IRS Announces 2024 Retirement Plan Limitations

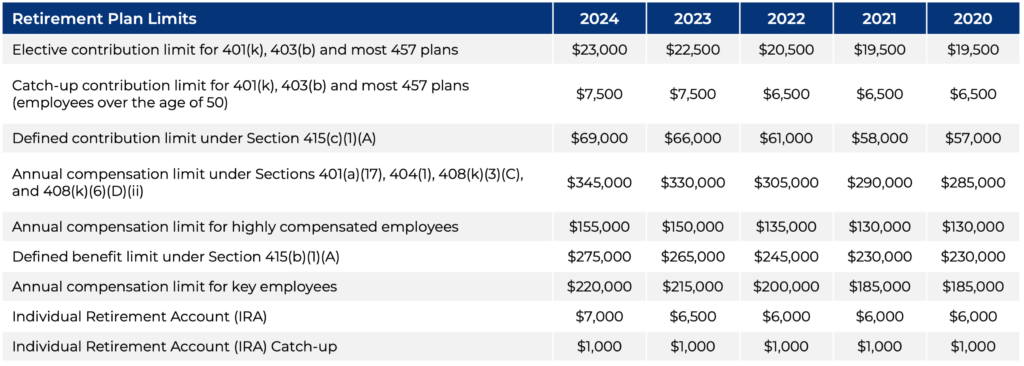

The Internal Revenue Service (IRS) has released its annual cost-of-living adjustments for retirement plan contribution limits for the 2024 tax year. These updates impact individuals contributing to 401(k), 403(b), IRA, and other qualified retirement plans, as well as employers managing benefit programs.

Staying informed about these limits is essential for maximizing contributions, planning for tax efficiency, and aligning your retirement savings strategy with your financial goals. Whether you’re an individual investor or an employer sponsor, understanding how these changes apply to you is key to making the most of your retirement planning opportunities.

The table below outlines a few key highlights for 2024:

Have Questions About Your Retirement Strategy?

Contact your CAPTRUST advisor at 800.216.0645 or visit your nearest CAPTRUST location to learn how to optimize your retirement savings for 2024 and beyond.