Michigan’s Consumer Sentiment Index, which surveys consumer confidence in current and future economic conditions, shows an average 12-month return of 20 percent in the four instances in which this gauge fell below 60. The survey currently reads an all-time low of 50.

Figure Four: Consumer Sentiment

Sources: University of Michigan: Consumer Sentiment Index

Investor sentiment data tells a similar story. A survey conducted by the American Association of Individual Investors on the percentage of investors with a bearish outlook reached 59.3 percent in June 2022. This level has not been seen since the depths of the financial crisis in early 2009, which coincided with that turbulent period’s market bottom.

What Is the Market Telling Us?

So often, the term priced in is used in relation to the financial markets. What does that mean exactly, and what is the relevance now? Investing requires making judgments about the future, and those judgements attempt to capture the knowable range of things that can happen. Influencing factors could be event-driven, data-driven, corporate, or economic. And when unexpected or unforeseeable events—like Russia’s invasion of Ukraine of February 24—occur, the market must recalibrate, pricing in the new information.

Since that week, the S&P 500 Index has fallen 11 percent (through July 15) and the Bloomberg U.S. Aggregate Bond Index has fallen 6 percent. Circling back to the financial and economic indicators presented earlier: Corporate valuations have moderated, and investor and consumer sentiment are hovering near all-time lows. Piecing all this information together, the financial markets are clearly demonstrating a greater awareness of the current economic challenges.

The case for hope? Today’s low expectations increase the potential for future, positive outcomes. A surprise to the upside—even if it’s a less-negative data point—could be the catalyst for higher prices and better returns in months and years ahead.

While this may sound counterintuitive, it is important to remember that markets don’t move based on good or bad news; they move based on better or worse news. And, with investors, consumers, and policy makers all understanding and discounting the riskier investment landscape, the possibility for upside surprises and better outcomes has increased.

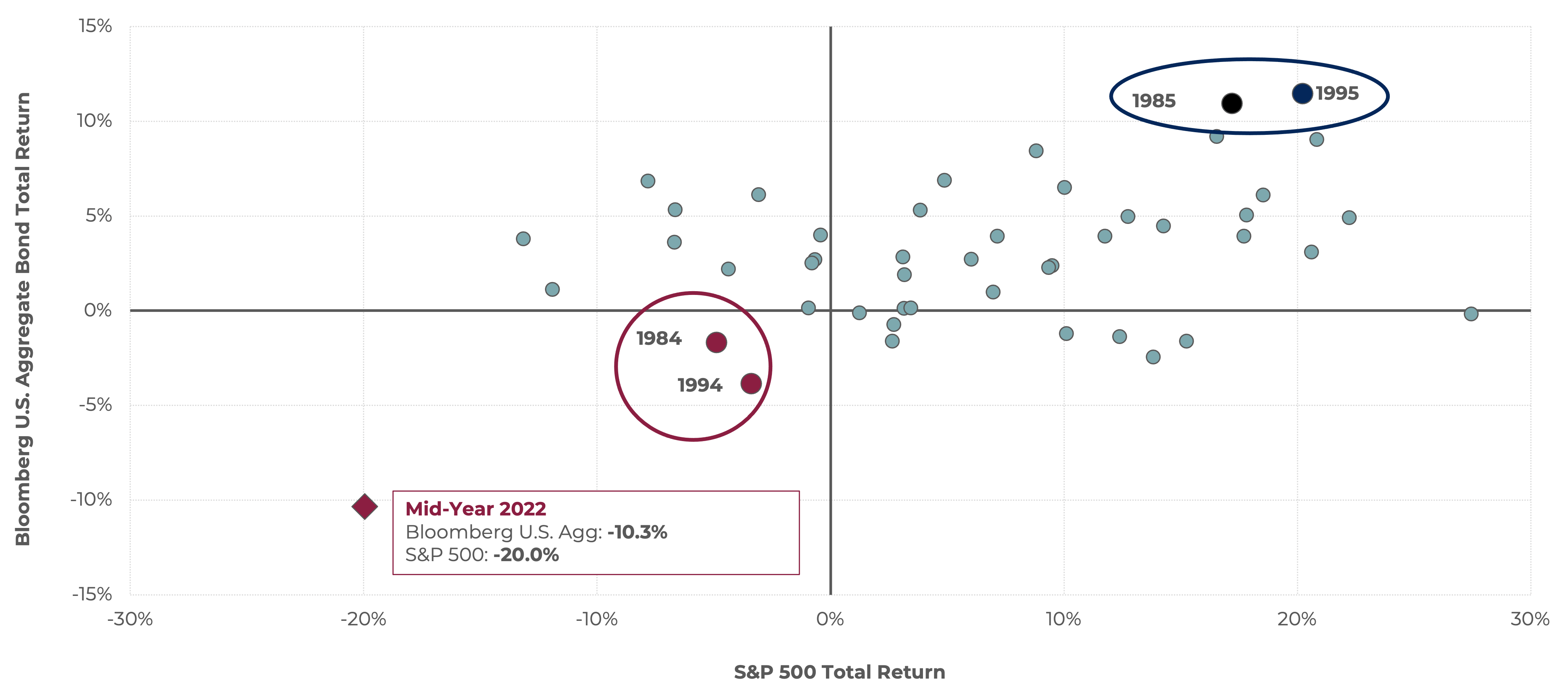

Figure Five: First Half Returns for U.S. Stocks and Core Bonds (since 1976)

Historical data supports this idea. The first half of 2022 marks a rare instance when both stocks and bonds fell in concert. Since 1976, we have seen only two other times—1984 and 1994—when both stocks and bonds reached negative territory at the halfway point. But, as demonstrated in Figure Five, these challenging environments, where expectations were reset lower, set the stage for two of the best midyear returns in the following years—1985 and 1995.

Will history repeat itself? Only time will tell.

Their mother disapproved of Doris going to clubs and magnetizing audiences with her rich and expressive voice. But the music found a way to be heard.

As a teenager, Doris got a job as an Apollo usherette, sang at Amateur Night, won, and eventually got discovered by the Godfather of Soul, James Brown. And that’s how “music from the church ended up on the Apollo stage,” says Higginsen.

Taking the stage name Doris Troy, she had a top 10 hit in 1963 with the love song “Just One Look.” The next year, the British group The Hollies covered her song, and her reputation continued to grow. The sisters moved to London together, where they rubbed shoulders with Elton John, The Beatles, and The Rolling Stones in the 1960s and 1970s. Troy impressed The Beatles so much that she got signed by Apple Records and made a solo album produced by George Harrison. Later, she became a backup singer who contributed vocals for The Rolling Stones’ “(I Can’t Get No) Satisfaction,” Pink Floyd’s The Dark Side of the Moon, and Carly Simon’s “You’re So Vain.” Though Troy died in 2004, her voice is familiar to millions who might not know her name.

Higginsen was moved to write down her sister’s story in the 1983 runaway hit Mama, I Want to Sing! She felt it reflected the journeys of a swath of African American artists who similarly grew up with gospel music in their churches and who carried this musical legacy into popular American culture to become stars in the ’50s, ’60s, and ’70s.

The gospel musical ran for eight years at Harlem’s Heckscher Theater, breaking records, establishing an American classic, and helping preserve the legacy of Black music by acting as a major employer of African American singers and performers throughout its time. Later, it toured nationally and abroad; it is approaching its 40th anniversary next year.

“When we tell the story of Mama, I Want to Sing!, it’s a metaphor for anything anyone ever wanted to do that got blocked or pushed aside or that was not valued or was considered not good enough. All the things that sometimes happen to young people—or to a culture—that it’s felt that your contribution is valueless, unless you’re seen and heard,” Higginsen says.

Mama Foundation for the Arts

After the success of Mama, I Want to Sing!, Higginsen was moved to give back to her community and work with young people. Her idea for the Mama Foundation for the Arts came when her daughter, a very musical child, was not receiving music education at school.

“The whole thing started because music was taken out of the school system,” says Higginsen. She and her husband tried enrolling their daughter in a music school where she could learn singing, but the fit just wasn’t right. “They were teaching classical music, but we felt that she needed to sing the music of gospel, jazz, and R&B,” she says.

It dawned on Higginsen that many talented African American children had no options for musical education other than expensive private lessons. The realization that many young Black singers she met were unable to sing gospel told her that the musical heritage was in danger of being lost. So she started a small Saturday singing group with a few students.

Black music history and Black music matter because it is American music. “It’s really important to teach this art form. We don’t want this music to ever die.

“You can’t forget those ancestors whose voices paved the way,” says Higginsen. “Knowing that and celebrating that, we present, we preserve, we promote, and we teach the history and legacy of African American music and its relationship to American history.”

We sometimes forget that Black people were not allowed to read or write, she says. “It was punishable by death. But they were allowed to sing, and through their incredible genius, they used the music as a code to communicate. If someone said, ‘Down by the riverside,’ they knew that meant ‘We’re getting out of here.’”

With her daughter, Ahmaya Knoelle Higginsen, she cofounded the Mama Foundation for the Arts in 2006 to mentor the next generation of Black singers and preserve the musical arts of gospel, jazz, and R&B. Gospel for Teens, their free Saturday program for teenage boys and girls to learn singing and performing, is training young singers to this day.

Lifting Up the Music and Young People

In a decade and a half, the Gospel for Teens Choir has grown from a small weekend gathering into a mighty force in the world. Teens from New York, New Jersey, and surrounding areas have received this unique opportunity to be supported, learn to find their voices, perform in front of audiences, and be seen and heard.

Each fall, Higginsen signs up a new class of kids. They audition for the choir, but they don’t need to read music or have singing experience to join. “If you can carry a tune, we help you develop your own voice,” she says.

“When you come to our school on a Saturday, you’re not going to look at a piece of paper,” says Higginsen. “It will be call-and-response. You’ll learn the harmony by ear. It’s the best thing that can happen to young people.”

“This is one of the most underrated teaching styles,” she says, noting that the requirement to be able to read music has historically excluded talented Black performers from participating in the music business.

“We use total ear training, breathing, harmony, pitch, and control. You’ve got to learn by listening, harmonizing, and blending, and you can’t look at the music. That style of learning—ear training—is often not acknowledged or appreciated.”

These days, Higginsen basks in the successes of students she has nurtured. Though the inspiration for Mama Foundation for the Arts was to save Black musical heritage, the program has saved many a young person along the way.

She says an astonishing 87 percent of the young people who go through the Gospel for Teens program go on to higher education and careers in the entertainment industry or the arts. With Mama, I Want to Sing! celebrating its 40th anniversary next year, Higginsen’s vision is to keep expanding Mama Foundation for the Arts by adding more staff; finding a larger space to house the students and music masters; expanding to more genres of African American music, such as hip-hop; and continuing to showcase the music.

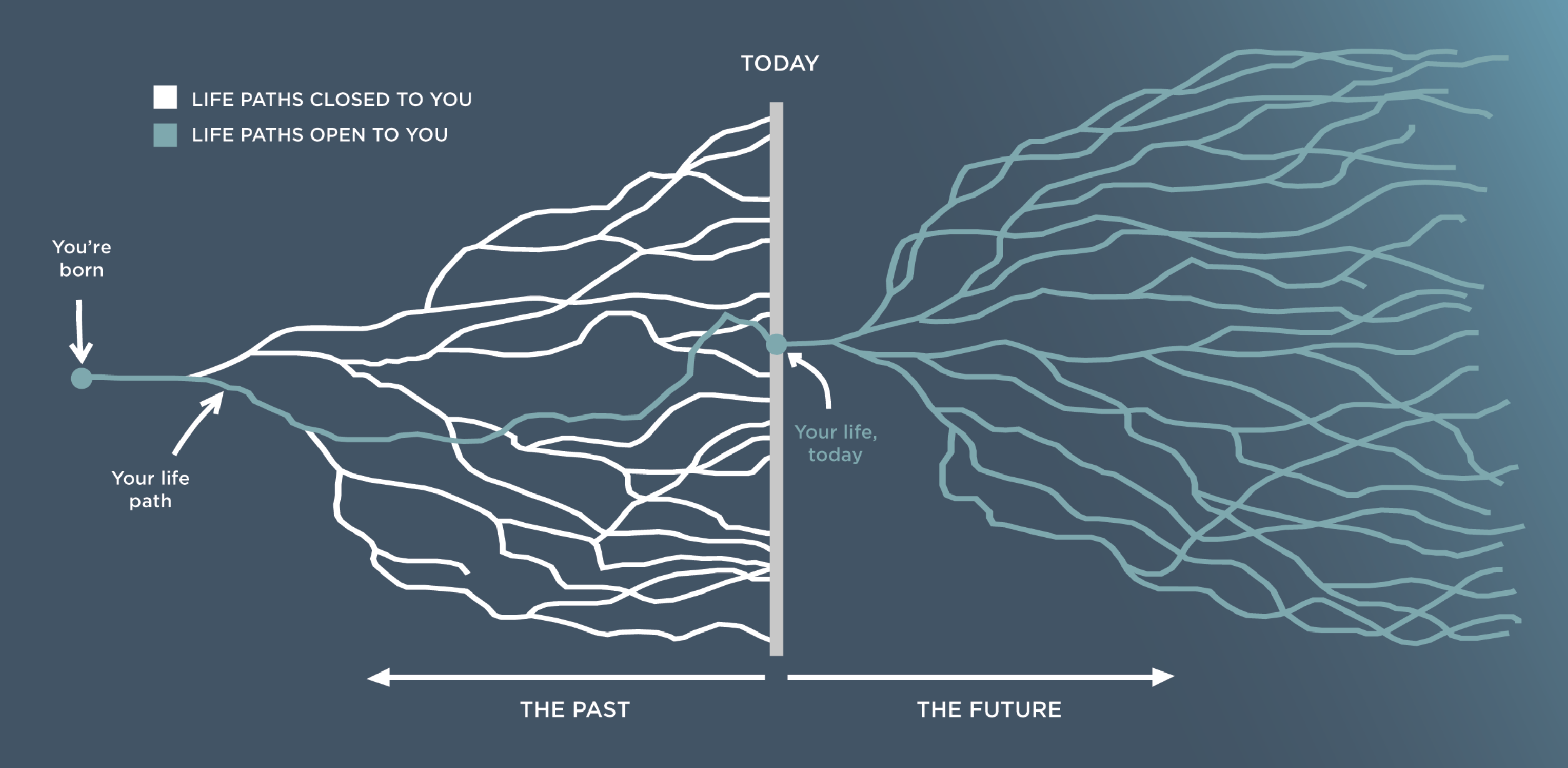

Investing requires making judgments about the future. But from where we stand today, the future consists of a range of possibilities. Elroy Dimson’s popular definition of risk—more things can happen than will happen—encapsulates this idea very well.

To deal with this uncertainty, most investors look backward to plot a forward course, connecting the historical dots to create a forward-looking story. However, we would caution that while this historical knowledge is valuable in making decisions about the future, it likely raises confidence more than predictive abilities.

Nobel Prize-winning psychologist Daniel Kahneman explains, “Confidence is a feeling, one determined mostly by the coherence of the story … even when the evidence for the story is sparse and unreliable.”

Because we enjoy the benefit of hindsight, we can weave together a forward-looking story that provides perfect clarity, giving us high conviction. However, that story may be based off a single path, providing a limited or, worse, a misleading picture. This is a very dangerous combination in the world of investing.

So how does CAPTRUST position for the future while acknowledging the ubiquitous disclaimer that past performance may not be indicative of future results? First and foremost, we approach all decisions with a mindset of confident humility. We have views and opinions—often strong opinions—but we acknowledge that we also have biases and limited information. We incorporate these views within a framework of guiding principles that surround how we think, how we act, and how we react.

1. Wisdom over Knowledge

Words are no match for an experience. A child who burns his hand will undoubtedly have a better understanding of the painful consequences of touching a hot stove than a child only warned by a parent. It is impossible to fully learn from others’ experiences because lessons learned from words lack the emotional weight carried by experiences.

The source of wisdom is often pain, and unfortunately, there are scars behind all these principles. Similarly, investing can only be learned by putting capital to work and experiencing the consequences of the decisions you make in an effort to grow capital. There is absolutely no way to simulate this learning. Real confidence—or “true intuitive expertise” as Kahneman describes it—stems from prolonged experience with quality feedback on mistakes. In the investment world, that feedback most frequently comes in the form of financial losses.

The smartest investors are not the most knowledgeable but, rather, the ones who know the limits of their knowledge because the market humbles them every day.

Inexperienced intelligence is a breeding ground for overconfidence because you have not learned what you do not know.

2. Comprehensive over Complicated

Most extreme investment errors occur when investors take simple concepts and add complexity. Financial experts can mathematically prove certain strategies have a high probability of success, but the complexity incorporated into these strategies frequently ends in catastrophe.

Gilbert Keith (G.K.) Chesterton, famed English writer, perfectly captured this fundamental risk in his book Orthodoxy when he stated, “Life is not an illogicality; yet it is a trap for logicians. It looks just a little more mathematical and regular than it is; its exactitude is obvious, but its inexactitude is hidden; its wildness lies in wait.”

A ship that has its center of gravity above the water line can sail smoothly for years but suddenly capsize in rough seas. That’s what complexity and leverage can do to a simple investment strategy.

Do not mistake complexity for comprehensiveness. Portfolios should be constructed utilizing understandable components combined to provide comprehensive exposure to a diversified set of economic return drivers (economic growth, real interest rates, inflation, credit, liquidity, currency, etc.).

3. Predictable over Surprise

Investing is an emotional roller coaster, and no one is spared from the ride. We all have bouts of anxiety and excitement, patience and impatience, and fear and greed. Successful investors find ways to control these emotions by managing their expectations. Psychologists theorize that surprises have a greater emotional impact than expected outcomes, especially negative surprises. This is called decision affect theory.

There is a downside to every investment. Acknowledging and defining this downside is critical in constructing portfolios. Understanding the risk associated can help an investor manage emotions. For your investment advisor, explaining the risk affords the opportunity to provide proactive education. Conversely, reactive explanations should always trigger an immediate review, whether the outcome was better or worse than expected.

Predictable outcomes allow for proactive education, which builds investor confidence. Conversely, surprises require reactive explanations, which can erode confidence.

4. Preparing over Predicting

Few people would ever find a guiding investment principle from the movie Roadhouse, starring Patrick Swayze. However, one line in the movie captures a critical element of how we approach the future. After one of the countless bar fights, Swayze’s character was asked if he ever lost a fight. His response: “A man looking for a fight is not as prepared as a man who is ready for one.”

Being prepared for multiple outcomes is suboptimal because the eventual path will always outperform the aggregate collection of potential paths. So why is positioning so important? Because it protects you from what you do not or cannot see.

In a blog post titled “Risk Is What You Don’t See,” published in January 2020, Morgan Housel noted, “How risky something is depends on whether its target is prepared for it. A big event people have time to prepare for can be handled without much fuss. A smaller one out of the blue can be deadly.”

Portfolio positioning should emphasize out-planning the market by preparing portfolios for the future rather than attempting to outsmart the market with short-term market-timing predictions.

5. Probability over Magnitude

Napoleon Bonaparte once said, “The greatest danger occurs at the moment of victory.” This “danger” is caused by successful outcomes raising confidence and higher confidence resulting in a new definition of “victory.”

Investors are notorious for constantly changing their definitions of success. When outcomes are better than expected, they rarely dial risk back and increase the probability of success. Rather, they move the victory bar higher and overconfidently continue down their paths, focused on what can go right without stopping to question what can go wrong. However, as mentioned previously, investing is an emotional roller coaster, and like a roller coaster, the slow grind higher can often be followed by a sudden terrifying freefall.

It is critical for investors to clearly define what success looks like in their portfolios. It is even more critical for investors to stop the game and celebrate if they are fortunate to be able to declare victory. Though, being content with your definition of success while watching others run the score up often requires a herculean effort.

Every decision should have a clear definition of success, and the focus should be on maximizing the probability of success, not the magnitude of success.

6. Net over Gross

Every investment decision contains multiple layers of costs. While the direct financial costs are most obvious, the emotional costs are often the most expensive. The financial cost of investing in stocks depends on the approach, but every equity investor pays the emotional price: volatility.

Portfolios typically represent historical sacrifices—trips not taken, cars not purchased, experiences not experienced—in the hope of a better future that includes retirement, a child’s education, or support of charitable causes. Consequently, witnessing those portfolios decline in value has a high emotional price. Unfortunately, it is impossible to know whether this emotional price is too high until after you’ve paid it. The cost associated with turning a potentially temporary decline into a permanent loss because the emotional price was too high can be exponentially higher than a management fee, but they are all costs.

Investment success can only be measured over time, net of all costs, including direct costs (e.g., transaction and management fees), indirect or frictional costs (e.g., timing and taxes), and often most impactful, emotional costs.

7. Portfolio over Pieces