First Quarter Investment Strategy | Breaking Customs

Key Takeaways

• In a rule-shifting world, confidence and clarity come from diversification and sound planning.

• The first quarter marked a turning point, as markets that were priced for perfection met maximum policy disruption.

• Aggressive and unexpected trade policy shifts caught businesses, world leaders, and investors off guard. Market reaction was swift and severe.

What Happened

Over the first months of 2025, the investment landscape radically transformed. A few short months ago, markets were thriving, fueled by confidence in a stable economy, a strong outlook for corporate earnings growth, excitement for an artificial-intelligence-fueled productivity boom, and optimism around pro-growth policies from the new administration.

Today, investors find themselves grappling with the implications of the most significant reshuffling of global trade policy in a century. The networks of global commerce that have contributed to economic growth and prosperity, both here and abroad, have been upended by the Trump administration’s desire to radically rewrite the rules of trade.

The result could be one of the most important economic shifts of our lifetimes—or a short-lived negotiating tactic from a consummate dealmaker—and one that could change with a single social media post.

Either way, markets reacted powerfully as world leaders, business executives, and investors assessed implications for the global economy. U.S. stocks approached bear-market territory from their mid-February highs. Bond investments initially provided stability amid the chaos, before also succumbing to uncertainty. Gold rallied as a safe-haven asset amid the storm.

In such times, it’s important for investors to think clearly, assess the knowns and unknowns, and evaluate the impact to their financial objectives. How did we arrive at this position? What is the range of potential future outcomes? And most importantly, what steps should investors consider next?

How We Got Here

At year-end 2024, investors celebrated their second consecutive year of 25 percent returns for the S&P 500 Index—a rare occurrence in market history. From its low of March 2020, the S&P 500 had risen by 183 percent, with technology stocks surging more than 288 percent. International equities returned 93 percent during the same period, while bonds remained largely flat due to rising interest rates.

This divergence in returns was partly driven by the U.S. government’s fiscal decisions during and after the pandemic. The degree of COVID-19-era stimulus far surpassed that of other nations, fueling consumer spending and corporate profits, while also contributing to inflationary pressures, leading to higher interest rates.

Although optimism persisted as we entered 2025, we also began to see a shift in the familiar return patterns of the past few years. U.S. stocks showed a modest decline as economic indicators began to soften. Previously high-flying technology stocks showed weakness as investors began to worry that the artificial intelligence frenzy had maybe gotten ahead of itself. Meanwhile, international stocks outperformed, fueled by lower valuations and stimulus pledges to offset the tariff threat. Bonds benefitted from falling interest rates driven by rate-cut hopes.

Overall, the first quarter offered a great illustration of the benefits of global, multi-asset-class diversification.

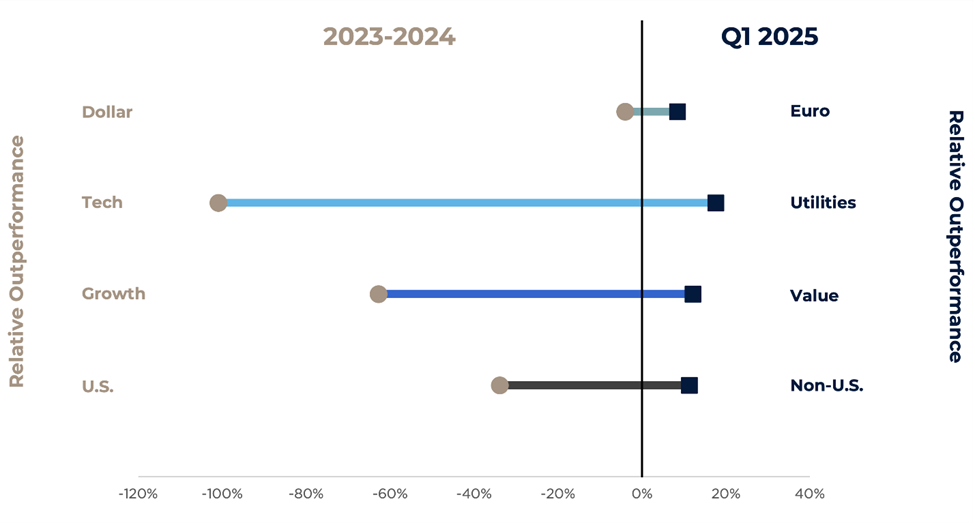

Figure One demonstrates the reversal of recent trends in the first quarter of 2025. In 2023 and 2024, the dollar, the tech sector, growth stocks, and U.S. equity markets showed relative outperformance. Today, however, we see relative outperformance from the euro, utilities, value stocks, and non-U.S. equity markets. Relative performance is a way to compare how two investments performed relative to one another over a specified period. It’s the difference in their returns over the period, and basically answers the question: Which one did better, and by how much?

Figure One: Reversal of Trends, First Quarter 2025

Sources: Federal Reserve Board, Morningstar Direct, CAPTRUST research. Sector returns reflect S&P 500 sector indexes. Growth and value returns reflect Russell 1000 Growth and Value indexes. U.S. and non-U.S. returns reflect S&P 500 and MSCI EAFE indexes.

Trade Takes Center Stage

This landscape shifted radically in late March and early April as the Trump administration moved on its trade agenda. What began as the sequential rollout of targeted policy grew to a crescendo on April 2, when the administration launched a sweeping import-tax program including a universal 10-percent tariff plus reciprocal levies calculated on each nation’s degree of trade imbalance.

If fully implemented, the announced tariff program would have raised approximately $600 billion in revenue—effectively, the largest tax hike in modern U.S. history— while ripping up the script of global commerce.

Market reaction was swift and severe. The S&P 500 suffered a series of days of 4 percent or greater losses, for a total drop of nearly 19 percent from its mid-February high. Global equity markets lost more than $5 trillion of market capitalization in a matter of days.

Meanwhile, the U.S. dollar weakened. Typically, in periods of market stress, investors flock to safe-haven, U.S. dollar-denominated assets, driving the dollar higher. This time, however, because the uncertainty was U.S. policy-driven, investors sought alternative havens, including gold and other major currencies, such as the euro and yen. This unexpected dollar weakness amplified the outperformance of non-U.S. stocks.

Treasury yields fell, suggesting investors were more worried about slower growth than rising prices. On April 4, the 10-year Treasury yield dipped below 4 percent before abruptly rising above 4.5 percent on an intra-day basis on April 9: a worrisome sign of market stress.

More than any other measure, spiking Treasury yields suggested that the market’s tolerance for uncertainty had neared its limit. This, along with rising pressure from businesses, led to the announcement of a 90-day pause on reciprocal tariffs, a move that sent stocks soaring. The S&P 500 rose by 9.5 percent—one of the largest single-day moves in the past 20 years.

Despite the 90-day pause and subsequent temporary exemptions, most of the proposed tariffs remain in place, raising the effective U.S. tariff rate from 2 percent to above 20 percent.

Global policymakers reacted swiftly to counteract the effects of U.S. tariffs. Germany launched an aggressive infrastructure and defense spending package to bolster domestic growth. China ramped up monetary and fiscal support. These measures underscore how profoundly the U.S. trade strategy has coursed through international economic policy.

Manufacturing Exceptionalism

The administration’s trade policy is driven by clear goals: enhancing U.S. prosperity, strengthening supply-chain resilience, reshoring manufacturing jobs, securing fairer trade terms, and funding tax cuts. It’s hard to argue with any of these goals.

What has been debated is the unorthodox approach the administration has taken, forcing parties to the negotiating table by applying maximum pressure. We have already begun to see ripple effects in the form of evolving trade relationships and international alliances. Like water, trade will always find ways to flow. When barriers are erected, new channels form.

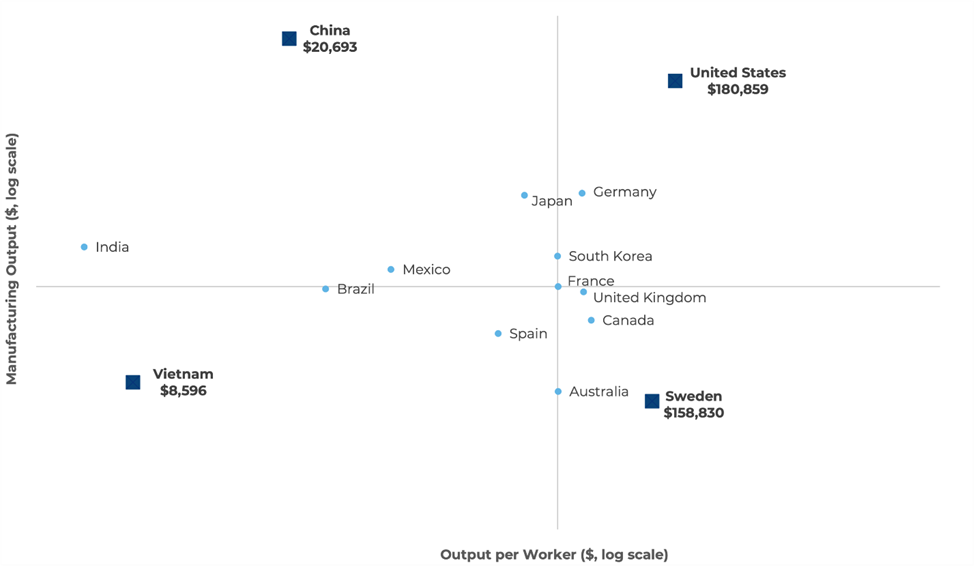

It’s important to recognize that we are starting these negotiations with a U.S. manufacturing sector that is already robust and globally competitive. Despite decades of trade deficits, U.S. manufacturing output approached $3 trillion in 2023, second only to China. As lower-margin production has shifted overseas, the U.S. has retained high-value manufacturing jobs while also becoming more productive.

While China leads the globe in total manufacturing output and employment, the U.S. leads decisively in total output per manufacturing worker. This reflects substantial competitive advantages in productivity, technology, and innovation.

Figure Two: U.S. Manufacturing Leadership, 01.01.2005 through 01.01.2023

Sources: World Bank; International Labour Organization; U.S. Bureau of Economic Analysis; Japanese Ministry of Economy, Trade and Industry; CAPTRUST research

If the administration’s strategy is successful and manufacturing jobs flood back into the U.S., another practical challenge is finding workers to fill them. Today, there are fewer available workers than job openings. In manufacturing alone, there are an estimated 460,000 job openings: a number expected to grow even before the administration’s recent moves. [1]

Fundamentals Take a Back Seat

With these strategic economic considerations as the backdrop, markets face another challenge: heightened uncertainty driven by opaque and unpredictable policy actions. This type of uncertainty, arising from behind-closed-doors negotiations and rapidly shifting stances, creates an environment particularly disliked by investors—one characterized by ambiguity rather than fundamentals.

This uncertainty is exacerbated by several critical factors.

- Unclear Objectives: The administration’s ultimate goals are ambiguous. Are tariffs intended to level the playing field, boost domestic manufacturing, or raise revenue to fund tax cuts?

- Tariff Trajectory: Almost-daily changes give markets little insight into the policy’s final shape or implementation timeline.

- The Fed’s Tricky Position: The Federal Reserve always faces a delicate balance between managing price pressures and maintaining full employment. Constantly shifting tariff targets make this task Herculean.

Business leaders are beginning to express concern. CEO confidence dropped sharply in April, reaching its lowest level since the pandemic, with two-thirds of survey respondents expressing concern over the potential negative impacts of tariffs. [2] Professional forecasters have also downshifted their economic growth expectations for 2025 while raising their recession odds.[3]

What Should Investors Do?

We clearly remain in a period of elevated uncertainty. There are no historical analogues to help us understand a global trade realignment of this magnitude, and markets are reacting in kind. Such periods of disruption often feel like a time to retreat.

Market volatility, while unsettling, is an important element of investing—not a flaw, but a feature—and precisely why equities offer higher expected returns.

While leading and bleeding headlines intentionally generate fear, and despite today’s volatility, portfolio diversification continues to anchor investor strategy. It is especially important when uncertain policies create the potential for uneven impacts across industries, sectors, asset classes, and regions.

Despite the rocky start, an investor with a balanced portfolio of 60 percent stocks and 40 percent bonds has likely experienced a drawdown in the mid-single digits so far this year. When measured against the degree of volatility and investor angst, losses in diversified portfolios have been relatively contained.

Of course, every investor’s situation is different. Risks, goals, income needs—none of these are one-size-fits-all. This is why we plan. A good plan isn’t knocked off course by periods of volatility; if built well, it can weather storms and help provide clarity in uncertain times. Businesses and markets will adapt. And if investors stay disciplined—diversified, long-term focused, and anchored to a plan—they will, too.

[1] U.S. Manufacturing Could Need as Many as 3.8 Million New Employees by 2033, According to Deloitte and The Manufacturing Institute

[2] Tariffs Push CEO Confidence to Multi-Year Low in April Poll; SBET Report—NFIB

[3] U.S. Economic Outlook Dives Just Three Months into Trump’s Term—WSJ

The information in this article is provided for informational purposes only, and does not constitute an offer, solicitation, or recommendation to sell or an offer to buy securities, investment products, or investment advisory services. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Nothing contained herein constitutes financial, legal, tax, or other advice. Consult your tax and legal professional for details on your situation. Past performance does not guarantee future results. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered with the SEC under The Investment Advisers Act of 1940.