Foretelling an Uncertain Future

After reading, rereading, and following every path, you’d find some books in the series had a balanced set of outcomes, while others skewed heavily positive or negative. In the latter, winning seemed impossible.

As investors consider possible scenarios for the global economy and investment landscape for 2023, a similar wide range of outcomes is possible. And they can be reached via multiple paths. Unlike the perils of a children’s book, the potential economic dangers ahead are real, including the risks of persistently high inflation, widespread job cuts, or a deep and extended global recession.

Yet some of the potential outcomes are also positive, such as the U.S. economy achieving a soft landing as inflation recedes without a recession, forming the base of a new secular bull market.

Predicting the Unpredictable

Making predictions for the year ahead is standard practice in the finance industry. This annual forecasting frenzy is a year-end tradition. However, economic and market forecasts—particularly for a full year—are necessarily far more uncertain than, say, tomorrow’s weather forecast. This is especially true when the economic and geopolitical environments are as volatile as the ones we face today. The reality is that it’s often impossible to understand or explain how the markets performed in the past, let alone in the future.

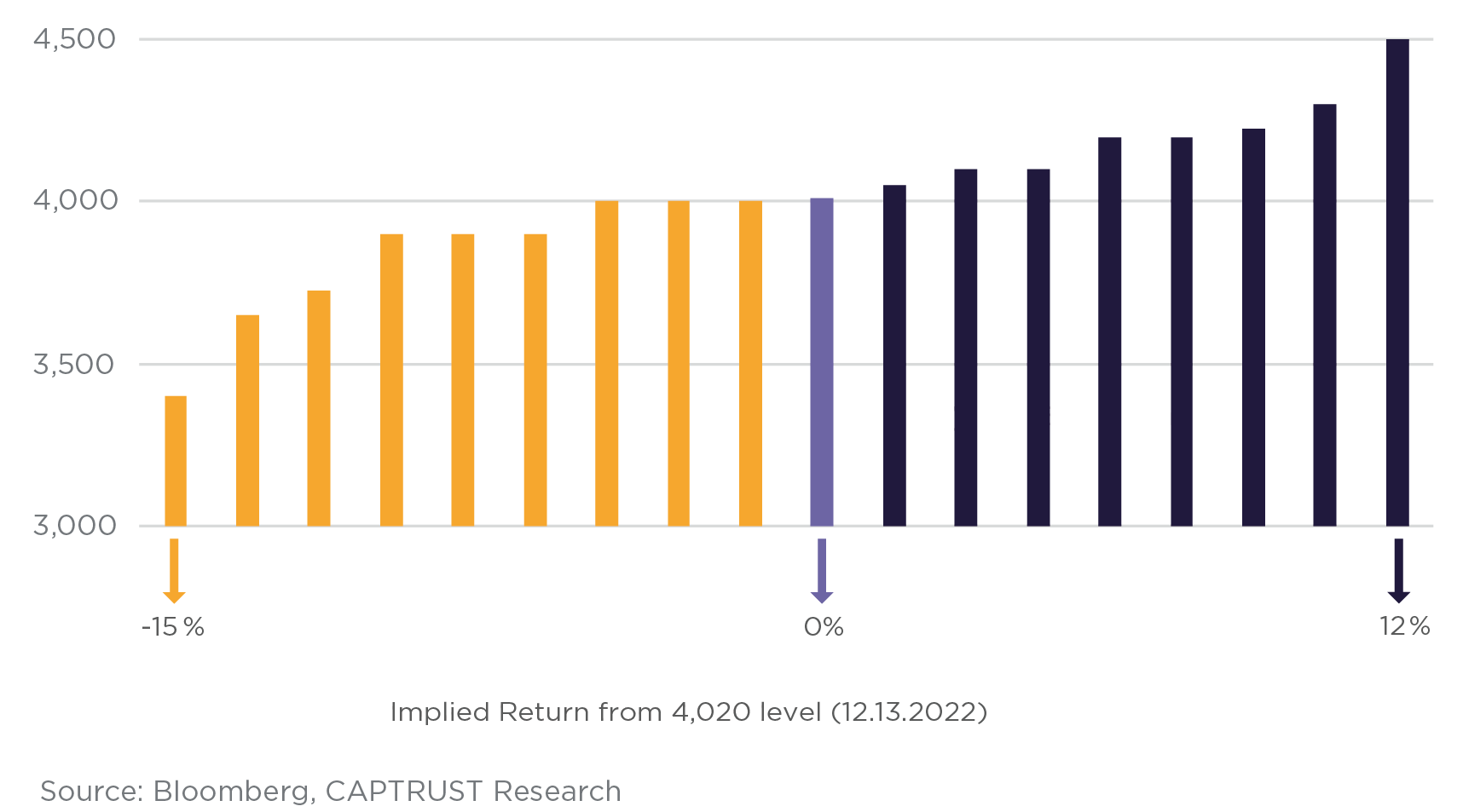

Today’s uncertainty leads prognosticators to a wider-than-normal range of outlooks. For instance, see Figure One, a sample of investment strategists’ forecasts for the year-end 2023 value of the S&P 500 Index. You’ll notice these predictions range from a bearish level of 3,400 to a high of 4,500. This range of forecasts implies returns for 2023 ranging from negative 15 percent to positive 12 percent—a difference of 27 percentage points, the widest dispersion of predictions since 2009.

Figure One: Investment Strategists’ Forecasts for the S&P 500 Index in 2023

The level of the S&P 500 is just one of many elements included in forecasts. A sample of other data points collected by CAPTRUST reflects similar disagreements, such as the year-end price of a barrel of oil ranging from $80 to $125. Others are more consistent, like the year-end level of the 10-year Treasury yield being between 3 and 4 percent.

The reality is that, even in a typical year, the average or consensus forecast often misses the mark by a considerable margin. As investment strategists, we do the best we can, but the future is, by its nature, opaque.

Looking at the Landscape

Market predictions are more useful in the aggregate than they are individually. Any single forecast has high odds of being wrong, but for investors and investment advisors, the goal is to understand the range of possible outcomes and the conditions that could create them. More than the specific numbers in the forecasts, it’s the competing narratives that provide the most insight for thoughtful students of the game.

In late 2022, the CAPTRUST Investment Group began creating a set of scenarios that it believes encompasses the most likely range of outcomes for the coming year. It’s important to do this work with a heavy dose of humility and with the understanding that reality may—and most likely will—fall outside of these scenarios.

Still, making predictions is important because it helps investment advisors think through portfolio implications and planning considerations that can improve results.

The outcome of our work resulted in four scenarios. Note that while these scenarios are primarily U.S. focused, they likely have spillover effects on the trajectory of global markets, due to the size and interconnectedness of the U.S. economy.

Scenario One: The U.S. Achieves an Economic Soft Landing

After rapid-fire interest rate hikes in 2022, the Fed succeeds in tightening financial conditions. Combined with healing supply chains, resumption of global trade, and resolution of production bottlenecks, the tide of inflation begins to reverse due to the slowing economy, without stalling into recession. By midyear, the Fed concludes its tightening cycle.

Corporations adeptly manage through cooling economic conditions by managing costs, thus restoring balance to labor markets without a significant impact on unemployment levels. This allows corporate earnings to stabilize. A new secular bull market for equities begins as price-to-earnings valuations recover from their recession-anticipation malaise.

What could this mean for investors?

This Goldilocks scenario may offer equity investors returns that range from modest single-digit losses to mid- or high-single-digit positive returns, depending on the timing of the Fed’s pivot and the degree that recession avoidance has already been priced in to the markets.

In an environment in which growth is constrained, dividends and other yield sources will likely make up an important component of total return.

Scenario Two: Inflation Tamed via Mild Recession

Despite falling price pressures in goods and services categories distorted by the pandemic, inflation proves to be sticky. Meanwhile, demographic shifts, early retirements, and low levels of immigration keep the labor market tight. The combination of high input prices and labor costs forces the Fed to raise rates higher and keep them higher for longer, pushing the economy into a mild recession.

Most U.S. corporations navigate the slowing environment without significant strain. This is especially true for companies able to take advantage of the exceptionally low post-pandemic interest rate environment to restructure debt and those able to pass along price increases to consumers. However, weaker companies with higher financing costs suffer, creating a wide gap between winners and losers.

What could this mean for investors?

It is difficult to expect corporate earnings to grow in this scenario. And a souring risk appetite among investors could pull valuations lower, from the modestly elevated levels of year-end 2022 toward the longer-term average. This could imply equity returns ranging from flat to mid- or high-single-digit losses, with a higher dose of volatility along the way. The widening gap between winners and losers could also place a premium on active investment managers with the ability to assess the specific conditions facing different sectors of the economy and the companies operating in those sectors.

Scenario Three: Overshooting the Target

Ever since the stimulative jolt of slashed interest rates and aggressive quantitative easing during the early months of the pandemic, experts have expressed concerns about the growing risk of a Fed policy error. Even in normal economic cycles, monetary policy acts with a lag that is unpredictable and often undetectable until it is too late.

This risk is amplified by the unique nature of current conditions and the extreme pace of Fed tightening. Inflation recedes faster than expected as the pace and magnitude of Fed action proves too much for the economy to bear. But even as the Fed recognizes its error, it cannot reverse course quickly due to fears of repeating the past error of taking its foot off the brakes too soon.

What could this mean for investors?

In this scenario, corporate profits come under pressure as demand wanes, leading to widespread job cuts and rising unemployment. Investors, confused by the mixed signals of tame inflation but souring conditions, finally reach the breaking point, sending markets lower as the Fed’s error becomes evident.

The combination of weaker corporate earnings and risk-off investor sentiment could lead to another year of volatile prices and double-digit losses for equities at some point in the year, while rising credit and liquidity risks make the bond market difficult to navigate.

Scenario Four: Stagflation Crisis

The most dire of these four scenarios is driven by the possibility that the Fed’s tool kit is simply incapable of addressing the specific type of supply-driven inflation pressures the country is experiencing. In this scenario, inflation remains elevated, even as the Fed continues to take aggressive action, placing significant financial stress on both the U.S. and global economies.

Meanwhile, household debt levels rise as pandemic-era savings are depleted and debt service costs spike with rising rates. The housing market remains largely frozen, and the negative effect of falling home prices weighs heavily on consumer spending. As demand declines, corporations are forced to slash jobs. Due to ongoing inflation pressures, the Fed is unable to pivot to a more accommodating stance. Stocks remain under pressure as the length and severity of the recession are debated.

What could this mean for investors?

In this scenario—which is not what we expect—we would not be surprised to see corporate earnings decline by as much as 20 percent, leading to a commensurate decline in equity prices, if not more. Safe-haven assets, such as Treasury bonds and the dollar, would likely see higher demand as global investors seek safe harbors.

Fed Up

If we could somehow ignore the inflation story and the Fed’s attempts to combat it, the economic picture today would appear quite rosy. Consumer spending remains strong and resilient, and jobs are plentiful. Energy prices are down, providing a boost to consumer sentiment. Yes, the housing market has cooled, but homeowners maintain a high degree of home equity, and the banking system is strong. So far at least, corporate earnings have been resilient.

In other words, it is hard to look at the data today and square it with the consensus view that the U.S. will enter a recession sometime in mid-2023 to early 2024.

Nevertheless, the risk is there, and it happens to be the very type of risk that markets dislike the most. It is no surprise that the central character in each of these four scenarios is the Federal Reserve.

Perhaps this is why professional forecasters, on average, expect a decline in the S&P 500 for 2023, which, if true, would represent only the third occurrence of back-to-back declines for the index since World War II.

By now, it’s safe to say that all but the most faithful Fed watchers are fed up with Fed-speak, the dense and often vague statements parsed word by word by policy analysts. Managing risk is far more difficult when the actions and statements of a small group of policymakers carry such outsized influence.

Because the Fed has said its decisions will be data dependent, every shred of economic data released is interpreted against the Fed’s anticipated reaction to it. As a result, sentiment swings wildly from one data release to the next, causing investors to struggle to determine if bad news is bad, good, too bad to be good, or vice versa.

But perhaps the most important change in the investment environment as we enter 2023 is the end of the ultra-low interest rate policy that has existed since the global financial crisis. This represents a sea change. The availability of zero-cost money distorted markets, amplified risk-taking behavior, boosted corporate profits, reduced the prevalence of defaults and bankruptcies, and diminished expected returns from bonds. Excesses like these must eventually be flushed out. As interest rates rise, the fear of missing out is replaced by a more tangible form of fear: fear of loss.

2023: Sure to Be a Page Turner

The best-case scenario for next year would coincide with fewer surprises, more stability, and fewer large-print headlines that complicate the Fed’s ability to thread the needle with its policy decisions. Thankfully, our task is not to predict the right outcome but to understand the range of potential outcomes, how they could affect different asset classes, where risks and opportunities could emerge, and how to position portfolios for resiliency.

Regardless of the path the economy takes, whether described in our four scenarios or some other circumstance we can’t envision today, investors should remain anchored to their financial plans.

For long-term investors, this means staying invested. History shows that some of the most explosive daily returns occur during bear markets, and timing them is impossible. For investors with shorter time horizons, an emphasis on reliable sources of liquidity and income remains at the fore.

As always, the best move is to discuss your situation with your financial advisor so you can turn the pages with confidence that your financial plan can survive the inevitable twists and turns.