Nonprofits Increasingly Explore Alternatives and Seek Help

Each year, CAPTRUST releases its “Endowment and Foundation Survey” in an effort to identify nonprofit investment trends and concerns. The goal of this survey is to find out what nonprofits are doing and why, then share these findings to arm decision-makers with clear and actionable information that can help them make a positive impact. Responses in each section provide sector insights that can help inform growth, strategy, and internal practices.

In 2023, a shorter survey and a narrower scope of questions allowed for more responsive perspective sharing within the nonprofit community. Questions were focused on investments and asset allocation, and results showed two key takeaways: increasing interest in alternative investments and the continued rise of OCIOs. Both these findings reiterate multi-year trends.

Optimism Abounds

Survey results indicate that nonprofit investors are feeling decidedly more optimistic about this year’s investment landscape than they were at the end of 2022. Across the board, fewer nonprofits reported feeling concerned about future return expectations, market volatility, or inflation.

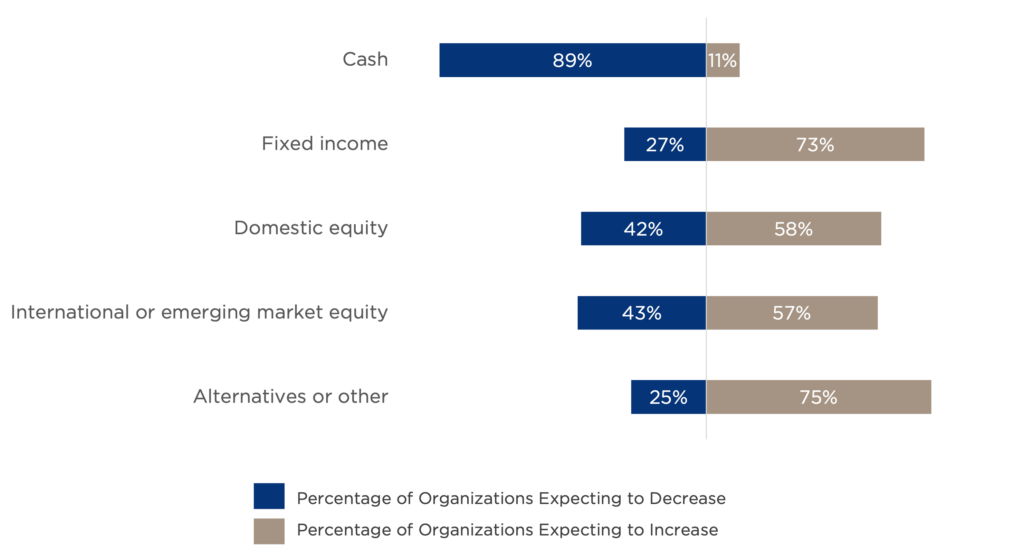

Buoyed by that optimization, endowments and foundations are now interested in increasing allocations to all investment types and reducing cash reserves.

As shown in Figure One, 75 percent of organizations that are planning to shift their asset allocations said they anticipate increasing their allocation to alternative investments. This marks the fifth consecutive year that organizations planning for reallocation named alternative investments as their largest predicted area of change.

Figure One: Expected Changes to Asset Allocation

Source: CAPTRUST Research

Why Alternatives?

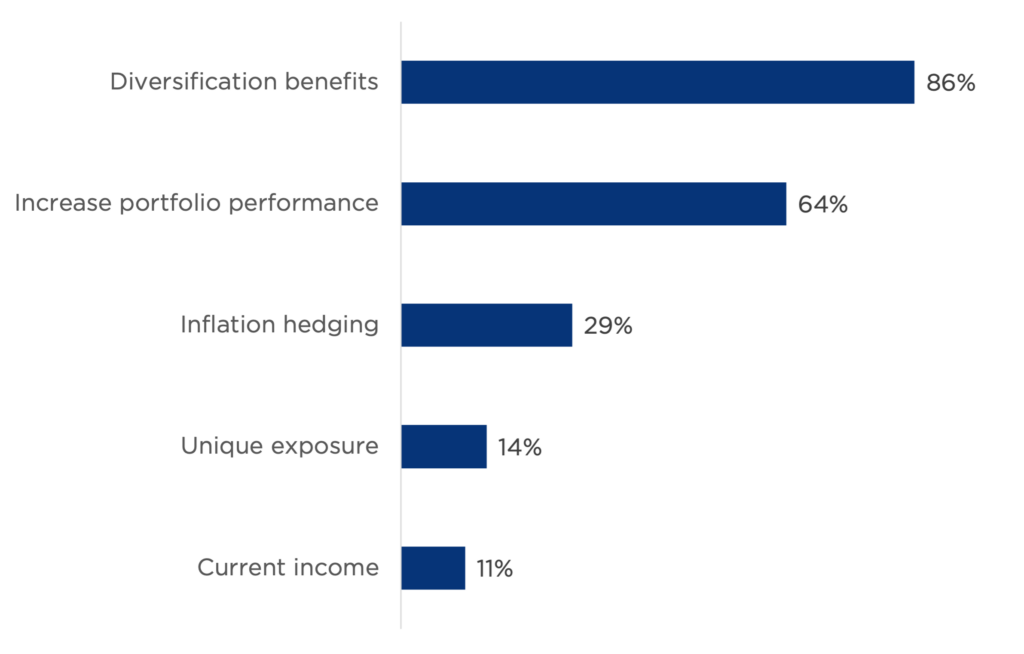

Alternative investment strategies vary greatly and can be used to meet a variety of organizational goals. In CAPTRUST’s 2023 survey, endowments and foundations that are turning to alternatives reported two common objectives: diversification (86 percent) and increased portfolio returns (64 percent), as shown in Figure Two.

Figure Two: Alternative Investment Objectives

Source: CAPTRUST Research

Diversification occurs primarily via exposure to different asset classes. In this case, it seems nonprofits want asset classes in addition to cash, stocks, and bonds. Furthermore, “since private markets are not correlated to traditional public market investments, they may offer a diversification strategy that potentially reduces portfolio risk,” says Pat Burkett, a manager on CAPTRUST’s investment research team.

Two additional potential benefits: Alternative investments may offer higher expected returns than traditional investments, and private market valuation practices may help mitigate market volatility.

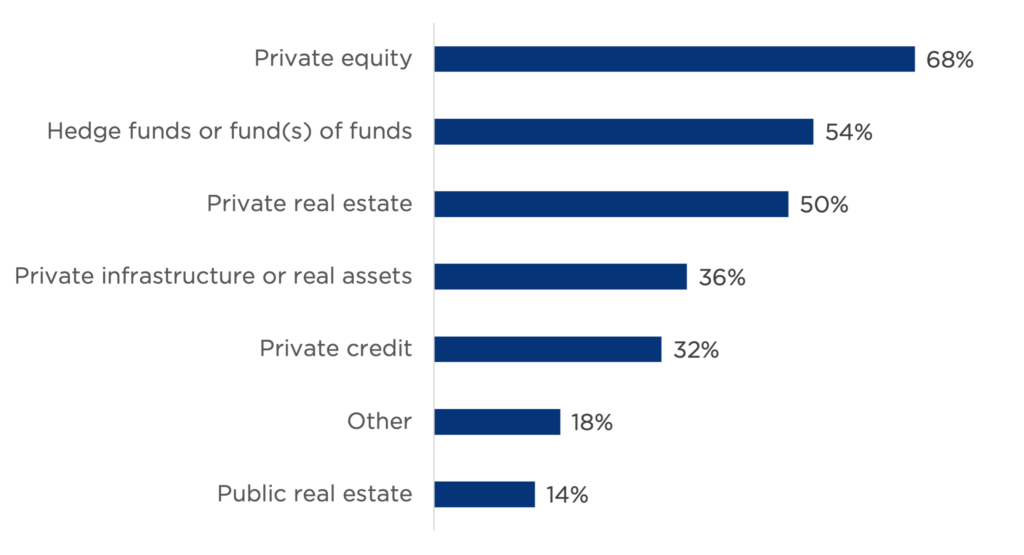

With these benefits in mind, it is not surprising that most nonprofits investing in alternatives are choosing to invest in private equity (68 percent) and other private markets strategies, such as real estate (50 percent), infrastructure (36 percent), and credit (32 percent), as shown in Figure Three.

Figure Three: Alternative Investment Strategies

Source: CAPTRUST Research

“While each strategy differs, all these types of private markets investments can provide access to unique opportunities but will also have unique risks,” says Will Volkmann, an investment research specialist at CAPTRUST.

For instance, many of these investments, such as private equity and private real estate, can be illiquid and challenging to sell quickly. “Investors in private markets may be rewarded with higher expected returns in exchange for committing to a longer time horizon,” says Volkmann. “But they’ll need to be sure that these long-term, illiquid investments are balanced by other, more traditional assets in case they need money in a pinch.”

Lack of regulation can also be a risk, as these investments may be subject to less regulatory oversight than stocks or bonds. Also, alternative assets can be subject to significant price fluctuations and higher fees compared to traditional assets. These risks are inevitable but can be mitigated.

Endowments and foundations considering alternative investments should make sure to do their due diligence or hire a professional with alternative markets expertise to vet the opportunity set.

Complexity and the Rise of OCIOs

Considering the time, effort, and expertise required to decipher alternative market opportunities, it is likely that this trend toward alternative investments is intertwined with another key finding from our “2023 Endowment and Foundation Survey”: the continued rise of OCIOs.

An OCIO is a professional advisor or advisory firm hired by a nonprofit to manage its investment portfolio and make strategic investment decisions on the organization’s behalf. Typically, an OCIO provides day-to-day management of the organization’s investment program, allowing nonprofit leaders to focus on their mission.

“The OCIO is directly accountable for portfolio performance and has investment discretion,” says Volkmann. That’s why the OCIO relationship is also sometimes called discretionary portfolio management or simply discretion.

This short video explains more: “OCIO for Nonprofits.”

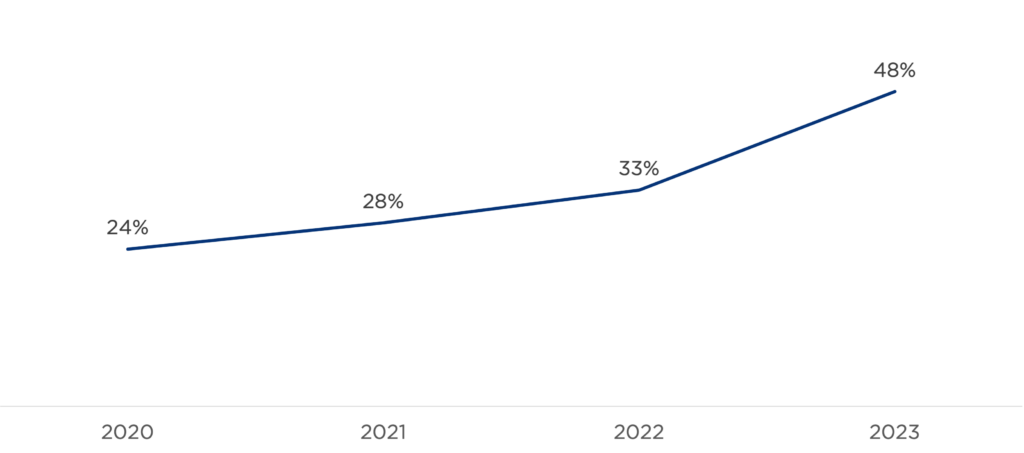

As shown in Figure Four, by the end of 2023, nearly half (48 percent) of endowments and foundations reported utilizing an OCIO—a percentage that has doubled in only four years.

Figure Four: Percentage of Organizations Utilizing an OCIO

Source: CAPTRUST Research

Many nonprofit board members believe delegating the investment manager search process to outside professionals will yield the best outcomes. However, Burkett says, “Perhaps the biggest benefit of hiring an OCIO is that it frees up time for internal staff to concentrate on other priorities.”

Nonprofit organizations often have no full-time staff members dedicated to investments. With an OCIO at hand, they have a full-time investment professional focused on their organization’s unique needs and objectives.

“Another benefit of the OCIO relationship—especially as it concerns alternative investments—is having someone else available to handle capital calls and distributions, and to fill out subscription documents, which can sometimes be time-consuming and cumbersome,” says Burkett.

However, engaging in OCIO may not be the right move for every organization. Those with well-resourced internal investment teams might not need one, and institutions that prefer direct control over investment decisions could find the discretionary relationship less appealing.

Looking Forward

Ultimately, these findings highlight the dynamic nature of the nonprofit investment landscape, where shifts in asset allocation and investment management often reveal evolving priorities and opportunities. By staying attuned to these trends, nonprofit leaders can proactively identify emerging challenges and take advantage of new avenues for growth and impact.

Whether it’s seizing opportunities for diversification through alternative investments or optimizing investment management processes through OCIO partnerships, a keen awareness of sector dynamics can empower nonprofit organizations to navigate uncertainty with resilience and foresight.

But paying attention to sector trends isn’t just about staying competitive. It’s about fulfilling the fiduciary duty to steward resources effectively to achieve the organization’s mission. In a rapidly changing environment, the ability to anticipate and adapt to shifts in investment strategies and practices can make all the difference in driving sustainable outcomes and maximizing social impact.

Written by James Stenstrom and Ben Smiley