Understanding and Evaluating Retirement Plan Fees, Part Two: Benchmarking Investment Fees

NOTE: Information on this page has been updated as of August 2024.

When it comes to fee benchmarking, most advisors and plan sponsors tend to think first about recordkeeping and other vendor costs. But investment fees are another important component of retirement plan fees. Retirement plan sponsors need to benchmark their plans’ investment fees to meet their fiduciary obligations. However, evaluating investment costs is complicated, and sponsors may encounter a series of common pitfalls. Here are a few to be aware of.

Benchmarking only the total expense ratio of the fund: A fund’s total expense ratio may not take into consideration all the components that comprise that fund’s true cost. This is particularly true for funds with revenue sharing.

Revenue sharing consists of fees built into the expense ratios of the plan investments. These fees are often used to offset plan expenses, like recordkeeping and administration. The amount of revenue sharing present within a fund’s expense ratio is a function of how the plan sponsor opts to pay for plan expenses. It is not directly tied to how much an asset manager charges to manage the fund. Recordkeeping and administrative fees are typically benchmarked separately by the plan sponsor.

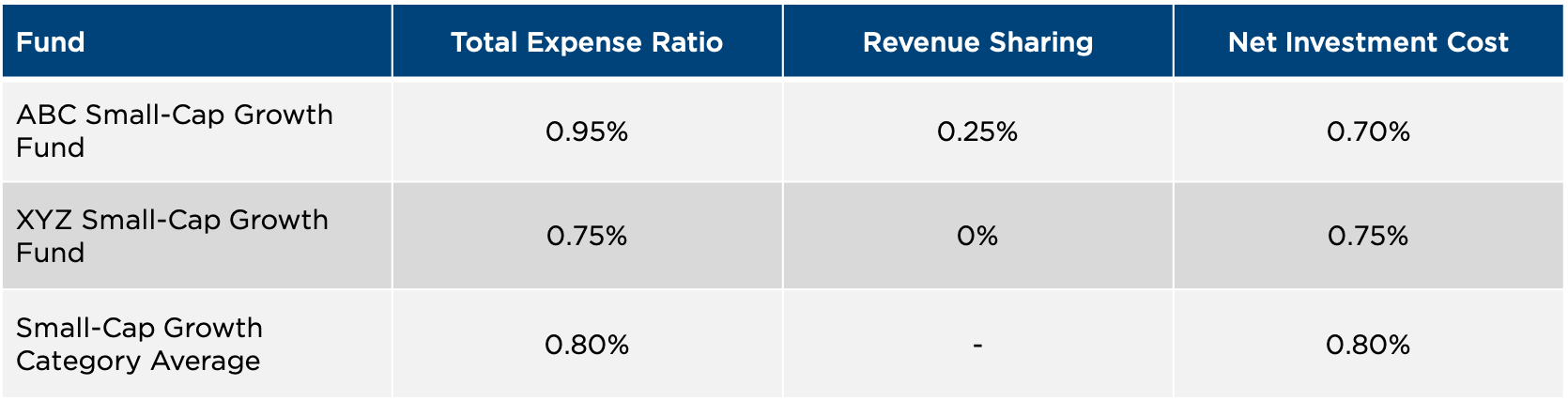

Comparing the overall fund expense ratio without isolating the net investment fee component can result in a misinterpretation of benchmark results. Figure One demonstrates this concept.

Figure One: Understanding Total and Net Investment Costs

Source: CAPTRUST Research

IIn this example, the ABC Small-Cap Growth Fund has a higher total expense ratio than the category average and the XYZ Small-Cap Growth Fund. One could, therefore, erroneously conclude that its investment fees are high when compared to both. However, incorporating revenue sharing into the equation results in a net investment cost lower than both the category average and the XYZ Small-Cap Growth Fund.

Not considering investment fees in conjunction with overall investment performance of the fund: It’s important to evaluate investment costs in conjunction with fund performance. The Employee Retirement Income Security Act (ERISA) requirement for plan sponsors to determine that plan fees are reasonable is in consideration of the services received. In the case of a fund, the service received can be considered the fund’s performance relative to standards set by the plan sponsor. That’s why actively managed funds typically charge more than passively managed investments.

When funds are benchmarked, sponsors usually evaluate costs before performance standards.

It is important to remember that the lowest fee is not always the best value. The fund’s investment fees may be reasonable if, net of all fees, the fund is meeting performance standards set by the plan. This is true even if its net investment fee is higher than the appropriate category average. The determination should be made by the plan sponsor.

The takeaway: Benchmarking investment fees can be complicated, and it’s not always clear whether a fee is reasonable. Making an accurate comparison is sometimes harder than it sounds.

Like other plan fees, investment fees should be reviewed on a periodic basis. Plan sponsors should understand how the investment fees for their plan compare to alternatives in the market and in consideration of the services received.

In part three of this series, we dive into the revenue-sharing portion of a fund’s expense ratio and how share class selection can impact the method by which plan sponsors pay for plan expenses.

Legal Notice

This material is intended to be informational only and does not constitute legal, accounting, or tax advice. Please consult the appropriate legal, accounting, or tax advisor if you require such advice. The opinions expressed in this report are subject to change without notice. This material has been prepared or is distributed solely for informational purposes. It may not apply to all investors or all situations and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. The information and statistics in this report are from sources believed to be reliable but are not guaranteed by CAPTRUST Financial Advisors to be accurate or complete. All publication rights reserved. None of the material in this publication may be reproduced in any form without the express written permission of CAPTRUST: 919.870.6822.