-

Solutions

- Solutions

- Individuals

-

Retirement Plan Sponsors

- Retirement Plan Sponsors

- Corporations

- Educational Institutions

- Healthcare Organizations

- Nonprofits

- Government Entities

- Endowments & Foundations

- See All Solutions

Comprehensive wealth planning and investment advice, tailored to your unique needs and goals.Investment advisory and co-fiduciary services that help you deliver more effective total retirement solutions.CAPTRUST provides investment, fiduciary, and risk management services for nonprofit organizations. -

About Us

- About Us

- Our People

- Our Story

- Learn About CAPTRUST

-

Locations

-

Resources

- Resources

- Articles

- Podcasts

- Videos

- Webinars

- See All Resources

Kim Hunter once owned a popular Korean restaurant in a trendy area of downtown Raleigh before making the decision to close and take her food to the streets. She enjoyed owning a successful restaurant, but she wanted more flexibility. Her stationary restaurant found itself susceptible to a constantly evolving downtown, and with this comes traffic changes, construction, and parking challenges. Hunter now avoids these rapid disruptions with her mobile eatery, Umma Foods.

Many chefs like Hunter are deciding to forego traditional brick-and-mortar establishments in favor of a traveling restaurant—with far less overhead and restraints. With this shift in dining options, hungry customers are taking advantage of the convenience, variety, and novelty of food trucks to experiment with foods from around the world.

“Having a food truck allows more flexibility, both in my personal life and in where we can connect with customers. We aren’t constrained to a particular location,” Hunter says.

Hunter often finds herself parked in one of the many Triangle breweries, such as Trophy Brewing and Bond Brothers Beer Company. She’s also been booked to park her truck and cater weddings, birthdays, and corporate parties. With her mobile kitchen, she’s able to introduce her international cuisine to a larger area of the city.

One of the perks to operating in such a small space with few staff is the connection between chef and customer.

“On the truck, I am directly involved in every interaction—from greeting the guest, talking with them about the menu, taking their order, and cooking it. I enjoy that level of interaction,” Hunter says.

The Traveling Restaurant Trend

The food truck evolution has changed the way people eat out. So much so that it no longer appears to be a trend. Those seeking a quick and convenient international experience, instead of spending hours at a traditional restaurant, are finding themselves drawn to experimenting with different cuisines at food trucks.

“Enjoying food is about the experience. And people are interested in finding unique experiences and trying new cuisine. Food trucks come from the idea of international street food and, when done well, food trucks give people that sense of being on a street or festival in a town in a faraway place,” Hunter explains.

While food trucks might not create the same ambiance people get with a sit-down restaurant, Hunter says there are ways to create a unique and special atmosphere. Her Umma Foods truck brings a Korean vibe into the experience through the signage and menu, customer service, plating, the locations or setting where the truck is parked, and, of course the food itself.

Take Your Taste Buds on an Adventure

Jeff Clement has been a food truck enthusiast for years. He enjoys waiting among fellow foodie comrades in long lines to try a new and popular food truck. He’s particularly interested in foods with an international flair. Clement enjoyed chasing after food trucks so much that when it came time for him to retire from the advertising agency world, he decided to join his friend—and food truck owner—this past summer to travel throughout St. Paul feeding hungry Minnesotans.

“What I like best about international trucks and doing international foods as specials is it creates a perfect environment and intersection where consumers can try new foods with limited risk or commitment,” Clement explains.

When Clement helped his friend on the food truck, Signature on Wheels, his goal was to enjoy and immerse himself in his passion for cooking and introduce people to the delicious foods he’s tasted while traveling the world with his family. Some of his favorite dishes to prepare were peri peri chicken from South Africa, Goan shrimp and tandoori cauliflower from India, Korean barbeque beef tacos, and Croatian lamb kabobs.

While Clement might be retired from advertising, the practice is still ingrained in the way he thinks. Not only did he help create interesting foreign specials for Signature on Wheels, he branded them World Food Adventures. He even created a Facebook page and the website worldfoodadventures.com, with the goal of eventually expanding to partnerships with other food trucks.

If you can’t find a food truck offering a variety of cultural cuisines, like Signature on Wheels, attending a food truck festival or event where multiple trucks are parked allows for even more freedom to experiment, with minimal risk and cost to the customer. If you’re with a large group, it can sometimes be a challenge choosing a restaurant to please everyone; a festival could cut down on conflict. Also, if you don’t like what you’ve just eaten, you can move along to a different truck without the regret of putting all your hopes into one dish and having to leave hungry.

A Chef’s Advantage

The risks chefs face when trying to decide on menu options might become less risky when operating out of a food truck because they have a direct and immediate connection with the customer. They can see how they’re interacting with their food, and depending on the reaction, they’re able to adjust their menus accordingly.

Cooking from a food truck can also offer a level of satisfaction they might have missed out on, if stuck in a busy kitchen without a visual of their customers. Chefs wouldn’t have to rely on an intermediary, such as a waitress or waiter’s observation.

Dining at a food truck lends itself to comingling with strangers while waiting in line, versus if you were at a traditional restaurant. And since there’s no hostess to provide separate seating, you could find yourself sitting family style at a picnic table or side by side on a street curb, among new friends, enjoying a shared international cuisine experience.

Track a Truck

The thrill of the hunt is part of the attraction to food trucks. Discovering where your favorite trucks are going to be parked next adds an additional element of excitement to the dining experience. It can also take you to new locations you might never have journeyed to.

Social media has played a large part in the popularity of the food truck revolution. After all, following a food truck via Facebook or Instagram and the actual act of eating at a food truck are inherently more of a community experience.

On the ride home from a meeting with their financial advisor, Sophie tells her husband Rob that she’s been thinking a lot more about how their money is invested. “Getting a good return is nice, but I also want us to make sure we consider the bigger picture.”

Sophie starts by explaining to Rob that she doesn’t want to invest in companies with a reputation for being careless—whether it’s with employees, the environment, or with her personal data. “I want to make sure we’re not enabling the wrong organizations.”

“What do you mean?” said Rob.

“I think how we invest matters—or at least it should,” she said. “I’d like to go to sleep at night, knowing we’re not invested in companies that do objectionable things, like pollute the environment, exploit workers, or kill animals. Don’t you agree?”

Rob thinks Sophie’s suggestions sound like nice ideas but wonders if it makes financial sense. “It would be nice to know that the companies we own a piece of are doing the right thing—or at least aren’t doing the wrong thing. But we also need to make sure we are getting a good return.”

An Important Discussion

Talking about personal finances, including how to best invest your wealth as a couple, can be challenging. In fact, almost half of Americans would rather discuss religion, politics, or dying than personal finance with a loved one. Like Sophie and Rob, you may find it difficult to discuss and resolve financial differences and the many questions that need to be answered when jointly investing.

How do you make investment decisions together? Do you solely look at financial return on investments, or do you also factor in nonfinancial returns such as your core values, the environment, and responsible corporations? And when there is a difference in mind-sets, how do you design a portfolio that respects and appreciates both of your goals and objectives?

Finding the answers to these questions may not be easy, but they are a key part of the financial planning process. So make a commitment to engage in this important dialogue with your partner. In doing so, you will increase the financial harmony in your home, improve your relationship, and help your advisor develop a strategy and plan that meets both your needs. The following are a few tips for talking with your partner about values, investments, and making decisions together.

Focus on Shared Values

Begin by focusing on what you two have in common, not your differences. By first highlighting areas of agreement, you set the stage for acting as a team in deciding when, where, and how to invest. Begin the dialogue by asking your partner to name two or three core values and how these principles are honored when making monetary decisions. Listen carefully to the response before sharing your thoughts or reactions. The goal of this part of the conversation is mutual understanding and finding shared values that you might use in the context of investing. For example, Rob and Sophie both value friendly environmental practices and gender parity. They got stuck on where they differ—how much to factor these values into their portfolio—and lost sight of how much they agree on core issues.

Understand Key Gender Differences

When it comes to how people invest and think of wealth, gender often comes into play. Gender differences are based on research, and there are always exceptions to these findings, but appreciating your partner’s gender lens can be helpful in understanding his or her investment selection criteria. Ask your partner for their definition of wealth and how they evaluate risk. Notice any variations in your viewpoints that may be influenced by your genders.

Sophie, like a large percentage of women investors, views wealth more holistically. She wants to invest her money in a socially and environ-mentally responsible way. Financial performance is important, but not the only factor in her decision-making process. Rob’s perspective is indicative of the more traditional male investor. He values financial performance over other investment objectives. Neither of these gender lenses is wrong or faulty; they are just different.

Define Investment Success

It is common for partners to define investment success using different criteria. Different risk profiles, money personalities, and experience with investing all factor into the equation. Ask your partner to tell you about his or her biggest financial success and what they learned from the experience. Then inquire about his or her greatest financial mistake and what lessons he or she learned from this experience. Remember to suspend any judgment and simply listen to his or her responses.

Once you have each had a chance to explain your history and definitions of success, create a joint statement that spells out the types of success you want to include when evaluating your portfolio. Sophie and Rob did this exercise and discovered that together, their definition of success was more robust and factored in both values and performance.

Celebrate Diversity

It is rare that two partners or spouses agree on all aspects of investments. Stop trying to convince your partner that your way is the best way to proceed. Instead, take a deep breath and ask for more data. Your diversity is not a sign of weakness; it is actually your superpower. For instance, Sophie takes longer to make an investment decision, takes calculated risks with her money, and is very philanthropic. Rob is aggressive in his approach and, therefore, tends to tolerate more risk. If they capitalize on these differences, they will create a diverse portfolio that is likely to perform better in the long run.

It is not always easy to communicate about finances, but it is a valuable skill that brings with it positive rewards. For Sophie and Rob, what started off as a financial conflict ended in a meaningful money talk about core values, risk and rewards, and the purpose of wealth in their lives—all worthwhile topics no matter how they decide to invest in the future.

Gloria Gladd, 63, has been active her whole life but has never loved solo exercise. She shudders remembering a free visit to one gym that looked like “a graveyard of equipment” for lonely treadmillers and weight lifters.

Instead, she goes five or six times a week to a Fitology club in State College, Pennsylvania, where she might join a group spin class one day, an intense whole body group workout the next, and a group weight-lifting session the day after that.

She’s always trying new things, Gladd says, and working out with others makes that easier. She remembers the day she got new spin shoes and struggled to attach them to her bike: “Three people jumped off their bikes to help me,” she says.

Gladd likes the idea that if she doesn’t show up for classes, people will ask where she’s been. “There are a lot of regulars, so there’s a lot of accountability,” says the just-retired medical office assistant.

Gladd has discovered something well supported by research. When we exercise alone, we can get a good workout—but when we exercise in a group, many of us get an added boost.

“We are greatly influenced by the company we keep,” and when our exercise mates push us to do one more squat or sweat for five more minutes, that can be a very good thing, says Cedric Bryant, president and chief science officer of the American Council on Exercise (ACE).

Benefits of a Group

A group can drive us to work out harder—perhaps because we want to measure up or do our part for the team. It’s an example of the well-known Köhler effect, seen in everything from business to mountain climbing. When working on a task with others, many of us will put in extra effort.The effect is named after German industrial psychologist Otto Köhler, who first demonstrated it in experiments with rowing teams in the 1920s. But working harder is not the only benefit of working out in a group. Studies have suggested that:

- Exercisers who join a group or a partner are more likely to make exercise a habit;

- Group exercise may do more than solo exercise to reduce stress and increase quality of life;

- Group exercisers who synchronize their movements may develop higher pain tolerance and greater endurance than those who work out alone; and

- People who exercise in groups or pairs might even live longer.

That’s right. A recent study of nearly 8,600 people in Denmark found that all varieties of exercise, as expected, were associated with longer lifespans. But the biggest boosts—ranging from five to 10 years of extra life—were seen in people who choose activities that are typically social, rather than solo, with tennis, badminton, and soccer players outliving runners, swimmers, and cyclers (and exercisers of any sort outliving couch potatoes).

The study did not prove that exercising in pairs or groups made the difference in longevity, but it did account for income, education, age, and other factors that might skew results. The findings held up even when the researchers looked only at college graduates, reducing the odds that the results merely reflect the advantages of those who play certain sports, says study co-author James O’Keefe.

“I really think the social aspect of it may be the most important part,” says O’Keefe, who is director of preventive cardiology at the Mid America Heart Institute at Saint Luke’s Health System in Kansas City. To get the most out of exercise, including the most fun, he says, “we need to embrace our identities as very social creatures.” In other words, O’Keefe says, we need to “play with our friends.”

Not All Groups Are Equal

If you have ever been to an exercise class where everyone walks in, takes a spot, and then wordlessly follows along with an instructor—then you’ve been to a class with a low level of what researchers call groupness.

On the other hand, if you’ve been to a class where participants set goals together, work as teams, cheer one another on, and bond in other ways, you’ve been to a class with a high level of groupness—and probably better results, researchers say.“

What the recent research has shown is that the higher the level of groupness, the higher the level of exertion, enjoyment, and satisfaction. And the higher the intention to do it again,” says Jinger Gottschall, an associate professor of kinesiology at Pennsylvania State University. Gottschall also founded the Fitology club in State College and is a scientific advisor to ACE, the exercise council.

Gladd, who has taken fitness classes from Gottschall, describes the ideal “group vibe” this way: “It’s like being at a sporting event, but you’re participating in it.”

The bonding in a group class can begin even before anyone starts sweating, says John Ford, a New York City personal trainer who works with individuals, couples, and small groups. In a cohesive group, people might be “touching, high-fiving, giving pats on the shoulder” as they greet one another, triggering the release of “feel-good hormones” that can give people more energy and make exercise more enjoyable, he says.

And the bonds can last beyond class, Ford says. That’s why he offers corporate team-building sessions where co-workers might crawl, lunge, and shuffle through a relay competition and perform push-ups in waves—seeing how long they can keep the fun going.

And, Ford emphasizes, the group activity should be fun and conducted in a way that no one gets hurt, physically or otherwise. If not, it can be counterproductive, souring people on exercise. In a country where just one in five adults meets recently updated physical activity guidelines, no one wants that.

Different Workouts for Different Folks

JC Cassis, a 35-year-old musician and podcast producer who lives in Brooklyn, spends much of each day working alone in her house. At some point, she very much needs to get out and see people, and a trip to a nearby gym for some Pilates, yoga, or high-intensity interval training is a way to combine exercise and social contact, she says.

“I’m definitely an extrovert, so the actual human contact is non-negotiable for me. This is the way I’m wired,” she says. “I love seeing the same people over and over again.”

But not everyone likes to exercise in a crowd—and that’s just fine, Gottschall says. “Some people like to go for meditative walks in the woods by themselves,” she says. “And I know some moms who are like, ‘I just want to go for a jog by myself—it’s my me time.’”

“People who have had bad experiences with group exercise in the past—who felt humiliated in high school gym classes or sports settings, for example, can lack the confidence to try again,” Ford says. “But finding a trainer or a group with a positive, supportive vibe can make all the difference,” he says.

Among other ideas for people who are shy, short on time, or living in areas with limited options: virtual exercise partners and online classes.

There are now apps that connect real runners, bikers, and others with online buddies who can share stats and compete. Researchers also are working to improve digital “exergames” to make them more like working out with supportive friends (ideally, friends who motivate you by being just a little fitter or faster than you are). And some exercise studios now offer live streaming classes along with recorded classes on demand. “There really is something for everyone,” Gottschall says.

Whether it’s a once-a-year or once-in-a-lifetime family trip, vacations with multiple generations of family members become interwoven into family folklore, creating a treasured legacy that endures, even after family members pass on and new ones are born.

Many families are embracing a new style of American family vacation, one that includes three or more generations traveling together. These days, grandparents, siblings, uncles, aunts, and cousins are often geographically scattered and leading busy lives, so family trips can be a great way to create special memories and allow different generations to create a lasting bond over a shared experience.

In fact, multigenerational family vacations have been the top travel trend for more than five years, according to Virtuoso, an upscale travel agency network. Their popularity makes sense since they provide a way to fulfill many—or all—of what the agency identified as consumers’ top five motivations for travel—exploring new destinations, checking off bucket list dreams, seeking authentic experiences, relaxing, and reconnecting with loved ones.

Video chats and texts can’t fully replace actual face time with family members—leading many families to plan multigenerational vacations. According to a 2016 survey from the NYU School of Professional Studies and the Family Travel Association, 60 percent of families have taken a vacation that includes a child, parent, and grandparent. Of those who haven’t done so, 26 percent are considering such a trip in the future.

Baby boomers’ active lifestyles are another contributor to the multigenerational travel trend. This generation has reinvented retirement—and grandparenting—to suit their own tastes. Many retirees are physically fit and have cultivated a taste for adventure, so if they want to share bucket list experiences with family members, that might mean renting a European villa, hiking mountain peaks, or exploring the Great Barrier Reef.

Not surprisingly, the travel industry has responded with a slew of specialized offerings for multigenerational and grandparent travel. Organizations like Smithsonian Journeys, Tauck Bridges Family Adventures, and Road Scholar take the work out of extended family vacations with their creative packages and itineraries. Road Scholar, for example, offers unique educational trips designed for grandparent-kid teams, like exploring the hot springs of Costa Rica, seeing the French art and architecture of Lyon and Provence, and snorkeling and riding a submarine in Hawaii.

Boomers who have traveled extensively during their lifetimes can now take advantage of curated trips to guide younger generations to see the world, while deepening relationships with their grandkids. Of course, the larger the group, the more complicated travel logistics become, which is why multigenerational vacations often evolve as families grow and change.

Accommodating Travel for All Ages

Ideally, vacation plans need to have flexibility built in, so that everyone gets to engage or disengage as much as they want.

Working adults may need to allot quiet time with Wi-Fi and a laptop or join the family trip for fewer days, depending on job requirements. Older family members sometimes need special dietary accommodations or have varying levels of interest in physically challenging activities, like water sports. New babies’ sleep schedules might require the group to adjust dinner reservations to an earlier hour or book a beach house with a deluxe kitchen rather than a European tour.

Spending time with extended family is paramount for Raleigh-based CAPTRUST Financial Advisor Kevin Monroe. He and his wife, Rasheeda, typically take their two sons—Marcus, 11, and Derek, 8—on vacations with large groups of relatives each spring and summer.

A favorite spot for the Monroes is the Nantahala River in North Carolina, where they hike and go white-water rafting.

“Then, as my in-laws got older, they couldn’t go anymore,” he says. “They couldn’t ride the currents but still relished seeing their family and being outdoors.” So, the Monroe family had to find a new approach that would work for young and old.

The family adapted. They sought out campsites that were easily accessible by car, with comfortable facilities where Rasheeda’s parents could relax nearby—while the younger generations paddled the river.

“Depending on the age of the grandparents, you might be limited in what you can do,” says Monroe. But with some creativity, everyone can be together and make precious memories that last a lifetime.

Kevin and Rasheeda celebrated their 10th anniversary by renewing their wedding vows, taking the opportunity to plan a huge family vacation in Jamaica. They chose their all-inclusive beach resort for sentimental reasons, since the couple had honeymooned there.

But from Monroe’s financial advisor perspective, it was also a practical choice for taking care of the group’s needs.

“Everything is on-site and planned for you. You wake up and go to the pool. Walk up to the bar for a drink. Go kayaking and jet-skiing without having to go rent all the equipment. Plus, you are not allowed to tip, and there’s a lot less pressure,” he says.

It’s also nice to have just one bill. It limits hassle when dividing up the cost, especially if just a few family members are footing the bill. With multigenerational family vacations, 61 percent of the time the cost is split between parents and grandparents, according to the NYU/FTA survey. “Maybe the grandparents and siblings give money to you, then you pay for everyone. That way, you can pitch in to cover any shortfalls,” says Monroe.

The Monroe family’s next trip will be in March, with a group of 14 relatives headed to Disney World. It’s especially meaningful since they will be joined by Kevin’s parents, James and Rita Monroe.

While multigenerational family vacations can be expensive and challenging to plan, their sentimental value is beyond measure. Through time together, family members get the rare opportunity to share discoveries with loved ones, capture photos that will long be treasured, and imprint younger generations with family memories that will remain in hearts and minds for a lifetime.

It begins so early. As tiny children, when we’re forced apart from our mothers. Then there are the rejections on the playground, the losses of jobs, the collapse of marriages. By the time we are adults, most of us are experts on experiencing grief.

“Grief is just mixed into the stuff of life,” says Jack Hileman, a licensed marriage and family therapist and a retired pastor in North Carolina. Even smaller events like a child who says, “I never want to talk to you again” or reaching the end of an exceptional book can be painful and cause us distress. “It’s really about separation and having to let go of a certain time in your life or a connection and having to move on.”

But our lived experience of grief often seems inadequate when we lose a person we love. The suffering we feel at such an irreversible separation can send us into a dark cocoon of our own spinning. Or send us spiraling outward into social media to see our feelings reflected back to us as comments and likes.

When we experience grief, it often feels like an affliction-and an unfair one at that. But Hileman says grief is also the beginning of potential growth toward something positive: meaningful connections that can enrich our lives.

Avoidance and Isolation

Grief can affect our minds and bodies in very real ways—from body aches, fatigue, and upset stomachs to lethargy, crying, loss of libido, and a lack of interest in participating in our usual activities. Its mental toll is undeniable. Hileman describes grief as “an internal psychological process we go through in a time of loss; a keen mental suffering.”

It is a common myth that we can avoid loss or avoid feeling the emotional, mental, and physical effects of it, according to Hileman. But almost as pervasive is the myth that we can isolate ourselves within that loss from other people.

“Avoidance and isolation. Those two myths are functionally predominant,” Hileman says. “Often the biggest psychological driver in all human activity is the avoidance of loss. And so that takes over. How do I not feel this? Or how do I make myself feel this when I don’t want to? They are flip sides to the same coin.”

Hileman remembers one client whose father had passed away after expressing a wish that his ashes be spread in a favorite vacation spot out west. The man wanted to take his dad’s ashes to his final resting place all alone, without other family members. A few relatives had divided up the man’s ashes so each could carry out his or her own ritual. They were literally isolating themselves to engage in private grieving experiences.

Instead of grieving alone, Hileman says we need to start mourning. “Mourning is the sharing of grief in a communal setting—or with those whom we trust or with whom we want to attach or connect,” says Hileman. “Mourning is actually the healing of the separateness that we feel at the time of loss.”

Coping Means Connecting

We simply cannot avoid loss and the grief that sometimes follows. But Hileman says the key to healing from it is connecting.

He’s seen the deep-seated urge to do so within his own family. At a reunion a few years ago, Hileman looked around to notice a bunch of people had suddenly disappeared. Hileman’s grandmother and her four living children had retreated to a corner and drawn close together to share the story surrounding the sudden death of a fifth sibling who had passed away in 1961. They still felt that need to connect and share his memory even after so many years had passed.

Hileman encourages his patients to engage in something similar. In all of his grief therapy, he helps the individual or family take an action that feels like a connection to the person they’ve lost.

For the man who was planning his solo trip west to scatter his father’s ashes, for example, Hileman suggested he include more people in planning and taking the journey. By responding as a connected, loving group of people, Hileman believed they each would find more solace and be able to move forward.

Take an Action

Hileman believes connecting with people who care about us is the most crucial element to overcoming grief. And although it can be an extremely challenging first step, we cannot just feel something; we need to do something.

“That’s where some people get sidelined into complex grief—it’s that they’re so focused on the feeling that’s pulling them down,” Hileman says. “They stop doing on purpose to assuage the feeling. And the opposite is really the appropriate response. The less you feel like doing, the more you need to do something.”

Hileman remembers one woman struggling with grief after the passing of her mother, a gentle and nurturing person. He encouraged the woman to write down her memories of her mother, and then move on by doing something with another person who would benefit from feeling the kind of love she was missing. The woman began journaling about her mom and started volunteering in a soup kitchen with people who had not felt the same gentleness and provision she’d felt from her mother. “It became kind of an integration of all that she felt into what she did in a positive way, and connected her with other people,” Hileman says.

Grief Can Be Collective

For better or for worse, we are not often alone with any emotion these days, including grief. In today’s world of digital connections, we find unending opportunities to engage, involve, commiserate, and remember in very public ways.

Sharing grief on social media “creates instant access to a support network and a virtual memory that is never more than a click away,” wrote Harriet Allner in a 2014 article following the highly public death of Robin Williams. “Sharing allows us to enter into a community of loss, to search and find solace, to show solidarity, or provide it for those closer to the epicenter of grief,” she wrote.

The evolution of our experience from personal into public has been a dramatic shift, Hileman says. “Even Pinterest is a place for people to post, memorialize, and grieve,” he points out. “That kind of thing would have been unheard of even 10 years ago.”

But that kind of sharing can sometimes come at a cost, Hileman cautions. We risk having negative online interactions with those whose experience of grieving has been quite different, those who cannot understand what we’re going through, or those whose proffered comforts come up woefully short.

So Hileman advises people dealing with grief turn to a surprising source for advice on coping: themselves. “I would encourage people to reflect on the kinds of things they’ve heard and felt in funerals or in situations of loss that have really touched them and helped them think differently about what just happened.” What calmed your stomach down? What helped you relax? Focus on things or thoughts that previously helped you stop obsessing about a loss.

Then, find someone else who’s felt the same way, and reach out. “Respect your own feelings about what you need, and then look around with new eyes about who acts that way, who talks that way, who have I seen doing that?” Hileman suggests. “Tell people who’ve dealt with grief that they’ve inspired you, and you’d like to learn and connect.” It’s likely they want to share and connect, too.

In this issue, we offer a few insights about protecting yourself and your data from cybercriminals and how the Tax Cuts and Jobs Act may impact your tax filing for 2018.

Q: Someone I know got scammed by a thief posing as an IRS agent. What can I do to protect myself against that kind of scam?

A: You’re right to be concerned about scammers with fraudulent intentions. In fact, in 2018, the IRS noted a 60 percent increase in email schemes that seek to steal money or tax data from unsuspecting victims. More than 2,000 tax-related scam incidents were reported to the Internal Revenue Service from January through October, compared to approximately 1,200 incidents in all of 2017, according to a recent Forbes article.

Typically, these scams are conducted via phone, email, texts, and through websites that appear legitimate but contain phony login pages. It could be a call on your home phone claiming to be from the IRS or IRS tax partners in the community, an email asking you to pay back taxes, or someone posing as your company’s payroll provider asking you for W-2 information.

In a recent malware scam, thieves sent emails with subject lines like “IRS Important Notice” and “IRS Taxpayer Notice.” Scammers demanded payment or threatened to seize recipients’ tax refund.

The more you know about how to protect yourself, the better chance you have to not be a victim. Here are a few ways you can guard yourself from tax-related scams.

Recognize what the IRS does not do. The IRS does not initiate contact requesting personal or financial information by email or other electronic communication, such as text messages or social media, according to the IRS’s Taxpayer Guide to Identity Theft. Also, the IRS won’t demand credit- or debit-card numbers over the phone or threaten to have you arrested by local police.

Learn to spot phishing emails and other scams. Phishing is an attempt to fool you into revealing personal or confidential information the scammer can use illicitly. Phishing often comes in the form of an unsolicited email or a fake website that poses as a legitimate site to get you to disclose your personal or financial information. Do not click on links or download attachments from unknown or suspicious emails. Keep a radar up for thieves posing as legitimate organizations such as your bank, credit card companies, and even the IRS.

Be careful with public Wi-Fi. Public Wi-Fi access might be convenient, but you should understand that public Wi-Fi connections are unsecured, and when you use one, your data is vulnerable to others using the same public network. It’s best to avoid websites that could expose your passwords or financial information to cyberthieves on public Wi-Fi connections. If you have another option, like using cellular data, consider that instead.

Use your common sense. Always use security software with firewall and antivirus protections. Use strong passwords. Don’t routinely carry Social Security cards, and make sure your tax records are secure. Lastly, verify that you’re on legitimate websites before sharing your data; if you must access a particular site, avoid any links that you’re not sure about, and navigate directly to the site instead.

Q: How will changes from the Tax Cuts and Jobs Act affect me when I file my 2018 income taxes?

A: The net result of the Tax Cuts and Jobs Act passed in December 2017 is a simplification of the tax code for many Americans. And when you file your 2018 income taxes this April, you’ll primarily feel the difference through changes to the deductions that are available. Many tax deductions were kept intact, but others were modified, and some were eliminated. The result should be positive for most taxpayers but may be a little confusing.

The biggest overall change for most individual taxpayers will be the increase in the standard deduction, which will nearly double from $6,350 to $12,000 for single filers and $12,700 to $24,000 for married individuals. As a result, more than 90 percent of tax filers are expected to utilize the standard deduction rather than itemizing their deductions—up from 72 percent in past years.

The additional standard deduction for the elderly remains available as well. In 2017, the tax rules allowed individual tax filers over age 65 to claim an additional standard deduction of $1,550, and married couples over the age of 65 could increase their standard deduction by $2,500. The new rules increase this higher standard deduction for people over age 65 to $1,600 per individual and $2,600 per couple.

Offsetting the increase in the standard deduction are several changes for taxpayers who have itemized deductions in the past.

- State and local taxes. The cap on the deductibility of state and local income or sales taxes—known as SALT—may be the most notable change after the standard deduction increase. The Tax Cuts and Jobs Act limits the deductibility of SALT to $10,000. That means that taxpayers in high-tax states like New York, New Jersey, Massachusetts, and California may not be able to deduct all of their state and local taxes.

- Mortgage interest. Mortgage interest remains deductible but only on indebtedness up to $750,000—down from $1 million—and interest paid on home equity debt may only be deducted if the money is spent on acquiring, updating, or building a primary or secondary residence.

- Miscellaneous expenses. The tax code eliminated the deductibility of expenses such as tax preparation, investment management fees, and unreimbursed work expenses that had been deductible in excess of 2 percent of adjusted gross income (AGI).

Meanwhile, several deductions became friendlier, including cash contributions to public charities, which are now deductible up to 60 percent of AGI, and medical expenses, which are now deductible if they exceed 7.5 percent of your AGI.

Despite the elimination or reduction of most deductions, most taxpayers will come out ahead due to the higher standard deduction, tax rate cuts, and other changes. That said, the changes to the U.S. tax system resulting from the Tax Cuts and Jobs Act are too sweeping to fully capture in a short article like this. If you have questions or if you need help, you should seek the advice of a skilled tax advisor.

Over the past year, women have individually and collectively spoken out against gender inequality and decided that the cost associated with staying quiet is too high. Celebrities like Ashley Judd, Reese Witherspoon, and Oprah Winfrey declared “Time’s Up” when it comes to the sexual and financial mistreatment of women in Hollywood. This movement has sparked a dialogue that extends beyond the entertainment industry and into all our homes.

This cultural phenomenon presents a great opportunity for women and men to break the money silence and discuss taboo topics like money and power. At times like these, dialogue may cause discomfort, but there has never been a better time to engage in these conversations.

Why now? Because the economic strength of women is on the rise and power dynamics at home and at work are changing. According to the Center for Talent Innovation, the number of wealthy women in the U.S. is growing twice as fast as the number of wealthy men. Currently, women oversee $11.2 trillion in investable assets. By 2030, they will control two thirds of the nation’s wealth.

Despite these positive trends, many women are still paid less than men. The average woman earns 81 cents to every man’s dollar, and the gap widens if you are a woman of color. This pay inequality puts many women and their families at a financial disadvantage. Whether they are primary breadwinners, co-contributors to their families’ incomes, or stay-at-home moms, this type of discrimination impacts them and often renders women silent.

The gender wage gap surfaced very publicly when Michelle Williams, an A-list actress, was paid $1,800 for reshooting scenes in the movie All the Money in the World. Her male costar, Mark Wahlberg, received $1.5 million for the same work. The difference? Wahlberg used his voice and demanded his contractual reshoot fee, whereas Williams accepted the standard fee without question. In the end, Wahlberg donated his salary to the Time’s Up legal defense fund and showed that men are an important part of the solution.

If even the rich and famous cannot overcome this issue, how likely is it that women can advocate for themselves? This challenge may sound difficult, especially if negotiating your salary is a new skill, but it’s possible.

Consider the following women’s stories…

McKenzie, a 25-year-old paralegal, spoke up when she was promoted to a new position with more responsibility. Unfortunately, when she asked the human resource director for a salary increase, she was called greedy. “The worst part is the human resource director is a woman,” McKenzie said. She did receive a pay increase, but only because she was persistent, professional, and determined not to let gender bias stop her.

But what if you don’t work outside the home or contribute only part of the household income? Do you still need to talk more about money and advocate for yourself ? The short answer is yes.

Danita is married with an adult daughter. She feels strongly that women have to have an equal stake in their financial health and well-being. “I remember when my father-in-law had a stroke and couldn’t manage the daily tasks as he once did. My mother-in-law was lost, never having paid a bill or written a check in her life. I remember thinking, ‘I never want to be in that position, and I never want to see my daughter in that position either.’”

Danita and her husband believe that managing money is an important life skill. They have made a commitment to raise a financially literate daughter and serve as role models for how couples can talk openly and honestly about money and share financial decision making.

Gina also believes that women need to take part in money management. As she says:

When a woman speaks up about finances and participates in money conversations, that leaves an impact of being equal—regardless of her role, whether she’s a stay-at-home mom or someone who works part time—in all decisions. It enables her sons to have respect for women and be inclusive in conversations with them—rather than feeling like financial discussions are the purview of men only—and for daughters to be raised as strong, independent women.

Different life-changing experiences spurred these women to make a change. But you don’t have to wait for a promotion or a loved one’s illness to act.

Here are a few tips on how to be an advocate for breaking money silence about women and wealth right now.

Take an Active Role in Your Financial Life

Don’t delegate your financial decision making to someone else. Instead, participate in identifying your short-term and long-term financial goals and working toward achieving these objectives. If you are a member of a couple, attend legal, tax, and financial advisor meetings with your partner. If you are single, find trusted advisors to work with. Ask questions. Learn as much as you can about how to be financially fit today—and financially secure tomorrow.

Be a Role Model

Set a good example for the next generation. Show your daughters, sons, nieces, and neph-ews how women can play an active role in their financial lives. Set a powerful example by managing your money and discussing the impact of your gender on your finances. If you are a man, use your role as a husband, father, uncle, or brother to show your loved ones that no matter a person’s gender it is important for them to be a part of household decision making and planning.

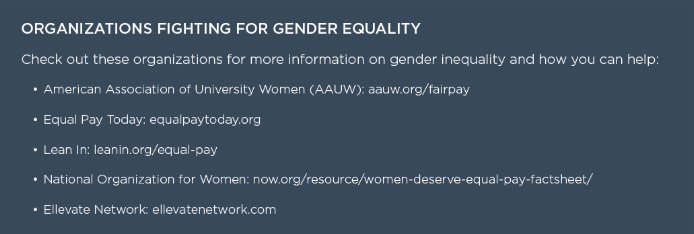

Get Involved

There are many opportunities to support the fight for gender pay equality. Get involved with organizations that advocate for gender parity. Contact your local senator and congressional representatives and encourage them to support legislation to end financial discrimination. Run for political office or support a qualified female candidate. Or volunteer to teach financial literacy to young girls. Whatever you choose to do, you will make an impact. The Time’s Up movement shows the power women can have by speaking up. Yet, silence persists around taboo topics like money and power. With women’s economic strength rising and dynamics at work and home changing, the time has never been better for women and men to break this money silence.

Moving homes at any age can be stressful. The organizational and physical tasks can be immense, and for older adults, this process can easily become overwhelming. Understanding the challenges seniors and their families will face while either transitioning to a new residence or making the necessary updates to a current home are why people are looking to senior move managers for assistance.

Before Anne Nieland became a senior move manager in Urbandale, Iowa, she was teaching art classes to senior citizens. That’s where she fell in love with their demographic. She often heard her students talking about how they needed help moving and always volunteered to lend a hand. Nieland found this work to be incredibly rewarding. Eventually, her husband suggested she turn it into a business.

“I didn’t realize there was an actual industry. I went to conferences, got a mentor, and job shadowed,” Nieland says.

Now, Nieland finds herself constantly busy with her thriving company, Smart Senior Transitions. She says, “I am willing to do anything and everything for my clients,” which can range from finding a trusted real estate agent within her treasure trove of contacts to the arduous job of setting up televisions.

A large portion of her time is spent going through what can be decades of clutter. She asks her clients, “Do you use it?” and “Can you part with it?” If they’re willing to let it go, it ends up in the van, where Nieland’s favorite saying comes into play, “The van makes things vanish.”

For unwanted items, Nieland says, “I try to keep as much out of the landfill as possible.” She can find value in just about anything. She goes on to say that ripped or stained sheets are always needed at animal shelters, partially used cleaning products can go to a women’s center, used glasses can be donated to a Rotary Club, and just about every client has a drawer full of discarded cables that can be dropped off at any Best Buy. If a client wants to try selling instead of donating, Nieland selects the best-suited consignment shop for that item.

It’s inevitable that clients’ emotions get brought to the surface while sifting through meaningful items. When Nieland was packing up a recently divorced client, they came across personal correspondence from her ex-husband. The client, understandably, got very upset. Nieland often faces clients who get angry, frustrated, and teary. She’s learned how to pay attention to triggers and knows when to ease off.

Nieland says, “We’re ripping open old wounds. It’s a lot of listening and paying attention to how they’re feeling. Sometimes you sit on the couch and let them cry. It’s hard not to cry myself. The ride home is often in silence. No radio. No calls. Just deep breaths.”

According to Nieland, it’s challenging not to form personal relationships in this line of work. “It’s virtually impossible not to become friends. They’re so warm and appreciative,” she says. She often hears from her clients long after a job has been completed. After hours of working together, they’ve developed a relationship, and clients will call to check on how she’s doing.

What Exactly Does a Senior Move Manager Do?

Senior move managers are experts who specialize in resettling older adults and preparing them for a different lifestyle as they age. Essentially, they’re project managers with extensive practical knowledge about the costs, available local resources, and obstacles that can arise when downsizing. While specific services vary, most senior move managers offer the following:

- House cleaning

- Waste removal

- Shopping

- Assistance with Realtor selection

- Helping to prepare a home to be sold

- Packing and unpacking

- Scheduling movers

- Donating or selling furniture

- Sending special keepsakes to family members

- Calling the cable company and other utilities

- Preparing a new home with safety features

But Nieland often finds herself going off-menu. She describes having an 88-year-old client who is in excellent health and has no intention of moving; instead, the client enlisted Nieland’s help for after she passes. When that day comes, Nieland knows where everything needs to go and, most importantly, will be the one to oversee the welfare of George, the client’s beloved dog. In addition to providing comfort and peace of mind, Nieland is helping this client’s family by relieving them of the burden and heartache of packing up their loved one’s belongings.

Some families are geographically hindered and can’t help their loved one pack and move. Senior move managers can be useful in this type of situation. They can figure out the best and most cost-effective way to ship items to family members and friends and, perhaps most importantly, they can be there as a comfort to help with the emotional element of relocating.

Talking Through Senior Living Options

Nieland assists her clients in determining whether they want to live independently in their current or new home or in an assisted senior living community. Often, older adults and their families are unaware of many of the costs associated with staying at home, while others might not know about all the options available for assisted living. However, Nieland never gets into the specifics of health care or offers financial advice regarding the cost benefits of options.

When an older adult decides to age in place, a senior move manager can help turn their home into a safer dwelling. Nieland recommends modifications such as, “getting them to cook with an induction stove [which uses magnetic fields and turns off when a pot or pan is removed], widening doorways, adding ramps, and raising items such as the washer and dryer.”

A Network of Senior Move Managers

The National Association for Senior Move Managers (NASMM) is an excellent resource and networking tool. For example, Nieland had a client who was relocating to a different state. She was able to use the NASMM to find a trusted senior move manager operating in the client’s destination state. This person assisted with the unpacking and setup of the client’s new home. Both senior move managers worked as a team to accomplish the goals of the client.

In another instance, Nieland found herself having to crate and ship a rather large art piece. So, she turned to the community and asked, “I have a life-size statue of a horse, what do I do?” She ended up receiving some helpful tips, and the horse made it to its new home in one piece. When asked if having the responsibility of shipping treasured items makes her nervous, she replies, “It’s like running a road race: you’ve prepared and you’re confident in your resources, but you still have butterflies.” Jokingly, she adds, “Also, I have liability insurance.

”Since this is an industry based on the needs of older adults, who can at times be vulnerable, it is important for the NASMM and all their members to follow a strict code of ethics. There is usually a free in-home evaluation, followed by a written estimate of the time and cost of a job, before any payment is processed. Some senior move managers charge on an hourly basis, while others prefer to package everything together at one price.

Being sensitive to this demographic, Nieland tailors each service, as well as her hourly rate, to every client’s specific need. She advises clients not to sign the contract the same day, and she encourages them to talk to their families before doing so.

While uprooting oneself from a well-lived-in home of many decades can be stressful and intimidating, it is a comfort to know there are caring people, like Nieland, willing to help with the transition.

Serial entrepreneur Cindy Eckert sold her last company for $1 billion, got it back for next to nothing, is launching a controversial drug that could be the next blockbuster, and is on a mission to make other women equally rich. Never underestimate @cindypinkceo.

A Pharma Career Wasn’t the Plan

At least not at first. As a graduating business major, Cindy Eckert was hell-bent to work for Merck Pharmaceuticals, not because of the industry but because it perennially ranked as a Fortune MagazineWorld’s Most Admired Company. “I wanted to work for the best business out there, and I figured I could take that and apply it anywhere,” Eckert said.

She ended up falling in love with the science and how it could change people’s lives. She stayed in pharma, stepping to ever smaller companies to be closer to research and development and be heard. In 2007, she started her own company, Slate Pharmaceuticals, which redefined long-acting testosterone treatment for men.

Then she heard about flibanserin, a daily pill that treats low libido in women. Boehringer Ingelheim, the pharmaceutical giant that developed the drug in the 1990s, had given up on it after the U.S. Food and Drug Administration rejected it by unanimous vote.

Eckert contrasted the FDA’s ready acceptance of treatments for men while dismissing options for women. She sold Slate, acquired flibanserin (branding it Addyi), launched Sprout Pharmaceuticals—and kickstarted an improbable David-and-Goliath crusade.

A Tale of Two Genders

The path to FDA approval was a journey marked by gender disparity. For example, while Viagra had been fast-tracked for approval in only six months, Addyi was again rejected by the FDA, even though Eckert had three times as much data. “I had done the work I needed to do, and then I got rejected. That was not a good weekend.”

This is the point where most drug makers go away. But Eckert received a moving letter from a woman who had been in the clinical trial. Her marriage and self-esteem were suffering, all the result of a brain chemistry imbalance outside her control. She implored Eckert to continue the fight.

“For women like her to be denied a treatment option was heartbreaking and infuriating,” Eckert said. “So, on Monday I showed up in the office and told everybody we were going to dispute the FDA.”

It was an audacious move for a tiny company, one so small that all the staff could fit into an elevator, Eckert quips. Could the female chief executive of a newly born startup take on the FDA with any prayer of succeeding in a third attempt at approval?

Yes. In 2015, the FDA finally approved Addyi. Two days later, Eckert sold Sprout for $1 billion to Valeant Pharmaceuticals and looked forward to seeing Addyi launched worldwide. That was not to be; under its new ownership, Addyi was shelved.

So, Eckert and a group of Sprout’s shareholders sued Valeant on the grounds that it overpriced the pill and made little effort to commercialize it. Valeant, which not much earlier had made Eckert a very wealthy woman, handed Sprout and Addyi back in exchange for dropping the suit. Valeant also extended a $25 million loan to restart the business, asking only for a small cut of royalties from future sales.

For the second time, Eckert had won control of the drug without having to write a check.

“Women with a medical condition deserve access to a medical treatment, not our value judgments on whether or not they need it or the worthiness of treatment,” said Eckert. “The science had spoken, and we needed to listen. I wasn’t in this to create the next blockbuster drug. I was in it to make sure women have access and get to choose for themselves.”

Advocating for the Unexpected

After getting a $1 billion payday from the sale of Sprout to Valeant, some of Eckert’s friends were disappointed she didn’t retire to relax on the beach with pink cocktails. You know, live the billionaire dream.

But her struggles to bring Addyi to market—being routinely underestimated along the way—left her impassioned about women’s lack of access to mentoring and money in business. “I shouldn’t be in a club that’s lonely,” Eckert said. “I shouldn’t be in a club in which so few other women have gotten to exits like mine. I need to get other women there, and I need to get them there faster than I got there myself.”

She knew what it felt like to always be unexpected in the room, to navigate a sea of gray suits as a female in stilettos and hot pink. To see worthy ideas sidelined because of preconceived notions. She had seen all that and made it. She also acknowledged how much help she had received along the way from powerful women—policy leaders and those who bravely spoke to a federal agency about an intensely personal subject.

“I’d had a front-row lesson in what it means for women to advocate for themselves and each other,” said Eckert. “So, my next act was going to be about advocating for an earlier version of me, the young woman entrepreneur who can’t raise money because the system doesn’t give her a chance. Consider that 2 percent of venture capital is given to women. You cannot tell me that 50 percent of the population has 2 percent of the good ideas.”

She resolved to champion for all of the unexpecteds in the room, those who didn’t come from Silicon Valley or didn’t attend the business school with the crowd that had inside access to capital.

So, in 2016, The Pink Ceiling was born.

The Pink Ceiling is a venture capital firm, “pinkubator,” and consultancy with a mission to support women-centric biotech startups that could drive real social change.

“We put our creativity, contacts, and cash to work for cutting-edge concepts and founders,” said Eckert. “The thesis is: Let’s stack the billion-dollar club by smashing the pink ceiling together.” She’s on a mission to make women rich.

It isn’t about the money for the sake of it. It’s about bright, passionate women having access to operational support and capital, so they can bring forward the next generation of advances in health tech. Money provides the freedom to make decisions, invest in what matters to them, and pay it forward again.

Only Groundbreaking Business—by or for Women—Need Apply

Eckert looks for companies that offer a patented breakthrough in health tech, will catalyze some important social conversation, and are unequivocally by and for women.

The ideal founder also has a certain DNA that makes her scrappy. Eckert likes those who are self-made and overlooked by the system at large because they are young, female, or not connected into privileged networks. The first round of partners includes 10 innovators:

- Undercover Colors produces a wearable decal that detects common date rape drugs.

- Fathom produces a wearable biometric sensor that collects and interprets movement data to improve athletic performance and prevent injuries.

- uMETHOD combines big data analytics and medical research to improve outcomes for those with Alzheimer’s disease.

- Seal Innovation’s SwimSafe wearable technology helps prevent drowning, the leading cause of accidental death in children.

- Pursuit Sleep Technology (aka Senzzz) embeds sleep center science into wearable consumer products to reduce snoring and improve sleep quality.

-

Lia Diagnostics has created the first FDA-approved, flushable pregnancy test.

-

IntuiTap developed the world’s first imaging device to guide a needle for spinal taps, epidurals, and steroid injections.

-

Medolac is the only company that provides shelf-stable human milk products for babies in need.

-

Renovia created a non-surgical device that addresses incontinence for women by training pelvic floor muscles.

-

Sunscreenr makes a handheld device that reveals vulnerabilities in sunscreen coverage.

The relationship with these companies is not just an investment play. “We’re very selective,” said Eckert. “We’re not playing the odds and saying, ‘we’re going to make x many investments; we figure 8 out of 10 of those are going to fail, but we’re going to have two big wins.’ We’re really picking a company to sit alongside. Almost all of them are between a year and three years out from launch, and we’re going to help them get there.”

Partner companies—often led by scientists and engineers rather than business experts—have access to The Pink Ceiling space, resources, and a business team that knows how to build companies. “So much of this is walking back through my own past and what I wish had gone differently,” said Eckert. “Do I wish somebody had told me their experience? Like, ‘I’ve stepped on that land mine, step left. I’ve done that; don’t do it. You don’t need to repeat it.’”

By making early bets on these companies, The Pink Ceiling also builds their credibility. “We raise money through our fund, but you want to bring in other partners with diversity of thought and strategic sense,” Eckert notes. “It helps validate these companies that somebody has already said yes.”

Changing Perceptions

As an engineering student at Purdue University, Jessica Traver knew she would be one of very few girls in her classes. “I never really noticed or had an opinion on gender bias until I founded IntuiTap and started pitching to physicians, investors, or pretty much anybody. It was just so obvious then that people weren’t taking me as seriously.”

“People say, ‘I never would have expected that you’re an engineer or a company founder. You just don’t look like one.’ And 90 percent of people didn’t get that what they just said is wrong,” said Traver.

Traver is 20-something, five-foot-ten with long blonde waves. “When she walks into the room of a conventional venture capital firm and sits at a board table, she’s already discounted,” said Eckert—too model-like to possibly be an engineer who designed a revolutionary medical device.

IntuiTap’s “stud finder for the spine,” as Eckert humorously describes it, replaces manual palpation and guesswork with a device that uses a heat map to find the right spot and advance the needle by itself. “When Jessica’s company is bought by one of the giants, she will change everybody’s perceptions when the next five-foot-ten blonde engineer in her 20s walks into the room.”

Or consider Bethany Edwards, co-founder of Lia Diagnostics, makers of the world’s first flushable pregnancy test. “Bethany is about four-foot-nothing, little glasses, full of power, and she’s come to really change the world,” said Eckert. “She has masterfully patented a groundbreaking first that will be an interesting conversation starter in women’s health. And I love the idea that it will surprise everybody that it’s Bethany at the helm of this.”

Edwards shares the unifying principle of The Pink Ceiling—women helping women in a big way. “Not only is Cindy investing in women and really encouraging them to lead their companies, but she’s also trying to make sure they have successful exits, so they can, in turn, reinvest in other women. Her candor in wanting to help women get rich is pretty important, because that is one of the only ways you can move the needle on power structure.”

An Opportunity to Pay it Forward

“I hate squandering opportunity,” said Eckert. “Today, I have an opportunity I never imagined, to get onto a big stage in front of all of these young women who are rising stars and help them. The privilege is all mine, that they’ll wait and ask me questions, and I think, you’re further ahead than I was at that same age. So, you’ve got me beat and then some.”

“It’s just such an honor to get to do that. We’re doing that in a small way, but we’re loud about it. We’re loud about it so that others will do the same—and so those who come in and get to be part of it also feel their obligation to pay it forward as well.”

A Decidedly Pink Office

The Raleigh, North Carolina, office of The Pink Ceiling is strikingly pink. Not “it’s a girl” pink. Not cotton candy pink. Not a gentle blush. It’s a fierce, hot pink, and so are Eckert’s suits. “I wear pink all the time. You should see my closet.” It’s a declaration about the dismissive way people talked about Addyi as “the little pink pill.”

“You can run away from gender stereotypes, but if you’re me, you run right toward it,” Eckert said. “The idea that there isn’t something valuable and unique that a woman brings to the table and in owning her femininity—pink for me is about owning it as a woman, unapologetically pink. I like pink. I’m going to wear it. I started showing up in blazing pink to the FDA and said, ‘We are going to have this conversation.’”

A new generation of companies that provide goods and services on demand via smartphone applications has begun to reshape consumer and worker behavior, providing both groups with more choices than ever before. The growth of these services has created a gig economy, where workers are independent freelancers who choose their own hours and assignments over permanent employment.

Although most people, an estimated 89 percent, are not familiar with the term gig economy, the majority, more than 70 percent, have participated in it by using a shared or on-demand online service.1 When planning a vacation, you can rent a beachfront condominium directly from a homeowner rather than stay at a resort. Instead of renting a car, you can request a ride with your phone and popular ride-sharing apps such as Uber or Lyft. What if you need someone to pet sit while you’re away, or you want to come home to a detailed car or a completed landscaping project? Today, there’s an app for just about anything. New gigs can emerge quickly in this technology-fueled environment. In the city of Raleigh, North Carolina, over the course of a single summer weekend, flocks of electric, pay-by-the-minute Bird scooters appeared, with riders soon zipping along sidewalks, leaving some less cheerful drivers and pedestrians wondering what had just happened and city officials scrambling to catch up with regulation. What isn’t as visible is the troop of paid Bird hunters who drive around town after hours to collect, recharge, and reposition the scooters, in a type of scavenger hunt meets part-time job.

The growth of the gig economy presents opportunities and challenges to all market participants. It has been described both as the Industrial Revolution of our age, with the potential for massive gains in productivity—and as the end of job security. It’s been hailed as a liberator for workers seeking to work on their own terms and criticized as a predatory system that leaves workers underpaid, overstressed, and more unprepared for the future than ever before.

What’s the real story? Is it a good gig?

What’s the Gig?

Services or service platforms that make up the gig economy share a few common traits, such as:

- The ability for consumers to grant (or gain) temporary access to underutilized assets, such as a vacation home or a car, with idle capacity. Cars, for example, are unused for 95 percent of their lifetime.2

-

Greater flexibility for both buyers and sellers of goods and services. Consumers and businesses gain the ability to buy services or contract help on demand, and sellers or providers of services can choose when to work, including nontraditional hours that fit with their lifestyles or other time commitments.

-

A willingness by both sides to conduct business with strangers. In a decentralized model, building mechanisms for trust becomes one of the primary roles of the platform provider, whether that’s a driver or riders given ratings in a ride-sharing app or your eBay feedback rating.

Gigs Past

The comparison to the Industrial Revolution is interesting, because in some ways the gig economy seems like a 180-degree turn. As economic historian Louis Hyman describes it, the Industrial Revolution of the 18th century saw a movement of workers from farms and artisans’ shops to centralized locations where their efforts could be coordinated and managed. They earned a wage instead of the profits of their labor. This change in labor patterns, when accelerated by the new technology of the day—steam power and assembly lines—powered massive gains in productivity.

Today, the movement is in the reverse—from formal, centralized workplaces to more flexible, loosely affiliated work arrangements. This phenomenon is not new. Hyman explains that it has been underway since the 1970s: “Over these four decades, we have seen an increase in the use of day laborers, office temps, management consultants, contract assemblers, and every other kind of worker filing an IRS form 1099.

”More recently, what has changed is the pairing of workers’ appetite for short-term, independent employment with smartphone technology platforms to connect these workers to buyers. As with the Industrial Revolution, technology did not create the movement; rather, it has accelerated it. Digital gig platforms, for example, solve the challenges of efficiently linking buyers and sellers, establishing trust, setting a price, and facilitating payments.

Gigs Present

The Brookings Institute has estimated that this facet of the economy will grow from $14 billion in 2014 to $335 billion in 2025.3 However, the size and growth rate of the gig economy labor force is not easily captured in official employment statistics. In 2016, the JPMorgan Chase Institute estimated that around 1 percent of adults had earned income in a given month from online platforms, and that more than 4 percent had participated over a three-year period.4

In addition to replacing a traditional full-time job, gig economy workers may also use the platforms to earn extra income. Business strategy consulting firm McKinsey & Company, with a somewhat broader set of criteria for independent workers, put the number at 20 to 30 percent of the working age population. They also found that these workers participate in the gig economy for primary or secondary sources of income and either out of choice or necessity.5 Figure One breaks down the numbers.

Gigs Future

The gig economy is likely to affect aspects of our lives and economy that are difficult to imagine today. Studies have shown that where ride-sharing services are widely available, many choose to use them in lieu of ambulances for emergency room visits. From farm equipment and private aircraft to personal and professional services and skilled trades, the gig economy stands to alter the ways in which many services we rely on will be provided, with implications for all stakeholders.

Consumers

The driving forces behind the growth in gig economy services are convenience, flexibility, and price. By matching providers and consumers directly, in many cases using physical or human assets that would otherwise be idle, these services can remove layers of costs. Beyond choice and price, consumers also stand to benefit from greater service availability, particularly in areas underserved by traditional businesses. But a variety of risks—beyond the risk of an inexperienced driver behind the wheel—also face consumers in this new business environment where innovation has so far outpaced regulation. One such risk is the potential for new forms of discrimination. A 2017 Harvard Business School study found that guest acceptance at a leading home-sharing service was 16 percent lower for users with names that did not sound distinctly “white.”6 Future regulation is likely to focus on limiting the impact of potential discrimination on online platforms, both from the humans and algorithms involved in decision making.

Workers

The balance of costs and benefits to workers is perhaps the most hotly debated aspect of the gig economy. The fundamental tradeoff to workers is one of flexibility versus security. The ability to clock in and clock out with a swipe of a smartphone screen empowers workers to create a work-life balance that meets their own unique circumstances, limitations, and obligations.

As the Pew Research Center’s work on the gig economy shows (Figure Two), not surprisingly, alternate employment is most popular among younger and lower-income workers. The gig economy seemingly combines the more nomadic work preference of millennials with the always-connected-to-your-phone behavior of Generation Z.

Another group likely to benefit from the gig economy are skilled workers that have been marginalized by the rigid requirements of traditional full-time work. As professor and author Diane Mulcahy explains, “Stay-at-home parents, retired people, the elderly, students, and people with disabilities now have more options to work as much as they want, and when, where, and how they want, in order to generate income, develop skills, or pursue a passion.”

On the other side of the ledger are the costs and risks to workers. There is no free lunch, and the flexibility benefits of gig employment must come at a cost. Examples include:

- Greater income volatility and potentially lower incomes for the same types of work;

- Fewer workplace safety protections;

-

Lack of valuable benefits packages typically provided by employers, including paid vacation and sick leave, health insurance, and retirement programs; and

- Tax complexity.

Taken together, these costs cause a dollar of gig earnings to be worth less than a dollar from traditional employment. Gig-oriented work can also take a toll on health, with studies suggesting that a decade of irregular work could lead to a cognitive decline of 6.5 years (compared to those working regular hours).7

Businesses

As with most shifts in technology or consumer taste, the gig economy represents both opportunities and threats to traditional businesses. With unemployment at record lows and businesses of all types struggling to find qualified workers, the prospect of scaling the workforce on demand—and potentially without the overhead of benefit and employment costs—may be appealing in fields where skills are more commoditized and transferrable

At the same time, employers may face a new source of competition for their already scarce talent pool. Against this new form of competition for workers, the gig economy may prompt employers to extend similar types of flexibility to their own workers. And against new gig economy competitors, businesses will not just compete for workers—they will also compete for customers.

As always, there will be winners and losers, and the companies that thrive will be the ones most attuned to the shifting preferences of their customers. Of course, these preferences—and the challenges of how to fulfill them—are changing at a heightened pace, thanks to technology trends.

The Economy

A fundamental premise of the gig economy is that suppliers and consumers of goods and services can be matched directly and efficiently through technology. This has the potential to improve capital efficiency and productivity. But once again, these gains do not come without costs and risks.

How does the gig economy affect the American dream of a tidy house with two cars in the driveway? If consumers can easily rent homes, cars, boats, planes, recreational vehicles, and snowmobiles on demand, then the same asset base is able to meet the demands of a larger population of consumers, with perhaps a disinflationary impact to the economy.

Finally, a thorough look at the gig economy must consider public benefits and security programs, such as Social Security, unemploy-ment, and health and retirement systems. In an extension of the trend from employer-provided retirement security through traditional pension plans toward defined contribution plans like 401(k)s that share the responsibility for retirement savings between employers and workers, workers in a gig economy will bear even more of the responsibility for financial security and retirement savings.

A Gig in Transition

In my travels across the country for client meetings over the past few weeks, I’ve made it a point to ask ride-sharing service drivers about their experiences in the gig economy and their motivations. I’ve heard from drivers who are making ends meet while they:

- Take real estate and community college classes,

- Interview for jobs after college,

- Study for the bar exam after law school, and

- Save to start a new organic produce business.

In each of these cases, the gig job is not a long-term objective. Rather, it’s a means to an end. If the availability of flexible, short-term work arrangements allows these individuals to start more businesses, retrain themselves, and acquire the skills required in our changing economy, it may be a small gig that leads to a much bigger stage. Only time will tell.