Investors in Limbo as Fed and Markets Clash

With confidence bolstered by a tight labor market and strong consumer spending, throughout the first quarter of 2023, the U.S. Federal Reserve continued to communicate a steadfast commitment to bring down inflation. This signaled to markets that interest rates are likely to move higher and stay high for longer, thereby increasing the risk of a policy-induced recession.

Meanwhile, fractures emerged within the U.S. banking system due, in part, to the speed and magnitude of rate hikes so far. These events hold the potential to dampen future growth if they lead to tighter lending conditions.

Nevertheless, equity investors seemed to shrug off these concerns in the first quarter. Stock markets have been surprisingly calm. The S&P 500 Index enjoyed its best January since 2019, while the tech-heavy Nasdaq Index posted its best start to the year since 2001. Despite the dramatic rise in interest rates and the banking scare, the S&P 500 is still trading at more than 18 times earnings.

But all is not quite so calm in the bond markets, where a significant disconnect has appeared. The Fed is still in tightening mode, worrying over persistent inflation, while the bond market is signaling concerns about economic slowdown and the risks of recession. This ongoing clash will likely be the key story throughout 2023, with consequences for both the markets and the economy.

Figure One: First Quarter Recap—A Glimmer of Good News

Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

In stark contrast to last year’s losses, most major asset classes delivered positive returns for the quarter, led by international market stocks with high single-digit returns, aided by the weakening dollar. Within the U.S., the financial sector faced stiff headwinds and investors reacted to banking stress by rotating back to the comfort of mega-cap technology companies with fortress balance sheets and strong cash flows.

U.S. bonds also rebounded from last year’s painful losses, with a total return of 3 percent.

The standout performer of 2022, commodities were the only major asset class to experience negative returns, driven by declining energy prices fueled by fears that a slowing economy would reduce oil demand. The OPEC+ organization of oil-producing countries reacted by cutting production targets to raise prices. With U.S. shale production lagging due to higher financing costs and an uncertain regulatory environment, and with the Strategic Petroleum Reserve at its lowest level since the 1980s, the U.S. will now have fewer tools in its arsenal to rein in higher energy prices, which could contribute to lingering inflation.

Growth Conditions Persist

Global growth remained strong during the first quarter, providing bullish investors ample evidence of the potential for an economic soft landing. Consumers benefitted from a tight labor market and lower energy prices, while the pandemic reopening of China strengthened global growth conditions through higher domestic demand for goods and commodities. The rebound in U.S. and European purchasing managers’ index (PMI) survey data during the quarter also reflects improved global growth conditions.

Consumer purchasing power has also improved, as the prices of key items such as groceries and gasoline receded from their 2022 peaks. As shown in Figure Two, consumer sentiment—a key driver of consumer spending behavior—has also rebounded significantly from its all-time low in June 2022 as food and energy prices eased.

Figure Two: Consumer Sentiment and Food and Energy Prices (2022-2023)

Source: Federal Reserve Bank of St. Louis

While savings rates have declined and credit card balances have grown, economists estimate that consumers still hold approximately $1 trillion of excess savings accumulated during the pandemic that can continue to fuel consumer spending. According to Federal Reserve data, overall household financial obligations, including debt, leases, property taxes, and rents, also remain low relative to levels of disposable personal income.

By driving wages higher, the robust labor market has also contributed to consumer confidence and spending. Although tight labor conditions may be a thorn in the Fed’s side as it seeks to control inflation, these conditions continue to support economic activity. Even so, workers have struggled to keep pace with rising prices. March 2023 was the 23rd consecutive month when wage growth failed to keep pace with inflation, a sign of weaker bargaining power among the workforce that may suggest less risk of a wage-price inflation spiral.

Mixed Progress on Inflation

The strength of the labor market provides room for the Fed to continue its aggressive inflation-fighting campaign. Since 1970, there has not been a recession with the unemployment rate at its current level of 3.5 percent. The Fed views price stability as a prerequisite for an economy that works for everyone, and over the past year, it has acted forcefully to attain this objective, raising the fed funds rate nine times from 0 to 4.75 percent.

The March Consumer Price Index (CPI) showed mixed results toward this objective. The combination of higher interest rates, tighter lending standards from banks, and consumer spending behavior brought headline inflation down to a year-over-year level of 5 percent. While this is still far above the Fed’s 2-percent target, it shows significant progress relative to the 9 percent level seen last summer.

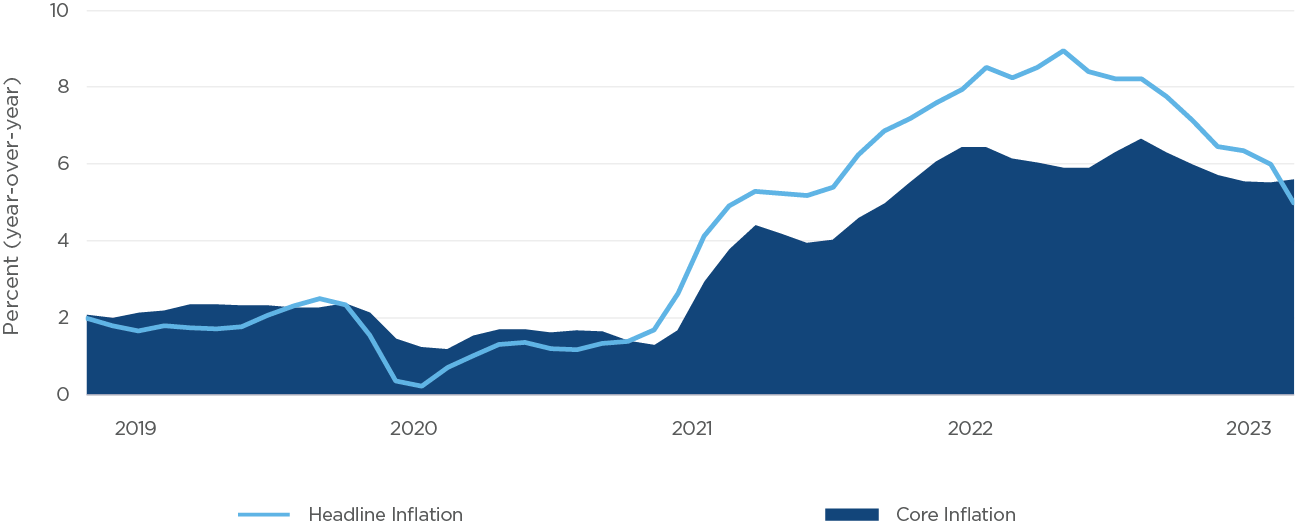

Headline inflation encapsulates a wide range of goods and services, and its return to levels not seen in nearly two years is good news. However, as shown in Figure Three, another closely watched measure called core inflation increased slightly in March. By excluding some of the most volatile categories, such as energy and food, core inflation is considered by many as a more reliable indicator for predicting future inflation trends than headline inflation. If its downward progress stalls or levels out, this could be a sign of inflation that risks becoming entrenched.

Figure Three: Core vs. Headline Inflation (Mid-2019 to Present)

Source: U.S. Bureau of Labor Statistics

A Banking Tremor (Not a Crisis)

In light of this combination—a strong labor market and sticky inflation—the Fed continues to signal that additional rate hikes lay ahead. Notes from its March meeting suggest that virtually all committee members expect the fed funds rate to rise to at least 5.1 percent, which would suggest at least one more rate hike at its May meeting, after which rates would likely remain steady through year-end. The Fed is reluctant to reverse course too soon, which could allow inflation to regain its footing.

It is often said that, when trying to fight inflation, the Fed raises rates until something breaks. Yet, in addition to managing inflation, the Fed is also charged with maintaining financial stability. The challenge of balancing these two objectives came into clear view throughout March, after a bank run led to the second largest bank failure in U.S. history. This was followed by a second collapse soon after.

The root cause of these isolated collapses goes back to the pandemic, when households were flush with cash and interest rates were extraordinarily low. Bank deposits swelled, so banks did what they always do: They looked for ways to earn money on those deposits. To earn a greater net interest margin—the difference between deposit rates and what the bank can earn on its securities and loan portfolio—they loaded up on bonds.

But, as interest rates rapidly rose, those bonds declined in value. At the same time, rising interest rates made alternatives to bank deposits, such as money market funds or Treasury bills, more attractive to bank clients. As depositors withdrew funds from banks to take advantage of higher yields, banks were forced to sell securities at a loss, negatively impacting bank capital levels and liquidity.

To keep these isolated cases from causing stress on the larger financial system, the Fed stepped in, providing liquidity to banks through a new program called the Bank Term Funding Program. In effect, the Fed was helping to address the very problem it created—acting as both the arsonist and the firefighter.

These bank failures were isolated and idiosyncratic, but stresses within the banking system represent a form of tightening financial conditions that will either make the Fed’s job easier or risk pushing the economy into recession. In the week following these regional bank failures, consumers withdrew more than $180 billion from small banks—the largest weekly deposit decline of the last 20 years. Declines in deposit balances could leave small and midsize banks vulnerable, leading to tighter lending conditions particularly for real estate and small business loans.

Earnings Pressures

Historically, recessions have always coincided with a decline in corporate earnings. According to FactSet, earnings for the S&P 500 companies fell by nearly 5 percent in the fourth quarter of 2022 and are expected to have fallen by another 6.8 percent in the first quarter of 2023. If FactSet’s estimate proves to be true, this would mark the largest decline in earnings since early 2020.

Corporate profit margins are under pressure on several fronts. Companies face rising labor and input costs, greater scrutiny of supply chains, rising inventories as pandemic-driven demand slows, and importantly, rising financing costs. For companies and industries calibrated to the extraordinarily low interest rates of the past decade, moving to more historically normal interest rate levels will be a difficult transition.

Debt Ceiling Drama

An important deadline looms in mid- to late summer: the need for Congress to raise the U.S. debt limit. The U.S. debt ceiling represents the cap on the amount of money that the Treasury can owe before it risks a default on its debt. Congress has raised the debt ceiling 78 times since 1960, typically without fanfare.

Not raising the debt limit and defaulting on U.S. obligations would have devastating economic implications. As Treasury Secretary Janet Yellen recently told lawmakers, global confidence in the U.S. government to reliably pay its bills is the cornerstone of what makes the U.S. economy the soundest and best in the world.

With such serious consequences, the debt ceiling problem is likely to be solved. However, given the high degree of political polarization and the tight margins between political parties in Congress, reaching an agreement could be difficult and holds the potential to inject volatility into markets. Outside the U.S., the geopolitical landscape also remains challenging, with no end in sight for the war in Ukraine, escalating tensions between the U.S. and China, and more recently, the leak of top-secret Pentagon documents that reveal intelligence on adversaries, competitors, and key partners.

The Fog of Data

As the Federal Reserve ponders the forward path of interest rates, it has reiterated its dependence on data to guide its course. In this especially unpredictable environment, investors cling to every piece of new data, examining each detail through the lens of the Fed to determine if it’s good or bad news.

For much of 2022, the market’s expectations and the Fed’s own projections were tightly aligned. However, the two began to diverge late in the year. The Fed continued to emphasize its higher-for-longer stance, while markets envisioned a faster pivot, sending rate expectations lower. This difference of opinion will likely be a key driver of market behavior for the remainder of 2023.

For investors, there are several key points to remember in this type of environment. First, don’t be lulled into complacency by the orderly returns we saw in the first quarter. While prices and valuations suggest that calm has been restored to markets, powerful forces are still at work, promising a suspenseful and eventful remainder of the year.

Also, in choppy, directionless markets, income from dividends or coupons becomes an even more important source of total return. For long-term investors, this is a reminder that being aware of the environment does not mean reacting to every headline that crosses the screen.