-

Solutions

- Solutions

-

Individuals & Families

- Individuals & Families

- Individual Investors

- Executives & Business Owners

- Families with Complex Needs

- Professional Athletes

-

Retirement Plan Sponsors

- Retirement Plan Sponsors

- Corporations

- Educational Institutions

- Healthcare Organizations

- Nonprofits

- Government Entities

- Endowment & Foundation Leaders

- See All Solutions

Comprehensive wealth planning and investment advice, tailored to your unique needs and goals.Investment advisory and co-fiduciary services that help you deliver more effective total retirement solutions.CAPTRUST provides investment, fiduciary, and risk management services for nonprofit organizations. -

About Us

- About Us

- Our People

- Our Story

- Learn About CAPTRUST

-

Locations

-

Resources

- Resources

- Articles

- Podcasts

- Videos

- Webinars

- See All Resources

American Airlines Breached Duty of Loyalty, But Not Prudence, in ESG Case—On Unique Facts

As previously reported, American Airlines and its 401(k) plan fiduciaries were sued for inappropriately including investments with environmental, social, and governance (ESG) objectives in their plans. The plans offered BlackRock Index funds, which made up approximately $11 billion of the plans’ $26 billion in assets in 2022. As the judge observed, BlackRock actively supported ESG efforts and social change by making investment decisions and voting proxies on this basis. American Airlines had also publicly endorsed ESG efforts as an important part of its long-term success. Additionally, BlackRock was a significant investor in American Airlines, holding more than 5 percent of American Airlines’ stock and approximately $400 million of its corporate debt. As detailed below, the judge found that American Airlines “incestuous relationship with BlackRock and its own corporate goals disloyally influenced administration of the plans.” Spence v. American Airlines, Inc. (N.D. Tex.).

The lawsuit alleged that American Airlines and its plan fiduciaries had violated ERISA’s prudence and loyalty rules. After reviewing the plan fiduciaries’ processes, the judge decided there was no breach of fiduciary prudence. The plan fiduciaries had a robust process, which included an independent outside investment consultant, regular quarterly investment reviews, and quarterly meetings. The judge concluded that American Airlines’ fiduciary process was in line with the industry norm. However, meeting industry norms, which, according to the judge, are effectively set by a few large players, does not safeguard against breaches of loyalty.

With respect to loyalty, the judge observed that ERISA “requires a fiduciary to always act solely for the plan and in the plan’s best financial interests—not just some of the time.” Plan fiduciaries must follow an “objective, analytically rigorous standard when it comes to a fiduciary exclusively pursuing the best financial interests of the plan.”

Loyalty considers the reasons whya fiduciary acted, not the process of acting. ESG investing, by definition, pursues a non-pecuniary interest as an end itself rather than as a means to achieve financial results. If there is a solid premise that ESG factors will advance a company’s financial performance and could reasonably lead to positive financial outcomes for plan fiduciaries, the investment’s objective is pecuniary.

The BlackRock investments in the American Airlines plans were all indexed investments. In indexed investments, the composition of the holdings is dictated by the index that is being tracked (e.g., the S&P 500 Index) and not by the investment manager’s discretion (in this case, BlackRock). As a result, BlackRock had no discretion to pick and choose the companies whose stocks would be included. Noting its support for ESG, BlackRock’s CEO explained that, for index fund holdings, it would use its proxy votes to drive social change.

The judge took particular note of a lapse in regular quarterly reporting of proxy voting by BlackRock to the American Airlines plan fiduciaries. The judge also noted the plan fiduciaries’ failure to realize or call out the reporting failure. One individual at American Airlines was responsible for its corporate relationship with BlackRock and also had day-to-day oversight of the plans’ investment managers. This person’s failure to keep the roles separate and provide oversight of BlackRock’s proxy voting was seen as evidence of subordinating the interests of plan participants and sacrificing investment returns to promote goals unrelated to the interests of the participants. The judge observed that most 401(k) fiduciary committees do not receive regular reporting on proxy votes, so this lapse demonstrated the fiduciaries “turning a blind eye” to proxy voting, but not a prudence failure.

In reaching his decision, the judge gave considerable weight to the compound factors indicating that American Airlines and the plan fiduciaries were motivated by ESG objectives and BlackRock’s influence rather than being motivated to pursue the best financial results for plan participants. These factors included the similar corporate ESG positions of BlackRock and American Airlines, and the judge’s belief that BlackRock’s significant ongoing equity and fixed-income investment in American Airlines influenced American Airlines and its plan fiduciaries to support ESG objectives.

Key takeaways from this decision include:

- the critical importance of corporate executives being clear about their respective fiduciary and non-fiduciary roles—and keeping them separate;

- the complications and risks of having corporate service providers and investors who are also involved with retirement plans (there can be no corporate quid pro quo based on plan matters);

- the importance of plan fiduciaries understanding what their plan’s investment managers seek to accomplish and whether they have any objectives other than participants’ best financial interests; and

- the importance of plan fiduciaries’ understanding how proxies are handled for the assets in their plans.

This decision is likely to be appealed, and, following the Supreme Court’s elimination of Chevron deference, the Department of Labor will not be able to control courts’ interpretations of ERISA. Therefore, varying district and appellate court opinions are likely. The legal environment for ESG investing in retirement plans will continue to be uncertain and remain a likely target of legal challenges.

Note on Proxies: We can expect an increased focus on how plan fiduciaries handle proxies. Here is a quick refresher.

- Proxies issued on holdings in separate accounts and collective investment trusts must be voted in the best financial interests of plan participants. This voting is frequently delegated to the investment manager. If so, plan fiduciaries must monitor how proxies are voted. (This was the issue in the American Airlines case.)

- Proxies issued by holdings in mutual funds will be voted by the investment managers. Fiduciaries should understand the mutual fund’s investment philosophy and whether non-financial interests are a goal.

- Proxies issued by mutual funds must be voted in the best financial interests of plan participants. These will include issues like the election of the mutual fund board and changes in the mutual fund investment policy.

UnitedHealth Group Settles Target-Date-Fund Challenge for $69 Million Settlement Amid Conflict-of-Interest Allegations

As previously reported, fiduciaries of the UnitedHealth Group 401(k) plan were sued challenging their retention of underperforming target-date funds. The complaint alleges that the company’s retirement plan continued to offer Wells Fargo target-date funds from 2015 to 2021, even though these funds consistently and significantly underperformed. Snyder v. UnitedHealth Group (D. Minn., filed 2021).

Through the litigation discovery process, the plaintiffs claim to have found evidence that, even though the UnitedHealth fiduciary committee had decided to remove the Wells Fargo target-date funds, UnitedHealth’s chief financial officer (CFO) interceded to keep the funds in place. After discovering the CFO’s intervention, the participants’ claims were expanded to add the CFO as an individually named defendant.

The amended complaint alleges that the CFO directed an evaluation of UnitedHealth’s business relationships with Wells Fargo and the other firms whose funds were candidates to replace the Wells Fargo target-date funds. Upon determining that Wells Fargo was a significant business partner, the decision to replace the Wells Fargo funds was reversed. Soon after, the plan’s fiduciary committee was restructured to include the CFO, who had not previously been a member. The complaint contends that UnitedHealth’s plan fiduciaries put the plan sponsor’s business interests and profits ahead of plan participants’ interests, thereby violating ERISA’s exclusive benefit rule and causing losses for plan participants.

Against this backdrop of alleged conflicts of interest, the case has reportedly been settled for $69 million, which appears to be a record amount in a suit alleging the improper retention of underperforming investments.

Like the American Airlines case, this one is a reminder that, under ERISA, plan fiduciaries and sponsors may not make plan-related decisions that benefit corporate interest and compromise plan participants’ interests, and that even perceived conflicts of interest should be avoided.

Pension Settlements: Legal Challenges Continue

In recent years, many pension plan sponsors have fully or partially closed out their obligations to plan participants by purchasing annuities to fund participants’ earned benefits. The applicable fiduciary rules do not permit plan fiduciaries to seek the least expensive annuities. Rather, they must select the “safest available” annuity provider, and there can be more than one “safest” provider at any given time.

We have recently reported on several lawsuits challenging the selection of Athene as an annuity provider, most of which allege that it did not meet the safest-available-provider requirement. In those cases, Athene has been characterized by the plaintiffs as a “highly risky private-equity-controlled insurance company with a complex and opaque structure.”

In a recent suit, Verizon and its independent fiduciary, State Street Global Advisors, were challenged for entering a pension settlement of $5.7 billion and covering 56,000 pension plan participants. Prudential and RGA Reinsurance took on the pension liabilities. Prudential is a frequent party in these transactions.

The suit alleges that Prudential and RGA were not the safest available providers. Importantly, the case goes on to claim that State Street was motivated in its selection of Prudential and RGA by its own self-interest, due to its investments in Prudential, RGA, and Verizon. Dempsey v. Verizon Communications, Inc. (S.D. N.Y., filed 12.30.2024).

This case is in the early stages of litigation. Some commentators have expressed surprise at seeing a case like this involving Prudential, which is frequently selected as the “safest available” provider. One commentator observed that, if this case survives a motion to dismiss, the plaintiffs will have the leverage to force a settlement. And if that happens, similar cases are likely to follow.

Supreme Court Hears Case on What’s Needed in a Viable ERISA Complaint, Oral Argument Did Not Suggest an Outcome

Due to conflicting decisions in U.S. courts of appeal, the Supreme Court accepted a case to decide what must be included in a lawsuit alleging an ERISA-prohibited transaction violation. The law in this area is not clear. Some federal appellate courts consider many common day-to-day relationships to be prohibited transactions. In this situation, a suit can be brought forward with minimal facts, then the plan fiduciaries must prove there was no loss to plan participants. Other federal appellate courts require an allegation that fiduciaries overpaid for a service or purchased an unnecessary service. In this situation, the plan participants who are suing must prove there was a loss.

Frequently, comments and questions from Supreme Court justices during oral argument offer an indication of how a case will be decided. Not so in this case. Justice Barrett asked, “Why on earth” did Congress structure this part of ERISA the way it did? And Justice Sotomayor said, “This isn’t that easy a case in my mind.” Cunningham v. Cornell University (S. Ct., argued January 2025).

If the Supreme Court decides that plaintiffs who bring suit are not required to allege and show damages, the volume of plan-related lawsuits based on ERISA-prohibited transactions can be expected to grow significantly. A decision is expected by the middle of the year.

Vanguard Settles Target-Date-Fund Claim for $40 Million—Along with a $106 Million Penalty

In 2021, Vanguard lowered the minimum investment required to use the institutional share class of its target-date funds from $100 million to $5 million. This offered investors a significant fee reduction. As a result, a large amount of money left the retail share class to move into the less expensive institutional share class, which is a separate fund structure. To accommodate the movement of these assets, the retail share class investment managers sold significant amounts of holdings. For retail investors in taxable accounts, this triggered capital gains taxes. Tax-exempt accounts, like 401(k) plans, did not have this issue.

Retail investors in taxable accounts sued Vanguard for repayment of the capital gains taxes incurred because of the retail share class sell-off. In re: Vanguard Chester Funds Litigation (E.D. Penn. 2024).

Settlement of this case for $40 million was recently reported. In addition, the Securities and Exchange Commission has assessed a $106 million penalty for misleading statements related to capital gains and tax consequences of the sell-off.

A fresh, new year is a catalyst that drives nearly everyone in the money management industry to unpack their fortune-telling tools and make predictions. These forecasts are designed to impress the public with concise narratives that sound reasonable and wise, but they often add more confidence than value in the decision-making process.

At CAPTRUST, one of our fundamental portfolio management principles is that we do not predict; we prepare. To help us understand the range of possible futures we need to prepare for, we use four levels of analysis: the range of possibilities, probabilities, market expectations, and sources of uncertainty, in that order. Each level requires a different set of subjective decisions.

We consider this preparation and prediction process to be an ongoing thought experiment, not just in January but throughout the year, and we adapt as new information becomes available. We approach this exercise, beginning to end, with a healthy dose of caution and humility.

Here are the four primary levels of analysis we conduct when evaluating the macroeconomic landscape.

Level One: The Range of Possibilities

Legendary investor Howard Marks once said, “The future does not exist. It is only a range of possibilities.” In part one of our analysis, we attempt to define the range of near-term possibilities. We ask ourselves: what could the headlines say 12 months from now?

While this initial level of analysis only scratches the surface, it also provides a foundation for the other levels. In this level, the goal is not to make a prediction. It’s to determine whether the full range of potential economic scenarios has a mostly negative or mostly positive bias. That is, are there more negative or positive scenarios that could unfold this year?

For 2025, we see three primary possibilities. From most negative to most positive, they are:

- Optimism fades. In this scenario, sticky inflation keeps interest rates high in the U.S. while global economic activity decelerates. The productivity value of artificial intelligence (AI) lags, and earnings expectations soften against a backdrop of elevated valuations.

- More of the same. Despite continued AI enthusiasm, inflation hovers near the Federal Reserve’s target range. As a result, the forward path of interest rates and market leadership remains highly sensitive to each new data release.

- An upside surprise. Inflation pressures continue to ease as productivity begins to accelerate, with AI efficiencies becoming more widespread. This strong economic tailwind, combined with falling interest rates, supports double-digit earnings growth across corporate America.

This level one analysis of all the things that could happen helps us understand the overall risk landscape. Then, in level two, we assign probabilities to each possibility to determine what actually might happen next.

Level Two: Probabilities

Humans have a difficult time interpreting probabilities. Early in life, most people are taught the mathematics of certainty instead, so we tend to believe there are only two probabilities: 0 percent and 100 percent. In reality, few variables across the investment landscape have such binary outcomes.

Investing requires making judgments about a future in which essentially anything is possible and nothing is certain. Understanding the probabilities of each possible scenario helps us prioritize what we need to prepare for.

Unsurprisingly, when we assign probabilities to the range of possibilities, our expected near-term future looks a lot like our recent past. This is because short-term market moves are primarily driven by momentum. Without a change in a critical market assumption, a comfortable default for most forecasters is to assume there will simply be more of the same. And indeed, more of the same is the most likely scenario for this year.

We believe each of the three possible scenarios has a percentage probability of coming true in 2025.

- Optimism fades: 10 percent

- More of the same: 50 percent

- Upside surprise: 15 percent

Based on these first two levels of analysis, you could reasonably (and accurately) deduce that CAPTRUST is predicting a generally favorable outlook for the economic landscape—not the doom-and-gloom recession you might be fearing. That doesn’t mean a recession isn’t possible. It just means a recession is not highly likely.

The economy is sound, inflation is trending favorably, the labor market is robust, and under the new administration, regulatory burdens are likely to ease.

Most investment outlooks stop here and are circulated with this degree of explanation, leaving individual investors feeling empowered to take additional risk within their portfolios.

However, it is important to remember that this two-level outlook is incomplete. To be fully prepared, investors must also consider the next two levels.

Level Three: Market Expectations

One of the most difficult concepts investors must learn is that markets do not trade on good or bad outcomes. They trade on better or worse outcomes—that is, better or worse than what was expected.

While the first two levels of analysis are critical to understanding the economic backdrop and likelihood of certain outcomes, for investment decision-making, they are mostly useful as context clues to help evaluate whether the expectations already embedded in market prices are reasonable or not.

At any given time, current market prices incorporate the consensus investor outlook. A forecast that aligns with the consensus view will not provide excess value. Only a view that is better or worse than the consensus has the potential to add or remove value. But remember, while the consensus may not be correct, it captures the wisdom of the crowd.

The challenge is that nobody truly knows what the consensus views are. So we must interpret multiple data points, such as investor sentiment, equity valuations, earnings, interest rate projections, and credit spreads, to build estimates of consensus opinions. These data points change daily.

At present, the U.S. landscape reflects high investor sentiment, higher equity valuations, optimistic earnings projections, and near-record-low credit spreads. In other words, the consensus view—like CAPTRUST’s—is a favorable outlook for economic activity.

The question is how do CAPTRUST’s expectations compare with what we believe the market is projecting?

A good economic outcome can still be disappointing if the market was expecting something great. That’s why, sometimes, the best investments are those for which people have the lowest expectations. But also, sometimes, low expectations come with higher risk, because the consensus view is almost always based on valid reasoning.

Level Four: Sources of Uncertainty

In his 1921 book Risk, Uncertainty, and Profit, Frank Knight formalized a distinction between risk and uncertainty. Risk, he argued, is an unknown outcome for which the distribution of potential outcomes is known. Uncertainty, on the other hand, is an unknown outcome for which the distribution of potential outcomes is also unknown.

Astute readers may have noticed that our level two probabilities for likely economic scenarios only add up to 75 percent. What became of the remaining 25 percent? It is captured in what we believe to be an environment of heightened uncertainty. In other words, there is a 25 percent chance that something entirely unpredictable could happen.

This uncertainty is driven by a few primary factors.

Policy Questions: As President Trump’s new leadership structure is finalized, we will gain clarity on his administration’s upcoming policy agenda. While many expect that his proposed deregulation policies will support economic growth, many of his other proposed policy measures could create economic pressures. It’s not possible to conduct mass deportations, place broad tariffs on imports, and cut $2 trillion from government spending without putting upward pressure on inflation and downward pressure on gross domestic product growth. The president and his leadership team will likely be discussing these and other economic consequences when deciding which policies to enact and their timing.

The Federal Reserve is also awaiting clarity. Fed Chairman Jerome Powell has said the Fed will remain data dependent and not consider potential policy shifts or hypotheticals in its decision-making process. This adds another element of uncertainty, potentially raising the odds of a monetary policy error.

The Domestic Fiscal Situation: The president and his team will also need to consider how proposed policies could impact the U.S. fiscal situation. Deficits, debt ceilings, and debates will likely continue to contribute to heightened unease and market volatility. However, the promise of improved productivity from AI advancements may offset anxiety.

AI Productivity Gains: It’s possible that just about any short-term economic outcome could be overwhelmed by AI productivity gains and hype. However, the timeline for gains remains unclear. The AI revolution could happen faster—or much slower—than expected. In the meantime, as long as investors remain confident in AI’s long-term potential, it may not matter whether near-term corporate earnings expectations are realized.

Forecasting 2025

At CAPTRUST, we work hard to stay aware of how much we don’t know. The future is unpredictable, yet we revel in predicting, because a thorough prediction means we can be prepared for a wide range of potential outcomes.

It would be easy to think there’s no value in predicting. But the value is in the process, not the predicted outcomes. By trying to forecast what will happen next, we are forced to define our expectations, interpret the market’s expectations, and identify sources of uncertainty.

This year’s expectation: We believe the economic foundation is strong, with falling inflation, a robust labor market, a financially sound consumer, and an easing regulatory environment. Right now, we’re seeing high stock valuations and minimal premiums demanded for taking credit risk. This means market participants may be even more optimistic than CAPTRUST is when interpreting the forward path of the economy and the markets.

Still, we’re seeing elevated uncertainty, driven by shifting political policies, an unsustainable fiscal position, and soaring excitement around AI. Any of these factors could cause this year’s outcomes to fall outside our expected range.

Against this backdrop, we are approaching 2025 with caution and optimism. There are many things to like about the current economic landscape. However, the combination of elevated investor optimism and heightened market uncertainty can sometimes create pitfalls. We’re keeping a close eye on many factors.

This year, like in many of the years before, the most important positioning characteristic will likely be the ability to change course if the outlook changes.

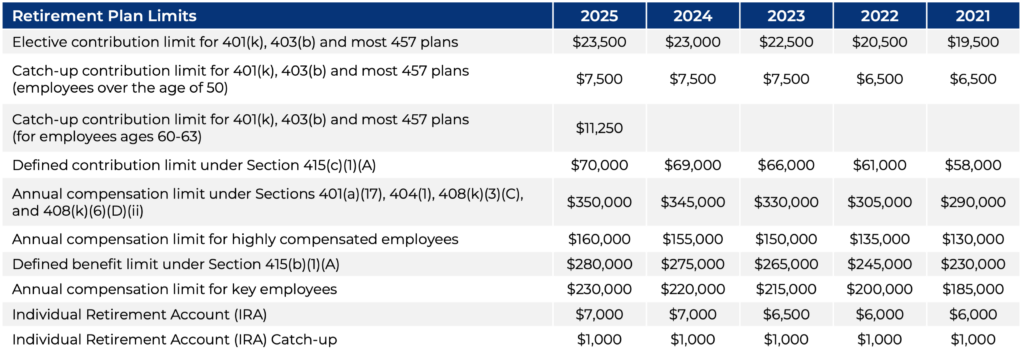

Key provisions of this guidance are as follows.

Roth Catch-Up Contributions

- Pretax catch-up contributions made by those earning more than $145,000 in the previous calendar year will be automatically designated as Roth contributions. No special election is required.

- When determining whether an employee qualifies for the Roth restriction on catch-up contributions, there will be no proration of wages for the prior year. Thus, new 2026 employees and those who worked for part of 2025 will only have their 2026 catch-up contributions designated as Roth if their Federal Insurance Contributions Act (FICA) wages for 2025 exceeded $145,000.

- Since qualification depends on FICA wages, individuals who do not have FICA wages from the plan sponsor will have no restrictions on their catch-up contributions, regardless of salary. This includes certain state and local government employees and partners in a partnership who have only self-employment income. Those with no FICA wages can choose to designate their catch-up contributions as pretax or Roth.

- Plans may not require that all catch-up contributions be Roth in order to circumvent these new rules.

- Roth contributions made before the participant has reached their general 402(g) elective deferral limit will satisfy the catch-up Roth requirement if the elective deferral limit is exceeded, even though these funds were contributed to the plan before the participant reached the elective deferral limit.

- Plans without a Roth feature will not be allowed to provide a catch-up option for those who earned more than $145,000 in FICA wages from the plan sponsor in the previous calendar year.

Auto-enrollment Requirement for Plans Created After the Passage of SECURE 2.0

- If a plan created before SECURE 2.0 joins a multiple employer plan (MEP) or pooled employer plan (PEP) that was also created after SECURE 2.0, the joining plan will not be required to have auto-enrollment.

- For plans that are subject to SECURE 2.0’s autoenrollment requirement, all new employees must be automatically enrolled. Existing employees who have never made a deferral election or an affirmative election to opt out of the plan must also be automatically enrolled.

- To determine the 10-employee threshold at which an employer’s plan would become subject to auto-enrollment requirements, the IRS will use existing Continuation of Health Coverage (COBRA) rules.

- For MEPs and PEPs, the IRS will determine the 10-employee and three-year thresholds using an employer-by-employer basis. These thresholds will not be based on the number of employees in the MEP or PEP, nor will they be based on the creation date of the MEP or PEP.

It’s important to note that these IRS regulations are not yet final. They include a 60-day comment period from their date of publication in the Federal Register. A public hearing is scheduled for April 8, 2025..

The term soft landing has pervaded economic commentaries for years. A soft landing was the optimistic outlook for the U.S. economy in late 2023 and the consensus prediction for most of 2024. But as 2025 begins, economists have started asking whether the economy will ever really land.

Two years ago, many market watchers thought they knew what would happen next. An extra $4.6 trillion, more than 15 percent of gross domestic product (GDP), had been injected into the economy since the beginning of the pandemic. Traditional economic theory assumed this gigantic stimulus would cause the economy to overheat, leading to an economic correction. Maybe, if everything went right, it could avoid a hard landing (a recession), but it would still have to face at least a soft one. In this soft-landing scenario, the economy would bump along for a while at low, but above zero, levels of growth before reaccelerating.

Yet, so far, there have been no dire repercussions—no big drop in consumer spending, no significant increase in unemployment, and no outbreak of housing foreclosures or business bankruptcies. The economy has cooled in an orderly fashion as economic distortions caused by the pandemic have slowly subsided. The consensus outlook for the U.S. economy has morphed from recession imminent to soft landing and now to no landing.

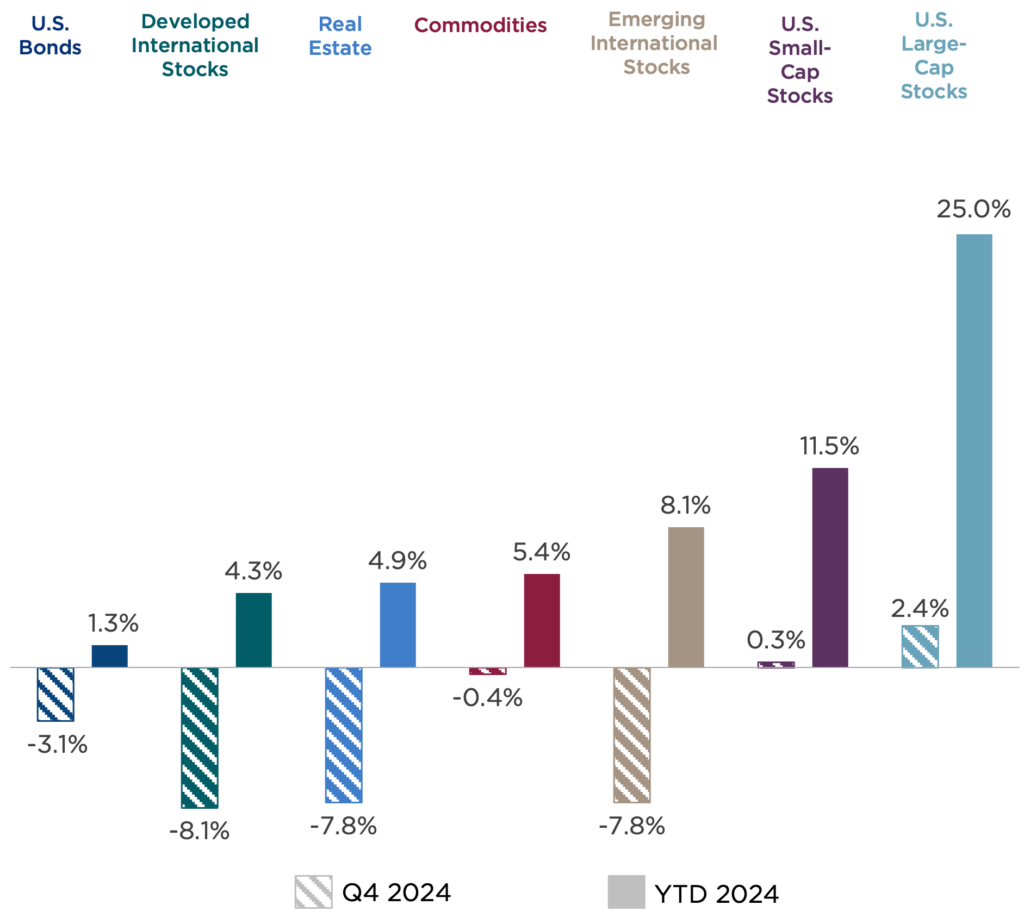

Fourth-Quarter Recap: The Rally Broadens

The fourth quarter of 2024 was marked by a stronger U.S. dollar and rising long-term fixed income yields. These shifts reflect both a resilient economy and worries that the new administration’s policies could be inflationary. Against this backdrop, most asset classes slumped.

In the U.S., large-cap stocks were the exception, climbing not only for the quarter but also for the last two years, with gains of 25 percent or more in both periods. This cohort has shown strong earnings performance and stands to gain significantly from the rollout of artificial intelligence (AI) technology.

A strong dollar and rising interest rates tend not to be favorable for international stocks, fixed income, real estate, or commodities. All these asset classes declined in the fourth quarter and lagged for the full year.

Figure One: Q4 2024 Market Rewind

Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

Interest Rate (In)Sensitivity

When battling inflation, the Federal Reserve’s primary tool is to increase interest rates. Higher rates make borrowing more expensive and, in turn, tend to stifle demand throughout the economy. Most Fed hiking cycles have led to recessions. Indeed, at the beginning of the most recent hiking cycle, Fed Chair Jerome Powell warned of this possibility, saying the battle against inflation could be “painful.”

But this time has been different. Ultra-low interest rates during most of the 2010s allowed some borrowers to lock in low rates for long periods, insulating themselves from the higher rates that came later.

Many who didn’t lock in low rates are now struggling to afford the larger purchases, like homes and vehicles, that help drive economic activity. Housing supply has been constrained, since current homeowners don’t want to give up their current low mortgage rates, and reduced supply has increased home prices across the country. This doesn’t usually happen when rates are rising.

The Search for Neutral

In September, the Fed started cutting interest rates, even though inflation had not reached its 2 percent target. This indicated a shift in monetary policy. In Powell’s words, “Recalibration of our policy stance will help maintain the strength of the economy and the labor market and will continue to enable further progress on inflation as we begin the process of moving toward a more neutral stance.” The Fed is trying to find a neutral policy.

Neutral policy is the level of the fed funds rate called R*. This is a theoretical rate that neither stimulates nor restricts the economy. All else equal, it is where the Fed would prefer to set policy. It is theoretical because there is no way to calculate the precise level of R*. It can change based on myriad conditions affecting the economy.

Since the first rate cut in September, the Fed has cut the fed funds rate by a total of 1 percent, ending 2024 at 4.25-4.50 percent. In its December 2024 “Summary of Economic Projections,” the Fed presented a median long-term forecast for the fed funds rate of 3.00 percent. But that’s a level it doesn’t expect to achieve until after 2027.

Part of a normal interest rate environment is that longer dated interest rates should be higher than shorter dated ones. This is known as a positively sloped yield curve. In the past few months, the yield curve has regained a positive slope. Before then, you may have heard it was inverted. The change to positive sloping might indicate a normalizing economy, but it could also reflect other factors, such as concerns related to government debt or higher long-term inflation expectations.

How and when the fed funds rate and the yield curve finally normalize have enormous implications for the economy and for asset prices. Higher yields on fixed income investments, such as bonds, may make the cost of capital too high to support economic growth. Fixed income investments and stock valuations tend to be inversely correlated. When one goes up, the other goes down. Fixed income levels deemed too high to support current stock valuations could result in a market correction.

Productivity Surge

The U.S. labor force is not growing very much. The latest count, from December 2024, was virtually unchanged from a year prior, and this includes the net effect of immigration. Yet despite this lack of labor growth, the economy has managed to grow by about 5 percent. This was achieved through the miracle of productivity.

Productivity is measured as GDP per hour of work. Getting more output per each unit of labor creates excess output that can be redirected into the economy in many ways, including wages and corporate profit growth.

Economic growth from productivity sets the U.S. apart from its developed market counterparts, where productivity has stagnated this century. It also provides much of the explanation for the outperformance of U.S. stocks during this period.

The largest companies in the world (many of which are based in the U.S.) are investing heavily in new technologies to accelerate productivity gains. These investments are likely already having a net-positive effect on the economy. If AI technology achieves even half of what its supporters are promising, the U.S. economy could be entering a golden age of productivity.

Conflicting Signals from Corporate Earnings

Among publicly traded companies, there have always been the haves and have nots, but the differences have rarely been so stark as they are today. Large companies are enjoying heady growth and productivity gains. Those with large cash piles and minimal debt have also managed to benefit from higher interest rates. In 2024, earnings per share for the S&P 500 Index grew by about 10 percent and are expected to grow another 15 percent in 2025.

By contrast, smaller companies have floundered. This cohort is far more heavily impacted by higher interest rates and regulatory burdens, and the primary index on which they trade—the Russell 2000—saw 2024 earnings roughly equal to 2018.

Such a top-heavy distribution of economic gains can have negative side effects for the economy. Small businesses represent most of U.S. employment. Stagnant or declining earnings may result in significant layoffs or, worse, business closures across the country.

Government Debt

Another factor worth watching this year is the federal government’s debt. The torrent of pandemic-related stimulus from 2020 to 2022 added to an already stretched government debt load, and the burden is now getting harder to carry as higher interest rates make debt more costly to service. At present, the federal government pays more in interest payments for outstanding debt than it does for all its military operations.

How does government debt impact the economy? Debts and deficits of this magnitude threaten to crowd out private-sector businesses by making them compete with the government for lenders’ dollars. A local restaurant has a harder time borrowing when the government is paying nearly 5 percent interest. This level of debt also makes it more difficult for the government to spend on other, economy-boosting line items.

The quickest way to address the issue is through austerity—that is, reducing public expenditures—but this would have a direct negative impact on the economy. Another way is to increase the money supply in order to pay the debt, but this would likely hurt the economy indirectly by increasing inflation.

A better way is to outgrow it. A larger economy makes the current amount of debt smaller as a percentage and can bring in more tax dollars to reduce the deficit.

New Administration, New Policies

The policy promises from President Trump’s campaign, if enacted, have the potential to create major economic impacts. But promises can be difficult to fulfill, so we’ll have to wait and see which items become reality.

Deregulation is one of the most likely policy agendas to be implemented. Eliminating regulations tends to produce higher growth rates as businesses are more willing to risk productive capital when the regulatory environment is less burdensome.

Other suggested policy shifts could have mixed or even negative effects. Examples are tariffs, which could impact supply chains and the cost of goods; immigration, which could impact supplies and the cost of labor; taxes, which could impact corporate earnings and aggregate demand; and the Department of Government Efficiency, which could impact the level of government spending.

Clear Skies Ahead?

When describing the economy, market pundits often use airplane metaphors. The economy can be taking off, cruising along, landing, or facing turbulence.

Here’s where the metaphor falls apart. Although an airplane always needs to land, the economy doesn’t. Real GDP, which excludes inflation, has grown every year since the turn of the century, except in 2008 and 2009 (the great financial crisis) and 2020 (the pandemic).

Historically, the economy requires either structural instabilities or external shocks to trigger a recession. At present, we see none on the horizon.

Structurally, the economy seems resilient. Consumer and business confidence are improving, jobs are plentiful, wages are rising, and inflation has eased. The U.S. equity market has responded to this economic backdrop with strong performance.

By their very nature, shocks tend to be low-likelihood events or completely unforeseeable. Any number of shocks with economic consequences could emerge, particularly from the numerous geopolitical events percolating across many parts of the globe. But let’s not prepare the runway just yet. It’s possible we may avoid a landing altogether.

In 2024, economic conditions steadied, the Federal Reserve started cutting interest rates, and the market anticipated—then reacted to—federal election results. Against this backdrop, retirement plan sponsors refined their plan designs to improve participant experiences, participation, and outcomes. Past trends accelerated, and new ones took shape.

2025 promises further evolution. From changes in investment menus to the impact of an incoming administration, employers will need to stay nimble to address shifting regulations, emerging technologies, and evolving employee needs.

Here, CAPTRUST leaders share some quick-take predictions for the coming year.

Prediction One: Sponsors Seek Discretion

As employers look for ways to increase efficiency and tap additional expertise, discretionary services continue to gain traction. Retirement plan sponsors are increasingly outsourcing investment management and plan administration to financial advisors through a range of discretionary relationships.

Retirement plan discretionary services include several key roles.

- 3(38) Investment Manager: A 3(38) fiduciary assumes responsibility for selecting, monitoring, and replacing investment options in the plan, providing sponsors with specialized oversight while reducing their fiduciary liability. This role is defined in Section 3(38) of the Employee Retirement Income Security Act of 1974, also known as ERISA.

- 3(16) Plan Administrator: Another ERISA-defined role, a 3(16) fiduciary handles administrative responsibilities, such as compliance, reporting, and participant communications, simplifying plan management for the sponsor and ensuring operational duties are performed accurately. A 3(16) administrator can also shoulder some of the liability for fiduciary functions.

- Outsourced Chief Investment Officer (OCIO): An OCIO takes on full discretionary authority over a retirement plan’s investment decisions, allowing plan sponsors to delegate day-to-day investment management to a specialized provider. The OCIO relationship is currently most common among defined benefit (DB) plans.

“Along with the rise in discretionary relationships, we’re also seeing more informed consumers,” says Grant Verhaeghe, CAPTRUST institutional portfolios practice leader. “Sponsors know what they’re looking for now, and they’re asking good questions about each firm’s service offerings, process, and more.”

While OCIO and 3(38) relationships have become more established, the emergence of 3(16) plan administration services is still in its early stages. “We get a lot of inquiries about high-level due diligence and who the players are in the 3(16) market,” says Lori Dillingham, CAPTRUST senior director of vendor analysis and plan consulting. “There’s a wide variety of services being offered, and sponsors need help navigating the landscape.”

In 2025, CAPTRUST expects continued growth in discretionary services, supported by increasing standards and industry advocacy.

Additional Resources:

- Revamping Retirement Episode 68: The 3(16) Fiduciary with Bruce Harrington

- Investment Advisor vs. Investment Manager: Who Do You Need?

- 3(38) Discretion for Retirement Plan Sponsors

Prediction Two: Financial Wellness for All

Over the past few years, financial wellness, education, and advice have evolved into cornerstone benefits, with employers now leveraging advanced technologies and data to deliver tailored solutions. This type of personalization is key, as financial wellness programs now address diverse employee demographics, from entry-level workers to seasoned executives.

“What’s changing is the view of who can benefit from financial wellness programs,” says Jennifer Doss, CAPTRUST defined contribution practice leader. “It’s not just employees with lower incomes or those in financial straits. It’s everyone.”

Also, financial benefits are no longer strictly retirement centered. “We’re seeing more consideration about the role of financial benefits to support each stage of a person’s career and what they might need at various point in life to make informed decisions about their financial futures,” says Chris Whitlow, head of CAPTRUST at Work.

For example, Whitlow says, executive benefits like employee stock ownership plans (ESOPs) and nonqualified defined contribution (NQDC) plans are now being included in financial wellness offerings in an effort to drive higher engagement across a broader spectrum of employees.

“In the coming year, I imagine financial wellness conversations—and plan design conversations— will mostly focus on issues supported by SECURE 2.0 provisions, such as student loan debt, emergency savings, auto portability, and missing participants,” says Whitlow.

As the financial landscape grows increasingly complex, employees will need better and more frequent advice to navigate.

Additional Resources:

- Transforming Financial Wellness with SECURE 2.0 | Retirement

- Episode 56: Financial Wellness with Kimley-Horn | Retirement Plan

- What is CAPTRUST at Work | Retirement Plan Services

Prediction Three: Nonqualified Plans Gain Wider Appeal

NQDC plans, traditionally viewed as executive benefits, may now be expanding to include key employees and others in critical roles.

“We’re seeing more conversations every year about making these plans accessible to a broader group of employees within allowable guidelines,” says Jason Stephens, CAPTRUST nonqualified executive benefits practice leader. “Generally, that’s one of our recommendations. It typically doesn’t cost much more to make your NQDC plan available to a wider audience, and you can make a big impact on key employees by including them.”

This shift reflects a growing focus on retention and recruitment strategies for highly compensated employees.

“Employers who may have overlooked nonqualified plans in the past are now beginning to see their value,” says Dillingham. “It’s about offering thoughtful and competitive benefits to attract and retain top talent.”

“We’re seeing an uptick in discretionary relationships in the nonqualified space too,” says Stephens. “For nonqualified plans, discretion does not provide fiduciary protection, but still, plan sponsors are mirroring qualified trends and trying to pick up on administrative efficiency across the board.”

In 2025, expect more integration of nonqualified plans into broader financial wellness strategies, along with increased participant education to optimize these offerings.

Additional Resources:

- Crafting a Competitive Nonqualified Plan

- Nonqualified Plans and Participant Education

- Executive Benefits for Plan Sponsors

Prediction Four: Measuring the Impact of SECURE 2.0 Provisions

The rollout of SECURE 2.0 provisions will reach a critical point in 2025, with sponsors now beginning to assess the impact of implementing optional features like student loan matching and self-certified hardship withdrawals.

“There’s huge interest in modeling tools to evaluate the return on investment of adding these provisions,” says Dillingham.

Sponsors are not only evaluating the impact of the provisions they’ve already chosen to implement but also looking at their peers’ plans for guidance on potential future changes. “In 2025, we’re going to see more and more sponsors asking, ‘OK, what’s the outcome of what we chose to do?” says Doss. “‘Did it lead to the results we were expecting, like higher participation, higher savings, or more retirement readiness? Or were there unintended side effects, like plan leakage?’”

Employers can expect 2025 to bring even more sophisticated tools and services that meet employees where they are. Plan sponsors will need to assess the effectiveness of their plan design choices and adjust as necessary to meet participant and organizational goals.

Additional Resources:

- SECURE 2.0 Act

- Revamping Retirement Episode 69: Fidelity and SECURE 2.0

- SECURE 2.0 Opportunities for Plan Sponsors

- Recordkeepers Enter a New Era

Prediction Five: Defined Benefit Plans Explore Their Options

Economic and market changes are leading sponsors to rethink the next steps for their defined benefit (DB) plans. Funding levels are high, with the average DB plan now funded at more than 100 percent, according to the Milliman Pension Funding Index November 2024.

“An improved funding scenario gives you more flexibility to make changes to your benefits package,” says Verhaeghe. “When plans are fully funded, sponsors have more options—whether that means terminating the plan, maintaining it, or restructuring benefits to leverage surplus assets.”

“It’s expensive to terminate a plan,” says Verhaeghe. “But for sponsors who manage it strategically, there’s an opportunity to optimize benefit programs.”

As 2025 unfolds, sponsors will continue exploring ways to balance risk and reward in their DB plans, using market conditions to inform decisions.

Additional Resources:

Prediction Six: Inevitable Change

As 2025 approaches, the retirement plan landscape is poised for some potentially rapid evolution, shaped by legislative shifts, economic conditions, and emerging trends in plan design and participant engagement.

“Among the uncertainties is the influence of a new administration, which raises questions about the future of tax policies, budget constraints, and retirement-focused legislation,” says Doss. “It’s possible we will see Congress discuss adjusting the tax benefits associated with retirement plans as a way to offset expiring tax cuts.”

“Plan sponsors are always managing multiple, competing priorities,” says Doss. “But next year could hold even more change than is typical.”

While the specifics remain to be seen, one thing is clear: Change is inevitable. Throughout it, CAPTRUST stands ready to guide employers through the complexities ahead, offering data-driven insights and tailored solutions so clients can navigate emerging challenges and seize new opportunities—no matter what 2025 holds.

The Tax Cuts and Jobs Act (TCJA) went into effect in 2018, reducing income taxes for individuals and corporations and increasing the Child Tax Credit, standard deduction, and estate and gift tax exemptions, among other impacts. Without congressional intervention, the TCJA will sunset after 2025, taking $3.4 trillion in tax cuts with it as tax law reverts to 2017 values, indexed for inflation.

As the expiration date approaches, it’s important to understand how this rollback will affect you. You may want to consider strategies to take advantage of lower tax rates in 2025 and prepare for changes in 2026 and beyond. Three areas to address are:

- Estate planning. The current estate and gift tax exemption allows you to remove up to $13.61 million from your estate, which would be more than the projected estate exemption starting in 2026. Before the TCJA sunsets, consider taking advantage of its higher gift tax exemption to remove assets from your taxable estate, thereby reducing or eliminating estate taxes.

- Credits and deductions. Consider the impact of the changes to the Child Tax Credit. Plan ahead for the change in standard deductions and talk with your tax professional or financial advisor about possibly itemizing your deductions for 2026. Itemized deductions may be more valuable after the TCJA expires. When possible, generate alternative minimum tax (AMT) preference items before 2026. AMT changes will impact more individuals compared to present tax policy and could have a larger impact on your owed taxes.

- Income planning. Use Roth conversions to take advantage of lower tax brackets and reduce cumulative tax obligations for retirement assets. Consider selling businesses or stock before the end of 2025 to take advantage of reduced tax rates. Utilize currently lower tax brackets by considering adjustments to distributions from—and contributions to—your qualified retirement accounts.

As always, your CAPTRUST financial advisor can help you assess these changes and apply them to your unique financial situation. Keep in mind that the sunset of these provisions is not guaranteed and could be changed due to future legislative action.

Smaller organizations may hesitate to use alternative investments, listing concerns such as liquidity and portfolio size. But endowments and foundations may benefit from pursuing alternative investments to help diversify their portfolios, enhance returns, or generate income.

Read on for an overview of alternative investments and what to consider based on your organization’s liquidity needs and portfolio size.

What Is an Alternative Investment?

An alternative investment is any asset that isn’t categorized as a stock, bond, or cash. This could include vehicles that invest in private markets, like private equity, private real estate, or private credit funds. As the figure shows, the term alternative investment represents a broad range of investment types, including debt, equity, real estate, and venture capital, that range across the risk-return spectrum.

Figure One: Risk-Return Characteristics of Private Market Alternatives Investments

Why include alternatives in your organization’s portfolio? CAPTRUST Senior Research Specialist Will Volkmann says that alternatives are a way to not only diversify a portfolio, but they may additionally increase returns for an endowment or foundation due to their long-term investment horizons. “In general, endowments and foundations can take advantage of private markets,” says Volkmann. “There’s an expected illiquidity [return] premium you get when you invest in private assets with time restrictions on accessing your money.”

A Range of Liquidity Options

Alternative investments are available in vehicles across the liquidity spectrum—from daily liquid mutual funds to less-liquid strategies to illiquid limited partnerships or direct investments. “Each option comes with its own characteristics, including fund structure, risk and return targets, minimum investment size, tax reporting, and investor accreditation requirements,” says Volkmann.

Despite hesitations about liquidity, alternatives can deliver benefits for organizations with a long-term investment time frame.

Liquid Investments

Liquid alternatives can be a good fit for nonprofits or organizations looking for a substitute for fixed income strategies or to reduce interest-rate risk. “These are daily liquid mutual funds that most closely resemble traditional hedge fund strategies,” says Volkmann. Liquid alternatives usually have low minimums for entry, making them a lower-risk option for an endowment looking for diversified alternatives exposure, income-generation, or both.

Illiquid Investments

On the other side of the spectrum are illiquid investments. These typically require a significant amount of capital to invest and are often best suited for large endowments or foundations—typically starting with portfolios that have at minimum around $50 million in assets—but can depend on a number of factors, says Volkmann. Despite the financial buy-in, illiquid alternatives reap potentially huge rewards. Illiquid investments—typically held in a limited partnership fund structure—frequently require seven- to ten-year-plus commitments but offer higher return expectations.

According to Volkmann, investing in this space doesn’t happen overnight and takes time and thoughtful planning. “To build an allocation, you must pace multiple investment commitments over time,” he says. “It could be several years before you reach the allocation target.”

Less-liquid Investments

A possible happy medium for alternatives, less-liquid assets are ideal for organizations that don’t want to lock up their capital for the long term and want to have the option to redeem if they need cash, says Volkmann. While semi-liquid strategies invest in illiquid assets, these strategies offer the potential to redeem quarterly or multiple times throughout the year. Less-liquid fund structures also typically require less capital than illiquid drawdown funds. “These less-liquid solutions mostly capture the beta of private markets, and depending on strategy, will target returns above the public market equivalent,” he says.

Consider the Risk and the Reward

When considering alternatives for a nonprofit, it’s important to know that not all alternatives—or liquidity options—are alike: Some have more considerations than others, and all require deeper due diligence. There’s also the question of your organization’s time horizon, so it’s helpful to consider how long a nonprofit plans to remain invested and can have the assets locked up. Keep in mind that the longer the money is kept in the alternative investment, the greater the return potential.

“We need love as we need water,” the poet Maya Angelou wrote. From the time we’re babies, through our teen romances, then as adults, we naturally look to our partners, children, friends, and family members to make us the object of loving attention. Some are lucky in love, while others continue to seek it, but the need to be loved and appreciated is widely accepted as being essential to happiness.

Psychologically speaking, though, there’s a much shorter, more direct path to happiness—and it’s a surprisingly accessible one: giving love. Though we may not pay as much attention to this parallel emotional need, research from the field of positive psychology tells us that humans indeed have a deep, hardwired need to be the givers of love, tenderness, support, understanding, and attention.

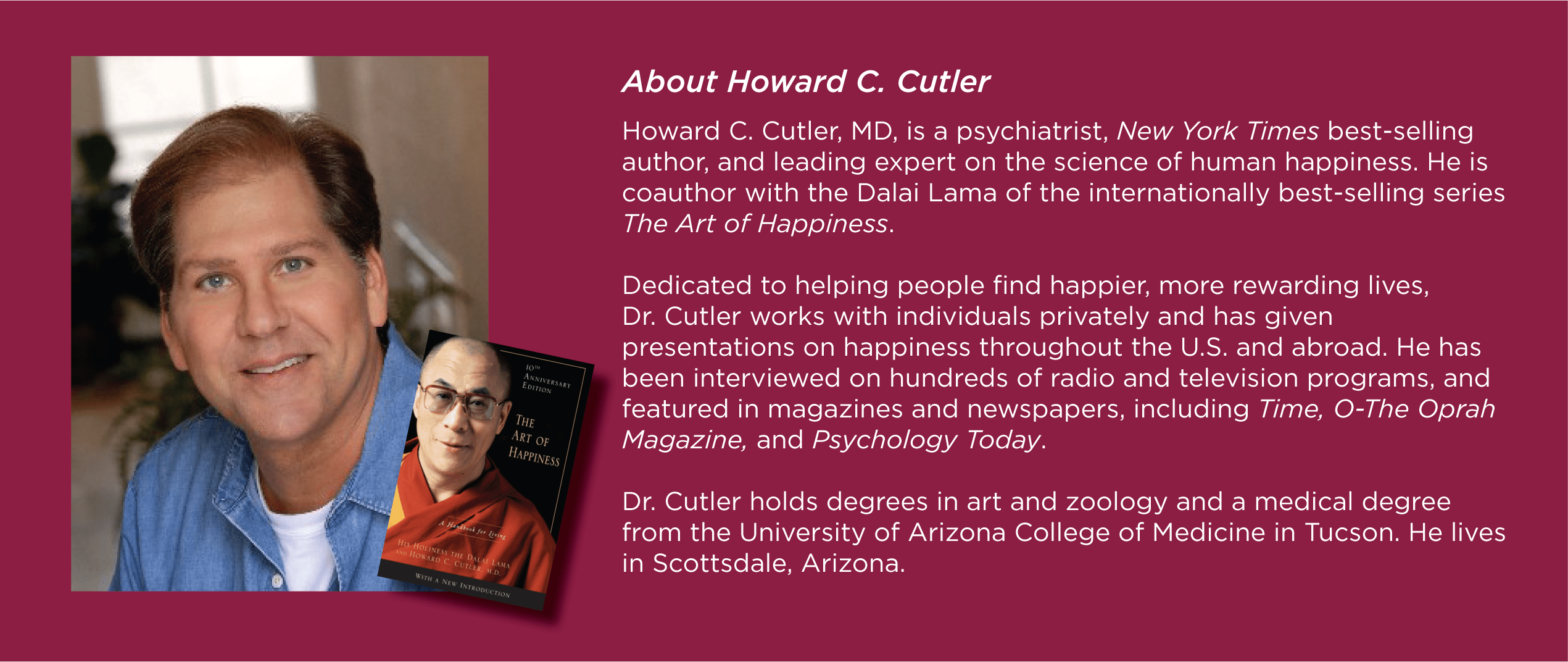

This is according to New York Times best-selling author Howard Cutler, M.D., an expert on the science of human happiness who co-wrote with the Dalai Lama the classic book, The Art of Happiness: A Handbook for Living. Drawing on 40 years of conversations with the spiritual leader of Tibetan Buddhism, Cutler is a psychiatrist who takes a secular approach to Buddhist practices.

What Is Love, Anyway?

Love isn’t a single emotion, Cutler says. Instead, it’s a family of emotions and mental states that includes compassion, caring, loving-kindness, mercy, and more. All love is positive, but there are nuances. Some types can be seen as conditional: I’ll love that person as long as they love me back.

For example, a husband may have tremendous love for his wife and harbor only good wishes for her. But say the wife later cheats, and the marriage ends in divorce. All the warmth and compassion he had for her is gone. Conditional love isn’t the most reliable or stable since it contains an implicit desire for someone to fill a certain role for you.

Compassionate love is a bit more selfless. A combination of empathy, kindness, and care, with no expectation of anything in return. It’s the feeling you have for that dog you never met on the internet, or a war-torn country.

A central feature in many religious traditions, compassionate love is rooted in feelings and behaviors that are focused on caring, with an orientation toward helping others.

Giving this kind of love is good for your overall health and well-being. Studies from Ivy League universities to prestigious medical centers report that love is not only key to a happy and satisfied life, it’s even good for our heart—literally and figuratively. These types of relationships can reduce our stress and protect us from certain diseases.

Give Love to Get Love

The road to happiness through giving love needn’t be convoluted.

When you choose to show someone compassionate love—that love comes back to you in the form of trust, respect, loyalty, and more. It can be a small gesture to make your partner or friend feel appreciated, practicing loving-kindness mediation, or just taking time out of your schedule to show up for someone on an occasion big or small.

Giving love is not about grand, showy gestures. It doesn’t take a lot of time, effort, or money to offer another person compassionate love and affection. However, if you want to live a life that is surrounded by love, you have to invest love in others.

Cultivate Compassion

Luckily, there are a host of ways to give love. Cutler offers techniques and exercises in his “Art of Happiness” training courses, executive coaching sessions, and corporate workshops, Cutler teaches simple activities and exercises that are secular in nature but drawn from Buddhist principles.

Take a few minutes to try some of the exercises. You may soon feel the effects for yourself.

15 Circles Exercise

This exercise cultivates compassion and forgiveness. Think of someone you know well and have some kind of grudge against, maybe a family member or former romantic partner. Draw a circle on a sheet of paper and write a few words in it describing your grudge.

Next, draw 15 more circles on the same paper. Fill each one with a word or phrase about something you could be grateful to that person for. Although you may not immediately feel grateful, use your creativity to think of some benefits to you that arose out of the situation. You can try asking yourself a few questions:

- Did I learn something from this person that I wouldn’t have otherwise?

- Did I meet anyone through the experience who became part of my life?

- Did this person help open any doors in my life?

- Would I have missed out on an opportunity if not for this person?

Fill as many circles as you can, even if you can’t fill them all. The exercise is not meant to excuse or minimize what you’re angry about. The purpose is to look at the person’s entire effect on your life, not just the negative, “and in the process, diminish the grudge as your perspective widens to authentically include this gratitude,” Cutler says. You may not end up loving the object of your grudge, but the gratitude produced will open up your heart.

A Simple Act of Gratitude

When was the last time you wrote a letter to your partner, friend, or family member? This simple act of gratitude can help reconnect you to a loved one. Moreover, practicing gratitude is one of the easiest, most effective ways to increase overall happiness, Cutler says.

Think of someone that you feel gratitude toward but have never properly thanked. Write a detailed letter to the person, explaining what they did that you appreciated and how specifically it made you feel. The next step is to make an appointment to see that person and read the letter aloud. This may feel awkward for some, but those who push themselves to do it will find it very powerful.

“This exercise often elicits intense positive experiences, which some people may find transformative—and the effects have been shown to last a long time,” Cutler says. Even writing the letter without sharing it can be a positive experience.

Remember to start slowly. You may find that what you get back can be very fulfilling, and even that the supply of love you have is endless. The truth is, the more love you give, the more love is given to you and that you have to give to others.

Yesterday, November 5, American voters made their choices for leadership across the country. On the federal ballot were the presidency, 34 seats in the Senate, and all 435 seats in the House of Representatives.

At the time of publication—late morning on Wednesday, November 6—former president Donald Trump is the projected winner. The Republican party is projected to retake the majority in the Senate, although the margin is still unknown. The makeup of the House of Representatives is not yet clear. Regardless, the margin is going to be thin.

Investors’ initial reactions to election outcomes are typically driven by emotion. However, these first moves often prove temporary as fundamental drivers ultimately outweigh feelings and policy speculation.

What is important to note is that markets generally do not prefer one result over another. Markets react to certainty and uncertainty and the health of the economy. After elections, stocks tend to do well because elections clarify some of the questions that have been swirling throughout the previous months.

Now that some of the election questions have been answered with more clarity than many expected, businesses can begin making decisions in the context of the new political landscape. Economists are reflecting on the likelihood and impact of policy actions, both in the near term and long term. Investors are considering portfolio positioning. And consumers are evaluating how the outcomes will affect them.

As financial advisors, we are paying close attention to many factors. While we may see short-term market volatility, tried-and-true investment principles still apply. Remain diversified, resist emotional decision-making, and stay invested to take advantage of the long-term compounding power of time.

For more information, contact your CAPTRUST financial advisor at 800.216.0645.