Third Quarter 2024 Investment Strategy | All Eyes on the Fed

Earlier this year, investors expected the Fed would eventually shift from its restrictive stance, which it adopted to combat inflation, to an accommodative stance with lower interest rates. But with higher-than-expected inflation throughout most of the first half of 2024, investors just weren’t focused on rate cuts.

Things changed in the third quarter. With inflation moving a step lower, market expectations shifted and all eyes turned to the Fed. At its September meeting, the Fed made the pivot investors were expecting, moving the economy into a new chapter. Here, we recap the third quarter and explain a few things the CAPTRUST Investment Group is watching to stay prepared for what could happen next.

Market Rewind: Third Quarter 2024

The cool inflation report at the start of July was a stark contrast to the previous quarter. All asset classes showed positive performance. A soft-landing narrative—driven by increasing confidence that inflation was decreasing as recession fears eased—allowed markets to shine.

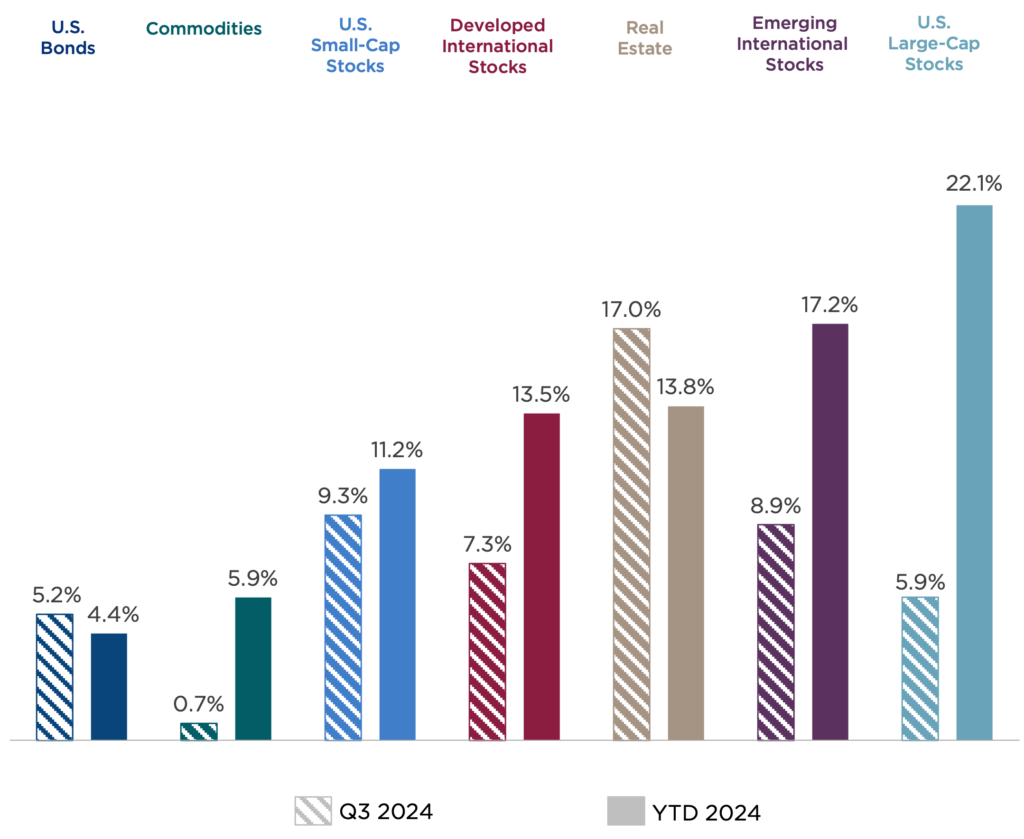

Figure One: Asset Class Returns, Third Quarter (Q3) 2024 and Year-to-Date (YTD) 2024

Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (international emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

Large-cap stocks saw another solid quarter, rising 5.9 percent and finishing near all-time highs. Although corporate earnings were roughly flat, we saw gains across a broad swath of the market, with all sectors other than energy rising for the quarter. Mega-cap stocks ceded leadership but remain ahead year-to-date.

After trailing in the first half of the year, small-cap stocks rocketed higher in July before falling in August. Despite this fall, they finished 9.3 percent higher for the third quarter.

As U.S. Treasury rates declined, interest-rate-sensitive markets performed well after a difficult first six months of the year. Investment grade bonds rose 5.2 percent, and real estate posted a stunning 17.0 percent return, boosted by low relative valuations. Declining interest rates eased concerns over financing in the commercial market.

Commodities managed to hold their ground, rising 0.6 percent. Geopolitical tensions simmered, allowing oil prices to decline. Meanwhile, gold continued its relentless climb, hitting a new all-time high of $2,672 an ounce.

Outside the U.S., developed market stocks performed well, returning 7.3 percent. Japan was the outlier as the yen’s appreciation relative to the U.S. dollar brought returns down 6 percent. Emerging market stocks were nearly relegated to a footnote this quarter, until China’s government announced a significant stimulus in late September. This sent the Chinese market soaring, after lagging for the past several years. In total, emerging market equities returned 8.9 percent.

The Fed’s Influence on Markets

When Congress created the Fed in 1913, it had three objectives:

- price stability;

- maximum employment; and

- moderate long-term interest rates.

Markets tend to focus most of their attention on the first two of these relatively ambiguous objectives. Generally, price stability equates to a 2 percent inflation rate. Maximum employment is the highest level of employment the economy can tolerate without driving inflation above the stated target.

While the Fed is often criticized for its approach to and execution in achieving these objectives, Fed officials take their responsibilities seriously. Therefore, when markets believe a change is imminent, they too care deeply about inflation and labor statistics.

What Changed

Inflation: For most of the first half of this year, not only did we see a continuation of elevated inflation on a month-to-month basis, but the data came in above expectations. This increased pessimism and uncertainty about whether inflation was truly on a path back to the Fed’s 2 percent target. While the data for May, released in mid-June, came in both low and below expectations, at 0.0 percent, there was enough doubt built up in the system to prevent a dramatic reaction.

However, with a -0.1 percent inflation data point for June, released on July 11, market perspective shifted dramatically. One obvious manifestation was an incredible reversal and rally in small-cap stocks, particularly relative to large-cap stocks.

Figure Two: Large-Cap vs. Small-Cap Stock Market Performance, January to September 2024

In Figure Two, the S&P 500 Index is used to represent U.S. large-cap stocks, and the Russell 2000® is used to represent small-cap stocks).

This dramatic performance was not the result of lower inflation. Small-cap stocks outperformed because markets saw lower inflation as a green light for the Fed to begin unwinding tight monetary policy. This could ultimately reduce the burden of higher borrowing costs, which were designed to slow the economy and which disproportionately impacted smaller businesses.

Labor: Inflation is important, but labor is the lynchpin.A crucial fact, omitted in the previous paragraph, is that the labor market and overall economy were in good shape throughout the first half of the year, likely headed toward a soft landing.

Consumers make up roughly 70 percent of the U.S. economy, and consumer spending is the primary engine for U.S. economic growth. Therefore, a healthy labor market is critical to the prospects of our economy.

Without a positive outlook for the economy, small-cap stocks, which are more sensitive to economic growth, could have seen their year-to-date struggles worsen. That’s what happened in early August when a weak unemployment report drove a near-perfect reversal of July’s small-cap rally. But because the economic outlook was positive in September when the Fed pivoted, small-cap stock values shot upward.

Markets interpreted the lower inflation data as confirmation that the Fed would be able to take its foot off the brake and lower rates. This caused the more cyclical sectors of the market, such as small caps, to rally. However, weaker employment data raised fears that the soft inflation data was being driven by a weakening economy, and this triggered a rapid reversal.

It turns out, when members of the Federal Reserve Board of Governors consistently tell the market they will be data-dependent in their decision-making, the market listens and becomes data-dependent itself.

What the Pivot Means for Markets

For the moment, there has been an increase in uncertainty. You could say that the volatility of volatility has increased. In plain language, the market is more likely to experience day-to-day swings.

Investors were surprisingly split about whether the Fed would cut the fed funds rate by 25 or 50 basis points (a basis point is 0.01% and commonly referenced as bp or bps) at its September meeting. When it cut the rate by 50 bps, investors were then concerned about what this decision implied about the future rate path. Did Fed Chair Jerome Powell and his cohorts just begin an aggressive campaign to bring rates back down? Or was this a jump start to give the Fed the space to make more cautious decisions?

The anticipated path of the fed funds rate is well captured by the 2-year Treasury yield. The 2-year Treasury declined from 4.75 percent at the start of the third quarter to 3.65 percent at the end—an exceptional move itself. The implications of this movement could be seen across other markets, such as currencies. The U.S. dollar has been very sensitive to the potential path of interest rates, and we’ve seen it decline neatly with the 2-year Treasury.

As mentioned, when the Fed cut rates, more economically sensitive sectors and markets briefly moved higher before retreating. The broader equity market jumped up and down for most of the quarter before moving to new highs at the end of September. And fixed income, which struggled to get its head above water in the first half of the year, enjoyed a strong rally throughout most of the quarter as the market priced in a series of future rate cuts.

Much of this intra-quarter turbulence was the result of two things: investors pricing in a shift from restrictive monetary policy, and the market evolving its view on how quickly the Fed would move.

Figure Three: Two-Year U.S. Treasury Yield vs. U.S. Dollar, September 2023 to September 2024

More Questions Ahead

The Fed has now pivoted to an easing cycle, but there are still many unknowns to face.

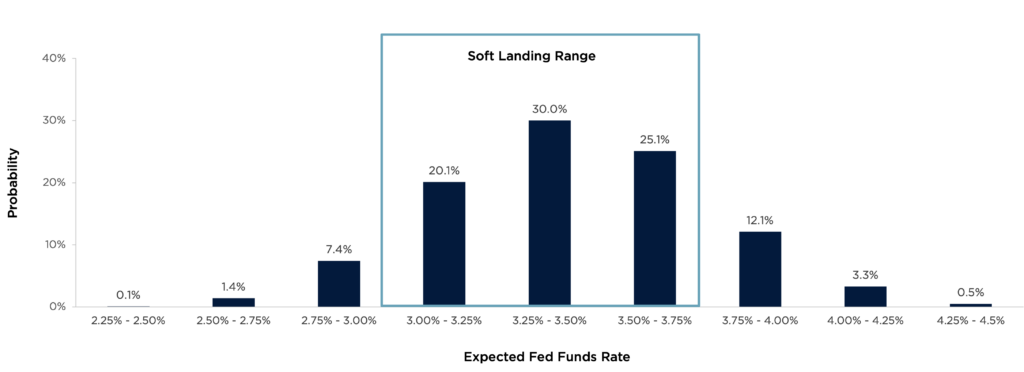

- We don’t know the pace or terminal rate for the fed funds rate. At this point, the market is pricing in eight more 25-bps cuts by the end of 2025. The messaging from the Fed, and Jerome Powell in particular, has been far more sanguine.

- The soft-landing analogy is starting to feel long in the tooth, but it does appear that the economy is headed in that direction. There are some cautionary signs for the labor market, but those shouldn’t be overstated, as most of the data points to a benign environment.

- The U.S. presidential election is close enough to a be a tossup. This is likely to create anxiety and market turbulence, potentially even after the election. The silver lining for markets is that a divided Congress is likely. A divided Congress tends to mean that fewer bills are passed and those that become law are more moderate in their policy impact.

- Geopolitical tensions continue to simmer—and, in some cases, boil over—in Ukraine, the Middle East, and Taiwan. While the humanitarian concerns are substantial, these conflicts have so far not been significant drivers of market movement. However, they do remain outsized risks that are challenging or maybe impossible to mitigate.

What We’re Watching

Investors are students of previous market cycles, and many historically significant indicators are flashing warnings. While we take these indicators seriously, we also recognize that we are in a unique economic environment that continues to normalize from the fiscal, monetary, and economic experimentation that took place after the pandemic. This leaves us in a low-conviction environment as we seek to adapt our historical experience to the unwinding of novel policy choices from the past four years.

Figure Four: Target Fed Funds Rate Probabilities for December 2025

Our base case—what we think is probably likely to happen in the next few months—is that equities will perform in stride with earnings growth. Corporations, particularly mega-cap companies, are healthy and strong. We anticipate they will be able to continue to grow their earnings as the market expects.

Similarly, we expect to clip coupons in fixed income, albeit with some potential volatility as markets digest the Fed’s new direction. With the yield on fixed income markets near 4.25 percent, investors could earn a nice advantage over inflation on investment grade bonds.

In a more optimistic scenario, the elevated margins at corporations, a more dovish Fed, and the potential for increased productivity driven by artificial intelligence could pave the way to higher equity market returns. This scenario would likely be accompanied by an increase in inflation and, therefore, higher interest rates, which could hold down fixed income returns in the near term.

On the other hand, if we choose history to guide us through this novel environment, it does not take long to draw a more pessimistic conclusion. The Fed has a track record of holding interest rates too high for too long, thereby pushing the economy into recession. And we have seen unemployment levels rise steadily over the past year, although not to concerning levels. Historically, high unemployment rates align with recessions.

Cautiously Optimistic

The next quarter is likely to be turbulent, but we may see markets steady themselves after the election and as economic data unfolds. Throughout the bumps, it’s important to keep in mind that turbulence is a normal market reaction to uncertainty. With the tailwind of the Fed’s new stance, and attuned to the multiple unknowns before us, we see a lot to like in this economy and in markets today.

Of course, markets will need to adapt to this new monetary policy regime to gain a better grasp on the Fed’s framework for analysis. But with consumers and corporations in fundamentally strong positions, we are cautiously optimistic.