What the Box Office Can Tell Us About the 2024 Markets

Numbers like these are common in the film industry, with project investments often surpassing hundreds of millions of dollars. Predicting box office success is, therefore, a high-stakes game. Losses can be devastating.

Between these two releases, which one stood the best chance of winning with its audience?

Box office receipts presented an unexpected outcome. Despite its relatively modest budget, the Barbie movie generated $1.4 billion in worldwide box office receipts, while the final Indiana Jones installment generated a disappointing $400 million.

The disparity illustrates how difficult it is to predict the future, even for knowledgeable specialists with advanced tools.

Like box-office prognosticators, economists, analysts, and financial market pundits apply a dizzying array of data, science, expertise, and gut feel to their annual market predictions. Yet it is exceptionally rare for any one forecaster to get everything right. This unpredictability reflects the complex nature of global economics and financial market dynamics, where success often hinges on factors beyond the numbers and consensus expectations.

A Spectrum of Possibilities

CAPTRUST’s Investment Group approaches annual predictions differently from most forecasters. Rather than focusing on one specific result, we prefer to prepare for a range of potential outcomes. Our objective, always, is to make prudent investment decisions that are resilient in the face of many different scenarios. We seek to minimize the potential for catastrophic losses and maximize the probability of success for clients.

While we regularly adapt our expectations based upon changing market conditions, at the beginning of each year, we share our thoughts on what could lie ahead. We do this recognizing that the future is unpredictable. Yet this exercise is important to prepare for a range of potential outcomes. After all, it is better to be approximately right than precisely wrong.

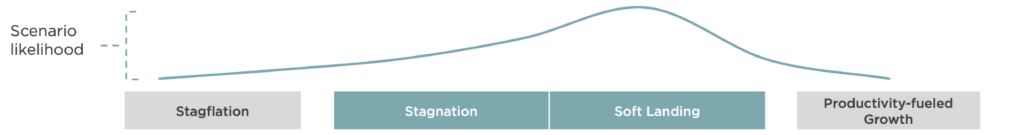

This year, we expect two scenarios to have the highest likelihood of playing out: stagnation or an economic soft landing.

Figure One: The Spectrum of Economic Scenarios for 2024

Source: CAPTRUST Research

However, it is important to reiterate that the range of potential outcomes for 2024 is exceptionally wide—as it was in 2023. It has only been three years since the COVID-19 pandemic sent shockwaves through the global economy. Central bank policy responses continue to reverberate throughout the global financial system.

Many other scenarios are also possible. At opposite ends of the spectrum of possibilities are stagflation and productivity-fueled growth. Stagflation, our economic worst-case scenario, would mean persistently high inflation, high unemployment, and stagnant consumer demand. On the other hand, productivity-fueled growth would mean technology-driven productivity gains that translate into strong corporate earnings and consumer spending. While each of these scenarios is possible, we believe stagnation or a soft landing to be the more likely outcomes.

Likely Scenario Number One: Stagnation

In this scenario, the robust annual gross domestic product (GDP) growth of 5.2 percent witnessed in the third quarter of 2023 becomes the high-water mark of the current economic cycle. The pace of economic expansion decelerates significantly to an average of approximately 1 percent in 2024. The exhaustion of excess household savings accumulated in the time of pandemic-related fiscal stimulus, coupled with decelerating wage growth, leads to a stark slowdown in consumer spending.

Even as the economy loses momentum, inflationary pressures persist, compelling the Federal Reserve to maintain its higher-for-longer monetary policy stance. The labor market, which previously saw record job openings, begins to cool, leading to a rise in the unemployment rate. Corporations face a tough economic climate marked by slowed consumer spending and the need to make difficult decisions, including potential workforce reductions, to navigate ongoing economic headwinds.

This scenario paints a picture of an economy in a state of sluggish growth, with continued inflation concerns and a labor market beginning to recalibrate to a challenging environment.

Investment Implications: Faced with rapidly declining economic growth, equity analysts begin reducing overly optimistic estimates for corporate earnings in 2024 and 2025. Given persistently high interest rates, the net present value of future earnings declines, causing equity valuations to fall. The S&P 500 Index falls by at least 10 percent at some point during the year.

Traditional fixed income investments experience positive returns, driven by high beginning yields and a falling interest rate environment, as the Fed begins to reduce interest rates to address a weakening labor market. In this environment, some diversifying and alternative investments—such as hedge fund strategies and private credit—may outperform the S&P 500.

Likely Scenario Number Two: Soft Landing

In this scenario, against historical odds, those predicting the Goldilocks outcome of an economic soft landing are correct.

Although the transitory thesis regarding temporary inflation drivers was abandoned in 2022, it turns out that the supply chain disruptions and excess fiscal stimulus related to the COVID-19 pandemic had longer-term impacts than anticipated. By 2024, these impacts begin to wane and, combined with the cumulative effects of monetary policy, drive inflation steadily toward the 2 percent target.

The Fed, acknowledging a moderating pace of inflation due to its successful policies, begins to ease interest rates by the end of the first quarter. This shows its confidence that inflation will approach the target by year-end.

As growth tempers and inflation falls in line with its goal, the Fed initiates a series of interest rate cuts, aimed at maintaining employment levels. Lower interest rates alleviate some of the burden on corporate, government, and household debt refinancing. But they also exert pressure on the housing market as lower mortgage rates liberate homeowners who feel locked in by their current mortgages, leading to an increase in available inventory. This surge in available properties places downward pressure on housing prices in certain markets, exerting a negative wealth effect on consumer spending activity.

Economic output shows modest expansion. While growth remains below the long-term trend, it signals a stable trajectory away from recessionary pressures. Consumer spending, which serves as a bellwether for economic confidence, stabilizes. Business investment shows signs of cautious optimism, with aggressive investments in automation and technology that set the stage for future productivity gains. These indicators suggest a growing sentiment that the economy is poised for a period of steady—if unspectacular—growth.

Inflation, while easing, persists above the target threshold in select regions of the globe, a reminder of the uneven nature of economic recovery. The lingering inflationary pressures in these areas may reflect localized issues such as supply chain constraints or regional policy responses.

This scenario paints a picture of an economy that is slowly but surely finding balance. Fed interest rate reductions serve as a testament to progress toward inflation control and provide a supportive backdrop for continued economic stability and growth.

Here, it is important to remember that consensus expectations carry correction risks. As the soft-landing scenario has become the principal expectation for 2024, investor optimism has reacted positively across both equity and fixed income markets. This creates a risk of disappointment if the expected conditions fail to materialize.

Investment Implications: Like a rising tide, the Goldilocks outcome raises all investment boats. Recessionary fears are laid to rest, and high inflation is defeated.

In this optimistic scenario, wages continue to expand in excess of the inflation rate, and labor market strength bolsters consumers’ ability to continue spending at a high rate on goods and experiences. Corporate earnings growth benefits from consumer strength, plus modestly lower interest rate expenses that begin to alleviate bottom-line pressures.

Mid-double-digit equity returns could be expected in this environment, with some industries generating performance of more than 20 percent. With rates beginning to fall early in the year, fixed income investments fully rebound from their 2022 drawdown, and equity-oriented alternative investments outperform.

Powerful Undercurrents

Regardless of how the economic script unfolds in 2024, there are powerful undercurrents likely to influence outcomes across each of these scenarios. These undercurrents will play a significant role in shaping economic conditions, as well as the extent to which market behavior diverges from the economy.

U.S. Elections: 2024 is a presidential election year. Whether the plot unfolds with an incumbent victory or a new administration, the successful candidate’s impact on the economy and markets is generally not experienced until a year or more after they’ve taken office. It takes time for campaign agendas to flow into new laws or regulations.

Nevertheless, in an endless news cycle, media attention on the candidates and their platforms is likely to introduce short-term financial market volatility. Historically, presidential election years have shown positive results for the S&P 500 Index approximately 80 percent of the time, regardless of which party succeeds. From an investment perspective, it’s better to vote with your ballot than your portfolio.

Geopolitical Tensions: With significant military action across both Eastern Europe and the Middle East, geopolitical tensions remain a constant and influential undercurrent, capable of disrupting even the most well-charted economic scenario. In addition to direct military conflicts, tensions can manifest in various forms, including trade disputes, global supply chain disruptions, and commodity price impacts.

These tensions can introduce significant economic uncertainty that affects the global climate via shifts in currencies, inflation, energy prices, and cross-border investment flows. In any scenario, the resolution or escalation of these tensions will significantly influence the global economy in 2024.

Productivity Advancements: Another important undercurrent is the potential for rapid advancements in productivity. These advancements are driven by technological innovation, process improvements, and, in particular, the growing excitement around artificial intelligence (AI).

Productivity gains have a direct impact on economic output. They influence labor market dynamics and corporate profitability.

Productivity gains also have the potential to reshape industries, redefine work, and create new value streams, thereby playing an important role in determining the pace and nature of economic recovery and growth.

Plan for Plot Twists

It is possible 2024 will deliver the same blockbuster success as the Barbie movie did. But it is also possible 2024 could be a flop on the scale of the strange, 2023 horror interpretation of Winnie the Pooh. Just as moviegoing audiences can be unpredictably fickle, often defying box office forecasts, so too can the financial markets demonstrate unexpected volatility in their response to global events and policy shifts.

As we begin 2024, inflation is still well above the Fed’s target. The costs of borrowing for households, corporations, and the government are higher than they’ve been in more than a decade. And the world is full of geopolitical strife.

In this environment, it is imperative for investors to remain agile, informed, and proactive.

Rather than attempting to predict the unpredictable, focus on understanding the economic drivers and undercurrents and how they might interact with these identified scenarios. This understanding allows for a more nuanced approach to investment, one that not only considers the potential for gains but also stays resilient in the face of uncertainty.

Instead of expending energy worrying about the market narrative of the moment, investors should focus on their financial plans and work with their advisors to control the variables that are controllable. With the confidence gained through sound planning, investors can enjoy their popcorn, if not the show, regardless of how the 2024 screenplay unfolds.