An Alternative Investment Realm

In the realm of finance, alternative investments—also called alts—represent a departure from traditional avenues such as stocks, bonds, and cash equivalents.

The term alternative is a catch-all label. Under it, the universe of alts includes a wide range of assets, many of which have little to nothing in common, except that they don’t fit into conventional investment categories.

Examples of alts include hedge funds, private equity, venture capital, real estate, commodities, infrastructure, natural resources, and collectibles like art and wine. What sets them apart is their potential for higher returns, their unique risks, and their tendencies to behave independently from traditional public markets.

Democratizing Access

Historically, alternative investments have been the domain of large institutional investors. Burdensome regulations once led managers to offer these strategies solely through private partnerships, which limited access mostly to pension plans, endowments, and the ultra-wealthy.

Now, regulatory guidelines have softened, allowing managers to build more investor-friendly vehicles, like mutual funds and exchange-traded funds (ETFs) devoted exclusively to alts. At the same time, individual investors have shown demand for alternative investment strategies, and the financial industry is responding.

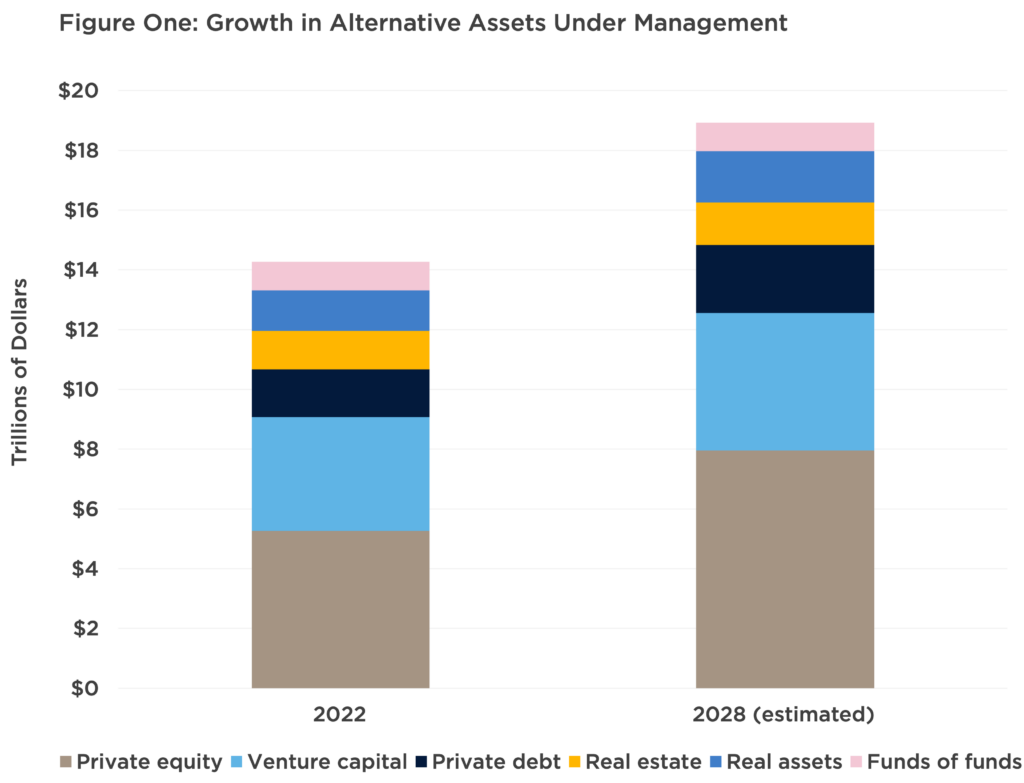

The overall effect has been a democratization of access to alts, and a corresponding explosion of assets under management. According to PitchBook, assets under management in the alts space nearly doubled between 2017 and 2022, rising from $7.4 trillion to $14.7 trillion. The same report forecasts that growth in the alts sector will accelerate exponentially in the next few years, reaching $19.6 trillion by 2028.

What is motivating investors to move their money into alternative investment strategies? Mostly, diversification and the potential for higher long-term returns.

Targets and Managers

Within the alts market, private equity and venture capital generally offer the highest potential long-term returns. Investing in private companies allows ownership access to businesses much earlier in their life cycles, when potential for growth is higher than in more mature publicly traded firms. However, private equity and venture capital typically also have the longest time horizons.

Return targets vary by fund, but in general, private equity funds aim for average annualized returns of 10 to 20 percent over a seven- to 10-year time horizon. Venture capital funds typically seek even higher returns but also involve the higher risk of investing in early-stage companies.

Of the six core categories of alts (private equity, venture capital, private debt, real estate, real assets, and funds of funds), real assets generally have the lowest targets, aiming for 5 to 10 percent net returns.

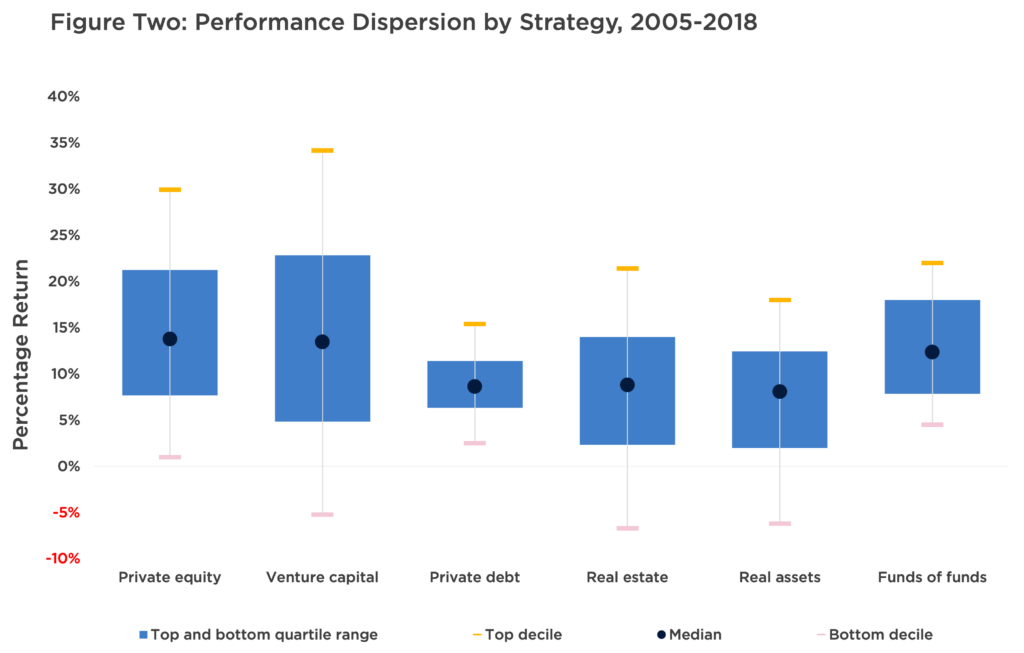

Realized performance varies considerably, based on both the inception year of the fund and the manager’s skill. Manager selection is always important for actively managed investment strategies, but for alts, it’s critical.

Figure Two shows the dispersion of returns between investment managers in different types of alts from 2005 to 2018. Over that period, the median return for private equity funds was 13.79 percent per year—an incredible bounty for investors. But it’s important to notice the full range of results. Those invested with the bottom 10 percent of managers barely made a dime, while those invested with the top 10 percent produced returns of more than 30 percent.

Source: PitchBook

For venture capital funds, the range of returns was even greater. Those invested with the top decile saw more than 34 percent returns, while those invested with the bottom decile lost money instead. The narrowest dispersion was in private debt, in which top-quartile managers earned an 11.42 percent return, and bottom-quartile managers earned 6.33 percent.

Allocating to alts can be a high-stakes game. To protect your portfolio from major losses, and improve your chances of success, align yourself with a manager who has disciplined investment and due diligence processes. In the alts universe, participating in the sector by simply entrusting your money to a manager, and hoping for the best, could be an exceptionally costly decision.

Liquidity Options: Daily to Decades

Liquidity refers to how easily an asset can be bought or sold without affecting its price. Cash is the most liquid asset of all. For other investments, the higher their liquidity, the easier it is to turn those assets back into cash. Less liquid assets require more time to be converted to cash, and the conversion may come at a higher cost.

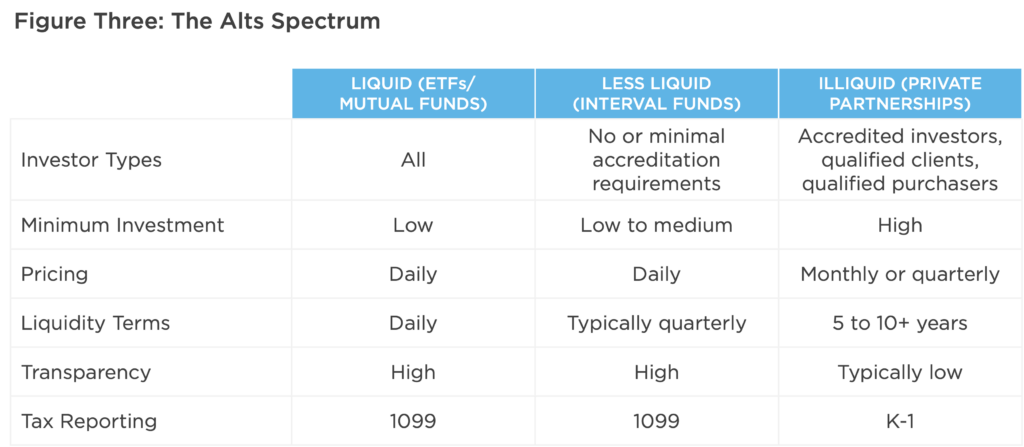

Within the alternative investment universe, a full spectrum of liquidity options exists, from daily to decades. The most liquid alts are ETFs and mutual funds, which provide access primarily to public market investments. As a result, these alts must limit their holdings to ultra-liquid securities like stocks, bonds, currencies, and commodities, with a few exceptions.

Source: CAPTRUST Research

Private partnerships sit at the other end of the spectrum. Because the managers of private partnerships effectively set their own liquidity terms, they can target investments in illiquid private equity or venture capital companies. These can have investment horizons of multiple decades.

For investors who don’t want to lock away their assets for many years or decades, but still want some of the benefits of alts, a newer form of mutual fund, called an interval fund, provides an interesting compromise between full and zero liquidity. An interval fund is a type of closed-end mutual fund that does not trade on the secondary market. Like other mutual funds, interval funds price daily, have a high degree of transparency, and report taxes on 1099s.

Unlike other mutual funds, interval funds periodically offer to buy back a percentage of outstanding shares from shareholders at net asset value. These are called repurchase offers. Shareholders aren’t required to sell their shares back, but they can choose to participate in repurchase offers during specified intervals. Repurchases are typically done on a pro rata basis, and they allow for a percentage of shares (usually 5 to 25 percent, depending on the fund prospectus) to be repurchased during any given window.

The important piece to understand is that even though interval funds may offer liquidity windows, managers often limit the total amount of outflows available. As a result, an investor may not always be able to withdraw as much as they would like during one of these windows.

Fee Considerations

The pros and cons of specific alts strategies are complicated, and they require research and due diligence. Yet there are common considerations for everyone interested in these types of assets. One is fees.

Alternative investment strategies are actively managed, specialized strategies that often come at a premium price. Fees are usually highest on private partnerships and take the form of an annual management fee—usually 1 to 2 percent of assets—plus additional fees on profits generated by the fund. These are called success fees, carried interest, or incentive fees, and they typically range from 10 to 20 percent of the profits.

Interval fund fees tend to be lower, ranging from a 0.9 to a 1.5 percent management fee. Most interval funds also include a performance hurdle (e.g., 5 percent annually) that the portfolio needs to reach before the manager charges an additional percent of profits.

Mutual fund and ETF fees are the lowest in the alts universe because they are generally prohibited from charging incentive fees. That said, with annual management fees of 0.5 to 2 percent, their fees are still considerably higher than the fees most people are familiar with for public equity and fixed income options.

Critics of alts often point to fees as a reason to avoid them. This argument resonates. When you have a choice between two identical products, it’s smart to choose the one that costs the least.

But when it comes to alternative investments, it’s important to focus on the skill of the manager and expected net-of-fees performance as well. Net-of-fees performance refers to the return on capital reported by an investment strategy after deducting management fees and other expenses.

An allocation to any alternative investment strategy is intentionally designed to deliver a return profile that’s different from public investments like stocks and bonds. Therefore, if the expected net-of-fees performance provides benefits to a portfolio—like higher returns, lower volatility, or increased diversification—the fees may be justified.

A financial advisor can help unravel the net-of-fees performances for different funds. They can also assess the potential risks and returns for different types of alternative investment strategies to help you discern which are worth considering as part of your unique financial picture.

Getting Started

As distinctions between public and private investments continue to blur, opportunities are expanding for individual investors to participate in alternative investment strategies. And it seems this expansion is just beginning. Yet as this article highlights, understanding what you’re buying is vital, as incorporating alts can influence the fees, liquidity, and performance of your portfolio.

Alternative investments are not appropriate for all investors. But in many circumstances, alts may make a sound addition to a well-diversified investment portfolio. To thrive in this new universe, personal education or aligning yourself with an experienced advisor is critical.