First Quarter 2024 Investment Strategy | Powering Uphill

Interest rates have a similar effect on economies. When financing costs rise, business decisions about new projects, growth, and expansion become more complex—and risky. For consumers, big-ticket purchases become more expensive. Across the economy, higher interest rates can cause a broad slowdown as individuals try to conserve energy for the uphill climb. This is why interest rates are such a powerful monetary policy tool for combating inflation.

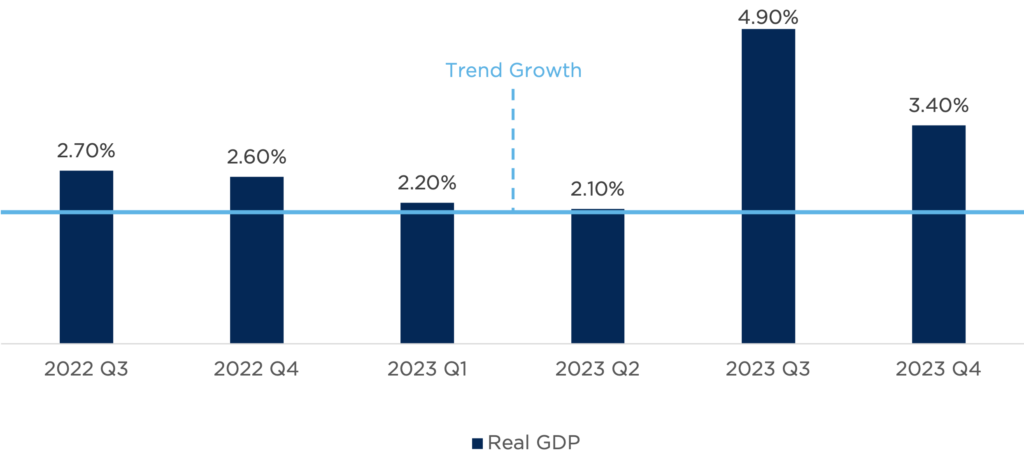

However, despite the Federal Reserve’s aggressive rate-hiking campaign over the past two years, the U.S. economy has not only maintained its pace on the uphill climb—it has accelerated. As shown in Figure One, real gross domestic product (GDP), the combined output of the U.S. economy, grew at an annual rate of 3.4 percent during the fourth quarter of 2023, easily outpacing the trend growth rate over the past 20 years of approximately 2 percent.

Figure One: Real GDP and Long-Term Trend Growth

Sources: U.S. Bureau of Economic Analysis, Federal Reserve Bank of St. Louis, CAPTRUST Research. Trend growth represents the average, seasonally adjusted annual growth rate over the past 20 years.

The stock market has likewise continued to climb, with the S&P 500 Index closing the first quarter of 2024 at an all-time high, surpassing its previous high-water marks 22 times during the quarter. What’s also impressive is the consistency of the ascent, with the index marking 277 consecutive trading days without a one-day decline of 2 percent or more.

So far, the U.S. has demonstrated economic athleticism in the face of rising rates. But with expectations now favoring a higher-for-longer scenario, with a Fed that is in no hurry to reduce interest rates in the face of sticky inflation, investors must consider whether the economy is strong enough to sprint across the finish line, or if its legs risk giving out just short of the goal.

Market Rewind: First Quarter 2024

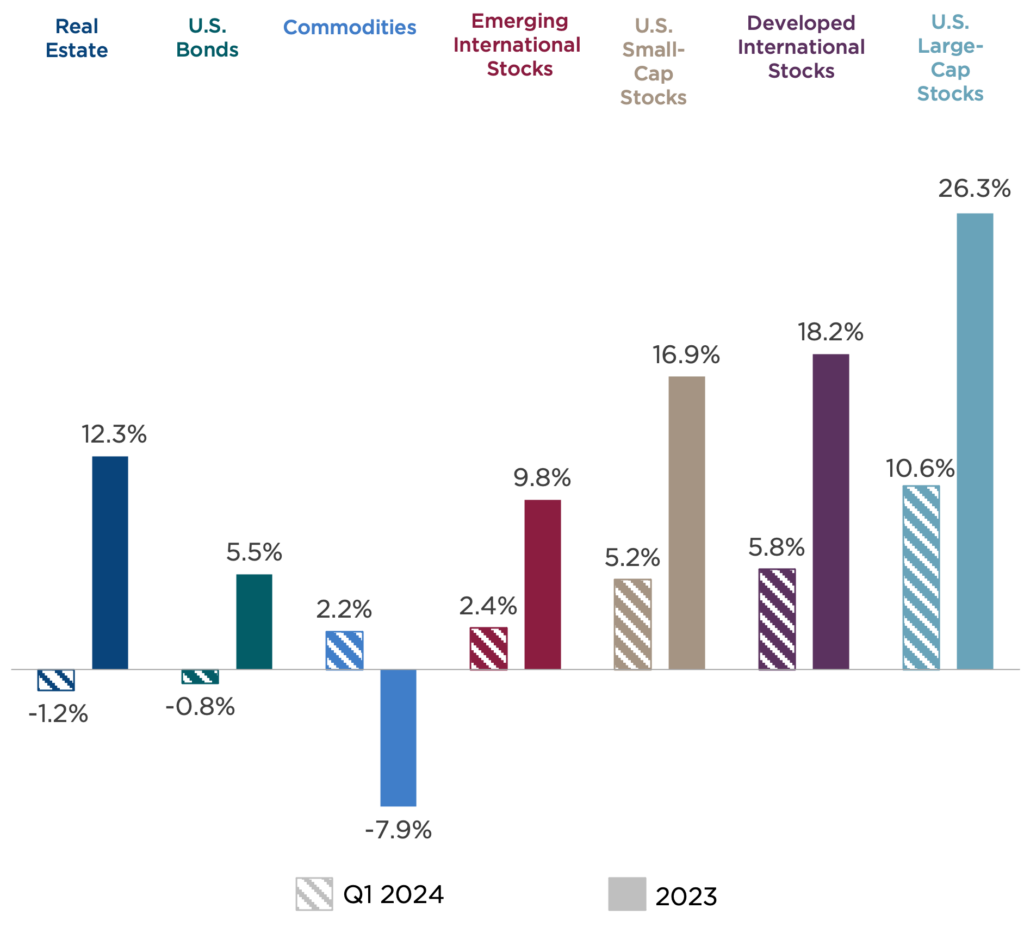

U.S. large-cap equities continued to power higher during the first quarter. The S&P 500 returned 10.6 percent, its best start since 2019, driving the one-year trailing return of the index to nearly 30 percent. All S&P sectors but one were positive. Those most closely aligned with the artificial intelligence (AI) boom continued to lead the market, including communication services and technology, which delivered returns of 15.8 percent and 12.7 percent, respectively.

Despite the continued strength of these sectors, markets also displayed a healthy expansion of participation during the first quarter. The much-talked-about Magnificent Seven mega-cap technology stocks were responsible for 60 percent of index returns in 2023, but their contributions fell to about 20 percent of index performance in March. Contributions from a broader swath of stocks is considered a sign of health in equity markets.

Figure Two: First Quarter 2024 Market Recap [1]

Value-oriented sectors, including financials, industrials, and energy, showed strength as well. In stark contrast to its lagging results during the fourth quarter of 2023, the energy sector showed a healthy return of 13.7 percent as oil prices rallied on strong demand expectations, supply constraints, and continued geopolitical concerns.

U.S. small-cap stocks rallied late in the quarter to erase their early losses and deliver a return of 5.2 percent. This represents a continuation of a three-year trend of underperformance relative to large- cap stocks. Investors continued to prefer mega-cap technology firms with higher profitability and showed a preference for less interest-rate-sensitive corners of the market.

Growth conditions also improved outside the U.S. during the quarter, with various sentiment and economic activity indicators on the rise. International developed market stocks returned 5.9 percent. Their emerging market counterparts trailed with a 2.4 percent return as the Chinese economy continued to face headwinds. Returns were particularly strong in Japan, where market-friendly regulatory reform pushed the Nikkei index past its all-time high, set more than 30 years ago.

The bond market proved less sanguine about the prospect of higher-for-longer interest rates. The yield on the 10-year Treasury climbed from 3.9 to 4.2 percent, leading to slightly negative returns for core bonds, along with higher mortgage rates and borrowing costs. Corporate credit spreads continued to tighten during the quarter, offering investors little incremental compensation for taking credit risk.

Gaining Momentum

Given the powerful impact that interest rates have on the economy and financial markets, it’s no surprise that the rapid rise of the federal funds rate in 2022 coincided with the largest stock market selloff since 2008’s global financial crisis. Since then, however, markets have shown remarkable tenacity.

Several strong tailwinds have supported economic resilience in the face of high and plateauing interest rates, including robust consumer spending, a healthy but not overheating labor market, strong expectations for corporate earnings, election year fiscal support, and optimism for an AI-driven productivity boom.

Consumer Spending

Consumer spending, which grew at an inflation-adjusted rate of 3 percent in the fourth quarter, was the largest contributor to the stronger-than-expected GDP growth at the end of that year. Consumers continued to spend despite ongoing inflation fatigue and higher debt servicing costs. This is largely due to the purchasing power provided by after-inflation wage increases.

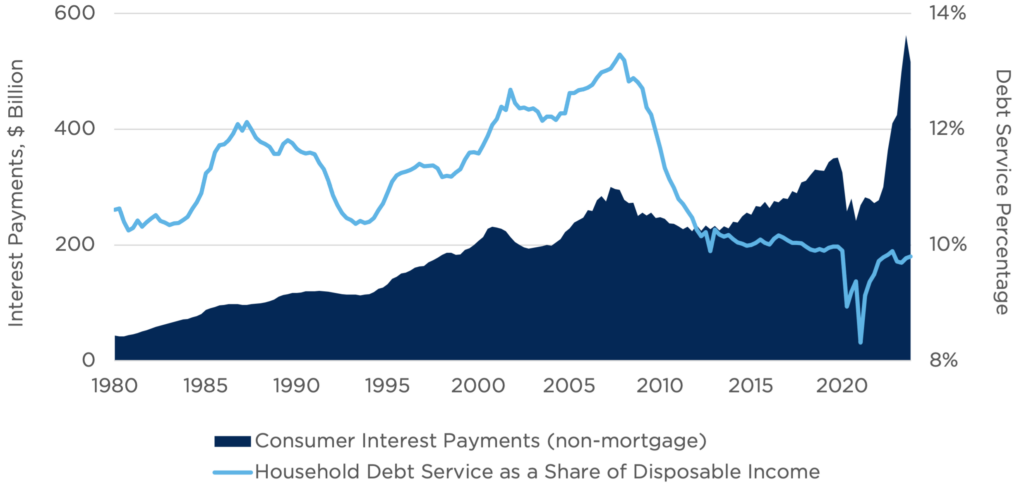

Consumers were also more reliant on credit to fund purchases, with credit card balances rising by 13 percent, even as credit card interest rates reached 30-year highs, according to Federal Reserve data. As shown in Figure Three, the result was a spike in the amount of non-mortgage interest paid by U.S. consumers. However, the increase was more than offset by rising real wages, allowing overall debt servicing costs to remain well below historical averages. This suggests that the tailwind of consumer spending may have more room to run.

Figure Three: Consumer Interest Payments and Share of Disposable Income

Sources: U.S. Bureau of Economic Analysis, Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis.

Labor Market

A robust labor market underpins the continued strength of consumer activity. The non-farm payroll jobs report presented a pleasant surprise in March, with the economy adding 303,000 jobs versus an expected 214,000. This degree of outperformance caught even the most bullish economists off guard. The unemployment rate fell to 3.8 percent, marking the 26th straight month that unemployment has remained below 4 percent.

The report was overwhelmingly positive. Still, there were subtle clues that momentum may be slowing. Employment in non-cyclical sectors, such as health care and education, was a larger driver of job growth than employment in more cyclical and economically sensitive sectors. Also, temporary employment declined, another potential indicator of future weakness. The ratio of job openings to unemployed workers continued to soften from its 2022 peak, and the quits rate remained at its lowest level since 2020, indicating that workers left jobs at a slower pace.

Earnings Growth

In 2023, equity market returns were closely tied to interest rate-cut expectations, and price gains came mostly from the expansion of price-to-earnings (P/E) multiples. Even with a strong fourth quarter, when S&P 500 earnings grew at a rate of nearly 4 percent on a year-over-year basis, calendar year 2023 earnings growth for the index was essentially flat, even as the S&P 500 returned more than 26 percent.

With a forward P/E ratio near 21 for the S&P 500, stock market valuations are expensive by historical standards, and returns from here will rely more on earnings growth than valuation multiple expansion. This represents a potential inflection point for equity investors as fundamentals come into greater focus. It also offers the potential for a lower degree of market concentration if businesses of all shapes and sizes are rewarded for strong financial results.

Expectations for 2024 earnings are robust, with analysts forecasting approximately 11 percent growth for the year. Corporate balance sheets are healthy, with high levels of cash as businesses prepared for a 2023 recession that never materialized. This excess cash now represents dry powder that could be deployed for investment and expansion or returned to shareholders. It could also provide a liquidity buffer in the event of a negative economic surprise.

Fiscal Support and Election-Year Dynamics

Another potential tailwind for markets this year is fiscal support from the federal government. This could come from both the continued rollout of already-enacted programs and election-year influences.

A range of in-process government programs will continue to provide economic support, including additional grants from the CHIPS and Science Act, the resumption of the Employment Retention Credit program, and student loan forgiveness. Restocking depleted weapons stockpiles will also create a tailwind for defense-related companies.

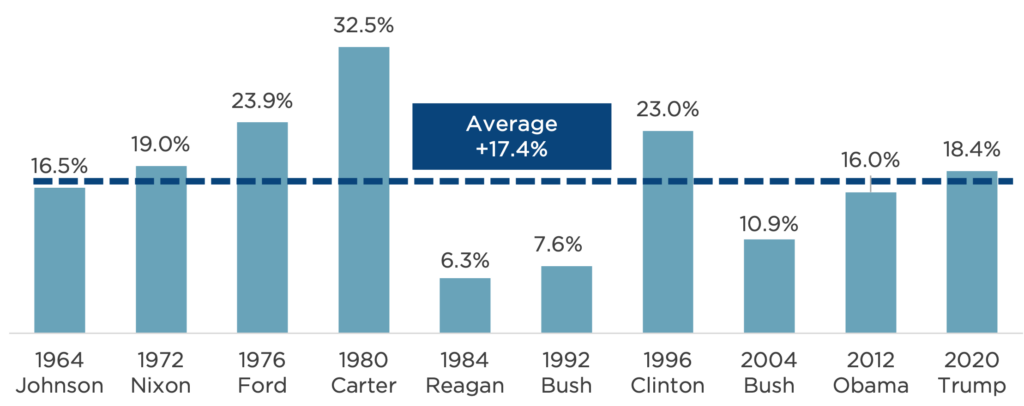

Federal election years have historically been favorable for markets, particularly when incumbent presidents are running for reelection. The economy is a consistent, top-of-mind issue for voters, encouraging market-friendly policy actions. As shown in Figure Four, the S&P 500 has ended the last 10 election years with an incumbent running for reelection in positive territory, with an average return of 17.4 percent.

Figure Four: S&P 500 Election Year Returns with Incumbents Running for Reelection

Sources: Morningstar Direct, CAPTRUST Research

AI-Driven Productivity Boom

Rapid and accelerating advancements in the AI field offer the potential for enormous productivity gains across industries. Productivity is an essential driver of economic growth and prosperity, and AI offers the potential to turn nearly every company into a technology company by automating and expediting tasks, anticipating problems, and making workers more productive.

The growth of an economy can be evaluated by assessing the total number of workers and the amount of economic output per worker. While workforce growth has decelerated amid slower population growth, per-worker productivity could increase meaningfully as AI automates a greater number of tasks and speeds up innovation and processing times. Some economists estimate that AI will increase productivity by 0.5% annually over the next decade, equating to an additional $1 trillion in GDP.[2]

The Course Ahead

While expectations for a dovish Fed pivot fueled late 2023 returns, the first quarter of 2024 delivered strong results despite a pullback of those hopes. At the beginning of the year, investors were predicting as many as six rate cuts during 2024, but by the end of March, that number had dropped to three, in line with the Fed’s own projections.

Recent data reiterates that the final leg of the inflation course may take longer than expected to complete, with more volatility. The Consumer Price Index rose 3.5 percent in March from a year earlier, well ahead of the Fed’s 2 percent target, as both goods and services showed continued price pressures. The Fed is reluctant to cut interest rates too soon for fear of an inflation resurgence, and the strength of economic data provides more room for them to wait.

We remain optimistic that the economy will continue to show resilience amid a higher rate environment. Solid economic activity, including a robust labor market and continued consumer and business spending, has diminished recessionary fears. However, we are also aware that equity prices and investor sentiment reflect this optimism as well, posing risks of a pullback if economic activity begins to falter or expected earnings growth fails to materialize. There are also continuing concerns about potential vulnerabilities within the commercial real estate market and the threat of geopolitical flare-ups that could pose risks to supply chains, trade agreements, and energy prices.

Market participants must now brace themselves for a longer uphill stretch than hoped. For runners, pacing is critical to a strong finish. It’s smart to leave some gas in the tank for the last mile. For the economy, the prospect of higher-for-longer interest rates means the distance to the finish line has likely grown. As always, investors would be wise to evaluate how the strong market results of the past six months have affected their portfolios and financial plans to ensure they are well diversified for the uncertain course ahead.

[1] Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (international emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

[2] “New Work, New World,” Cognizant and Oxford Economics, 2024