Inflation: What’s in the Basket?

The U.S. Federal Reserve also took notice. Previously, the Fed’s comments on inflation risks emphasized patience. As the transitory effects of COVID-19 disruptions faded, declining inflation pressures would allow it to gradually taper monetary policy support, allowing time for the labor market to heal. But in its final meeting of the year, the Fed struck a very different tone as it acknowledged growing risks of longer-lasting inflation pressures and announced a more rapid conclusion of the bond-purchase program launched to support economic recovery in 2020.

While this abrupt pivot seemed to catch markets off guard, many consumers were far less surprised. They didn’t need a Bureau of Labor Statistics report to know that prices were on the rise. All it took was a trip to the supermarket, gas station, or car dealership to feel the sting of higher prices.

However, the extent to which any individual consumer or household felt the tangible impact of rising prices over the past year was driven by their unique pattern of consumption, and their sources of income. While a 6.8 percent CPI print will— very appropriately—grab its share of headlines, the true impact to any individual could be much more or far less.

Beyond the Headlines

Inflation is caused by too much cash chasing too few goods. This can be the result of a hot economy, where jobs are plentiful, wages are high and rising, and consumer sentiment is strong. It can also be caused by supply constraints, such as disruptions in energy markets, supply chain problems, or other interruptions in the normal flow of goods. Or—as was the case in 2021—it can be caused by both.

Over the past decade, price inflation within the U.S. economy has been remarkably tame, often failing to reach the 2 percent threshold considered healthy for economic stability and growth. Across an entire economy, the expectation for modestly higher prices tomorrow provides incentives for consumers to buy today, providing support for healthy consumer spending and demand.

While that’s the macroeconomic effect, inflation’s impact can vary considerably from consumer to consumer.

Those who owe money at fixed interest rates—such as mortgages and car loans—can benefit from inflation, as the burden of fixed payments is reduced over time. In contrast, those whose incomes are represented by fixed payments from savings, bond coupons, or pension payments can see their purchasing power fall.

In other words, the true impacts of inflation are highly personal. Ultimately, the presence of price inflation only affects those who choose to or are required to buy at the new, higher prices.

The fact that everyone’s experience with inflation is unique illustrates the challenge faced by economists as they attempt to gauge price conditions across an entire economy. The CPI is designed to reflect an abstract, average U.S. consumer across different geographies and categories of age, income, and other characteristics. The U.S. Bureau of Labor Statistics accomplishes this with a market basket of expenditures created through tens of thousands of consumer surveys and detailed spending diaries each year. These expenditures represent more than 200 categories of goods and services, organized into eight major groups.

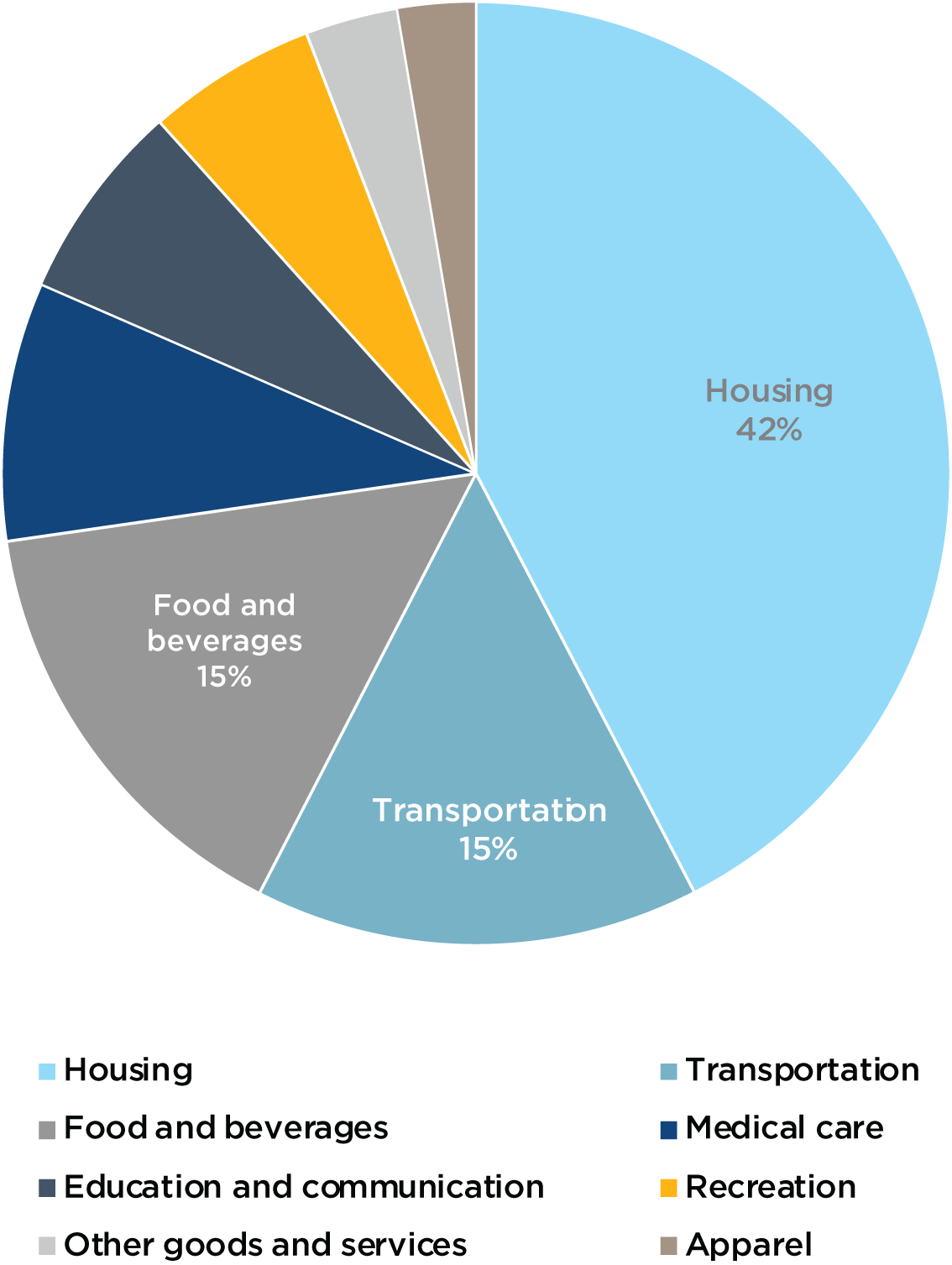

The basket of expenditures used to calculate CPI in 2021 was based upon expenditure survey data collected several years ago, in 2017 and 2018. And as shown in Figure One, housing, transportation, and food and beverages combine for nearly three-quarters of total expenditures, making the CPI measure (as well as the average consumer’s pocketbook) particularly sensitive to changes within these categories.

Figure One: CPI Expenditure Weights

Source: U.S. Bureau of Labor Statistics

Often, changes in prices are spread unevenly across these categories of goods and services. This has been particularly true over the last two years as pandemic conditions radically altered consumer behavior and preferences, the production and distribution capacity for goods, and the ability to deliver services amid social distancing requirements. And depending upon where higher prices crop up, extreme price changes within a few categories can have an outsized influence on the overall level of the index.

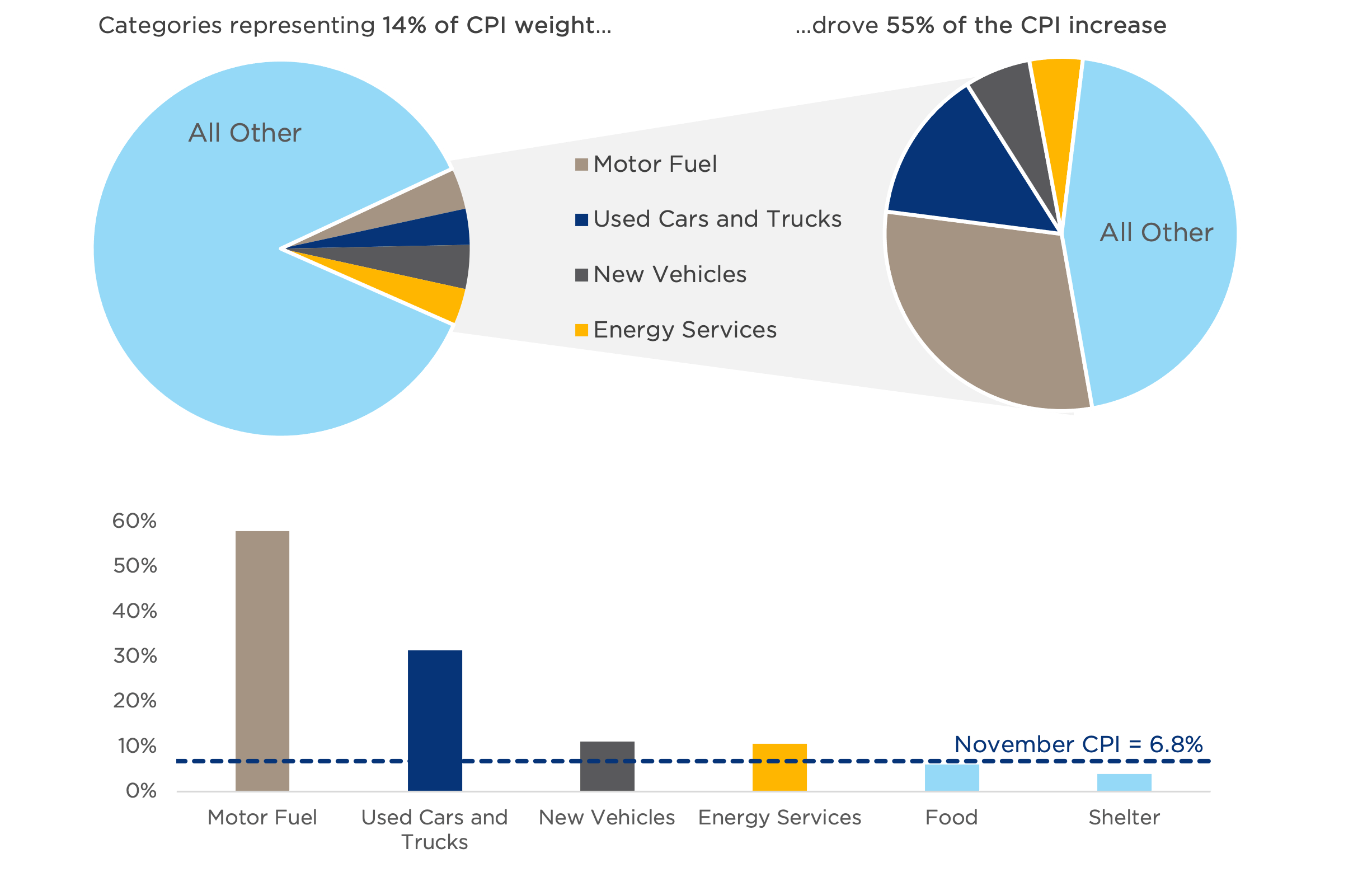

This effect played a major role in November’s CPI measure, as a relatively small subset of expenditure categories tightly linked to the economic reopening—such as fuel and energy—along with categories most affected by supply chain problems—such as autos—drove most of the year-over-year changes in CPI. As shown in Figure Two, the majority of the change in the November CPI was driven by a handful of categories, representing just 14 percent of total expenditures.

Figure Two: November CPI by Category

Sources: U.S. Bureau of Labor Statistics, Bloomberg, CAPTRUST Research. Selected categories, spending as a percentage of adjusted average annual expenditures (less cash contributions and personal insurance and pensions).

Weights and Measures

This uneven rise in prices seen over the past year means that different groups of consumers have felt the effects of inflation in very different ways. The dramatic rise in new and used car prices seen in 2021 was primarily felt by the consumers and businesses that needed to buy (or chose to sell) a vehicle. Likewise, expenditure patterns can vary considerably across age, income, and other household characteristics—differences that can be examined in detail with Consumer Expenditure Survey data.

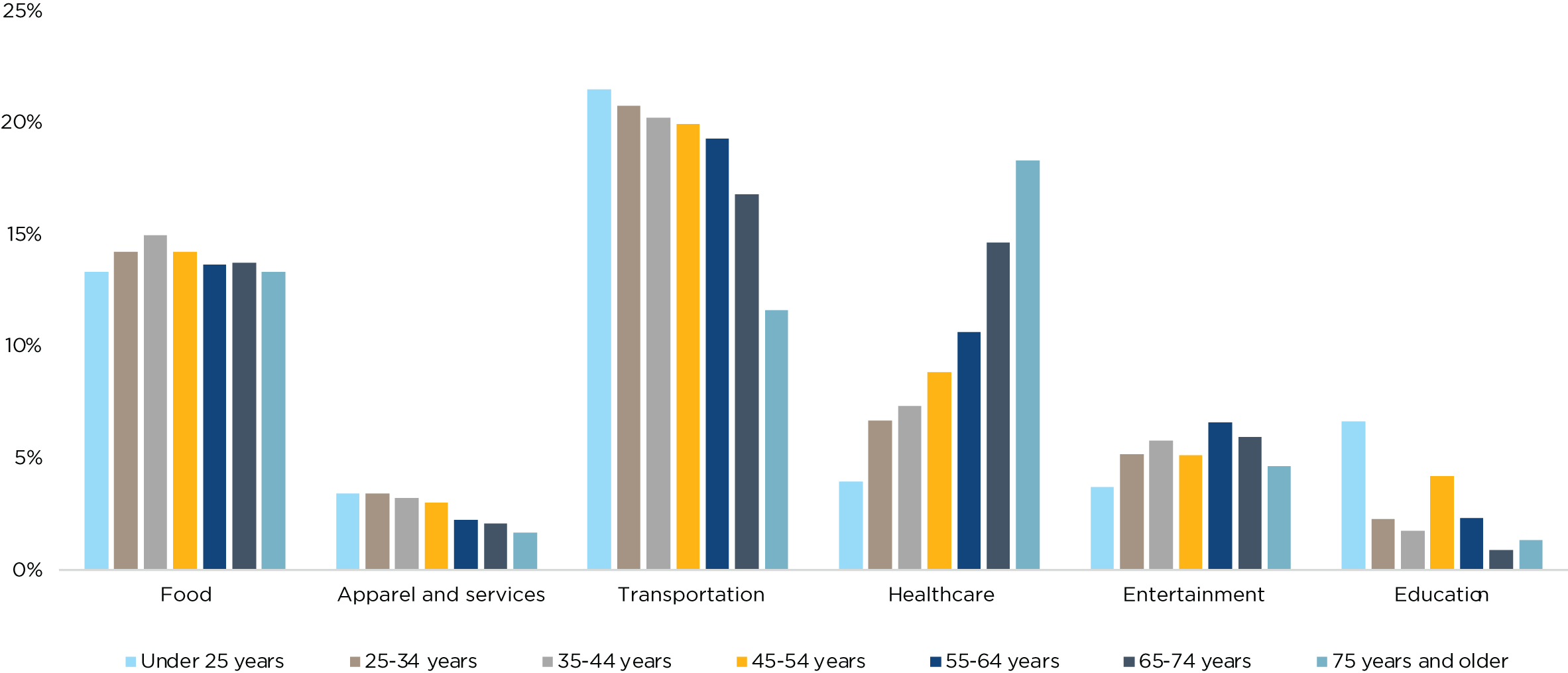

For example, Figure Three summarizes the 2020 consumer expenditure survey results that break down average consumer spending as a percentage of adjusted average annual expenditures (less cash contributions, personal insurance, and pensions), across a range of age segments.

Figure Three: Spending by Category and Age

Sources: U.S. Bureau of Labor Statistics (September 2021), CAPTRUST Research

As shown in Figure Three, some spending categories, such as food, don’t tend to vary much across age groups, while others—most notably health care, transportation, and education—can differ significantly. This means that price spikes within specific categories of goods and services can have an outsized impact on certain groups.

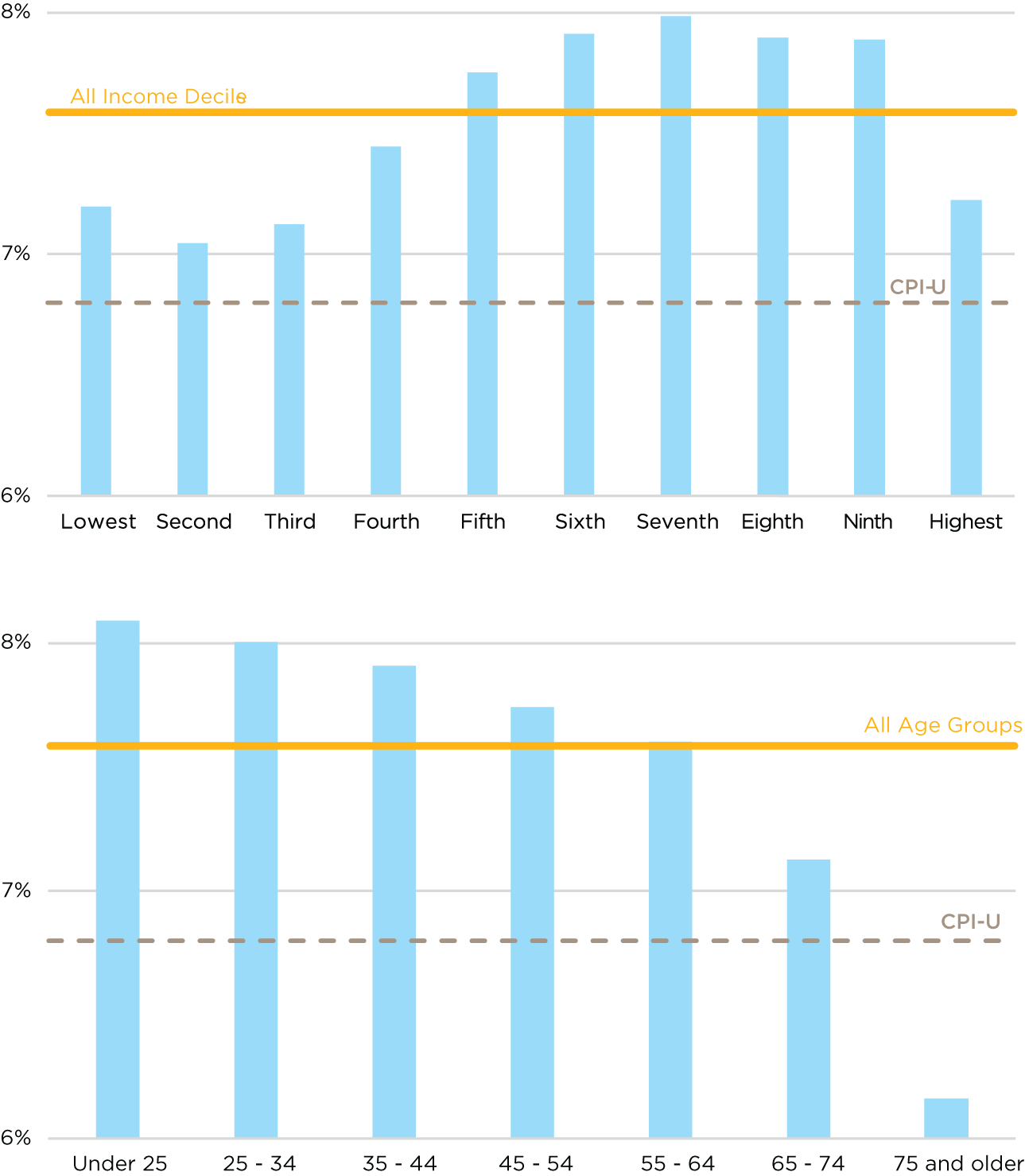

The availability of such detailed data on consumer expenditures allows us to adjust or reweight the November CPI data to illustrate the impact of inflation on different groups of consumers. Figure Four paints a picture of a very different inflation experience across different groups—even when limited to the broad brushes of age and income. When reweighted by differences in spending patterns, price pressures over the past year have been felt most acutely in households that are younger and within the middle- to high- income bands.

Figure Four: Reweighted November 2021 CPI, by Income Decile and Reweighted November 2021 by Age

Sources: U.S. Bureau of Labor Statistics, Consumer Expenditure Survey (September 2021), Consumer Price Index for All Urban Consumers retrieved from FRED, Federal Reserve Bank of St. Louis, CAPTRUST Research1

Note that reweighted CPI across all income and age groups of 7.6 percent differs from the November CPI reading of 6.8 percent. This difference is driven by differences in calculation weights due to the different time periods of the expenditure surveys, as well as differences in the populations surveyed (urban consumers for CPI vs. all consumers for the 2020 expenditure data).

Not surprisingly, the differences in inflation experience across groups is primarily driven by the degree to which each group is exposed to the categories (notably, transportation) that have experienced surprising price increases over the past year. Across income segments, the group with the largest share of transportation costs relative to income was the seventh decile, which includes those with 2020 before-tax income between roughly $76,000 and $96,000. When the November CPI results by category are applied to this group, their effective inflation jumps to nearly 8.5 percent.

Similarly, younger consumers tend to spend more of their paychecks on transportation costs relative to older cohorts. Given the complexion of inflation over the past year, this means that younger consumers may have felt the effects of higher prices the most.

The simple exercise above focuses on just one side of the ledger—expenditures—and does not reflect changes in income. If the wages for younger workers increased more than those of other groups, they may still be better off. However, it is still useful in thinking about which groups are more exposed to pockets of inflation as economic conditions change. If inflation pressures were to shift from transportation to health care, for example, as auto prices return to earth while the healthcare system continues to deal with lingering effects of the pandemic, then the inflation burden will likely shift toward older consumers.

But the key takeaway is that everyone’s consumption basket—and therefore their personal inflation experience—is a little different. Like any economic statistic, CPI is an abstraction of a system that’s far too complex to summarize with a single number, in the same way that no one would use the average daily temperature of the entire country to decide what to wear outside this morning. The experience in Phoenix and Anchorage will be very, very different.

Inflation and the Investor

As we move into 2022, there are reasons to believe that many of the inflation pressures described above will begin to ease as pandemic-altered consumption patterns and supply challenges continue to resolve. On the other hand, rising wages and rents may provide continued upward pressure on prices—and as illustrated earlier, changes across categories can affect different groups of people in very different ways.

But in addition to the inflation concerns of consumers are those of investors. Over the past year, one of the most common questions we’ve heard from investors of all types is: What can we do today to protect portfolios against inflation? As is so frequently the case with investment strategy, there is no silver bullet.

Part of the reason for this is a simple timing mismatch. By its very nature inflation is a long-term threat, which means it cannot be fully addressed with short-term tools. Some of the most commonly cited tools in the inflation toolkit— such as inflation-protected bonds, commodities, and gold—have shown an ability to react to short-term changes in inflation expectations but may also expose investors to other unintended risks or otherwise harm the total portfolio’s long-term return potential. Attempts at market timing often do more damage than good, and it can be shortsighted to reposition a portfolio for uncertain short-term risks at the expense of long-term success.

For long-term investors, the single best way to combat inflation is to seek to outgrow it via a diversified growth portfolio that is in line with their goals and risk tolerance.

But what investors can do today is think about what’s in their basket and how their consumption and income patterns are likely to change over time. In this way, inflation represents more of a planning problem than an investment problem, subject to a wide range of behavioral and cognitive biases, which, incidentally, are covered later in this issue. In his latest installment of Money Mindset, VESTED Editor-in-Chief John Curry explains the insidious effects inflation can have on our thinking and long-term financial plans—if you let them. “What’s So Bad About Inflation?” explains two cognitive biases that could lead to a big underestimation of the savings needed to fund long-term goals—or an overestimation of your future purchasing power.

1 Note that reweighted CPI across all income and age groups of 7.6% differs from the November CPI reading of 6.8%. This difference is driven by differences in calculation weights due to the different time periods of the expenditure surveys, as well as differences in the populations surveyed (urban consumers for CPI, vs. all consumers for the 2020 expenditure data).