Stick the Landing

For example, consider the gymnastics events. Long before sprinting toward the springboard in the vault competition, each gymnast has calculated the necessary number of twists and turns required to earn a medal. But success is not decided solely by the complexity of their routine. It also depends on whether they can stick the landing. The same is true in an economic context.

Over the past few years, we have witnessed a dizzying array of economic twists and turns, from pandemic-driven volatility to an inflation surge and aggressive interest rate hikes by the Federal Reserve. Now, investors are watching to see whether the Fed can stick the landing and control inflation while avoiding a recession.

Will policymakers be able to achieve an economic soft landing, or will they create conditions for a rough landing that pushes the economy into recession? Or could we experience something in between: a bumpy landing with an extra step that costs us a few points but doesn’t do much damage?

As the Fed carefully watches the economic data, there are some signs that suggest the rate-hiking cycle could soon end. But others could signal there is more work to be done. The stock and bond markets seem similarly confused; equities have shown continued resilience this year, while bonds have undergone a painful recalibration.

Third-Quarter Recap: Losses for Stocks and Bonds

After a strong first half of the year, U.S. stocks fell in the third quarter, particularly in September when the S&P 500 Index dropped nearly 5 percent. Although this ended a three-quarter streak of consecutive gains for large-cap U.S. stocks, as shown in Figure One, U.S. large- and small-cap equities remain positive for the year.

Growth and value stocks moved in tandem, although growth still leads the year by a generous spread. Interest-rate-sensitive sectors such as real estate and utilities lagged for the quarter, each with losses near 10 percent. Energy was the best-performing sector by a wide margin as the price of oil climbed by more than 20 percent during the quarter. This pushed commodities into positive territory as the only major asset class to end the quarter with a gain.

Figure One: Third Quarter and Year-to-Date Returns

Outside the U.S., both developed and emerging market stocks slumped, due in part to a U.S. dollar that strengthened for 11 consecutive weeks. European shares were weighed down by concerns about the impacts of rising interest rates as the European Central Bank raised policy rates twice during the quarter.

The third quarter was particularly difficult for bond investors. The total return from U.S. core bonds was -3.2 percent, as the 10-year Treasury yield advanced by more than three quarters of a percent to the highest levels in more than 15 years. These losses pulled year-to-date returns for core bonds into negative territory, at -1.2 percent. The Fed’s higher-for-longer interest rate message finally seems to be sinking in with investors.

The Economy Surpasses Expectations

2023 began with widespread anticipation of a recession, yet the U.S. economy has held up far better than expected and continues to grow. Now, easing inflation pressures and signs of a loosening labor market are fueling optimism that the economy could attain the elusive soft landing.

Several factors have helped the U.S. avoid the economic slowdowns witnessed across Europe and China. This includes inflation that has fallen to more manageable levels and a jobs market that, although tight and challenging for employers, offers consumers the ability and confidence to spend. Also, the housing market, an important driver of household wealth, appears to have stabilized despite limited supply and high mortgage rates.

Can Consumers Go the Distance?

The key question heading into this year was how long American consumers could continue as the driving force behind the economy. Even with dwindling savings and rising interest rates, consumers have almost single-handedly kept the economy out of recession.

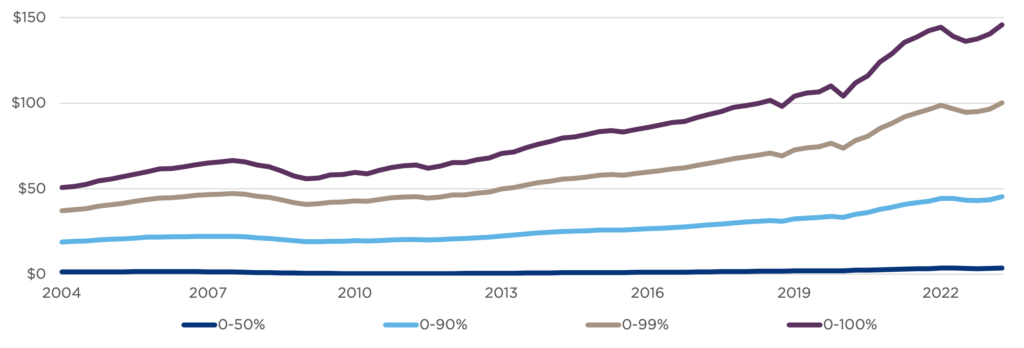

Personal consumption increased by more than 5 percent this quarter compared to a year ago, while retail sales continued to surpass expectations. And, as shown in Figure Two, although the excess savings people accumulated during the pandemic has been largely depleted, household net worth has bounded upward, increasing by a staggering $42 trillion since the first quarter of 2020, to a record-high level of $146 trillion.

Figure Two: Household Net Worthby Wealth Percentile Groups ($T)

Sources: Board of Governors of the Federal Reserve System, Distributional Financial Accounts

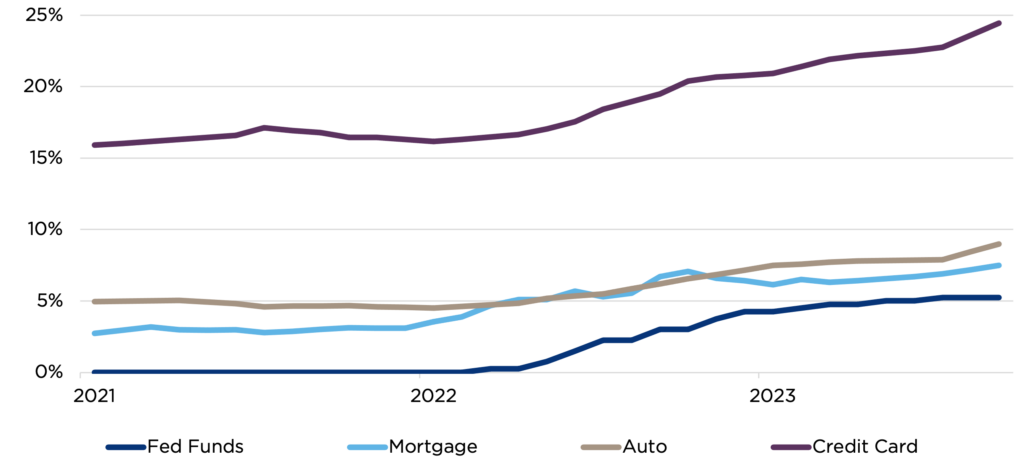

But even as U.S. consumers carry the economy on their shoulders, they face several significant headwinds moving into 2024. One important headwind is dramatically higher interest rates. As shown in Figure Three, consumer borrowing costs have risen across several important categories, including credit cards, auto loans, and mortgages. Rising debt balances and interest costs harm consumer spending because consumers must divert money away from current spending to pay interest and repay debt.

Figure Three: Soaring Consumer Borrowing Costs

Sources: St. Louis Federal Reserve, Board of Governors of the Federal Reserve System, Freddie Mac, Bankrate, LendingTree, CAPTRUST Research

Other headwinds include the resumption of student loan payments, with the net effect of an $8 billion per month drain on consumers’ spending capacity. Likewise, gas prices have risen by $0.63 per gallon since year-end 2022—the equivalent of an $86 billion tax on the U.S. economy.[1]

Finally, both consumers and businesses are facing tighter lending standards as banks respond to tough business conditions. However, although loan delinquencies have risen, they remain in line with the pre-pandemic trend, largely because of the amount of outstanding debt that is set at a fixed rate.

Given these challenges, it’s no surprise that measures of consumer confidence declined further in September. A slowdown in consumer activity seems likely from here.

Mixed Signals from the Labor Market

Another source of economic resiliency this year is the continued strength of the U.S. labor market. The September payroll report exceeded estimates as employers added 336,000 jobs in September—the highest reading since January. This report also revised July and August numbers upward by nearly 120,000 jobs.

Wages increased at a rate of 4.2 percent on a year-over-year basis, as the unusually tight labor market has increased the bargaining power of workers. This is also evidenced by ongoing labor strikes across various sectors, including the entertainment industry, health care, and manufacturing.

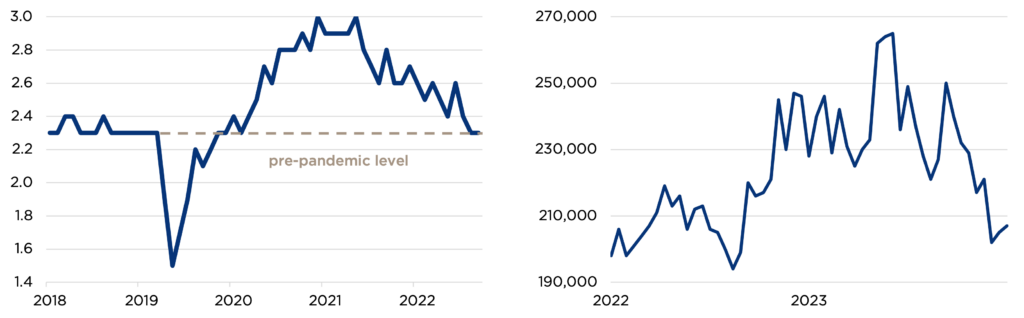

Many signs point to a still-red-hot labor market. As shown in Figure Four, after briefly topping a level of 250,000 in mid-summer, initial jobless claims data has trended steadily downward, indicating employers’ reluctance to let go of workers. However, there are also signs that the labor market is beginning to normalize. The quits rate, one measure of worker confidence in the labor market, has cooled considerably since the post-pandemic resignation boom. These mixed signals are difficult for economists to interpret.

Figure Four: Labor Market Mixed Signals: Quits Rate vs. Initial Claims

Sources: U.S. Bureau of Labor Statistics, U.S. Employment and Training Administration

Fed Policy Apparatus

The Fed left its policy rate unchanged in June and again in September, signaling optimism that it may be approaching the end of its rate-hiking campaign. However, following the last Fed meeting, Fed Chair Jerome Powell hinted that another rate hike could be in the cards for 2023, along with a somewhat cryptic statement that one can know when monetary policy is sufficiently restrictive, in his words, “only when you see it. It’s not something you can arrive at with confidence in a model or in various estimates.”

In other words, there remains significant uncertainty about the future path of Fed policy.

There is also uncertainty about the path that potential future rate cuts could take. If inflation remains elevated above the target while the economy stays strong, then interest rates could stay high for some time. But if inflation recedes to more comfortable levels, the Fed could begin mild rate cuts as soon as next year. Or, if the economy stumbles into recession, the Fed may be forced to cut rates more rapidly.

The Bond Market Dismount

Although the economy has not been knocked off course by the Fed’s actions, the bond market has been. The Fed’s higher-for-longer mantra has caught the attention of bond investors, sending yields up and prices down.

Core bonds are now flirting with their third consecutive year of negative total returns, even though fixed-income markets are offering their highest yields in more than 15 years. In this environment, only bonds at the short end of the maturity spectrum showed gains.

The tumbling bond market was somewhat surprising, given the widespread view that both the global and U.S. economies were moving toward recession. Slowing growth should be supportive of bond prices as investors seek safe haven investments, alongside an expectation for lower inflation and central bank rate cuts. One theory is that bonds were slow to react to rising rates because of recession expectations. Another possible explanation is the growing U.S. deficit and the growing burden of government debt servicing costs.

Earnings Face Hurdles

As the third-quarter earnings season kicks off in earnest, many investors are optimistic that S&P 500 earnings will land in positive territory after three consecutive quarters of decline. Early estimates are largely unchanged given the uncertain macroeconomic backdrop.

One area of focus this earnings season will be interest costs. Rising rates will have a growing impact as more companies must refinance maturing debt at significantly higher rates. However, if companies can deliver positive earnings growth, it could put stocks on a firmer footing for the fourth quarter following a year when stock price gains have far outpaced profit growth.

The Global Stage

Conditions outside the U.S. reflect a global economy that is losing steam. Thus far, Europe has narrowly avoided recession amid energy shortages and central bank tightening. In China, dimmed consumer confidence and a debt and property crisis have cast shadows over its economy, as well as other emerging market nations.

Finally, continuing conflict in Europe and the outbreak of war in the Middle East add new uncertainty to a fracturing global economy that poses risks to commodity prices, as well as to the decades-long globalization trend. Deglobalization would have significant implications for global growth and inflation conditions.

Trials Remain

As we enter the final quarter of 2023, major questions remain on the minds of investors. Can a stronger-for-longer economy coexist with higher-for-longer interest rates, or does continued strength today mean more pain later? Will corners of the stock market that have not seen gains in 2023 rally by year-end, or will recession pressures drag all sectors down?

As always, investors should assess both the risks and opportunities presented by the current market and economic conditions. A wide range of potential outcomes makes a strong case for portfolio diversification.

When we tune in to the Olympics for a welcome distraction next year, there will be a few new additions alongside our longtime favorite events. This includes breaking, also known as break dancing. The sport was, apparently, an outstanding success in the Buenos Aires Youth Games and features dancers who must improvise to changing music. Like these acrobatic athletes, investors must adapt to changing conditions as we hope that the economy can bend, but not break, under the pressures of higher rates and slowing growth.

[1] Fitch Ratings, Energy Information Administration, CAPTRUST Research