From the CAPTRUST Investment Committee: Everything… All at Once

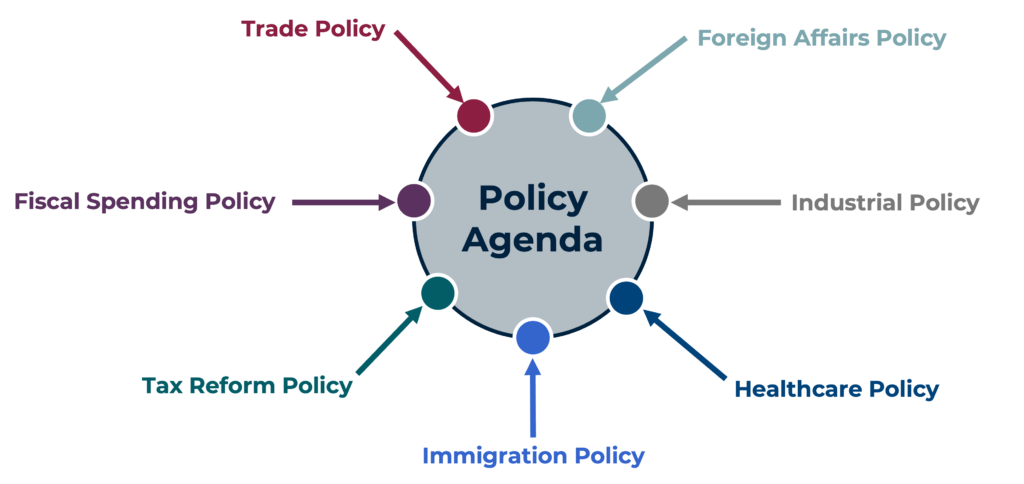

The first 50 days of President Trump’s second term have seen a surge of policy actions spanning a broad range of issues. While any one of these initiatives could serve as a stand-alone policy agenda for a president, this administration is ambitiously advancing multiple items through the policy funnel simultaneously.

The result has been a steady stream of headlines that has left investors navigating an increasingly complex and unpredictable landscape, akin to a multidimensional chess game. Capturing the most headlines over the past week has been the impending levy of tariffs on Mexico, Canada, and China. Here, we outline what we believe are the primary goals and potential risks of these rapidly evolving trade policy initiatives. We also highlight how economic uncertainty stemming from the crosscurrents of several policy shifts is influencing our investment decision-making process.

Figure One: The Policy Agenda Funnel

Source: CAPTRUST research. For illustrative purposes only.

Primary Goals

We believe the administration’s trade policy reforms are designed to pursue four main objectives.

- Reshoring and Foreign Investment: By making it more expensive to buy foreign goods, tariffs incentivize U.S. manufacturing. This has the potential to drive an increase in domestic and foreign investment into the U.S. For example, in the past week, we saw companies, including Apple and Taiwan Semiconductor, announce significant investments in domestic research and development and in semiconductor chip-making facilities.

- Balancing the Playing Field: The president strongly believes there are imbalances within existing trade relationships that create an unfair competitive advantage for other countries. He is seeking to counteract tariffs on U.S.-made goods and foreign subsidies for industries such as agriculture, forestry, and auto manufacturing.

- Creating Sources of Revenue: Tariffs are direct payments made to the U.S. government, which could improve our current fiscal condition. They could also potentially offset the cost of other proposed policy items, most notably the extension of the cuts included in the Tax Cuts and Jobs Act (TCJA). However, it is important to understand that the true revenue impact is far from certain, as tariffs and any potential retaliation could dampen economic growth conditions.

- Leveraging for Non-Trade Negotiations: Tariffs are a bargaining tool that extends beyond trade policy. They can be used to pressure foreign governments on issues such as border security, drug enforcement, and other geopolitical objectives.

Potential Outcomes with Meaningful Impacts

The immense scale, complexity, and importance of international trade mean that policy shifts introduce significant potential risks. This is particularly true at present, because the initial round of proposed tariffs targets nations that currently represent more than 40 percent of total U.S. annual imports. However, because these issues continue to be negotiated, the ultimate extent of impact on consumers, businesses, markets, and the economy will depend on the breadth and depth of actual imposed tariffs. We believe the most likely outcomes include the following.

- Profit and Inflation Pressures: In response to tariffs, companies can absorb the cost (placing downward pressure on profit margins), raise prices to consumers, or enact some combination of both of these actions. While higher prices may be viewed as inflationary, the market’s initial reaction—falling bond yields and increased expectations for 2025 Federal Reserve interest rate cuts—suggests they are currently being viewed as a one-time, short-term price adjustment rather than a sustained inflationary trend. However, depending on the length and magnitude of the trade conflict, shifting supply chains could serve as a longer-term inflationary influence.

- Economic Growth Headwinds: Initial market reactions to imposed tariffs suggest investors are more concerned with the potential impact to economic growth than with the short-term price impacts. The Yale Budget Lab estimates the economic impact of these tariffs would be a 0.6 percent reduction in real gross domestic product in 2025, leveling to a longer-term economic growth drag of 0.3–0.4 percent annually while in effect.

- Retaliation: Canada, Mexico, and China have all indicated they will retaliate with higher tariffs on U.S. goods. This unpredictable cycle of escalating tariffs creates greater uncertainty for businesses, increased complexity for global supply chains, and elevated market volatility for investors.

Investment Implications

In this uncertain and rapidly evolving environment, it is extremely challenging to determine specific investment implications with a high degree of confidence. Despite this uncertainty, what is becoming clear is that the decision-making landscape is being reshaped.

Some of the most important underlying economic assumptions that investors have historically modeled with confidence, such as trade relationships, security alliances, and free markets, are now being scrutinized and, in some cases, completely reset.

Although the final contours of the administration’s policy changes are far from certain, many of the fundamental factors that have shaped markets and investment outcomes for the past decade are now changing at an unprecedented pace and scale. These changes should not necessarily be viewed as bearish in the long term. Rather, changing assumptions are an indication that future winners may be different than past ones, and an uncertain transitional period is likely.

The two biggest questions the CAPTRUST Investment Committee is focusing on are “What bearing will this new environment have on U.S. technology leadership in global markets?” and “How will it influence unity and competitiveness in Europe?”

- America’s Global Tech Leadership: U.S. mega-cap technology giants have maintained a dominant position across the global equity landscape for much of the last decade. How could the changing policy environment affect their market position? The answer to this question will have an outsized impact on domestic markets going forward, given their current valuation levels and massive share of the overall U.S. equity market.

- The Unity and Competitiveness of Europe: European equity markets have been left behind by their U.S. counterparts, as their policymakers found comfort in the security the U.S. provided, and in cheap goods sourced from China. Europe may now be forced to become more self-reliant and more competitive, which could be the catalyst for real change. This, in turn, could drive potentially higher economic growth rates across the region, which has suffered from extremely low expectations, as reflected in depressed stock market valuations.

By any account, this is a historical moment. Investors are rarely faced with a true regime change, but the scale and speed of recent policy actions suggest that investors and businesses may need to adjust to a new set of economic conditions.

New environments can create risks—but also opportunities—for investors who adapt. The Trump administration has already demonstrated a willingness to employ unconventional negotiation strategies. While the ultimate outcome of various policy shifts is still unknown, what does appear evident is that market volatility is likely to persist as investors attempt to understand and adjust to this shifting economic landscape.

As financial advisors, we are paying close attention to fiscal policy outcomes. While we may experience short-term volatility as markets adjust to shifting policy, our core investment principles will not change: remain diversified, resist emotional decision-making, and maintain a long-term perspective to best capture the long-term compounding power of time.