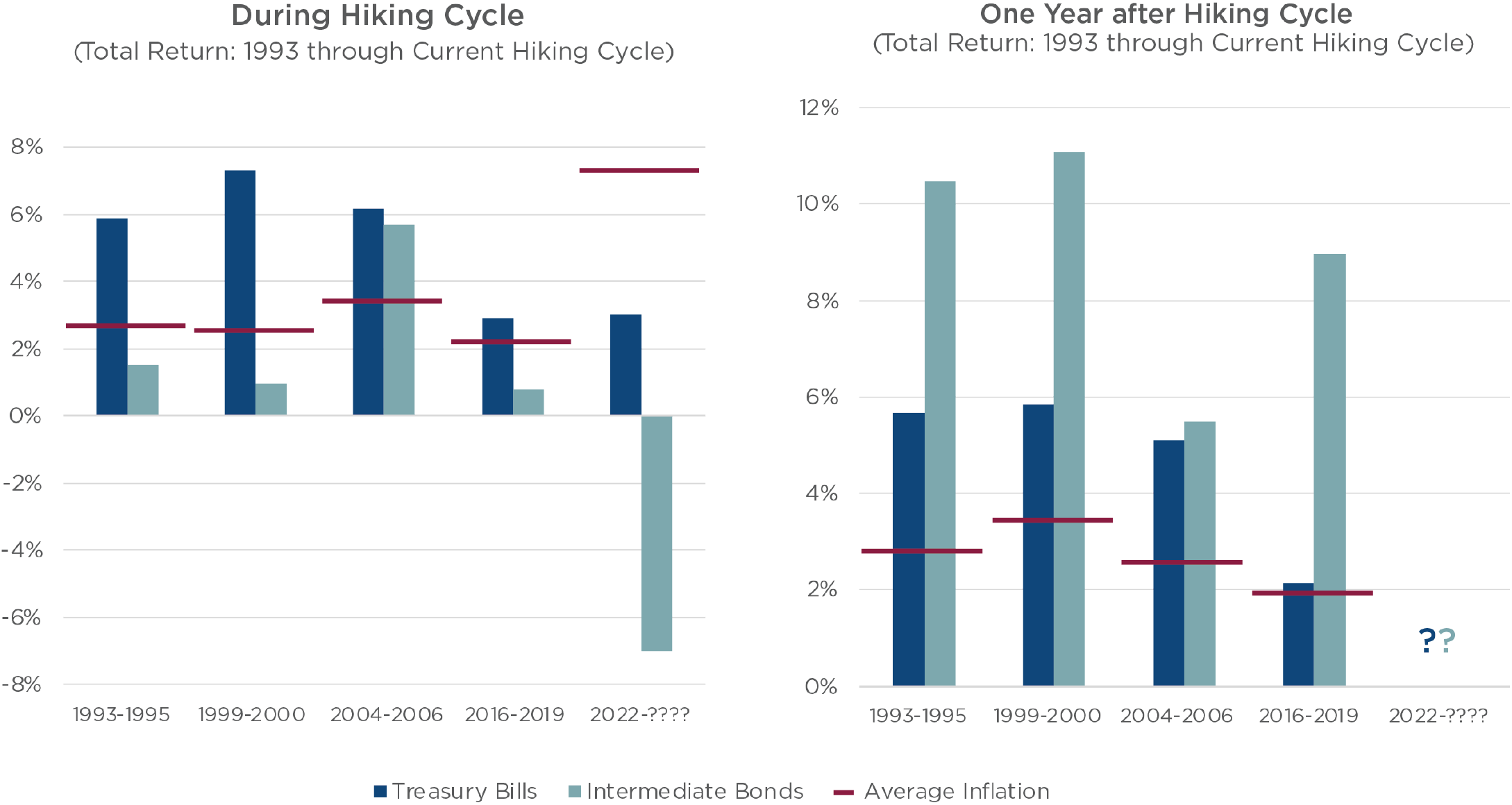

Bonds: A Comeback Story

In the mid-1990s, after a string of product failures, Apple teetered on the brink of bankruptcy. But in 1997, one of the company’s founders—the legendary Steve Jobs, who had been ousted a decade earlier because of internal conflict—returned to the company and launched what has become an almost unbelievable story of resurgence.

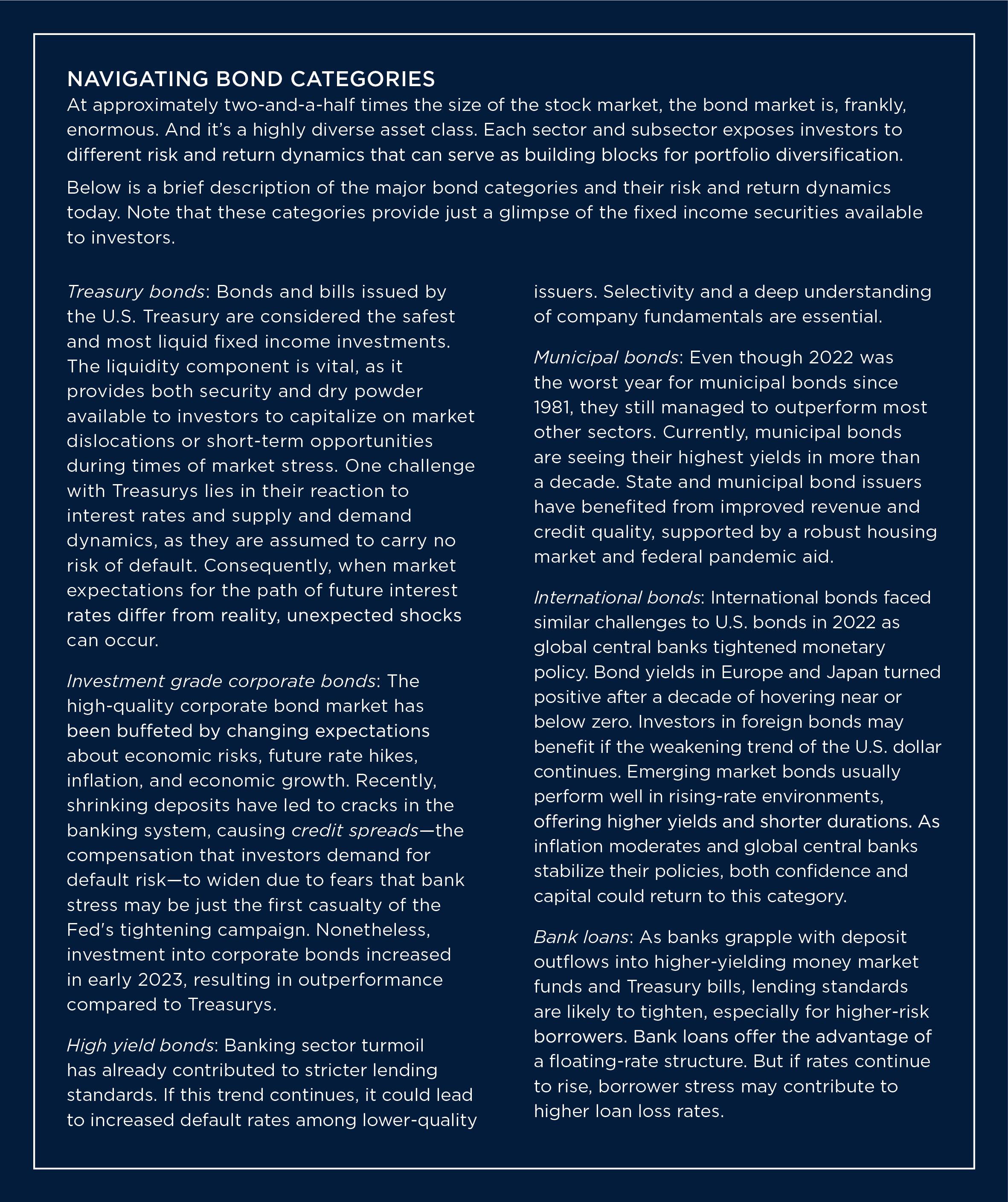

As shown in Figure One, the investment result has been astounding. Over the past 23 years, the market capitalization of Apple alone has eclipsed that of the entire Russell 2000 Index. To wrap your head around the size of this rebound, consider this: $1,000 invested on the day before Steve Jobs’s return as interim CEO in 1997 would now be worth more than $1,000,000.

Fast forward to 2023, and it’s not just one company or security that is standing on the brink of revival. Rather, it is broad swaths of the largest and most liquid investment asset class: the bond market.

Figure One: Apple’s Market Capitalization vs. the Russell 2000 Index

Sources: Bloomberg, CAPTRUST

The Bond Market Slump

Following the first back-to-back negative annual returns for core bonds since the inception of the Barclays U.S. Aggregate Bond Index in 1976, conditions now seem ripe for a rebound. Core bonds are experiencing positive returns so far this year. But even more promising is the view that today’s significantly higher yields, coupled with the added potential for price appreciation, have increased the prospects for future returns more than at any other time in recent history.

Several factors weighed on markets last year, including an inflation shock and the Federal Reserve’s aggressive policy response. Inflation plays a major role in the bond market because it erodes the purchasing power of fixed income payments and can drive real yields—that is, the income from bonds after adjusting for inflation—into negative territory.

To fight inflation in 2022, the Fed acted forcefully, raising the fed funds rate a total of seven times, from 0 percent to 4.25 percent. This was followed by three more hikes in the first half of 2023, bringing the rate to 5 percent, with the potential for further increases.

While stocks were impacted in this rising-rate environment, it was bond investors who were most surprised by the setback. Core U.S. investment grade bonds, for instance, suffered a 13 percent loss, their worst return since the inception of the Barclays index.

Here, it is important to note that bonds offer two distinct sources of return: coupon payments and the potential for price appreciation. While coupon payments represent a steady source of income until a bond matures—assuming the issuer does not default—the price of a bond adjusts continuously based on prevailing interest rates.

For an investor who holds a bond to maturity, these price fluctuations are irrelevant. However, they’re an important piece of understanding the total return of a bond.

The Opportunity

Compared to the past decade, when yields were exceptionally low, the income generated by bonds now provides a more substantial cushion to counterbalance price declines caused by rising rates. Today, intermediate investment grade corporate bonds yield approximately 5.5 percent, up from 2.4 percent at the end of 2019.

This means that even if interest rates continue to rise gradually, bond yields have a much better chance to offset price declines, making a repeat of steep 2022 losses less likely in the near term.

Additionally, the current rate environment has improved the risk-reward trade-off for bonds compared to stocks. When corporate bond yields were below 3 percent, as was the case for most of the 2010s, even conservative investors seeking income had to explore alternative options. This led to a phenomenon known as there is no alternative (TINA), prompting many people to invest in stocks. However, with bonds now offering robust yields that exceed inflation, the mantra has shifted to there is now an attractive alternative, or TINAA.

The takeaway: Despite continuing economic uncertainty, bonds may now represent a more compelling opportunity than they have in years.

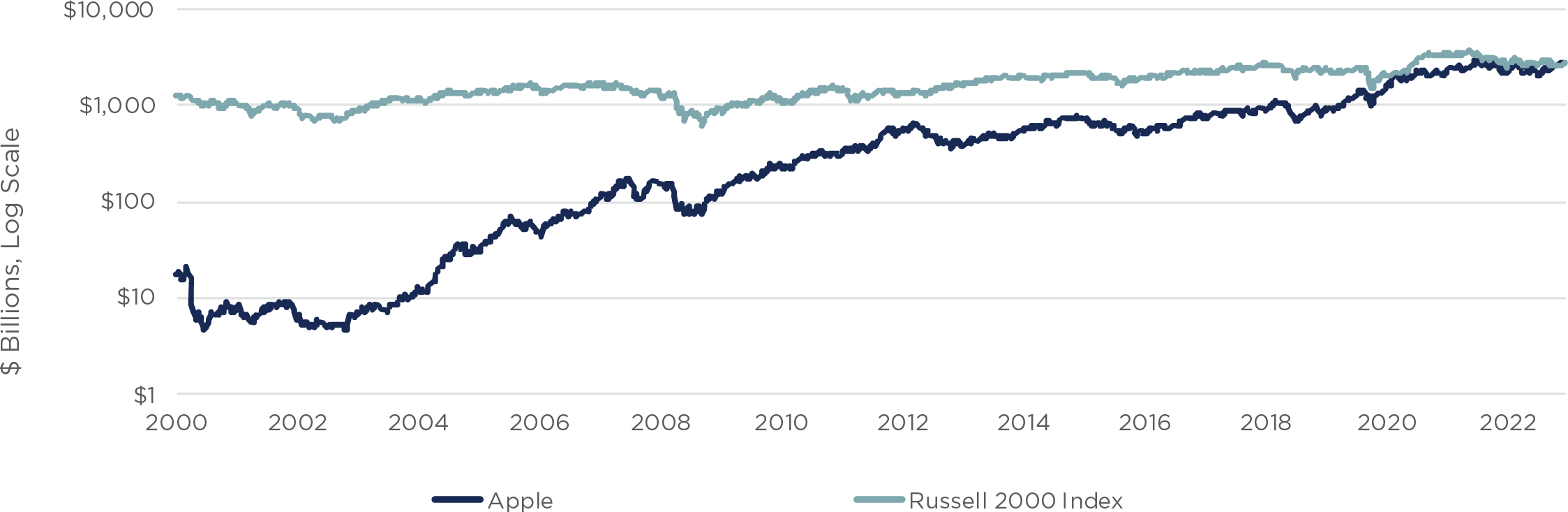

Figure Two: Treasury Total Returns during and after Hiking Cycles

Sources: Bloomberg, CAPTRUST

Bonds and Fed Tightening Cycles

The rate-hiking cycle that began in March 2022 represents the fastest and most aggressive move by the Fed since 1981. However, a significant distinction exists between now and then. While the fed funds rate was 16 percent at the start of the 1980s hiking cycle, it began 2022 at 0 percent. Essentially, the Fed’s tightening policy has begun to normalize interest rates amid its ongoing battle against inflation. This process of normalization has created a wide range of scenarios that could benefit bond investors through both higher yields and greater potential for price appreciation.

Recently, investors have grown anxious that higher rates, among other economic challenges, will push the U.S. into a recession. When anxiety grows about the state of the economy, investors tend to seek safe-haven investments and often flock to Treasury bonds. Higher demand for Treasurys drives their yields lower but their prices higher—a pattern that has repeated itself across previous hiking cycles.

As shown in Figure Two, bond returns are typically subdued during hiking cycles, with short-term bonds and Treasury bills outperforming longer-maturity bonds because they can be swiftly reinvested in the rising-rate environment. The left chart illustrates the combination of low initial yields and aggressive rate hikes. Since 2022, intermediate-term U.S. Treasury bonds have lost nearly 7 percent, while short-term (1 to 3 month) Treasury bills have shown positive returns of 3 percent. Adding to investor pain is the elevated level of inflation, represented by the red horizontal lines. This dynamic could compel investors to concentrate their bond investments in shorter-term securities like Treasury bills or even money market funds.

However, history shows a significant shift once the Fed’s hiking cycle is over. The right chart illustrates this trend. When the Fed maintains steady rates or begins cutting rates, it can trigger a bond rally that benefits longer-duration bonds, resulting in substantial price increases for those bonds.

Strategies for Investors

With money market funds now yielding 5 percent, investors may be tempted to load up on short-duration bonds to take advantage of these high yields with little or no price risk. This is particularly true given the current inverted yield curve, a relatively uncommon phenomenon when shorter-maturity bonds provide higher yields than bonds with longer maturities.

However, as with any investment strategy, there are risks in overconcentrating on any single type of investment, even safe, short-term Treasurys. Specifically, such investors face reinvestment risk—the risk that when a bond matures, interest rates may be lower than when it was bought, forcing the investor to reinvest at a lower yield.

There are three primary strategies bond investors can use to take advantage of attractive short-term yields while constructing a durable portfolio that is well-positioned for a range of potential future environments.

- A barbell is a tactical strategy that pairs bonds at different ends of the maturity curve—that is, both short- and long-term bonds. A barbell strategy represents a compromise, providing investors with the benefits of low-risk, higher-yielding short-term securities plus the lower reinvestment risk of longer-term bonds. If recession fears rise and investors rush to safe-haven assets, such as 10-year Treasurys, the barbell strategy could provide an effective hedge against risk.

- A bond ladder is a portfolio of bonds with staggered maturities. This serves to mitigate reinvestment risk and smooth out yield fluctuations. As bonds mature, the cash returned can be reinvested at the end of the ladder, allowing the investor to benefit if rates have risen. But even if rates have fallen, the investor can still benefit from earlier rungs on the ladder that retain higher yields. In addition, bond ladders can be structured to generate a consistent monthly income stream.

- Sector diversification across different bond categories is another way to enhance portfolio resiliency and tap into the potential for attractive risk-adjusted returns. However, navigating some corners of the fixed income market can be challenging due to nuanced risks and often hard-to-access information. Institutional-quality active managers with specialized expertise and resources may represent the best way to access these more specialized sectors.

As interest rates normalize from artificially low levels, the bond market seems well-positioned for a triumphant return. However, this does not mean investors can simply choose a bond strategy and then set it and forget it.

A wide range of dynamics will influence the fixed income landscape in 2023 and beyond. A prudent approach to the new bond market means intentional diversification in terms of maturity, sector allocation, and management style that matches investors’ risk tolerance and time horizon. Fortunately, the enormous size and robust diversity of the bond market provides a variety of securities that can be employed to create a diversified strategy.

Investment success is rarely achieved by chasing opportunities and avoiding challenges. Instead, it requires creating a financial plan and a resilient portfolio prescribed by that plan to transform setbacks into opportunities.

Catching the Comeback

Today, most people view Apple as a rousing success—both as an investment and as an innovator. But this doesn’t mean the business has not suffered its share of setbacks. For instance, consider the Newton, the Lisa, and the Pippin: devices that each presented a litany of faults, or perhaps ideas that were simply ahead of their time.

Yet companies, like people, should not be defined solely by their setbacks. And neither should investments. Many of us are familiar with the standard legal disclaimer used in investment advertisements: Past success does not guarantee future results. But the opposite is true as well. Past failures are not certain to be repeated.