Pension Funding Relief Included in the American Rescue Plan Act of 2021

The American Rescue Plan Act (ARP) of 2021 contains approximately $1.9 trillion worth of fiscal stimulus intended to address issues resulting from the COVID-19 pandemic. While the ARP contains a variety of fiscal stimulus measures, this summary focuses on the provisions impacting multiemployer and single-employer retirement plans. It is not intended to be a detailed analysis of the comprehensive measures contained in the ARP.

Multiemployer Plan Funding Relief Measures

Subtitle H—Pensions: Sections 9701 – 9704 and a new ERISA Section 4262

All multiemployer plans are characterized by an economic risk zone of red, yellow, or green. When plans are characterized in the yellow (endangered and seriously endangered) and red (critical) zones, current law requires certain remediation actions such as funding improvement or rehabilitation plans. The ARP provides relief by temporarily delaying the designation for those in the yellow and red zones, delaying certain participant notices and other requirements. Additionally, the ARP provides an optional and temporary five-year extension of the funding improvement and rehabilitation periods for plans in endangered or critical status.

The most significant provision for multiemployer plans creates a Special Financial Assistance Program for financially troubled plans. This legislation allows for funds from the general fund of the Treasury to be transferred into a special fund in the Pension Benefit Guaranty Corporation (PBGC) at the direction of the Secretary of the Treasury and the director of the PBGC. These funds will provide financial assistance to multiemployer pension plans in danger of insolvency (critical and declining), subject to certain provisions. Those plans will not be required to repay this financial assistance. For potentially impacted plans, the ARP contains further detailed provisions, which should be reviewed to ensure appropriate utilization of the relief measures provided.

Finally, the ARP includes adjustments to the funding standard account rules detailed in the legislation.

Multiemployer plan sponsors should work with their actuaries to determine the appropriateness of available temporary relief provisions offered under the ARP. Additionally, plan sponsors with plans characterized as critical and declining should consult with professionals to determine their eligibility in the Special Financial Assistance Program.

Single-Employer Funding Relief Measures

Subtitle H—Pensions: Sections 9705 – 9706

Corporate pension plan sponsors must estimate their defined benefit pension plan’s funded status on a regular basis to determine if they possess adequate assets to meet the benefit obligations promised to participants and determine minimum required contributions. To provide this estimate, actuaries determine the present value of future benefit payments, or the liability (in today’s dollars) for comparison to current assets. Actuaries discount future payments by an assumed interest rate often referred to as the discount rate. When this discount rate is higher, the present value of liabilities is lower, and vice versa.

The ARP eliminates any existing shortfall amortization basis for historical years preceding the 2022 plan year. This effectively provides plan sponsors a clean slate; prior shortfalls will not be factored into minimum required contribution calculations. It also increases the current seven-year amortization schedule to 15 years, which will reduce minimum required contributions in the coming years. Plan sponsors may elect to apply this fresh start to shortfall amortizations to an earlier plan year, specifically 2019, 2020, or 2021.

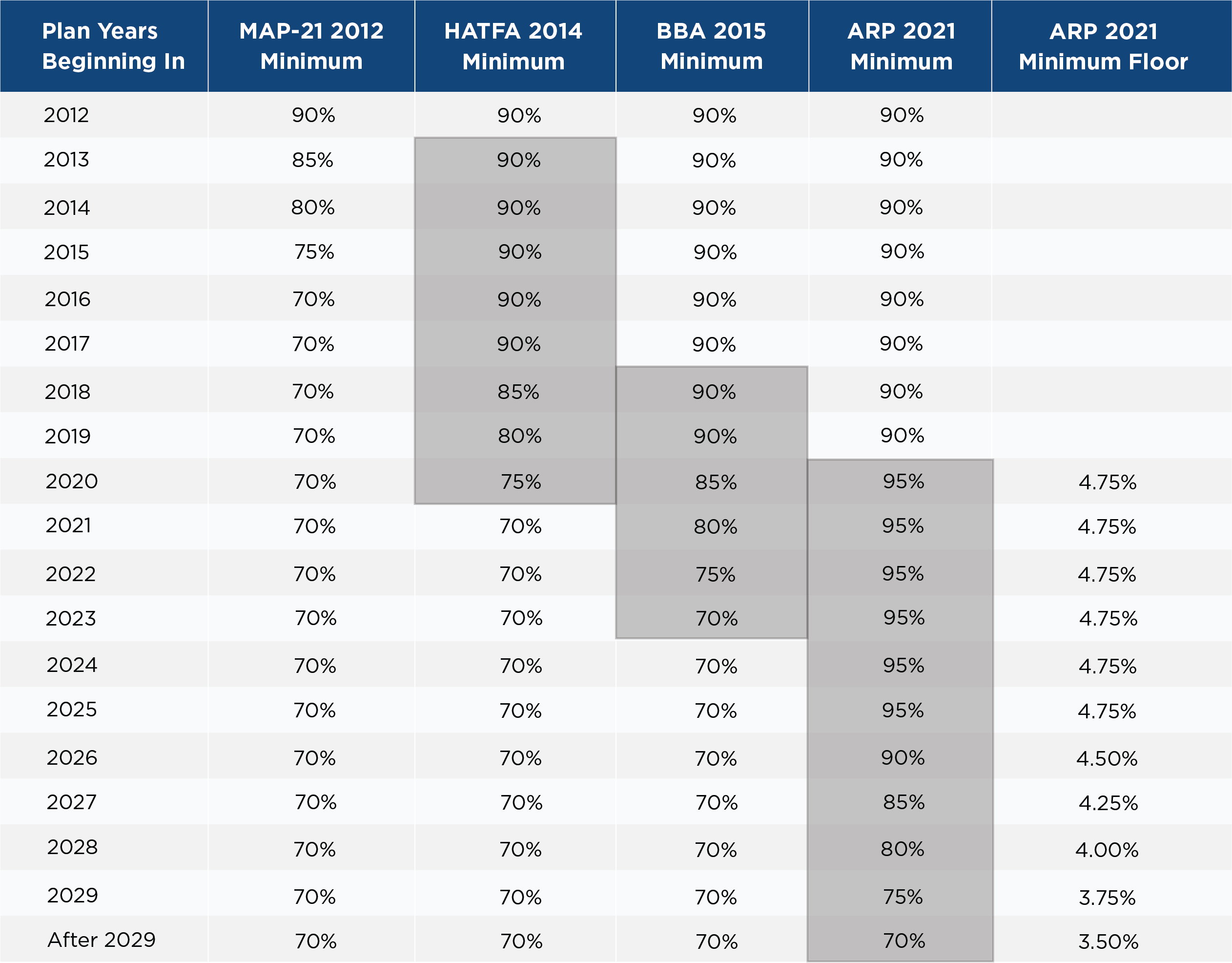

Previous legislation allowed actuaries to shift from using a two-year average of interest rates based on maturity to allowing the use of a corridor around 25-year averages. Essentially, actuaries reference the two-year average of interest rates at a given maturity. If that number is below the corridor relative to the 25-year average, as shown in Figure One, actuaries use the minimum rate, which is defined as a percentage of the 25-year average.

The ARP essentially extends the minimum corridor provisions of several previous Acts, including MAP-21 2012, HATFA 2014, and BBA 2015, which prescribe the use of higher historical interest rates, higher funding ratios, and therefore lower minimum required contributions.

Figure One: Minimum Corridor Percentage Applied to the 25-Year Average Discount Rate*

*If the two-year average discount rate is below the 25-year average under current and previous legislation, which Is also subject to an absolute minimum under ARP.

Source: CAPTRUST Research

Lastly, the ARP creates a minimum deemed 25-year average discount rate, which essentially creates an absolute interest rate floor, as noted in Figure One.

Plan sponsors should work with their actuaries to determine the implications of these new rules on minimum funding requirements. While this legislation will create more flexibility in funding strategies, we encourage plan sponsors to consider a defined funding policy based on their specific objectives. Ultimately, plan sponsors will need to determine the appropriate balance between contributing to their plans to shore up funding and investing in their core businesses and operations as allowed by the law.

As always, we continue to monitor the legislative and regulatory landscape. We look forward to assisting you in evaluating the implications to your organization.