An Economy on Approach

A year ago, a global recession seemed likely for three primary reasons. Spiking energy and food prices dragged on already strained consumers. Central banks were engaged in dramatic monetary policy tightening to combat inflation. And the world witnessed multiple, significant geopolitical flare-ups.

Yet instead of a slowdown or recession, 2023 was better than expected for both the economy and the financial markets. Inflation pressures abated while consumer spending, the labor market, and economic growth conditions remained surprisingly resilient.

Today, the Goldilocks outcome of an economic soft landing has become the consensus prediction for 2024. Investor expectations, as measured by stock and bond prices, clearly reflect this scenario. Equity markets seem to be moving steadily toward record highs, and bond yields have retreated.

But a rosy outcome is far from inevitable. Although the Federal Reserve and other global central banks have so far been effective at bringing down inflation, as any pilot will tell you, landing is dangerous and requires careful orchestration. In 2024, bumps are likely as real-world conditions rarely unfold exactly as expected.

Fourth-Quarter Recap: End-of-Year Rally

The Fed held interest rates steady at its December 13 meeting and gave the clearest signal yet that its rate-hiking cycle has likely concluded, with no additional rate increases forecasted for 2024. Although Fed Chair Jerome Powell made it clear that the central bank was prepared to increase interest rates again if inflation pressures return, he also signaled that the Fed’s focus is shifting to how and when it might cut rates as inflation moves toward its 2 percent target.

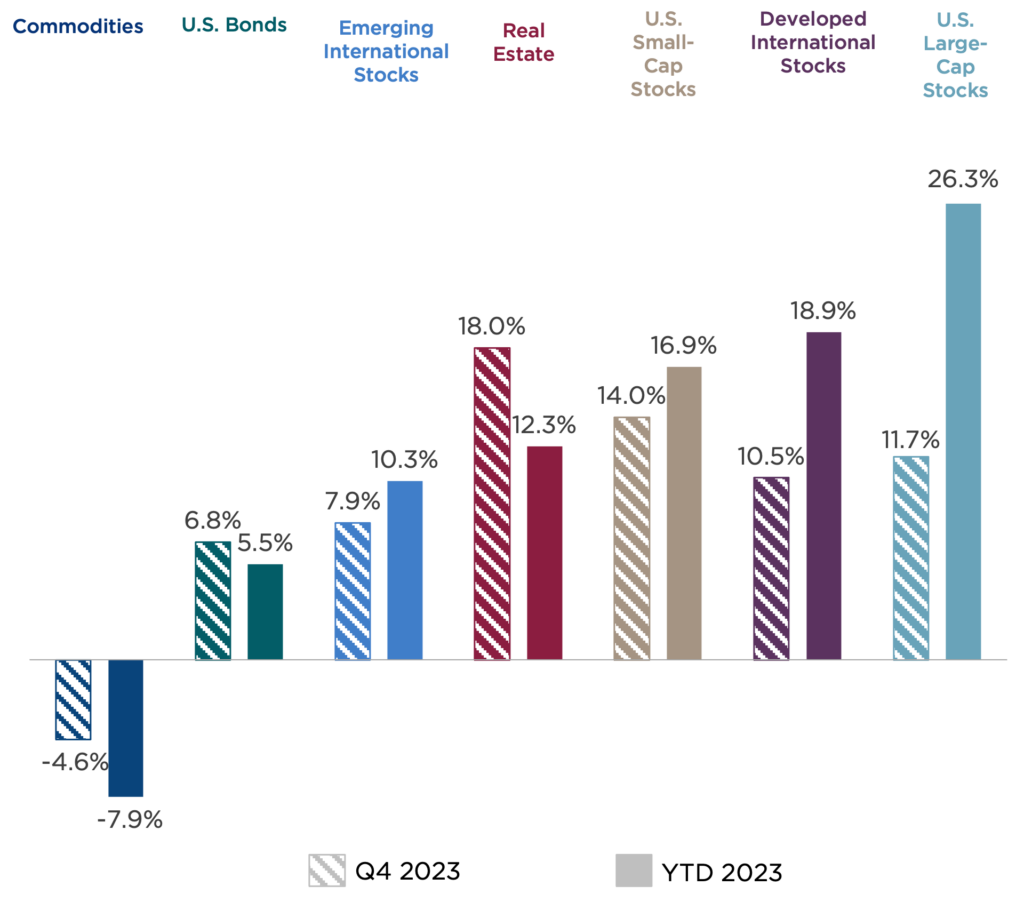

Following a mid-year correction and 10 percent decline, the S&P 500 Index closed the year with its longest weekly winning streak since 2004. This included nine consecutive weeks of gains for a total return of almost 12 percent in the fourth quarter and 26 percent for the year—numbers that placed the index just a hair below its all-time high reached in January 2022.

These strong returns occurred despite only modest growth in corporate profits. Instead, higher valuations drove nearly all of 2023’s gains as the S&P 500 price-to-earnings (P/E) ratio climbed from 17.4 to 21.6 times earnings by year-end.

For most of the year, the top seven stocks in the index—a group of mega-cap technology stocks sometimes called the magnificent seven—demonstrated significant outperformance relative to the rest of the index, delivering the lion’s share of returns. However, the rally extended to multiple sectors toward the end of the year, with the average stock outperforming the magnificent seven by a comfortable margin in December.

Similarly, small-cap stocks trailed larger companies by double digits for the first three quarters of the year but finished strong in the final quarter, delivering nearly 17 percent growth for the year.

Figure One: Fourth Quarter and Year-to-Date Returns

Source: CAPTRUST Research

International stocks also participated in this year-end rally, with developed market stocks advancing by nearly 19 percent for the year and emerging market stocks by 10 percent. Emerging market returns continue to be weighed down by a sagging Chinese economy. If Chinese stocks were excluded from the results, emerging market stocks would have outperformed developed market stocks for the quarter.

Within fixed income, bond yields fell dramatically in the fourth quarter on the expectation of 2024 rate cuts, causing bond prices to rise. As the 10-year Treasury yield declined from 4.7 percent to 3.9 percent, core U.S. bonds reversed losses from the first three quarters to deliver returns of nearly 5.5 percent for the year. The Bloomberg U.S. Aggregate Bond Index advanced 4.3 percent in November alone, its best monthly percentage gain since 1985. Finally, after treading water for the first three quarters of the year, beleaguered by macroeconomic uncertainty and high interest rates, real estate delivered strong returns for the fourth quarter. The Dow Jones U.S. Real Estate Index finished the quarter up 18 percent, as interest rate-sensitive sectors drew support from declining bond yields and hopes for a continued rebound in economic activity.

Expectation Course Correction

Given the gloomy predictions that kicked off 2023, investors have much to celebrate from the returns delivered last year. The global economy has seen strong disinflation, even as the labor market and growth conditions remain resilient.

However, it is still unclear what will happen next. Despite expectations, economic narratives seldom unfold as expected, and it is highly unlikely that all economic factors will move in favor of markets. Given the strength of the fourth quarter rally, there is little room for error. Any signs that the economy is diverging from its soft-landing flight path could be a recipe for market turbulence.

Such a high degree of consensus is surprising given the significant uncertainties that remain. This includes the potential for lagged effects of monetary policy tightening, the uncertain path of Fed policy and rate cuts, the unpredictable impact of fiscal policy in an election year, and the volatile nature of geopolitics.

Here, we explore a few of the major economic factors that could impact how the year unfolds.

Disinflation Continuation

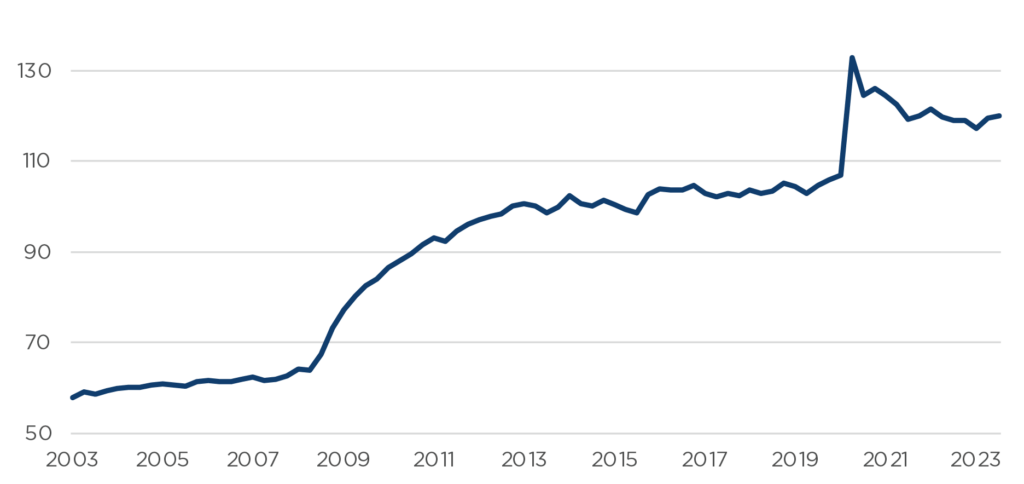

What Could Go Right: As shown in Figure Two, the latest reading of the Consumer Price Index (CPI) is now at its lowest average level since April 2021. CPI is a measure of the average change in prices paid by consumers for goods and services over a certain period. In November, CPI was just 3.1 percent, which means inflation has moderated to just half a percent above its 20-year average. If this trend continues, inflation could reach near-normal levels in 2024 without broad economic damage, creating an environment for stable prices, continued consumer spending, corporate earnings growth, and lower interest rates.

Figure Two: Consumer Price Index Changes, 2003–2023

Sources: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, Federal Reserve Bank of St. Louis, CAPTRUST

What Could Go Wrong: One of the biggest risks facing the U.S. economy is if inflation resurges. This could happen as a result of continued economic strengthening, OPEC oil production cuts, or unexpected geopolitical shocks. Inflation may remain stubbornly high or even reaccelerate. This scenario could force central banks to maintain high interest rates longer than expected, thereby risking a downturn in economic activity, higher unemployment, increased borrowing costs, and a potential recession.

Mortgage Rate Relief

What Could Go Right: In October, the 30-year average fixed mortgage rate approached 8 percent, the highest level in more than two decades, as the benchmark 10-year Treasury yield touched 5 percent for the first time since 2007. But as the inflation picture stabilized and the economic outlook improved, yields fell sharply to close the year, and the average mortgage rate followed suit, falling to 6.6 percent.

Continued declines in mortgage rates would help to thaw a largely frozen housing market. Lower rates would make home purchases more affordable. This could draw new buyers into the market and boost the real estate sector and related industries such as construction, home improvement, and furnishings.

Businesses of all types would benefit from a lower rate environment by improving profitability and financial flexibility and reducing the cost and risk of investing in new projects and technologies. The federal government would also see huge benefits in the form of lower debt servicing costs. Government debt increased dramatically in response to the COVID-19 pandemic, causing the U.S. debt-to-GDP ratio to skyrocket, as shown in Figure Three.

Figure Three: Total Public Debt as a Percent of Gross Domestic Product (GDP)

Sources: U.S. Office of Management and Budget, Federal Reserve Bank of St. Louis

What Could Go Wrong: The greatest risk to the soft-landing consensus is that the economy doesn’t cool as much or as quickly as the Fed would like. If so, it would be unable to follow through with the interest rate cuts the market is expecting.

Recently released minutes from the Fed’s mid-December meeting acknowledge “clear progress” on inflation but also reaffirm that “it would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably.” If Fed actions fail to align with market expectations, both borrowers and market sentiment will face challenges. The Fed does not have a good playbook for rate cuts in the absence of recession. But regardless of the future path, there is also the potential for delayed damage from the rate increases enacted so far. Spiking interest rates significantly strained the economy last year.

Consumer Dynamics

What Could Go Right: As we enter 2024, consumer strength will remain a pivotal factor shaping the economic landscape. Consumer spending, historically a driver of economic growth, is influenced by employment rates, wage growth, inflation, and credit availability.

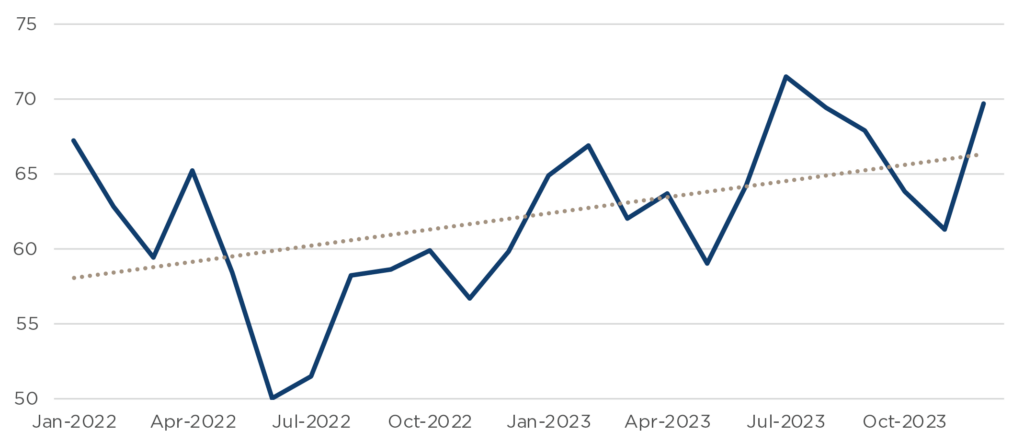

In December, falling energy prices, strong market performance, and declining price pressures combined to lift consumer sentiment, according to the University of Michigan Consumer Sentiment Index, as shown in Figure Four. When consumers are optimistic about the economy’s direction, they are more likely to spend on discretionary items.

Figure Four: Consumer Sentiment Changes, January 2022–December 2023

Sources: University of Michigan Consumer Sentiment Survey, Federal Reserve Bank of St. Louis

What Could Go Wrong: Despite rising sentiment, one major risk in 2024 is the potential for a slowdown in consumer spending. Credit card debt has surpassed $1 trillion for the first time, even as credit card interest rates soar and delinquency rates rise. If the job market softens, or consumers pull back on spending, there could be major economic repercussions.

Early data on the 2023 end-of-year shopping season shows mixed results. However, one report, from Mastercard, shows that retail spending grew by less than half as much in 2023 than in 2022, as more deliberate shoppers sought value and discounts.

The Goldilocks Labor Market

What Could Go Right: The job market plays a key role in maintaining consumer confidence and spending. However, as the U.S. has witnessed since the pandemic, a too-tight job market strains businesses and risks exacerbating inflation pressures. Now, it seems the labor market could be returning to more normal conditions. Hiring activity has eased, and job openings have declined modestly. The quit rate, an important measure of workers’ confidence in finding another job, also fell.

Fed Chair Powell was optimistic throughout 2023 that the Fed could achieve balance within the labor market. “There are no promises in this,” he said at a press conference in May. “But it just seems that to me that it’s possible that we can continue to have a cooling in the labor market without having the big increases in unemployment that have gone with many prior episodes.”

Adding to optimism today is the promise of a new era of productivity, driven by artificial intelligence (AI). Companies of all types are investing in technology to make their workers more productive, but AI could also help address labor shortages and make supply chains more secure.

What Could Go Wrong: A job market that moderates, without declining too much, is an ideal scenario. But if economic growth slows more than expected or the economy slips into recession, businesses may reduce hiring or lay off workers to maintain profit margins.

Election Year Unknowns

What Could Go Right: Historically, presidential election years have been good for market returns. Since 1928, the S&P 500 Index has delivered positive returns in all but four presidential election years. Incumbent administrations have a strong interest in maintaining economic health in the leadup to elections, with market-friendly policies such as tax reform and infrastructure investments, along with supportive actions by the Treasury department.

Following the election, a clear and stable policy environment with less uncertainty can bolster business and consumer confidence, leading to increased spending and investment.

What Could Go Wrong: Heightened political uncertainty, polarization, and contentious policy debates could lead to market volatility and uncertainty among investors and consumers. Potential gridlock or unfavorable policy outcomes might dampen economic growth, complicate fiscal management, and create an uncertain business environment. The Fed could also come under political pressure, threatening its independence.

Making Sense of Sentiment

After several years of heightened uncertainty and market volatility, markets are now priced with significantly lower embedded risk. However, the same optimism buoying the market today might become its Achilles’ heel. History suggests that when investor sentiment soars, investment returns often falter. It’s impossible to know how much good news is already priced into market prices today, but probably, it’s a lot. However, that doesn’t mean stocks can’t go higher. It simply means that future gains must be backed by good fundamentals.

Whatever 2024 has in store, as always, it is wise to maintain a balanced mindset and be aware of the risks of consensus thinking. As Albert Einstein famously cautioned, “Genius abhors consensus because when consensus is reached, thinking stops.”